Bad Credit Cash Advance Funding

Having access to business capital when you have bad credit may be extremely difficult to find if you don’t know where to look. If you’re a small business with bad credit looking to get funded by a bank, you won’t find much success. But lack of access to funding doesn’t mean the need for capital simply vanishes. Thankfully, a way to get funding for your small business with bad credit is to obtain a merchant cash advance. While not the cheapest type of business financing, it’s the easier funding to get approved for, being that some bad credit working capital cash advance lenders have approval rates as high as 95%. In this article, we will explore all of the merchant cash advance options for companies with poor credit.

What is a Merchant Cash Advance?

A merchant cash advance is a unique type of business financing that isn’t a loan at all. With a cash advance, the small business is actually selling a portion of their future small business revenue. So, in essence, a cash advance involves selling future small business receivables at a discount to the cash advance funding company. Business cash advances don’t use interest rates, but instead use a calculation known as a factor rate.

What is Bad Credit?

Credit is a way for companies to rate your history of repaying debt. Small business owners with credit scores below 629 are generally thought of as having bad or poor credit to many commercial lenders. Having bad credit usually means you’ve had a history of failing to repay your past personal credit obligations. If you apply for a loan through a more traditional source (like a large or small bank, community bank or credit union) or through alternative sources (like marketplace business lenders, fintech lenders and institutional lenders) chances are you’re going to find it difficult to get approved for a loan.

How Does Bad Credit Affect Financing?

Fact is, a bad credit score makes it impossible to get a conventional business loan. No traditional bank or SBA lender will be willing to provide credit to a small business owner that has had issues repaying their credit in the past. With that having been said, there are higher-risk small business lenders that will provide credit to companies that have owners with bad credit. But when these lenders are taking increased risk, the rate of the loan or financing will have interest rates such risk. The more risk a lender takes, the higher the interest rate the small business owner can expect to pay for financing. On top of a higher-rate, the lender will be expected to be paid-back much sooner than would be the case with conventional financing, because the lender doesn’t want to be exposed for long periods of time.

What are the Options for Bad Credit?

While the number of bank-rate financing options are limited for small businesses with bad credit, that doesn’t mean that alternative options are also limited. In fact, there are dozens if not hundreds of small business funding options for companies with poor credit histories. Some of the financing include securing a loan using the company’s assets (including commercial real estate, accounts receivables, equipment & machinery and inventory). Other forms of bad credit business funding include factoring and merchant cash advance financing.

What is a Bad Credit Cash Advance?

As mentioned earlier, a merchant cash advance is simply the sale of future business receivables at a discount to the cash advance company. While cash advances are generally used by companies that have less than stellar credit, they are also used for companies that need financing extremely fast (as cash advances will fund within a day or two) but also used by small businesses that aren’t able to produce the business and financial documentation required by a bank or other conventional lender. But even though cash advances are generally used by companies with less than perfect credit, there are specific cash advance companies that cater solely to small businesses that have bad credit. While a merchant cash advance will always have rates that are higher than conventional lenders, a bad credit merchant cash advance will have the highest rates of all the kinds of cash advances. On top of the highest rates, a bad credit merchant advance will also have very short term – sometimes as short as two months.

- Pros: the positives of a bad credit merchant cash advance are the fact that funding is available at all (which wouldn’t be the case if you were solely reliant on obtaining funding for your company from a bank) but also the speed with which funds can become available. Another plus is the fact that the only documents needed to get funding are a simple credit application and a few months bank or merchant statements.

- Cons: simply put, a bad credit merchant cash advance is the most expensive type of small business financing available. On a four month repayment plan, a company who receives a merchant cash advance may expect to repay 150% of the funding amount they received from the cash advance company. On top of the expensive rates, the repayments are generally made daily through automatic deductions from bank or merchant accounts, putting strain on cash flow.

What are Cash Advance Uses?

While a conventional business lender will usually put tough restrictions on how a loan or line of credit may be used, a cash advance company rarely put restrictions on uses of the business funds. So a cash advance can be used for just about any business use. That doesn’t mean that a small business would use a cash advance to make large purchases like commercial real estate. But it does give them maximum flexibility on short term business funding uses, including:

- Working capital

- Payroll

- Purchases

- Emergency uses

- Upgrades

- Expansion

- Inventory

- Bills

- Taxes

- Hiring employees

What are the Types of Cash Advances

- Short term: short term merchant cash advances usually range from 2-6 months. Short term cash advances are generally provided to companies with very poor credit, have limited or irregular cash-flow, or who already have one or more cash advances already in place.

- Long term: long term advances are generally cash advances that have terms longer than 12 months. Almost always, a long-term merchant cash advance is also a 1st position advance, meaning that they only have one cash advance.

