Have any of you been to a mall recently? If you have, you know how devastatingly empty malls are today; and if you have not been to a mall recently, well, you can just as easily understand why they are so empty. American’s are known for living a fast-paced, time constrained lifestyle today, leading to a rapidly increasing dependence on quick and easy purchasing options. Thus, the evolution of what all brick and mortar retailers today are calling the “Amazon Effect”.

But what is the Amazon Effect? According to Millennial Marketing, the Amazon Effect is the major impact that ecommerce brand Amazon has had on the digital and brick and mortar marketplace, leading to a new, diverse, and competitive business model that typical brick and mortar retailers are struggling to adopt. Consumers want to be able to purchase items with the click of a button and have the item there within a few short days at an affordable, unbeatable price. While it may seem like the Amazon Effect is only impacting brick and mortar retailers that carry similar items to Amazon (such as clothing, accessories, and so forth), the Amazon Effect is really changing all aspects of the retail and customer service world. Amazon has set a high bar for the rest of the retail and customer service world, resulting in consumers expecting the same quality service, care, expertise, and convenience that Amazon offers.

The Amazon Effect became unbeatable and unattainable because they decided to incorporate the Millennial Mindset that is leaving many retailers at a loss for what to do next. Retailers everywhere are having difficulties attracting younger customers, and even if these retailers attract them for a period of time, they then struggle with retaining these customers. The Millennial Mindset has shifted the way the retail world works, and too many retailers waited until the last minute to incorporate these vital business practices into their endeavors.

Now that consumers have experienced this highly specialized type of consumer care, they are not too willing to go back to how things used to be.

Easy, Free Return Policies and Same Day Shipping Crippling Retail Businesses

When Amazon became a major player that disrupted the digital ecommerce world, they attempted a few niche services that could have potentially been extremely expensive, leading to business failures. Luckily, their expensive niches paid off – easy and free return policies coupled with same day shipping options at affordable prices. These services then set a standard for all other omnichannel, ecommerce, and brick and mortar retailers, leaving most retailers with no other options to compete outside of mirroring these services. While this was a game changer for Amazon, it left many other retailers struggling and broke.

Easy and free return shipping policies are not cheap, and with Americans returning more than $260 billion in goods each year, many of these brick and mortar and smaller ecommerce retailers simply could not afford to maintain this service. The process of returning packages, especially after the holidays, left many retailers entering the new year with lower than expected profit margins and excess products that they can no longer sell. Simply put, retailers did not realize the true expenses associated with these niche services.

Lack of Innovation in Stores

When looking ahead into 2017, the major question that retailers are facing is what to do next. How do they attract more customers? How do they retain those customers? How do they adapt to changing business models? How do they compete with Amazon?

Unfortunately, too many brick and mortar and smaller ecommerce businesses do not have the working capital to make such a major transition to compete with Amazon and similar retailers. Those that can manage to engage their customers on new levels while integrating the newest technologies into their businesses will still stand a chance though. One of the biggest complaints from consumers when it comes to brick and mortar retail businesses is the lack of innovative services and products. Consumers today expect specialized service, clothing and other products that appeal to them as individuals, and they want to feel like coming to the brick and mortar location is not a waste of their valuable time. In other words, most retail businesses do not offer enough unique and customized product offerings, and even if they do, retailers are not rotating products quick enough. If a consumer goes to a brick and mortar location more than once and sees the same products every time, chances are they are not coming back. It is incredibly expensive to constantly rotate products, but by customizing and limiting product offerings and inventory purchases, this venture is possible.

The Omnichannel Advantage

Retail giants like Nordstrom are praised for their ability to compete with companies like Amazon due to the innovative, niche services and options they offer their customers. Nordstrom took advantage of major omnichannel outlets (social media, ecommerce websites, mobile sites, and so forth), similar to Amazon, but then emphasized their brick and mortar retail locations with unique consumer experiences. Customers today value quality experiences and great customer service above all else, and major companies are struggling to appeal to that sense of engaging experiences. This retail giant has differentiated itself from other brick and mortar, and omnichannel, retail businesses by offering a highly specialized product selection and engaging with their customers on that level. Nordstrom’s has made big waves by offering curated selections to both their affluent and middle class customers.

Nordstrom also customized all of their omnichannel options in ways that Amazon cannot. When you search for any item on Amazon, you get hundreds of page results, leading to an overwhelming search. Don’t get me wrong – Amazon has made a successful business doing this, but where Nordstrom has excelled is by customizing their omnichannel experience to each individual customer. In the end, taking advantage of omnichannel systems will make or break a lot of retail businesses in the near future, and unfortunately, too many smaller retail business owners simply cannot afford to make this vital transition. While there are plenty of financing options to help with these transitions, it will still be up to the retail business owner to make sure that the retail business is offering unique experiences, specialized products, and innovative ideas to engaging customers everywhere.

