Small Business Administration Loan Brokering

American small businesses are an essential part of the United States economy, being that nearly two out of every three new jobs are created by small companies. The U.S. currently has over 28 million small businesses operating for-profit and employ around half of the total U.S. workforce. To keep American small enterprises growing, these small companies need access to affordable capital. Oftentimes, these small businesses find themselves shut-out from traditional bank financing because they don’t meet their banks credit and capital requirements, the business firm hasn’t been in operation long enough to make the bank feel comfortable providing a loan, or because the small business doesn’t have sufficient cash-flow to service the loan. In fact, a 2013 study by the New York Federal Reserve of small business owners found that access to capital was the top concern of small business owners. Access to sufficient capital has been so difficult to secure that only 55% of profitable small businesses that apply for a loan actually receive funding.

Quick-jump to the following sections:

- Paycheck Protection Program

- SBA Express

- SBA Disaster Loans

- EIDL (Cash Advance)

- SBA 7(a)

- SBA 504

- SBA Veterans Advantage

- CAPLines

- Community Advantage

- Internatioanal Trade

- Export Working Capital

- Microloans

To help small businesses gain access to affordable capital the United States Small Business Administration provides loan guarantee programs to banks, community and commercial lenders to help increase the approval of bank-rate financing to small companies. But not all SBA lenders are the same. Some focus only on specific programs like the SBA 7(a) program and SBA 504 program, while others only focus on the SBA Express loan program and SBA Microloan program. On top of that, some lenders have regional and industry restrictions, or have a preference in mostly funding real estate, equipment, working capital, acquisitions, partner buyouts, etc.. Even more, SBA loans require more paperwork and documentation than other types of business loans because the SBA wants to guarantee that small businesses meet their standards to qualify for the program. Navigating the paperwork and documentation process can be tricky and time-consuming (especially for small business owners that spend enormous amounts of time running their operations).

What is a SBA Loan?

SBA loans are a type of financing provided by large banks, small banks, community and and other commercial lenders that are partially/mostly guaranteed by the U.S. Small Business Administration (SBA). The SBA doesn’t actually loan money to small businesses, but instead encourage SBA lenders to loan money to companies by covering up to 90% of the lenders’ losses should the borrower default on the loan. By covering a large portion of the lenders’ losses, the SBA loan program helps encourages lenders to fund companies with affordable bank-rate financing because their risk is almost reduced or nearly non-existent.

What is an SBA Loan Broker?

SBA loan brokers and financing consultants will analyze the borrowers financial data, explain all the SBA loan programs and financing options available to the small firm, prepare an SBA loan package to submit to SBA lenders, and then find the right SBA lender to fund the small business. After finding the small business the right SBA lender to provide them financing, the SBA loan consultant will then work with the borrower to prepare all the documents and paperwork needed for full-underwriting by the lender. After that good SBA loan consulting experts will work with you from the beginning of the process until you are funded.

Why Use a SBA Loan Broker?

- SBA loan brokers are proficient in all the SBA loan programs — allowing you to focus on running your business, rather than researching the various programs.

- Good SBA loan consultants and brokers can analyze your business financials and offer expert advice as to which programs would be the best fit for your company.

- Qualified SBA business loan brokers have relationships with all of the SBA lenders. Many SBA lenders have concentrations in specific industries, as well as regions of the country. A good SBA broker can match you with the best lender for your needs.

- SBA loan experts can speed up the overall funding process by weeks or even months by streamlining the SBA lender matching, rather than applying one lender at a time.

Reasons You Should Not Use a SBA Loan Broker

If you feel comfortable navigating the SBA process on your own, then deciding not to use SBA loan consulting may make sense. Some SBA financing brokers will require an upfront packaging fee to prepare their SBA loan request. The problem is: you may be paying that fee without knowing if you are even SBA qualified, or without knowing if the SBA loan adviser has a sufficient network of lenders to properly-handle the situation. In fact, you have to keep in mind that small business lending is pretty much unregulated at the moment. And with the lack of regulation the number of poorly-informed (or ethically challenged) business loan brokers have increased. These brokers are usually more concerned with putting their own interests before those of their clients. What does that mean for the client: the broker steers the small business towards a high-rate and expensive merchant cash advance or other alternative loans rather than traditional financing. They are also much more lucrative for the broker (at the expense of the client). That is why making sure a SBA brokering expert has your best interest at heart is important. Talk to them about your situation, and see what they have to say. If they want to steer you toward high-rate financing from the beginning, run.

Types of SBA Loans We Broker

There are various SBA loan options available to small businesses for almost every need including acquiring businesses, refinancing and consolidating business debt, working capital, equipment purchases, expansion, payroll, leasehold improvements and other uses. Below are all of the SBA loans we offer brokering services for.

