Just like any other business sector, the auto parts store industry experienced many low periods during, and after, the 2008 Great Recession. During the recession, many consumers relied on older cars and avoiding any type of excess replacements unless there was no other option. People simply did not have the disposable income to spend on new cars and car parts. Luckily, the last few years have shifted for the auto parts store sector. While there has not been exponential growth, the auto parts store sectors have seen slow growth through 2016, with expectations of 2017 having similar slow growth.

Many auto parts stores deal with cyclical economic business periods, particularly because the auto parts store industry is directly dependent on the auto industry production levels, fluctuating gasoline prices, the amount of disposable income consumers have, and the overall state of the United States economy. Thanks to all of these constantly shifting factors, the auto parts store sector is unsure what to expect for 2017, but since consumers have seen increased disposable income over the past few years, expectations are optimistic. Unfortunately, the biggest obstacle for most auto parts store business owners for the next year will be giant online retail stores such as Ebay and Amazon. Many auto parts store business owners are struggling with adopting omnichannel outlets to show case and sell auto parts and accessories.

Other major issues being faced by the auto parts store world revolve around the much-discussed issue of importing car parts from other foreign countries. According to the Wall Street Journal, in 2015, the United States imported a record number of car parts, totaling over $138 billion in car parts. This equates to over $12,000 of foreign parts in every American vehicle built that year. That was a record breaking number of car part imports for the United States, which was up $89 billion from 2008. As many are aware, the new president has made it his mission to bring back production and work to the United States, so many auto part store business owners are hoping that more production will be in the United States in upcoming years, but for now, no major moves have been made by the president yet. For now, these problems are up in the air, but paying close attention to what the future may hold for the auto parts store industry is vital to staying competitive in this sector.

Auto Parts Store Sector Trends

Overall, the auto parts store sector is doing well, however, as mentioned above, there are a few trends that are dominating the auto parts store world – with the most important one revolving around omnichannels and strong competition from retailers like Amazon. On top of that, there are also a variety of issues that the auto parts store sector is battling due to the constantly growing demand for smart, technology based cars and stricter government environmental regulations. In order for any auto parts store business owner to stay on top in this competitive industry, staying up to date on the latest trends for 2017 is essential.

- Personal Services and Ecommerce Sales: In 2016, ecommerce auto parts sales reached over $7.4 billion (not including auctions and used parts), accounting for a 16 percent growth period last year alone. In 2015, online auto parts sales saw a 21 percent increase from 2014. When reflecting on the rapid growth of ecommerce auto parts sales in the past few years, and with the constantly growing innovative technology sectors in the United States, it is obvious that ecommerce auto parts sales will remain a vital component to the auto parts store sectors. Unfortunately, most of these ecommerce auto parts sales are through online giants like Amazon and Ebay, forcing many brick and mortar auto parts store business owners to become creative to compete against these major companies. Many auto parts store owners have noticed that while many people utilize sites like Amazon, most customers have no clue how to replace many essential car parts – or consumers have plenty of questions that are better answered in person by a reputable auto parts store employee. Competing against these online giants is easier than one might think, especially if an auto parts store business owner has started to create and effectively implement successful omnichannel options for all types of consumers.

- Complexity of Cars and Innovative Technologies: As anybody with a newer car knows, replacing car parts has become increasingly difficult with the implementation of newer, innovative car technologies. This has led to many auto parts store owners being able to take advantage of their employee’s skills and knowledge in order to compete against online auto parts stores. As cars continuously become more complex with innovative technologies, more consumers will be looking at brick and mortar auto parts stores to answer all of their questions.

Auto Parts Store Financing Uses

- Auto Parts Store Financing for Technologies: Technology is impacting every single business today, but unfortunately, many new retail technologies, such as Point of Sale systems, are becoming increasingly expensive. This is why there are a variety of auto parts store financing options for technologies.

- Auto Parts Store Loans for Marketing, Advertising, and Social Media: Marketing and advertising are essential in any business, but by utilizing social media marketing, and even creating omnichannel shopping experiences through social media, many auto part store business owners will be able to compete easier with other online auto part sellers. There are plenty of auto parts store loans for marketing to help make this possible.

- Auto Parts Store Inventory Financing: Inventory is essential in every retail business, and many times, managing inventory can be a hassle that leads to over spending or loss of items. Through auto parts store inventory financing, many auto parts store business owners can purchase top of the line inventory management systems to help with this important business priority.

- Auto Parts Store Loans for Hiring New Employees and Payroll: Just as inventory is important for retail businesses, focusing on quality employees is even more important. The advantage that brick and mortar auto parts stores have over incumbent online sites have is quality employees who can answer any and all customer questions. Unfortunately, sometimes business owners have limited working capital or have to pay other important expenses, but covering payroll costs is always a top priority. During those difficult times, taking advantage of auto parts store loans for payroll and/or hiring new employees can help.

