Auto Rental Business Loans

Car rental companies will, from time-to-time, need financing – just like any other small business. Whether it be for purchasing the car rental property, upgrading the car rental facility, upgrading inventory, or paying for everyday expenses, having access to quick and affordable business financing is important. In this article we will explore all the financing options available to car rental companies that are exploring their financing options.

Have you ever rented or leased a car through a car rental agency? Most people would say yes, following up their response with issues of wait time when picking up or dropping off the car, lack of available resources on the go (i.e. booking mobile), and frustrating fluctuating rates and fees. Many car rental and leasing agencies today are shifting those old consumer mentalities by focusing on the latest emerging trends that are completely revolutionizing the car rental and leasing industry.

Various industry reports have shown the major hits that every car rental and leasing industry took during the 2008 recession, however in the past few years, car rental and leasing companies have shown a drastic increase in profitability. Thanks to increased tourism and disposable income, many car rental and leasing agencies are seeing a huge demand for car rentals, “both on airports” and “off airports”. There are many ways to grow in this highly concentrated and competitive businesses, even for the smaller car rental and leasing agencies looking to compete against the major players in this industry. The biggest focus for every car rental and leasing business today is staying up with consumer demands and making the consumer the number one priority. There is a forecast of increased maintence costs, investments in developing training programs for employees to increase safety, and capital increases towards green and safer vehicles; all of these issues are leading to a lot of expensive, up front costs, however these costs will prove to be the niche that will keep the best on top.

Car Rental Industry Trends and Statistics

The major trends affecting the car rental and leasing industry stem from one major theme – car rental and leasing companies must be viewing their businesses as retailers for travel products. This idea has become a core value for many different industries, however the car rental and leasing industry has been slow to adopt this mentality. Across all industries, technology, the Internet of Things, social media, and consumer centric business practices are becoming essential to growing any business, but car rental and leasing companies need to start incorporating more of these essential business practices into their businesses to stay on top – especially since the car rental and leasing industry is heavily reliant on consumer preferences and demands.

- Legislative and Regulatory Issues: Every person in America today is highly aware of the increased demand across all industries to improve sustainability through legislative green initiatives – and the car rental and leasing industry is no different. In most states in the United States, car rental and leasing companies are highly regulated, but with growing demand for more legislature to improve environmental issues, the car rental and leasing industry will see increased pressure in the upcoming years. Major legislative actions that are being considered today consist of improving the fuel efficiency of engines and emissions from vehicle use; the United States has mandated that by 2021, a sales weighted average fuel economy of 45 miles per gallon is required. This is leading to a variety of issues amongst car rental and leasing businesses who have to start trying to comply with these regulations.

- Going Green Opportunities: With many new legislative actions being taken throughout the United States to combat climate change issues, going green and offering more environmentally friendly products is essential for any car rental and leasing agency that wants to stay ahead of the competition. Not only is this issue being demanded by the American government, but it is also the number one consumer demand across all industries – but this also increases many short term costs for car rental and leasing agencies. Any car rental and leasing company willing to make significant contributions to lowering global greenhouse gases by changing out their car inventory will see increased profitability and consumer traffic; however, this measure needs to be communicated to the target demographics through effective marketing, social media, and an effective online presence.

- Consumer Safety Demands: The National Highway Traffic Safety Administration (NHTSA) has been taking a major interest in the safety issues and recalls that have been plaguing the car rental and leasing industry since 2014. While there are innately safety issues associated with driving cars that are simply unavoidable, the past few years have left consumers wary of many car rental and leasing agencies. In 2014, there were major car recalls across the United States, which lead to lost profits for many car rental and leasing businesses. While this is unfortunate, many car rental and leasing businesses were able to rebound, but there were still many cars being rented and leased that were never fixed or removed from their fleet of cars. This spurred the Rachael and Jacqueline Houck Safe Rental Car Act of 2013; two sisters were killed in 2004 in a rental car that had been recalled, but old legislation did not require car rental and leasing agencies to remove recalled vehicles from their business. This bill has increased the demand for consumer safety issues that many car rental and leasing businesses are working hard to fix today. Focusing on making sure safety is a number one concern across all car rental and leasing agencies is essential in growing and maintaining a loyal customer base.

- Innovation: GPS tracking, accident insurance, entertainment systems and other services are now high in demand from consumers. Innovation is key in this incredibly concentrated and competitive industry. It has been difficult for many car rental and leasing businesses to create a competitive niche, especially since the car rental and leasing industry has been slow to adopt much needed technological practices. Innovation has become a major turning point for many different car rental and leasing businesses, but to stay ahead of the competition, car rental and leasing companies need to be exploring more ways to become innovative with their cars and services.

- Technology, Omnichannels, and Marketing: Many car rental and leasing businesses have not started to implement essential technology and marketing practices that will only lead to increased profitability. Having a strong omnichannel presence is simply unavoidable in today’s technologically driven society. Recent research has shown that 48 percent of consumers do not even see a clear difference between car rental and leasing company brands! This should be incredibly upsetting for any car rental and leasing business owner, as well as incentive to get ahead of the competition by implementing better marketing and social media techniques. There are endless amounts of ways to incorporate a stronger mobile presence, website presence, social media presence, and even gamification strategies.

- Increased Disposable Income and Tourism: As mentioned above, there has been a major rise in GDP for the car rental and leasing industry. This is largely in part correlated to the increasing income levels for many American’s today, resulting in more disposable income to spend on travel, leisure, and other exciting items. This is been a major influence in the bouncing back from the Great Recession which led to major hits for the car rental and leasing industry. The number of people, both domestic and internationally, traveling has grown due to the increased disposable income for most families. This will be a major turning point for the car rental and leasing industry in the upcoming years, however the future is not set in stone when it comes to the fluctuating economy. If the economy were to take a turn for the worst, car rental and leasing businesses across the United States would be one of the first major industries to be affected, so making sure to know the multitude of finance options to help keep a car rental and leasing business afloat is beneficial.