Paycheck Protection Program

This program was passed as part of the CARES Act stimulus package was created to cover the payroll costs, utilities, rent, lease and interest on mortgages payments for business dealing with the impact of the COVID-19 / Coronavirus epidemic. This program will cover up to 10 weeks of a business’s payroll costs through a 10 year term loan with a 4% interest rate. Payments for this program are deferred for one year, and if a business keeps their employees for 4 months the entirety of the loan is forgiven, essentially converting the loan into a grant.

| Rates |

4% if not forgiven 0% if forgiven |

|---|---|

| Terms | Up to 10 years |

| Funding Amounts | Up to $10,000,000 |

| Collateral | Not required |

| Fees | 0% |

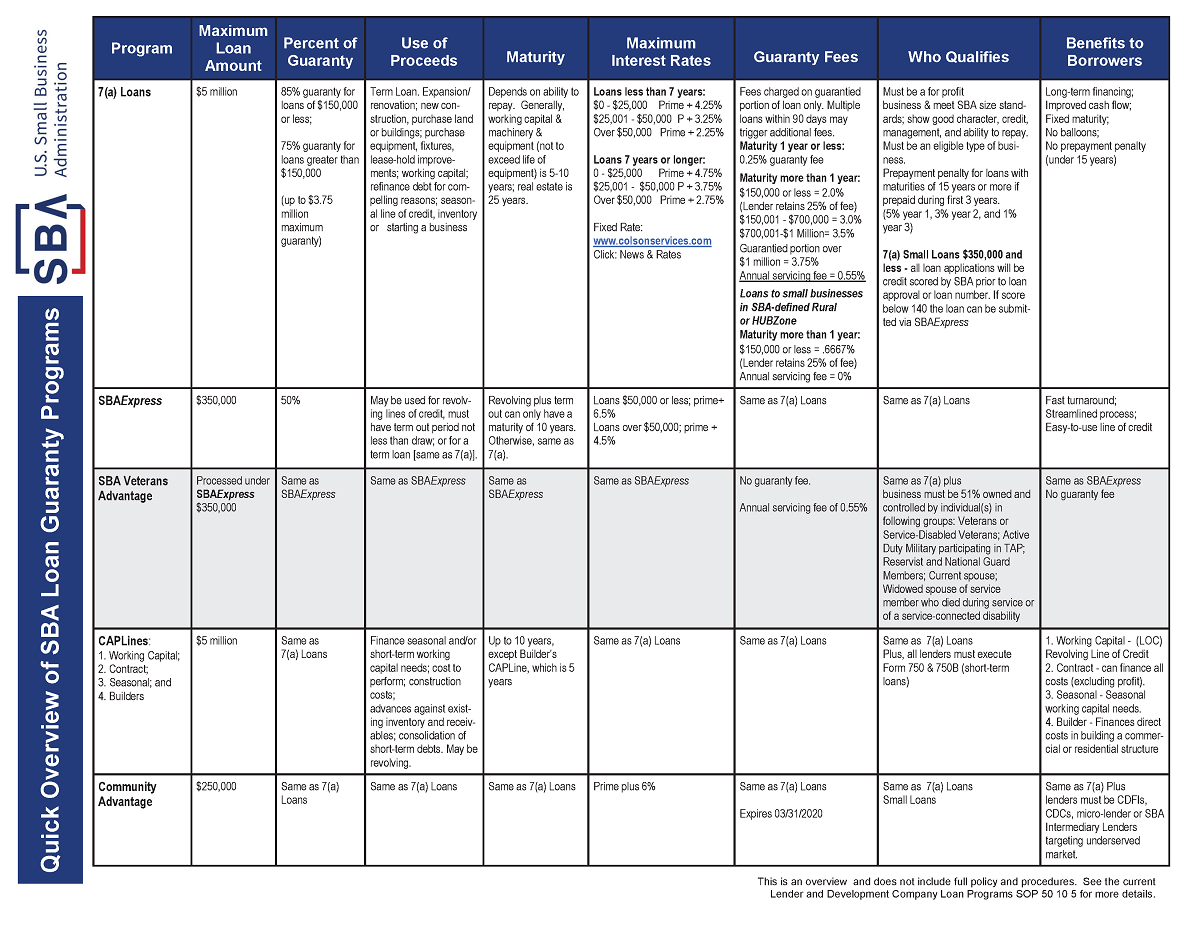

SBA Express Loans

SBA Express is a SBA 7(a) subprogram meant to provide faster financing than a standard SBA 7(a). With the 7(a) program, the lender will underwrite the loan, and then send to the SBA for final approval – which can take the SBA 2-3 weeks to approve. With the SBA Express program, the SBA turnaround is much quicker, taking only up to 72 hours for final SBA approval.