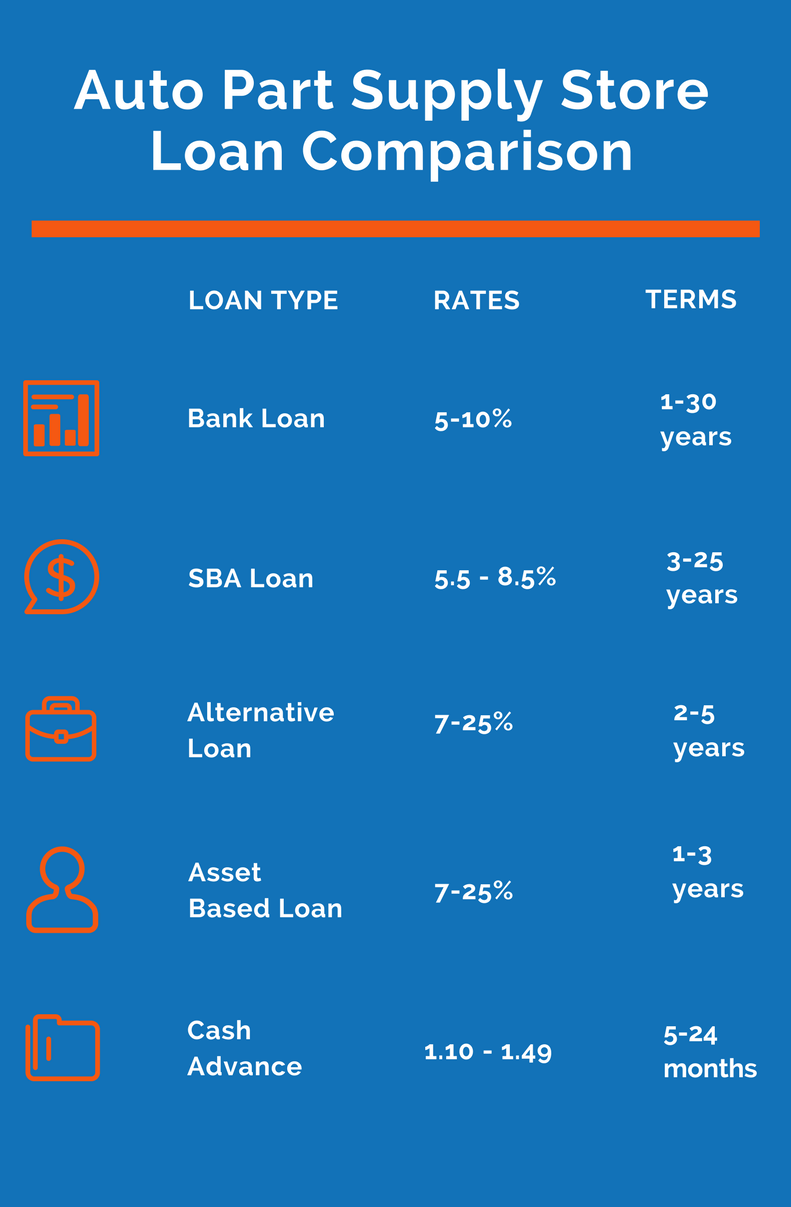

Auto Parts Supply Store Bank Loans

Auto part supply bank financing can be used for a variety of uses, including purchasing the real estate used by the party supply shop, refinancing and/or consolidating the parts supply shop debt, working capital (including for payroll, upgrades and repairs, advertising, cash flow, etc), inventory and just about any use a supply shop could have. Getting a loan through a bank is never easy, so the supply shop needs to have good credit and solid revenues (and profitability).

Documents parts suppliers need to get a bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Auto Parts Store SBA Loans

Auto parts supply SBA loans are a good way for a small business to get really good rates and terms from a bank if you were unable to get conventional financing previously. SBA loans are good for just about any use — especially refinancing and consolidating business debt into a bank-rate loan. Some of the uses of an auto parts SBA loan include purchasing a business, constructing new facilities, capital to help with business operations, etc.

Documents auto supply stores need for SBA financing:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Auto Parts Store Loans

Alternative auto parts business loans are mostly used for working capital purposes, but they can be used for advertising, making sure the supply store makes payroll, purchasing and replacing auto parts inventory, paying the business’s taxes, etc.. Alternative business financing is great for companies that need fast financing but don’t want to pay the high interest associated with a merchant cash advance.

Alternative auto parts store loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Auto Parts Store Cash Advance

Auto parts cash advances are the fast funding business funding option available. But, with superfast funding speeds comes a tradeoff: higher rates and terms. Cash advances fill a number of needs for small businesses: they’re good for auto parts stores with bad credit that need a loan, they are good for auto parts stores that need immediate financing, and they are great for company that need a business loan, but don’t have the documents that a conventional lender requires.

Documents for an auto parts store cash advance:

- Application

- Bank statements

- Credit card statements