Loans For Flooring Businesses

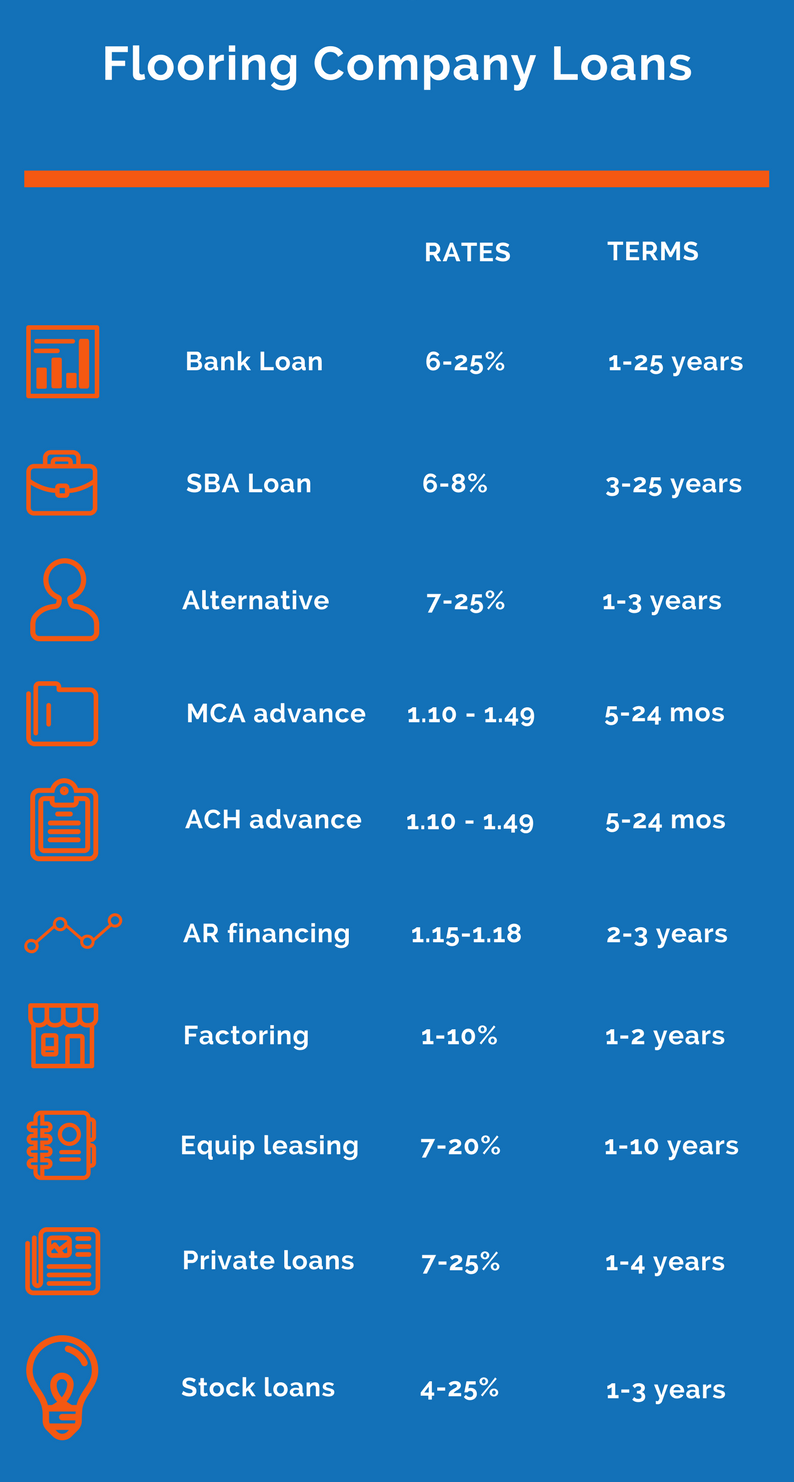

Running a flooring, tile or hardwood floor business requires capital to not only start your company, but also to keep in running, growing and thriving. Capital is used to purchase flooring companies and their assets, purchasing or leasing the commercial space used by the company, purchasing and/or leasing business equipment and machinery, paying employees among other uses. When it comes to flooring capital and business loan options, there are plenty of choices to choose from, whether its a bank term loan, line of credit, alternative flooring company loans, business and merchant cash advances for flooring companies, flooring equipment leasing among others. In this article we will explore all the debt financing options available to flooring companies and small businesses seeking loans.