| Rates | $50,000 or less; prime +6.5% over $50,000; prime +4.5% |

|---|---|

| Terms | Up to 10 years |

| Funding Amounts | Up to $350,000 |

| Collateral | May be required |

| Fees | 0.25 – 3.0% |

SBA Disaster Loans

SBA Disaster Loans program is traditionally used to offer financing to cover destruction to personal and business property due to national disasters. Recently it has become the program of choice to help small businesses obtain financing to deal with the Coronavirus (COVID-19 & SARS-CoV-2) epidemic.

| Rates | 3.75% |

|---|---|

| Terms | Up to 30 years |

| Funding Amounts | Up to $2,000,000 |

| Collateral | May be required |

| Fees | 0% |

EIDL Cash Advance

As part of the Economic Injury Disaster Loan program the EIDL provides businesses applying for economic injury relief a $10,000 cash advance that does not need to be paid-back, regardless if they are approved for other disaster loan programs or not. The process is simple, requiring only an application and supporting documents be uploaded directly onto the SBA website using a drag and drop function.

| Rates | Free |

|---|---|

| Terms | None |

| Funding Amounts | $10,000 |

| Collateral | Not required |

| Fees | $0 |

SBA 7(a) loans

SBA 7(a) loan program is the standard SBA loan with varying short-term and long-term uses, including working capital, commercial real estate refinancing, business debt refinancing, equipment purchases, among other uses. These loans aren’t provided by the government itself, but instead encourages banks and other lenders to provide loans by guaranteeing that if a borrower fails to repay such loan, the government will cover most of their losses.

| Rates | $0 – $25,000 Prime + 4.25% $25,001 – $50,000 P + 3.25% Over $50,000 Prime + 2.25% |

|---|---|

| Terms | Up to 25 years |

| Funding Amounts | Up to $5,000,000 |

| Collateral | May be required |

| Fees | 0.25 – 3.75% |

SBA 504 Loans

SBA 504 loan program is used to help expand commercial owner/user real estate by a business, as well as replace & purchase commercial real estate and also heavy equipment while allowing you to conserve your working capital by only requiring a 10% down payment.

| Rates | 20 year: 2.804% 25 year: 2.878% |

|---|---|

| Terms | 10-25 years |

| Funding Amounts | Up to $20,000,000 |

| Collateral | Required |

| Fees | 0.5% |

SBA Veterans Advantage

SBA Veterans Advantage program is geared toward businesses owned by veterans of U.S. armed forces, as well as current active duty military service members who are in the military’s Transition Assistance Program (TAP). This program offers “fee relief” by reducing certain fees associated with most SBA loans.

| Rates | $50,000 or less; prime +6.5% over $50,000; prime +4.5% |

|---|---|

| Terms | Up to 10 years |

| Funding Amounts | Up to $350,000 |

| Collateral | May be required |

| Fees | Annual servicing fee of 0.55% |

SBA CAPLines

SBA CAPLines are used to finance of contracts, sub-contracts and/or purchase orders and other expenses associated with contracts, as well as accounts receivable and inventory. Can also use for expenses related to construction and renovation costs of eligible real estate projects. Additionally, can be used for short-term working capital and operating costs.

| Rates | Prime +2.25% to 4.75% |

|---|---|

| Terms | Up to 10 years |

| Funding Amounts | Up to $5,000,000 |

| Collateral | May be required |

| Fees | 2.00% – 3.75% |

Community Advantage

Community Advantage loan program provides for profits small businesses help with credit, management and technical assistance that are in under-served areas. In order to qualify a business must be creditworthy and meet the SBA’s size requirements.

