Working Capital With Poor Credit

Just about every business at some point will find themselves in the need of financing to fund day-to-day business operations. For companies that may have poor or lack of credit can have a difficult time finding more conventional forms of business financing. Fact is, if a company has bad credit, they can’t just walk into their local bank seeking immediate financing. Conventional banks only have a 20-40% approval rating even for businesses with good credit. Chances of getting financed through a traditional lender without substantial collateral and fantastic cash-flow is limited. For companies with bad credit in need of working capital, there are plenty of other options available. In this article we will explore the options. But first, let’s take a broader look at working capital.

What is Working Capital?

(working capital = current assets – current liabilities)

Working capital is the difference between a small business’s current assets and current liabilities. When calculating a working capital ratio, you divide current assets by current liabilities, which, for a company that is capable of paying their bills, should come out with a calculation of 1.0 (or, using 100% of current assets to pay 100% of current liabilities). Granted, with a 1.0 calculation, a small business is barely capable of meeting their expenses, therefore a healthier calculation should be in the 1.2-20 range. Therefore, a company may need added capital and liquidity added to the company to help cover the day-to-day operational needs of the business without missing payments to suppliers, contractors, employees, etc.

Working Capital Uses:

- Cash Flow: represents total funds moving into and out of the business bank accounts. Without sufficient cash-flow, a business may find itself unable to meet its day-to-day business operations (like paying for expenses, suppliers, vendors, utilities, rent or mortgage of business facilities, covering the costs of leasing equipment, etc).

- Expansion: making the decision to expand your small business is an important step to help increase the revenues your company brings in. But the decision to expand will definitely require additional business costs to cover the expansion. Whether it be a build-out, opening a new location, introducing an online seller store, or purchasing extra trucks and equipment, you’ll need to have financing in place to cover the upfront costs.

- Payroll: if your company has employees, you have the responsibility to make sure they are paid on time without fail. Fact is, your employees are relying on you to pay them on time because your employees have their own financial obligations. If you are unable to consistently pay your employees on time, you’ll find yourself losing the best talent, and unable to recruit great talent.

- Repairs/Upgrades: no one plans on a stove not turning on, a truck breaking-down, and piece of machinery failing, a busted pipe, etc.. Every business will run into some sort of emergency expense to repair equipment, machinery or facilities, and waiting around is not an option. To make sure your business operates smoothly, you’ll need those issues fixed immediately.

- Advertising: you can have the best business ideas, the greatest of staffs, and an excellent business operation, but unless customers learn about the products or services you offer, you won’t get business. Making sure you have financing to cover the cost of your marketing and advertising is especially important for small businesses.

- Inventory: if you are a retailer or wholesaler you need to make sure you have a proper amount of inventory to fill any orders your customers may have. Without sufficient inventory, your customers will find themselves waiting on back orders, leading to a terrible customer experience. To make sure shipments are made on time, you must have the right amount of inventory to cover orders.

- Repayment of Debt: if you’ve taken a loan, it is of the utmost importance to make sure you don’t default on a loan repayment. Having sufficient capital in your accounts so you can mail-in your monthly (maybe daily or weekly) debt payment must be done without fail.

- Purchases: whether the purchase is for absolute necessity or if used to help with expansion, they always cost money. If you don’t have enough working or operational capital available you just can’t make these purchases. Missing out on these purchases could lead to a missed opportunity at growth, or worse, a setback to your company. Having enough capital to cover these costs is essential. Having access to fast working capital can be the difference between catching and missing opportunity.

- Payables: There isn’t a day that goes by that your small business doesn’t pay some sort of bill or miscellaneous expense, whether it be for a reoccurring payment that is expected, or maybe just taking the employees out-to-lunch. Having short term working capital in the bank is important to cover any and all business costs.

What is Bad Credit?

Bad credit is a representation of your failure to keep up with debt obligations in your financial past. Sometimes the debt relates to a prior small business loan that you had in the past in which you failed to stay current with your loan. Or maybe its from outstanding credit card or lease balances the small business has. In short, if your small business has bad credit, it means you’ve had difficulty paying debt in the past, the debtors have notified the credit reporting bureaus of these credit issues.

How Does Bad Credit Affect Ability to Get a Loan?

Having bad credit will definitely limit the availability of small business lending options available to your company. When a lender sees that you have bad credit, they know you’ve had issues repaying debt in the past, and therefore identify you as an increased risk of failing to repay. Depending upon how poor your credit is, the lender will adjust the rate to reflect the risk. If your company poses a greater risk to the lender, the lender will increase the interest rate and fees you’ll pay on your loan. If your credit is poor enough, the lender will refuse to provide any financing at all.

