What is the Deep Sea Freight Transportation Industry?

The deep sea freight transportation industry is made up of businesses involved in the shipping of goods across large bodies of water. Not only is the deep sea freight transportation industry made up of the businesses actually shipping the products, but the deep sea freight transportation business also consists of all businesses related to sustaining the sector. This means that any business involved in offering boat building, boat repairs, operations and rental services are included in the deep sea freight transportation sector. The demand for global imports and exports has shaped this rapidly growing transportation sector; many large companies dominate the deep sea freight transportation sector, with the fifty largest companies comprising over 90 percent of the business revenues.

Shipping volumes have continuously grown since the early 2000’s, and between 2000 and 2008, the world trade increased by 5.4 percent each year; the Gross Domestic Product (GDP) for those years increased about 3 percent. While every single business sector was hit hard during 2008, the deep sea freight transportation sector has fared well. Unfortunately, 2015 and 2016 were not great years for the deep sea freight transportation sector, resulting in many business owners entering another year of crisis. However, thanks to innovative technologies and increased growth in world trade, the sea freight transportation sector has remained a viable competitor in the transportation sectors.

Deep Sea Freight Transportation Business Trends

Over the past few years, the deep sea freight transportation business sector has seen stagnant growth, leading to many deep sea freight transportation business owners feeling worried about 2017. With any business however, there are always trends disrupting normal business patterns. Making sure to stay up to date on the latest trends affecting the deep sea freight transportation industry is essential to remaining competitive. Here are some of the latest trends for the deep sea freight transportation sector:

- Competition from Increasing Demand of Air Transportation: In the past few years, growth rates for air freight transportation has more than doubled, which has led to increased competition between the two transportation sectors. Many companies in different industries are playing with the idea of utilizing air transportation for the best shipping choice. For example, there has been much discussion about Amazon and their creation of drones to deliver Amazon packages right to a consumer’s doorstep much more quickly and efficiently than commonly used air transportation shipping companies (such as UPS and FedEx). This growing interest in air freight transportation has left many deep sea freight transportation businesses looking to create niche fields to increase profits.

- Increased Growth from Innovative Technologies: One of the biggest growth factors for the deep sea freight transportation business sector is the steady growth of the information and communications technology revolution. Through improved technological communication platforms, the deep sea freight transportation sector experienced drastically reduced costs of mobility and accessibility, as well as allowing the United States to improve production and execution of transportation. There are many other innovative technologies that are emerging in the deep sea freight transportation world, all of which will play vital roles in the evolution of the sector in years to come.

- Ships Continuously Getting Bigger and Better: A constant challenge faced in the deep sea freight transportation business is the overwhelming need to fit more and more on a single ship to increase productivity. Each year, deep sea freight transportation business owners work to create plans for new ships that are bigger, better, more automated, and versatile than ever before.

- Going Green and Sustainability: Going green has become a vital component to every single business across the United States today. The number of consumers demanding eco-friendly systems and processes has become so overwhelming that businesses can no longer ignore the demand. Many innovative technologies are being created today to help reduce the environmental footprint of ships in the deep sea freight transportation industry – whether it is improvements to engines, better propeller performance, high-tech coatings, or innovative skysails that can reduce carbon and Sulfur emissions, there are so many advancements that are taking place today that it becoming a part of the green movement is unavoidable.

Deep Sea Freight Transportation Business Financing Needs

As mentioned above, the deep sea freight transportation business has struggled in recent years, resulting in many deep sea freight transportation business owners struggling with what to do next. This is why so many deep sea freight transportation business owners must remember the variety of financing options available to help with important daily working capital costs. Some of the most common uses for deep sea freight transportation loan choices include:

- Deep Sea Freight Transportation Business Financing for Technologies: Innovative technologies and systems are becoming essential in the deep sea freight transportation sector today, especially because these innovative technologies will be the reason deep sea freight transportation companies remain competitive in this stagnant market. Some of these technologies can be incredibly expensive to purchase and effectively implement, which is why there are a variety of deep sea freight transportation business finance options for these vital technologies.

- Deep Sea Freight Transportation Company Marketing, Advertising, and Social Media Loans: Marketing and advertising have always been an important expense in the deep sea freight transportation sector, and with the ever growing dependence on mobility and social media, the way marketing and advertising has always been done is shifting. With the help of deep sea freight transportation company marketing and advertising loans, many deep sea freight transportation business owners can hire in house marketing specialists, or even chose to hire a third party marketing firm to handle all essential deep sea freight transportation content marketing and advertising.

- Deep Sea Freight Transportation Business Loan for Payroll and Hiring New Employees: Hiring new employees is always an exciting venture for any deep sea freight transportation business owner, especially when it is due to growing business profits. Unfortunately, the process of searching, interviewing, and hiring a new employee can be incredibly expensive, which is why there are a variety of deep sea freight transportation business loan options for hiring new employees. There are also a variety of deep sea freight transportation business payroll financing choices to help cover payroll costs during slow business cycles.