| Factor rates | Prime +2.75% to 6% |

|---|---|

| Terms | 7-10 years |

| Funding Amounts | $250,000 |

| Collateral | Pledge available collateral |

| Fees | Low to High costs |

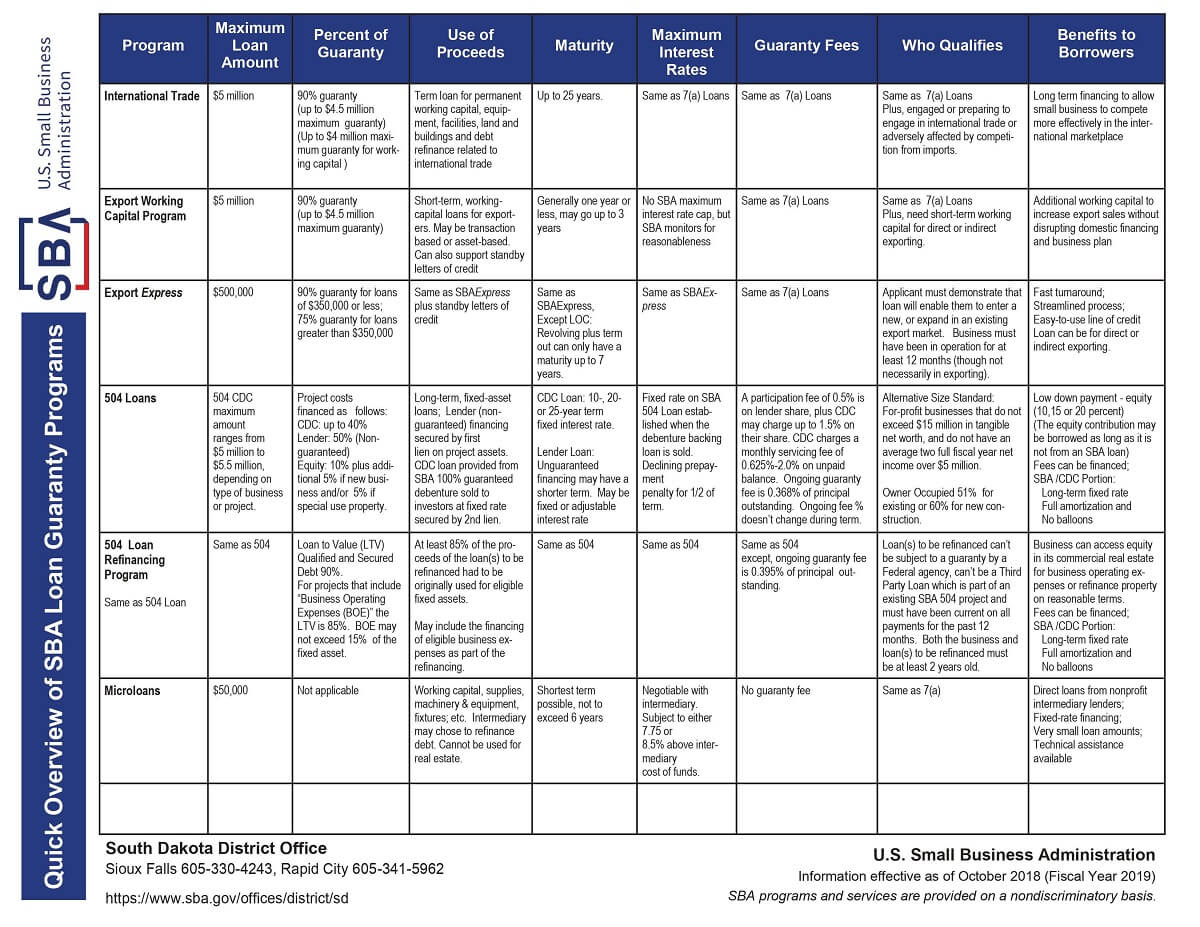

International Trade Loans

International Trade loan program offers small businesses financing to help with export loans to help with entering foreign markets and to expand their operation in such markets. This types of financing can come in the form of asset loans, working capital as well as refinancing of business debt.

| Rates | Prime +2.25% to 4.75% |

|---|---|

| Terms | 7 years for lines of credit 10 years for equipment and working capital 25 years for commercial real estate |

| Funding Amounts | Up to $5,000,000 |

| Collateral | First lien on real estate and equipment |

| Fees | 2.00 – 3.75% |

SBA Export Working Capital

SBA Express is a SBA 7(a) subprogram meant to provide faster financing than a standard SBA 7(a). With the 7(a) program, the lender will underwrite the loan, and then send to the SBA for final approval – which can take the SBA 2-3 weeks to approve. With the SBA Express program, the SBA turnaround is much quicker, taking only up to 72 hours for final SBA approval.

| Rates | Negotiated between the borrower and lender |

|---|---|

| Terms | Up to 36 months |

| Funding Amounts | Up to $5,000,000 |

| Collateral | Lien on collateral financed |

| Fees | 2.00 – 3.75% |

SBA Microloans

SBA Microloan program provides small loans to help small businesses and some nonprofit companies with startup and expansion costs. These loans aren’t provided by the SBA directly but, instead, provides funds to nonprofit community organizations who then disperse the funds to eligible small businesses and borrowers.

| Rates | 7.75 – 8.50% |

|---|---|

| Terms | Up to 6 years |

| Funding Amounts | Up to $50,000 |

| Collateral | Required |

| Fees | 2-5% |

Our SBA Brokering Fees

Other brokers will charge a $2,500 upfront fee to apply for the SBA loan while also charging an additional fee of 1-3% of the total loan amount at funding.

We do not charge any fees on the back-end. Therefore, you get to keep the entire funding amount at closing. The only charge we have is a $2,500 fee to complete your applications, package all documents, and then place with our thousands of SBA lenders using our matching technology. Even more, we will apply you for all the relevant programs at once.