- Multiple position: a second position merchant cash advance is an advance that is obtained with another one already in place. Additional position bad credit cash advance can be in 2nd position, 3rd position, 4th position, etc..

- Consolidation: a consolidation cash advance is an advance used to buy-out at least one other advance. Each consolidation cash advance funder have different requirements, with some requiring the merchant to net additional money after the cash advances are consolidated, with others requiring no net of new additional funds.

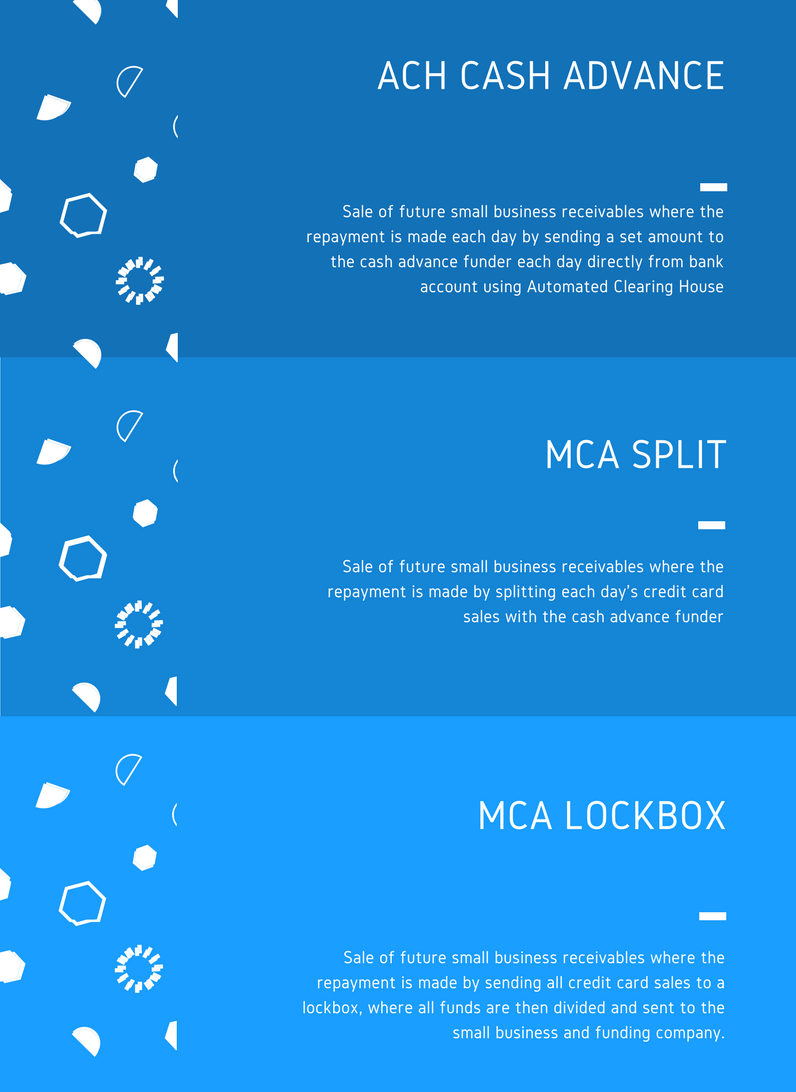

What are the Types of Cash Advance Repayments

- ACH advance: remittances made using Automated Clearing House are cash advances that have a daily repayment amount that is automatically transferred directly from the small business’s bank account, and sent to the merchant cash advance funder. The payment amount is done at a set amount, as is repaid Monday through Fridays, not including holidays.

- Split advance: a split repayment is a cash advance repayment where a funding company collects repayment by taking a percentage of a merchant’s credit card sales. Unlike with ACH repayments, this type of repayment is done by taking a percentage of each credit card processing sale.

- Lockbox: This type of repayment plan involves sending all credit card sales into a lockbox where the funding is then distributed to both the funder and the small business at the agreed upon percentages. Since this isn’t a split with the direct credit card processing company, there may be a lag in time when the merchant will receive their daily funds.

How to Get a Bad Credit Merchant Cash Advance

The process of getting a bad credit merchant cash advance is very simple. First, you will need to complete a basic credit application that asks for basic business and personal information, including personal and business names, business EIN numbers, social security number and date of birth, annual gross revenue and other information. Along with the credit application, you will need to submit 3-6 months bank statements to get an ACH cash advance, and if you’re looking for split or lockbox MCA financing, you’ll need to supply merchant processing statements. After you’ve submitted an the funder preapproves you for a set cash advance amount, you will then be supplied with contracts which you’ll need to complete and return to the funder (along with any other additional documents requested). After the funder receives the contracts, they will then verify that the information supplied is accurate by using a 3rd party service to verify your bank account. After the bank account has been verified, the funder will then place a funding call, and with the completion of the funding call, the money will then be wired directly to the small business’s bank account.