Commercial and Residential Flooring Industry

We are all blatantly aware of the major repercussions that the United States has faced since the Great Recession, however the industries that were most affected centered around construction related industries – with the commercial and residential flooring business sector being heavily impacted. Luckily, as with many other industries in the past few years, the commercial and residential flooring company sector has seen rapidly increasing profits and new commercial and residential flooring business innovations that are making the commercial and residential flooring industry more appealing to consumers. But what exactly is the commercial and residential flooring business world?

Commercial and residential flooring businesses focus on installing permanent floor coverings, such as carpets or tile flooring. Within the flooring business world, there are typically four product segment categories: soft coverings, resilient flooring, non-resilient flooring, and seamless flooring.

- Soft covering flooring, also commonly referred to as textile coverings, consist of rugs, carpets, and other related items. The soft covering flooring sector accounted for over 50 percent of the overall market share in 2013, but has seen stagnant profitability in recent years.

- Resilient flooring refers to mixtures of color, binders, and fillers such as cork, wood, rubber, vinyl, asphalt, and linoleum. The resilient flooring sector continues to see year after year growth due to the positive qualities associated with resilient floor coverings, such as their waterproofing qualities, overall cost effectiveness, and their durability and low maintenance qualities.

- Non-resilient flooring has always been an incredibly popular commercial and residential flooring business proponent, particularly because non-resilient flooring is easy to maintain and tends to last longer than other types of floor coverings. However, non-resilient flooring options are typically more expensive, leading to a limited market base. Non-resilient floor coverings include ceramic tile, clay tile, concrete tile, terrazzo stone, and brick.

- Seamless flooring is generally utilized for the protection of garage floors, as well as the restoration and protection of commercial business flooring, such as industrial work spaces. Seamless floor covering generally produced into a synthetic resin covering.

Commercial and Residential Flooring Business Trends

Overall, the United States commercial and residential flooring company sector has seen consistent growth since 2013, with many commercial and residential flooring businesses experiencing average sale increases. Even though there is growth, and the commercial and residential flooring business industry is expected to continue to experience this shift, there are still many areas that are falling behind pre-recession levels. The 4.2 percent in dollars increase that the commercial and residential flooring industry experienced in 2016 was not enough for many flooring business owners who are hoping to expand operations. Some of the major business trends that can help make or break a commercial and residential flooring business include:

- Cost Effective and Environmentally Friendly Flooring Options: Every single business in the United States today is grappling with the transition into more sustainably friendly products and services – and the commercial and residential flooring companies are no different. While many of the usual floor coverings may be more cost effective for many consumers, many people today are willing to pay the extra money to ensure that they are receiving environmentally and sustainably friendly products. Some of the most profitable options that the commercial and residential flooring business sector has seen so far include floor covering materials such as cork, linoleum, bamboo, glass, polyester (P.E.T) Berber, rubber, and reclaimed hardwood. While these are the common environmentally friendly options right now, there is always room for innovation and improvement to reach a larger key market demographic.

- Construction Industry Surging: As the real estate market rebounds, the demand for more construction related services increases, which then leads to higher demand for residential and commercial flooring services. Many residential and commercial flooring business owners will benefit by creating meaningful networking strategies with construction and real estate related people, as well as paying close attention to those market trends.

- Focusing on New Technologies: Innovation is key in every single business across the world today, and with the residential and commercial flooring business world only seeing slow growth and profitability, there is plenty of room throughout the commercial and residential flooring business sector for new, innovative technologies to disrupt the stagnant commercial and residential flooring company world.