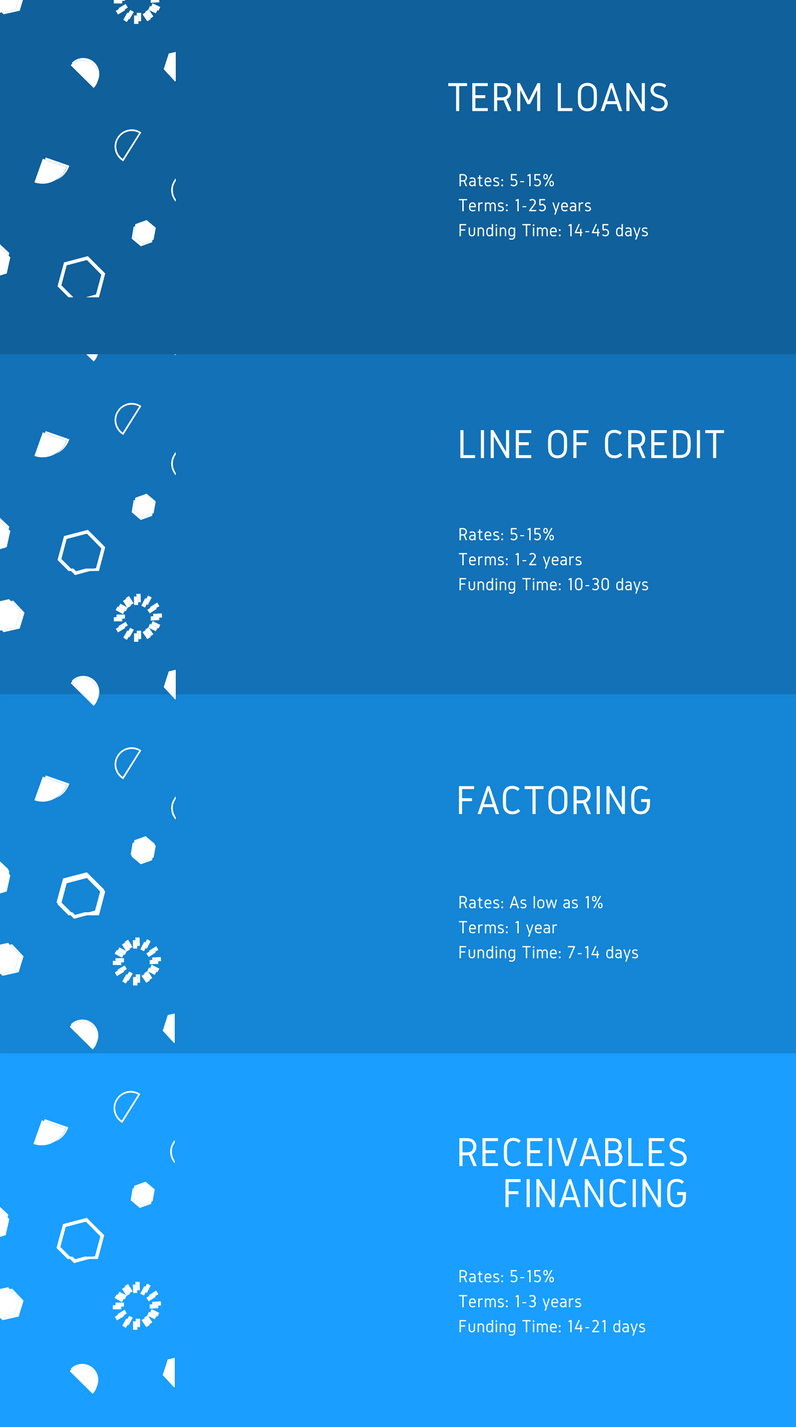

Sea Transportation Financing Term Loans

Term loans are your standard business loans that have an agreed upon maturity date for when the loan must be paid-off. Term loans are generally repaid monthly, although some alternative business lenders offer term loan products with weekly and even daily repayments. Term loan rates start as low as 6%, and can be as high as 20% or more depending on small business lender and the risk the lender is taking in providing the financing. Term loans are used for just about any business use, including acquisitions, refinancing other business loans, consolidating shipping company debt, working capital, purchasing equipment and other operational uses.

Shipping Company Line of Credit

A line of credit is a form of preapproved business financing that a company can access at anytime without having to seek further approval from the bank or lender. A line of credit is a fantastic form of financing that need to have access to operating capital from time to time and don’t want to get stuck taking out a term loan, and having extra money they don’t need (which will be accruing interest). A line of credit can be secured by using company real estate, account receivables, inventory and even equipment & machinery. Rates for a line of credit start as low as 6% and can be interest-only.

Alternative Deep Sea Freight Loans

Alternative financing options for deep sea freight transportation companies are vast and plentiful, with options tailored to just about any company’s needs. Alternative business financing may include AR financing, factoring, receivables financing, cash advance funding, equipment leasing, invoice factoring among others. Rates for alternative loans tend to be higher than conventional bank lenders provide, but alternative lenders offer more flexibility than conventional lenders while offering very aggressive funding facilities that can meet just about any deep sea freight company’s needs, no matter how unique the situation is.