Car Rental Bank Loans

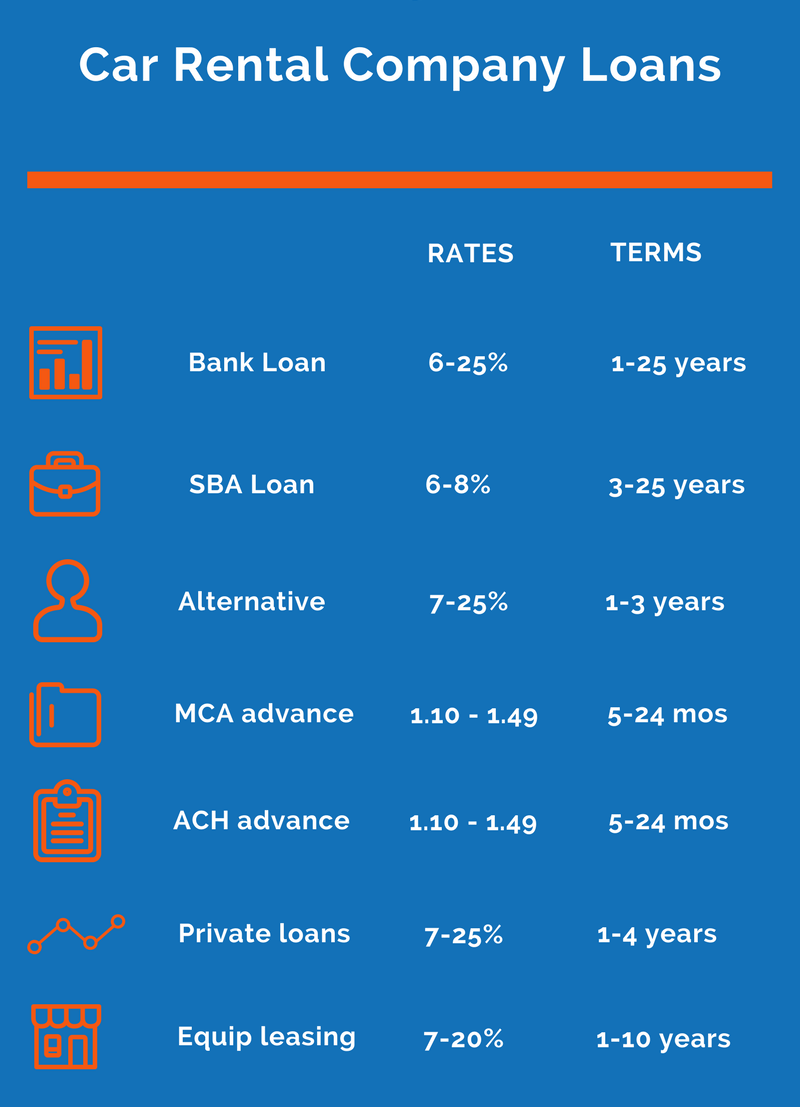

Bank loans offer car rental companies with the best rates and terms of all small business financing options. Banks and other conventional business lenders offer both term business loans, but also lines of credit and even equipment leasing. Bank loans are often used by car rental companies to help finance inventory, purchase new facilities, refinance and consolidate car rental company loans and debt, general working capital, financing to make payroll, and lending for just about any use that comes up in everyday business. While bank loans have the best rates and terms, they also have the toughest requirements to get funded. Banks will require lots of business and personal documentation to get approved for a loan, and the business owner will need to show they have outstanding business and personal credit, along with excellent profitability.

Documents needed for a car rental business bank loan

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Car Rental Company SBA Loans

A great way for car rental companies to obtain bank-rate financing, even if they’ve been turned down by conventional lenders in the past is to obtain a SBA loan. SBA financing is a type of loan created by the Small Business Administration to encourage traditional lenders to provide financing to small businesses through use of a SBA enhancement. By offering the enhancement, the Small Business Administration agrees to cover a large portion of the lender’s losses should the car rental company fail to repay the lender. By offering this guarantee, it reduces the lender’s risk exposure, and thus: encourages the lender to provide financing when they normally wouldn’t.

Documents needed for car rental SBA financing:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Car Rental Business Loans

Alternative business financing for car rental companies is a way to obtain financing without the tough requirements that a conventional bank requires. Car rental companies seeking alternative lending can be approved within a few minutes and can complete funding in less than a week. While alternative business loans are easier to obtain than bank loans (70% of applicants get approved) a small business will still need to show profitability in one of the past two years and have good business credit. Alternative loans are mostly used to operating capital purposes, like making payroll, paying for expenses, making rent, paying taxes and other shorter-term funding reasons.

Alternative car rental loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Car Rental Company Cash Advance

Obtaining more conventional forms of business financing can be difficult to newer companies that has put all their profits back into the business, leading to lower profitability than traditional lenders look for. When a car rental company needs funding with much lower credit and profitability requirements, a good option would be to obtain a merchant cash advance. A cash advance isn’t a loan, but the sale of the car rental company’s future receivables to a cash advance funder at a discount. After the car rental company receives the funding, they will then repay the funding company each day by either taking a set amount from the borrower’s bank account using ACH, or will remit a percentage of each day’s credit card processing transactions.

Documents for a car rental company cash advance:

- Application

- Bank statements

- Credit card statements