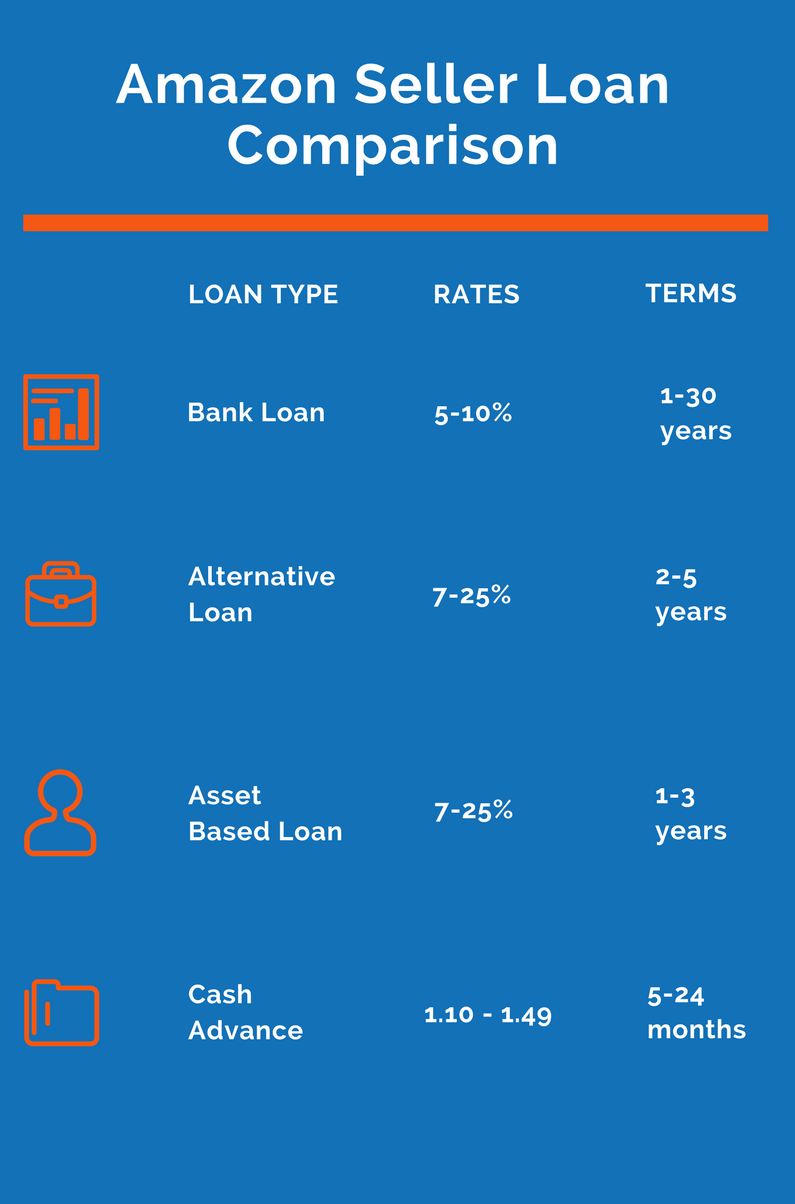

Online Seller Bank Loans

A very difficult type of financing for online Amazon sellers to obtain is a traditional or conventional business loan from a large or small bank, community bank or credit union. But if an online seller is able to get a conventional business loan, they can expect to have very affordable rates and terms to purchase inventory, help with marketing, refinance business debt and other uses.

Documents an online seller will need to get a bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Alternative Amazon Seller Loans

When we think of business lenders, we tend to think of commercial lenders from a bank or credit union, who have very strict underwriting criteria, require lots of business and personal documentation and take a long-time to fund a loan. Recently, alternative business lenders have stepped into the small business funding space to help provide small companies with affordable financing with much reduced lending requirements. On top of that, these alternative lenders (fintech lenders) are able to provide financing in a fraction of the time that a conventional business lender takes. Uses for an alternative Amazon seller business loan include inventory financing, advertising and marketing lending, refinancing and consolidation of business debt (including cash advance consolidation), operating and working capital, etc..

Alternative Amazon seller loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Online Amazon Seller Cash Advances

Amazon and online sellers process lots of debit and credit card transactions. One way for online sellers to obtain needed capital to help with purchasing inventory, helping to advertise your online store and its products, help pay for storage facilities, and other working capital purposes is to obtain a merchant cash advance or business cash advance for online sellers. A cash advance is different than a loan product being that its not a loan at all. What it is the sale of the online seller’s future receivables at a discount to the funding company, in return for immediate cash financing.

Documents for an online seller cash advance:

- Application

- Bank statements

- Credit card statements