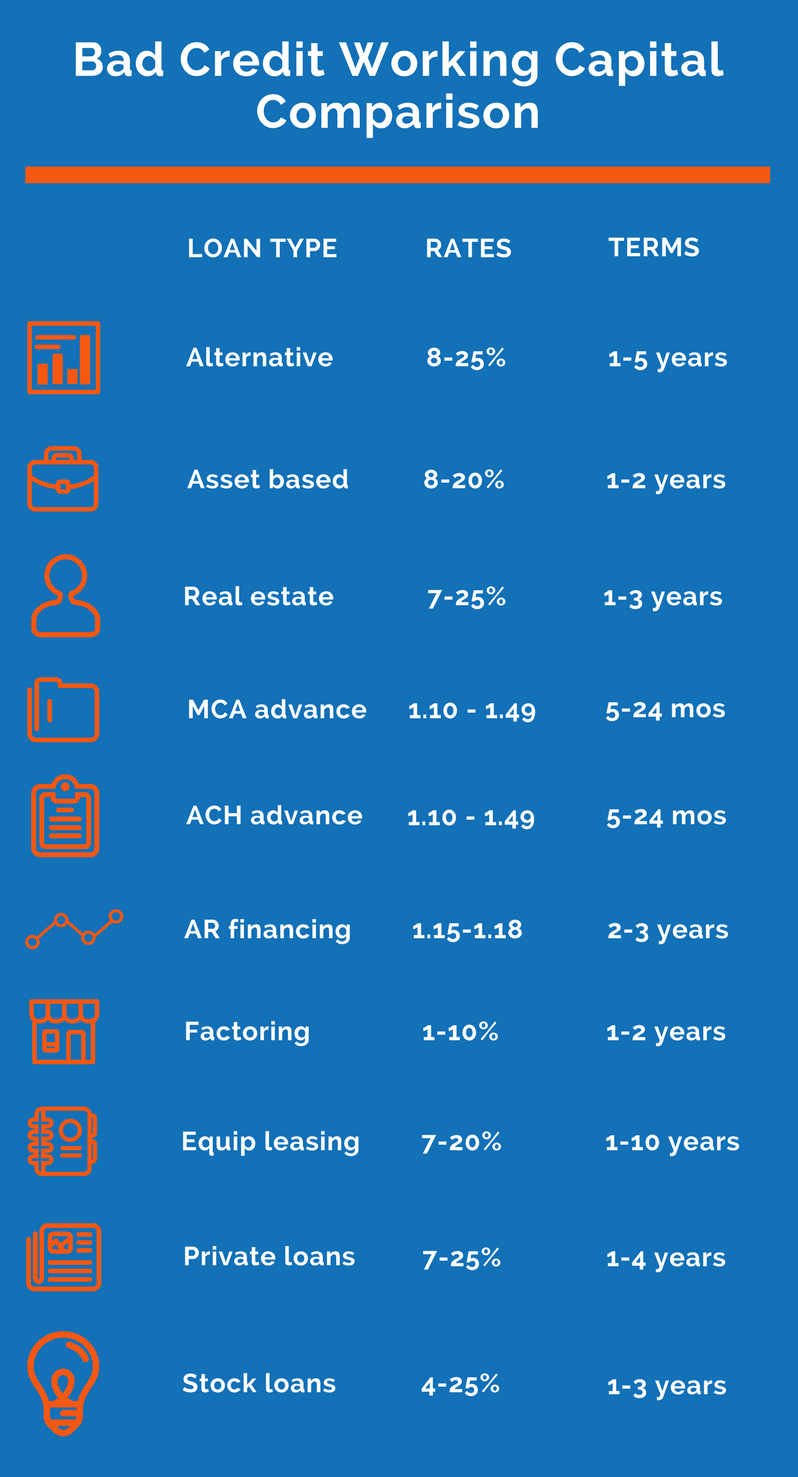

Types of Bad Credit Working Capital Options

- 1. Alternative Loans: loans provided by institutional, marketplace and fintech lenders meant to help fill the void left by banks who refuse to lend to quality small businesses who have great cash-flow and a history of profitability.

- 2. Asset Based Loans: a type of financing that is completed by using assets on a company’s balance sheet as collateral for the loan. Types of assets used as collateral for asset based financing include accounts receivable, inventory, real estate, equipment and machinery.

- 3. Working Capital Using Real Estate: if a company is in need of working capital but either has poor credit or may lack recent profitability, an option could be to use your business or personal real estate (buildings and land) as collateral to obtain operating capital.

- 4. Merchant Cash Advance: a MCA loan is a way for companies that process credit cards to sell a portion of those credit card transactions to a third party at a discount, in exchange for an immediate cash payment to the small business. After the financing is provided, the merchant will then repay the funder each day by having a percentage of their credit card sales withheld and given to the funder until the cash advance is repaid.

- 5. Business Cash Advance: this type of small business financing is very similar to the merchant cash advance being that they are both the sale of a small business’s future receivables at a discount. What makes a business cash advance different than a MCA is the way that its repaid (which is done by having a set amount deducted by ACH each business day by the funder until the cash advance is fully-repaid).

- 6. AR Financing: this type of financing is similar to factoring, the only difference is AR financing doesn’t involve the sale of the invoices but, instead, uses the small business’s invoices as sort of collateral to provide a line-of-credit. Since the accounts receivable is being used as collateral, the need for good credit isn’t as important.

- 7. Factoring: this type of funding involves a small business selling their invoices to a third-party factoring company. The small business will submit their invoices to the factoror, and the factoring company will then forward a percentage of the invoice’s amount. Since you are selling the small business’s invoices, you aren’t actually being lent money: thus: credit isn’t important.

- 8. Equipment leasing: if a business is in need of business equipment or machinery, sometimes you don’t have cash available to cover the cost of the purchases. One way to acquire essential small business equipment is to have a third party purchase the equipment to you, and then you lease it from the leasing company over a period of time (usually with the option to purchase at the end of the lease’s term).

- 9. Private Lenders: private business lenders are available to construct and structure small business lending facilities to cover just about any type of uses and needs. Private lenders have much more flexibility than conventional banks and other traditional business lender because they represent investors willing to take risk. Private lenders are especially able to help-out consolidate small business cash advances for companies with bad credit.

- 10. Stock Loans: another form of asset based financing used by business owners with less than good credit is to use your stocks as collateral to obtain financing. Your stocks aren’t being sold – only used as collateral – therefore you’ll always keep control over them.

Conclusion

Getting working capital when you have bad credit isn’t an optimal situation. The best situation is to improve your personal and business credit so that you’ll have access to more conventional forms of financing provided by large banks, small banks, community banks and credit unions. But if your credit is bad and you need working capital right now, there are a number of options available.