Growing Market for Luxury Vinyl Tile (LVT): One of the most noticeable innovative trends disrupting the residential and commercial flooring business market include the transition into more Luxury Vinyl Tile from Vinyl Composite Tile floor covering options. Vinyl Composite Tile (VCT) has been used in the flooring business sector for years, and is often installed in commercial buildings such as hospitals. This is due to the durability, ease of installation, cost effectiveness, and overall ease of replacement qualities. However, Vinyl Composite Tile only consists of about 8-12 percent vinyl. This is why so many people have been starting to favor the innovative Luxury Vinyl Tile – by being 100 percent vinyl, the benefits of Vinyl Composite Tile are now heavily amplified.

Flooring Company Financing Uses

There are endless amounts of trends affecting the residential and commercial flooring business world today, but trends come and go – the need for residential and commercial flooring business financing does not. Some of the most common residential and commercial flooring company needs for funding include:

- Commercial and Residential Flooring Business Loans for Technologies: As mentioned above, the residential and commercial flooring business sector is in need of more innovative and exciting technologies to expand the residential and commercial flooring business world. Utilizing residential and commercial flooring business loan choices can help make this a reality.

- Purchasing Real Estate: if your commercial flooring company uses a building or facility to store your equipment, inventory and supplies, the option of purchasing that real estate may be part of your company’s plans — which requires financing.

- Refinancing Business Debt: If you have a business loan or other types of high-interest debt, getting a small business loan to refinance that debt could possibly save you money and extend out your terms, making it easier to repay the debt.

- Debt Consolidation: Flooring companies may seek a small business loan to help consolidate high interest debt (especially multiple cash advances) into a single payment with longer terms.

- Working Capital: There are a number of expenses that a business will have to cover on a day-to-day basis. Having sufficient cash in the bank to cover these expenses without missing payment can be obtained by seeking operating capital.

- Marketing and Advertising: Getting the word out to the public about the services and products your flooring, tile or carpet company costs money. One way to help with marketing is to obtain a small business loans to cover the costs of advertising.

- Equipment Financing: In a business that relies heavily on physical labor and the installation of products, having specialized equipment is essential. Sometimes valuable, expensive equipment breaks, or a business owner simply needs access to more equipment that will increase business profitability. Consider residential and commercial flooring business equipment financing.

Flooring and Carpet Company Bank Loans

Bank financing for flooring and carpet companies are clearly the superior type of small business loans. The reason: no other type of business loan has lower rates, longer terms, and more reasonable fees than a bank term loan or business line of credit. Bank loans are used for a variety of uses, including acquiring businesses, purchasing or refinancing flooring company real estate, purchasing equipment or business machinery, having operating capital in the bank among others.

Flooring company bank loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Flooring Company SBA Loans

SBA loans for flooring companies are a way for small hardwood floor, tile or carpet businesses to obtain real bank-rate financing even if they’ve been turned-down by a traditional bank previously. SBA financing for flooring companies are loans back by the Small Business Administration in which they agree to cover a fairly-large portion of the SBA-enhanced loan should the flooring company fail to repay the loan to the SBA lender. This means that the SBA lender will have less exposure to risk, and therefore helps encourage them to lend to small businesses. SBA loans are used for acquisitions, refinancing and consolidation of flooring business debt, working capital, equipment purchases and just about any business use.

Flooring company SBA loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Flooring Company Loans

While conventional bank lending or SBA lending are always the most preferable small business options, sometimes a borrower lacks the credit, documentation, time-in-business and profitability to obtain those traditional forms of financing. When a small business has lower credit than needed, has limited business documentation, is not yet profitable or needs financing in the matter of days, not months, a good option would be to seek alternative financing. Flooring companies can get approved for an alternative business loan within minutes, and will fund in usually a week or less. While the uses for alternative loan can be used for just about anything, they are most commonly used for working capital, making payroll, emergency uses and advertising.

Flooring company alternative loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Flooring Company Cash Advances

Cash advances are different than conventional and alternative business loans in that they aren’t a loan at all. Merchant cash advances are, instead, the sale of the flooring companies future credit card deposits or bank account deposits in exchange for immediate funding. While cash advances are more expensive than other forms of business financing, they also fund much faster than all other forms of financing, with funding being completed within a couple of days, if not the same day.

Flooring company cash advance documents:

- Application

- Bank statements

- Credit card statements