ACH Cash Advances

ACH business loans (also referred to as bank-only loans) are a way for small businesses to obtain cash-flow loans and working capital without the credit and document requirements that a company would face with traditional bank financing. ACH loans are structured much differently than traditional bank financing in both the way the loan is repaid, and the cost associated with the loan. In this article we will take a look at what is the automated clearing house, how it is used by consumers and small businesses, and the pros and cons of ACH bank-only financing for small and mid-sized businesses.

What is Automated Clearing House?

Automated Clearing House is a way of transfering money from one bank account to another through direct deposit or direct payment via the use of banking ACH transactions. Banking ACH transactions can be setup as one time payments and as recurring payments – both consumer and business-to-business. The ACH network batch processes ACH transactions that banking and financial institutions accumulate through a business day. ACH direct payments and direct deposits allow transactions to be processed electronically – as opposed to paper – which speeds up the processing time because settlements between institutions the same day.

The ACH network is nearly 40 years old, and safely and securely helps 22 billion electronic transactions each year for a total of $39 trillion each year. In the first three months of 2016, the ACH network transferred over 5 billion financial transactions, a growth of more than 6% from the year before. When it comes to business-to-business transactions, the increase of automated clearing house service transactions increased by 9% in 2016.

How Do Automated Clearing House Loans Work?

ACH loans aren’t actually loans, but business-to-business transactions where a lender agrees to buy a small business’s future bank account receivables in exchange for an upfront amount of cash. After a purchase amount is agreed upon, a contract executed and the business funded via ACH, a repayment plan begins where the small business has a set amount automatically deducted each day (or each week) through the use of ACH transfer. Daily ACH payments are made to the factoring company Monday through Friday, not including Holidays, until the ach cash advance is fully-repaid.

How is an ACH Loan Different Than a MCA Loan?

An ACH loan is somewhat similar to an MCA loan in some respects, but the repayment is somewhat different. To understand those differences its best first to understand MCA lending. MCA loans (merchant cash advances) are also the sale of future business receivables. How a MCA cash advance difers from an ACH cash advance is that the MCA is repaid by withholding a percentage of the company’s credit card deposits as opposed to bank deposits. And instead of having a set daily repayment like an ACH, repayments are a percentage of the days credit card deposits.

What Are The Advantages of ACH Cash Advances?

The advantages of funding and repayment through ACH cash advances are numerous. As opposed to requiring lots of documentation like a bank loan or SBA financing, ACH lenders require minimal documentation. And unlike traditional business lenders and some alternative lenders, cash advance lenders require minimal credit to get approved for funding. In fact, many times credit isn’t even a factor, making an ACH loan a popular type of bad credit business loan. Another advantage is the fast speed of funding, in that ACH financing can usually be completed in a matter of days, if not a single business day.

What Are The Disadvantages of ACH Cash Advances?

Disadvantages of ACH loans are without a doubt their high rates. Because ACH business lenders offer high-risk business loans without requiring excellent credit and cash-flow, the rates are higher than other business loans. Factor rates for ACH loans usually start at 1.16 and may go all the way up to 1.55. This means that for every dollar “loaned” to a small business, the borrower will then need to pay back the amount borrowed times 1.16-1.55. Another disadvantage of an ACH business loan is the fact that payment must be remade daily which can put stress on a company’s finances if they have a period or gap between payments from customers or clients. With that having been said, if a small business or merchant does have a bank-only cash advance using a daily ACH repayment and is facing a few days or a week where they will have reduced cash-deposits and transfers to their company’s bank account, they can request from the lender to have payments paused for a period of time until the company’s deposits increase. Failure to pay any single days payments can lead to additional fees added to the company’s cash advance balance.

