Merchant Loan or MCA?

Nearly every small business owner will find themselves in need of financing at some point in time. Fact is, unless you have saved up substantial financing to help start your business and keep its operations running, you’ll probably find yourself looking outside your company for funding to help fill the gaps in cash-flow or other purposes. With so many small business lending options available a merchant may find themselves confuses about what the different options are, and what option is best for their company. While the array of funding options for merchants may be vast, there are essentially a few types of loan structures that are commonly used by lenders and funder to provide merchants the needed capital they need. In this article we will primarily focus on merchant loans and merchant cash advances, and the differences between the two.

What is a Merchant?

A merchant is a business owner or company engaged in trade and commerce of commodities using sales, cashflow, revenue, profit for commercial or industrial-use. Merchants have existed for as long as businesses have existed, dating back to pre-modern societies. In legal settings a merchant is held to a higher degree because the merchant is considered to be an expert in the products they provide and resell. Merchants generally fall under two categories:

- Retail: sale of goods or merchandise directly to consumers through retail storefront, business websites, e-commerce platforms and seller networks. For the most part, small business retailers generally sell such products in small products, and not in bulk.

- Wholesale: a small business wholesaler acts as sort of a middleman linking manufacturers with retailers by buying the products or merchandise in bulk, and then the products are resold in smaller quantities to retailers.

What do Merchants Need Financing For?

As with all small businesses, having sufficient capital is not only a necessity to make sure the company’s operations function, but having capital on hand to take care of opportunities that may arise may be the difference between a profitable adventure, and going in the red. Uses include:

- Acquisitions: financing used by an individual or business to acquire an existing business and its assets.

- Purchasing real estate: commercial loans used to purchase or refinance a business’s building and/or property.

- Refinancing business loans: help ease the burden of higher-interest business loans into a more affordable loan with a lower rate and longer term.

- Consolidating debt: taking all the merchant’s business debt and consolidating all forms of debt into a single payment.

- Working capital: having sufficient business cash to handle day to day operations and cover the company’s expenses.

- Payroll: financing to make sure that all employees of your small business are paid on-time, whether it be weekly, bi-weekly or monthly.

- Expansion: financing to help your small business expand either through larger business facilities or through online presence.

- Inventory: making sure the merchant has enough goods and products in stock to support sales.

- Advertising and Marketing: providing customers with a way for them to become informed and familiarized with your company.

- Repairs and upgrades: fixing and upgrading business equipment, machinery and business structure.

- Hiring employees: Providing enough runway to support the hiring of additional employees to help increase sales and efficiency.

When is Debt Financing Worth It?

Its worth it for a merchant to take out some sort of debt financing if they feel that the loan or advance will lead to growth of your small business, will lead to greater profits, or if your company is attempting to gain profit share. Taking a loan or advance just for the sake of taking the cash doesn’t make sense unless there is a very clear use, and the money being borrowed will lead to a multiple return of the cost of financing.

What is a Merchant Loan?

Simply put, a merchant loan relates to any type of financing that involves the borrowing of money with the promise of the merchant to fully-repay the loan. The costs the lenders charge merchants for the loans are usually calculated using interest rates, with the rate calculated on an annualized bases. Merchant loans are almost always repaid on a monthly payment schedules, and may have prepayment penalties depending on type of merchant loan.

- Pros: merchant loans almost always are much more affordable than even the best merchant advances, and allow the merchant to capture savings by repaying the loan early. Other pros include spread-out payments, lower origination fees and longer terms and amortization schedules.

- Cons: merchant loans generally have higher credit and revenue requirements than merchant advances. Also, merchant loans take longer to fund than advances, sometimes taking weeks and months after approval before funding occurs.

- Types: there are a number of loans available to merchants, including conventional and traditional bank merchant loans, SBA merchant loans, mid prime merchant loans, sub-prime merchant loans and asset based merchant loans.

- Uses: merchant loans are have a wide variety of uses, including: purchasing real estate, refinancing and consolidation, operating capital, cash-flow financing, payroll, expansion, etc..

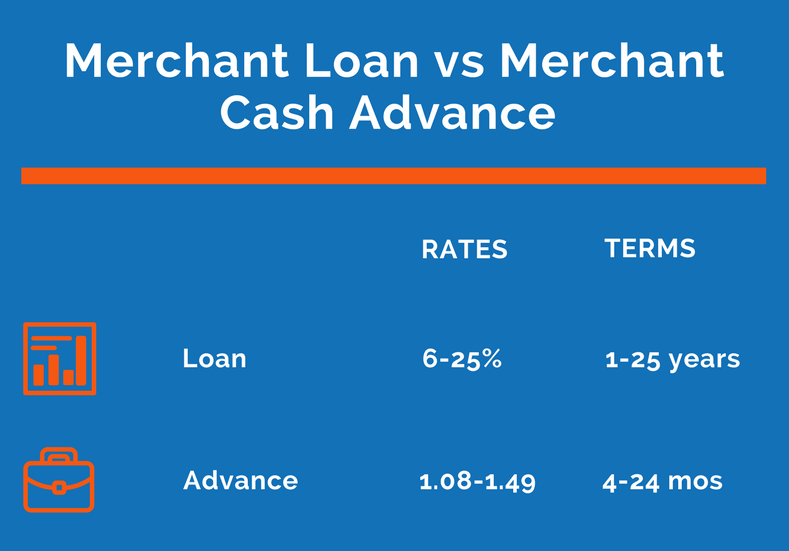

- Rates and terms: the rates and terms of merchant loans will also vary depending on type of merchant financing, credit risk, profitability and a number of other factors. Usual rates are between 6-20% with terms ranging from 1-25 years.

What is a Merchant Cash Advance?

A merchant cash advance (sometimes referred to as a MCA loan) isn’t actually a loan at all. A cash advance is a financing product offered by funding companies that purchases a portion of a merchant’s future receivables at a discount in return for immediate financing. Cash advances are generally repaid either by withholding a percentage of the merchant’s daily credit card deposits to repay the funder, or by taking a set amount from the merchant’s bank account each business day using Automated Clearing House (ACH) until the funding if repaid.

- Pros: the biggest advantage of a merchant cash advance is the speed with which a merchant can be approved and funded – generally occurring within days if not hours. On top of the fast funding is the ease of the transaction with minimal documentation needed.

- Cons: an obvious negative of a business cash advance are the very high rates you’ll pay. A merchant may expect to payback 150% of the total amount borrowed. Even more, the terms associated with an advance are much shorter than a loan, with terms ranging just 4-24 months.

- Uses: while a merchant wouldn’t use a cash advance for long term debt uses, like purchasing real estate or acquisitions, a cash advance is a great way to obtain fast cash for working capital and emergency uses.

Alternative Merchant Funding Options

- Equipment leasing: rather than purchasing equipment outright, leasing business equipment is a way for merchants to obtain machinery and equipment without having to pay the full-costs upfront.

- Invoice financing: factoring is a way for merchants to access capital locked in unpaid invoices of your customers. By selling these invoices, you may be able to access up to 95% of the invoices values.

- SBA loans: business loans that are backed by the Small Business Administration. The govt agrees to cover a large portion of the lenders’ losses should the merchant fail to repay the SBA loan – which reduces the lender’s risk. That helps encourage them to lend.