What is a Private Business Loan?

A private business loan is any type of business financing provided by a non-bank business lender. Unlike with an equity investor like angel investors and venture capital, a private business loan doesn’t require giving away a portion of your company’s equity in order to obtain financing. Private business loans are almost always structured as a type of debt financing, that are structured as loans, lines of credit, factoring and sales of future business receivables.

What is the Purpose of Private Business Lending?

Private small business lending is meant to fill the gap left by traditional and conventional bank lending institutions. Oftentimes, conventional lenders have very strict lending criteria with little to no flexibility in their underwriting and structure of the business loan facility. Private lenders on the other hand aren’t constrained by many of the regulations and restrictions that FDIC-insured lending institutions have. With these looser regulations and fewer restrictions, private lenders are able to offer small businesses with creative types of business financing that can work for nearly any business that can prove their ability to repay the loan, and doesn’t pose too much risk to the lender or funding company.

Benefits of Private Business Loans:

The benefits of getting a private business loan are many, but the most important benefit is usually just simply having access to capital. Banks only provide a 20-40% approval rate for most small business applicants. Private business lenders on the other hand can have approval rates as high as 90% depending upon the company’s situation and financial health. Beyond access to capital there is also the ease of obtaining funds, reduced documentation requirements, more flexibility about use-of-funds, little to no covenants, and speed of funding, and all around creativity of private lenders that think ‘outside-the-bank’.

Additionally, getting a bank loan without exceptional credit is nearly impossible. If your credit score is below 680 your chances of getting conventional or SBA financing can be very slim – and that’s before other financial factors are even considered by the bank. Nearly every alternative business lender is a private lender of some sort, and the private lender’s can accept credit as low as 500 as long as the company can prove they will repay the loan and offer sufficient collateral to mitigate the lender or private funding company’s risk.

Downside of Private Business Lending

The downside of private business funding is generally the fact you will pay higher interest rates than you would with conventional financing. Keep in mind, when your small business is being evaluated for a loan, the funding company will figure out how much risk is involved, and then price-in the risk into the loans rates. The more risk your small business poses in not repaying the loan, the higher the rate the lender will charge. Since banks take little to no risk, they are able to offer the lowest rates available to small businesses seeking capital. On the flip side, since you were unable to get financed through traditional means the bank felt you posed too much of a risk for their lending model. Therefore, in order for the private lender to step-in, you must understand that your firm poses a higher risk, and thus: you’ll pay a higher rate.

Collateralized vs Unsecured Private Business Lending

Uses for private business financing cover just about any expense or investment a business may have. While conventional lenders may have restrictions on how their term loans and lines of credit are used, many private lenders will allow the use of funds to be used on just about any business expense one can think of. Some of these uses include:

- Private working capital lenders

- Private commercial real estate lenders

- Private cash advance consolidation lenders

- Private bridge lenders

- Private term lenders

- Private line of credit lenders

- Factoring companies

- Bridge lending

- Equipment financing

Private Business Lending Providers:

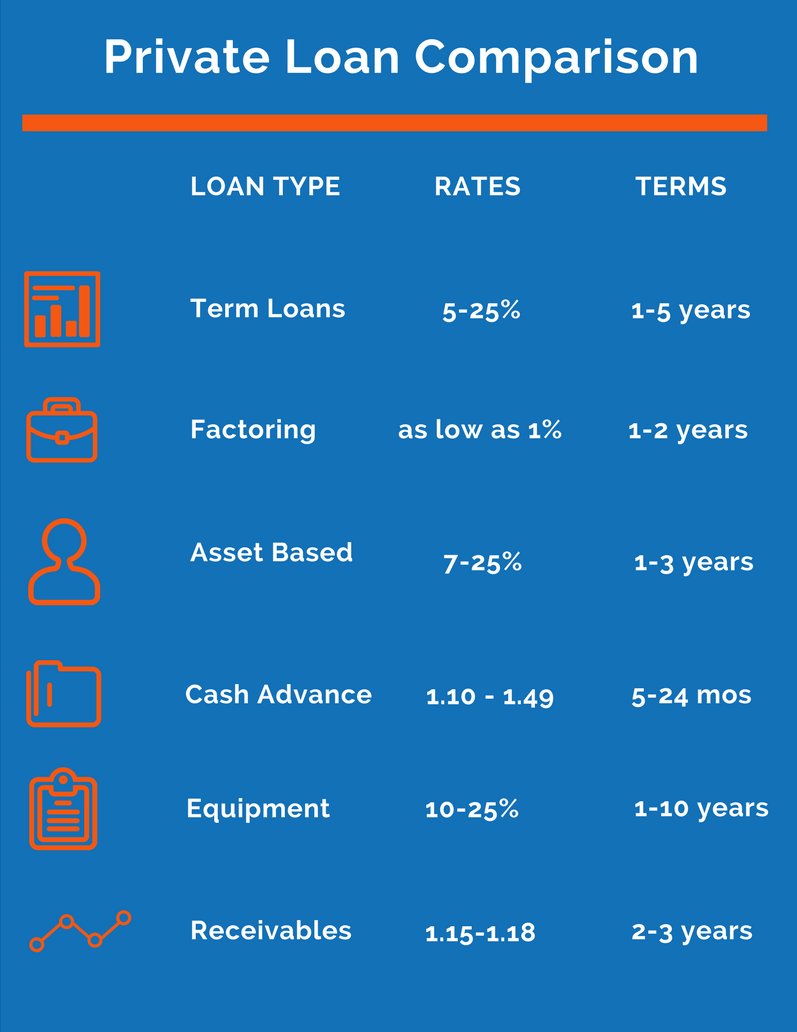

- Private Term Lender: A private term lender will generally look to structure their term loan much like a bank would. For real estate, there is a chance the private lender may offer rates and terms and are similar to what a bank would provide for commercial real estate loans – although many private lenders usually seem to focus more on shorter term-higher rate bridge loans. For working capital uses, private term loans are generally in the 1-5 year range, and have rates that can start at nearly bank-rate.

- Private Line of Credit Provider: Private lenders that offer lines of credit usually focus on a company’s assets to collateralize their funding facility. The main type of asset used as collateral by private lenders is a company’s accounts receivable – which is used to offer revolving funds (although this type of financing requires monitoring the AR to check for ups and downs).

- Private Working Capital: The most common type of private lender that offer working capital for small businesses are institutional, fintech and investment lenders. There are hundreds if not thousands of different variety of private working capital loans and lenders, with rates that can start in the single digits, but can also be quite expensive if the risk supports the high rates.

- Private Cash Advance Consolidation: There are private lenders that focus almost solely on purchasing, refinancing and consolidation small business merchant cash advances into a more affordable payment plan. Private lenders offer company’s struggling with cash-flow crunches from cash advances with monthly payments with terms up to 36 months (as opposed to 4-18 months with merchant cash advances). But these types of funding companies focus heavily on net profitability, so you’ll need to show that you have the ability to service the debt solely through the company’s profits.

- Private Future Receivables Financing: Another type of private small business financing is the process by which a private merchant cash advance funding company will purchase a portion of the firm’s future business receivables, and provide the business with a portion of those future receivables, upfront, in cash. So since the receivables are actually being purchased, this type of funding isn’t considered a loan, but a business-to-business transaction.

- Private Factoring: A way for a small business to obtain financing from a private lender is to sell their unpaid business invoices to a third party to obtain immediate cash. A private factoring company will pay up to 95% of the invoice’s value with a day or two of the invoice being submitted.

- Private Equipment Lenders: For small businesses that need equipment, but have been unable to get a loan from a bank to purchase the machinery, an option is to have a third party buy the equipment, and then lease the equipment from that third party.

How to Find a Private Lender:

The best way to obtain a private business loan is to research all of your funding options, and seek-out the type of financing, and structure of financing that makes the most sense not only immediately, but also projecting forward into the future to make sure your business is as successful as possible.