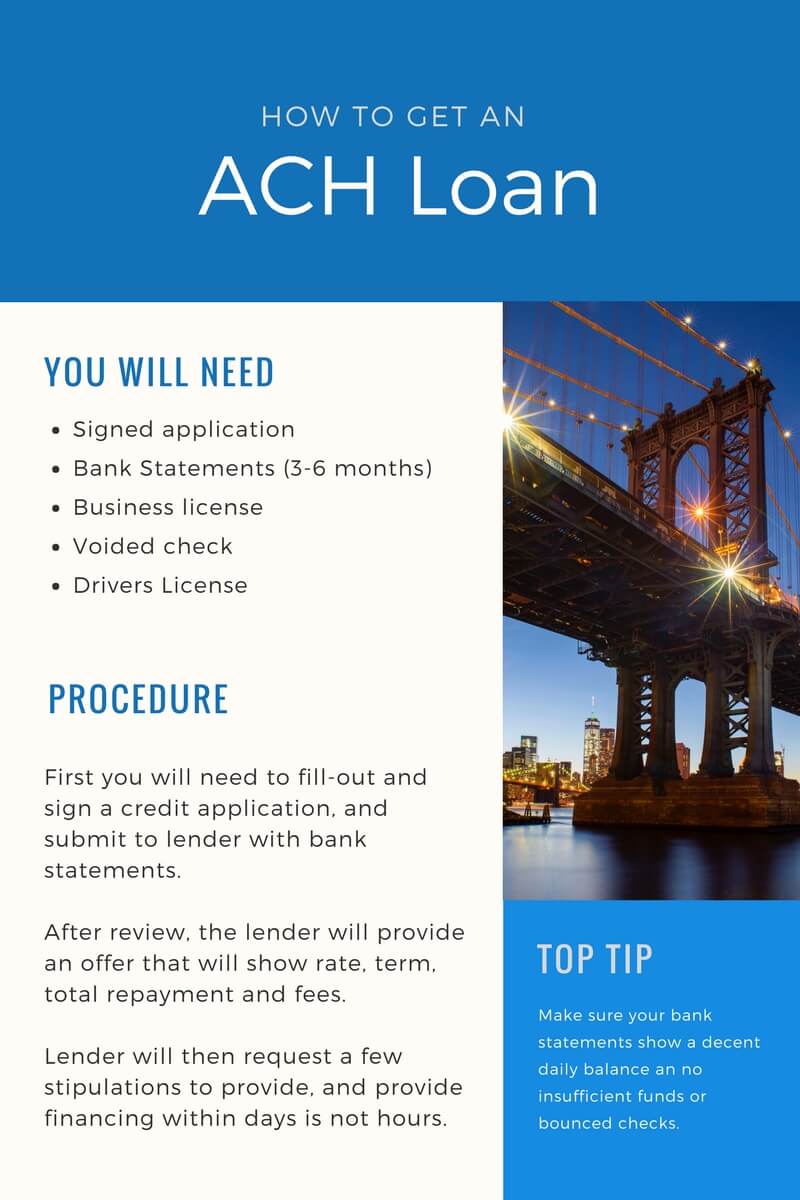

What is the Process of Securing an ACH Cash Advance?

To get approved for an ACH small business loan a company will first need to submit a signed credit application and provide 6 months of their most recent business bank statements. After the merchant cash advance lender runs the small business owner’s credit and analyzes the company’s bank statements (they look at the total amount of deposits, total number of deposits, frequency of deposits, minimum daily balance, average daily balance, and other factors) they will either provide an offer, or decline the merchant for funding. If the merchant is approved, the ACH funder will then provide a range of options for the merchant to chose. After chosing the best ACH funding option that best meets their needs, they will then receive contracts from the lenders with a list of documents needed before funding. Documents needed for funding under $100,000 usually include voided check, drivers license of the owner(s), provide business licenses and verify their bank account. Bank verification is done by the lender either signing-in to the merchant’s bank account, using a third party service or join.me meeting to verify the account transactions match the bank account statements provided. If the loan amount is over $100,000 additional company financials may be needed, included profit and loss statements along with company balance sheets. After all stipulations have been provided to the lender and the contracts fully-executed, the ach funder will wire the funding amount to the merchant and the ACH repayment process will begin the next business day.