As the owner of a B2B company, you may find yourself needing access to capital from time to time for a variety of reasons. B2B loans are available to help with real estate financing, inventory lending, payroll funding, lending to help with expansion, refinancing and consolidation of the B2B’s business debt, and a variety of other uses. In this article we will explore and explain each type of small business financing available to business-to-business companies.

What is Business to Business?

When thinking about a business’s selling practices, most people think of retail experiences where a business sells to a consumer, otherwise known as Business to Consumer (B2C). But how to businesses get those products to sell to consumers to begin with? This commercial transaction is commonly known as Business to Business (B2B). Business to business is a type of transaction between two businesses, such as a business venture between a manufacturer and wholesaler, and then a wholesaler and a retailer. Once the retailer purchases the products from a wholesaler, the retailer often engages in a business to consumer transaction model, where the retailer sells the end product to a consumer. The three most common types of business to business transactions include:

- When a business sources materials for production processes; such as when a restaurant purchases salt for their food production.

- When a business needs the service of another business for day to day operational reasons; such as when a business employs a marketing firm to handle their marketing needs or an accounting firm to handle a business’s accounting needs.

- When a business re-sells goods and/or services produced by another business; such as when a clothing retailer buys the end product (accessories, clothing, etc) from other businesses.

Business to business transactions typically have a much higher transaction sale volume, particularly because companies with this business model have a larger supply chain filled with various transactions. Through business to business transactions, business owners deal with a variety of subcomponent (raw material) business ventures. In comparison, business to consumer transactions often involve only one business to consumer transaction – the sale of the finished product by the business to the end consumer. While there are always exceptions, and some business to consumer models will see more transactions than a business to business model, most of the time, this is not the case.

Business to Business Ecommerce

Ecommerce is revolutionizing the entire business world today, and this is no different for business to business transactions. Business to business ecommerce is basically the electronic exchange of documents, goods, and capital between businesses. This is most often seen in supply chain logistic business industries, but this revolution is now expanding into every single business to business sector. Through the use of business to business ecommerce, an endless number of companies are seeing improved communication networks among business partners and enhance buying experiences. Basically, business to business models allow for business owners to have access to omnichannel experiences that they are now accustomed to in their personal lives.

The business to business eCommerce models are complex, but are often broken down into specific categories. The categories for the various types of business to business eCommerce transactions include:

- Company Websites: Through company websites, just like in business to consumer transactions, business owners can reach their target audience (other businesses that they can sell products to or buy products from). The reasoning for a company website in a business to business transaction model is almost identical to a business to business transaction model because a website is used to target an audience, express mission and value statements, show background into a company, and sell and/or buy a product and/or service. Company websites also supply business with jobs. This means that a business that creates websites and provides software services for building business to business websites then becomes a business to business for business to business.

- Product Supply and Procurement Exchanges: Product Supply and Procurement exchanges are often interchanged with the term known as e-procurement sites. These business to business sites facilitate the exchange of products, supplies, and procurement for companies, while providing a wide range of services for a niche market (that niche market obviously varies based on the industry the business to business company focuses on). Through product supply and procurement sites, businesses can shop for supplies, request proposals, and so forth.

- Specialized or Vertical Industry Portals: Where product supply and procurement sites provide access to purchasing options, specialized or vertical industry portals focus on providing information to specific and vertical industries (such as healthcare, construction, and education). These specialized or vertical industry portals will sometimes offer similar purchasing support like product supply and e-procurement sites, but this is not the main objective for this business to business transaction category.

- Brokering Websites: Just as the name implies, brokering websites facilitate interactions between service providers and potential business customers. For example, if a business is looking for industry specific niche equipment to lease from another business, the business owner will often turn to business to business brokering websites for help.

- Information Websites: Information websites for business to business transactions are often referred to as infomediaries. These business to business information websites provide specialized, industry specific information for companies, employees, and their investors. These information websites have become a common tool for business to business transaction trade and industry standards.

Business to Business Trends and Statistics

Omnichannel Experiences: As mentioned above, business owners everywhere are realizing the effects of an omnichannel experience. After experiencing omnichannel experience in their everyday life as a consumer, they are now starting to make the shift into omnichannels in their business to business models. The omnichannel revolution has led to more than half of business to business buyers, over 52 percent, expecting one out of two of their business to business purchases being made online within the next few years. From that same study, some other interesting facts about business to business transactions in correlation with the omnichannel experience emerged:

- Almost 78 percent of business to business customers claim next day delivery options and other fulfillment options are very important.

- Over 70 percent of buyers and consumers want to know about product availability instantly across any channel.

- Business to business consumers and customers value useful, online convenience services. This includes self-service access to accounts and orders (72 percent of buyers) and scheduled deliveries (64 percent of buyers).

Overall, business to business buyers and consumers will profit from making the transition into omnichannel options for buyers and consumers everywhere.

Traditional Bank Loans For B2B Companies

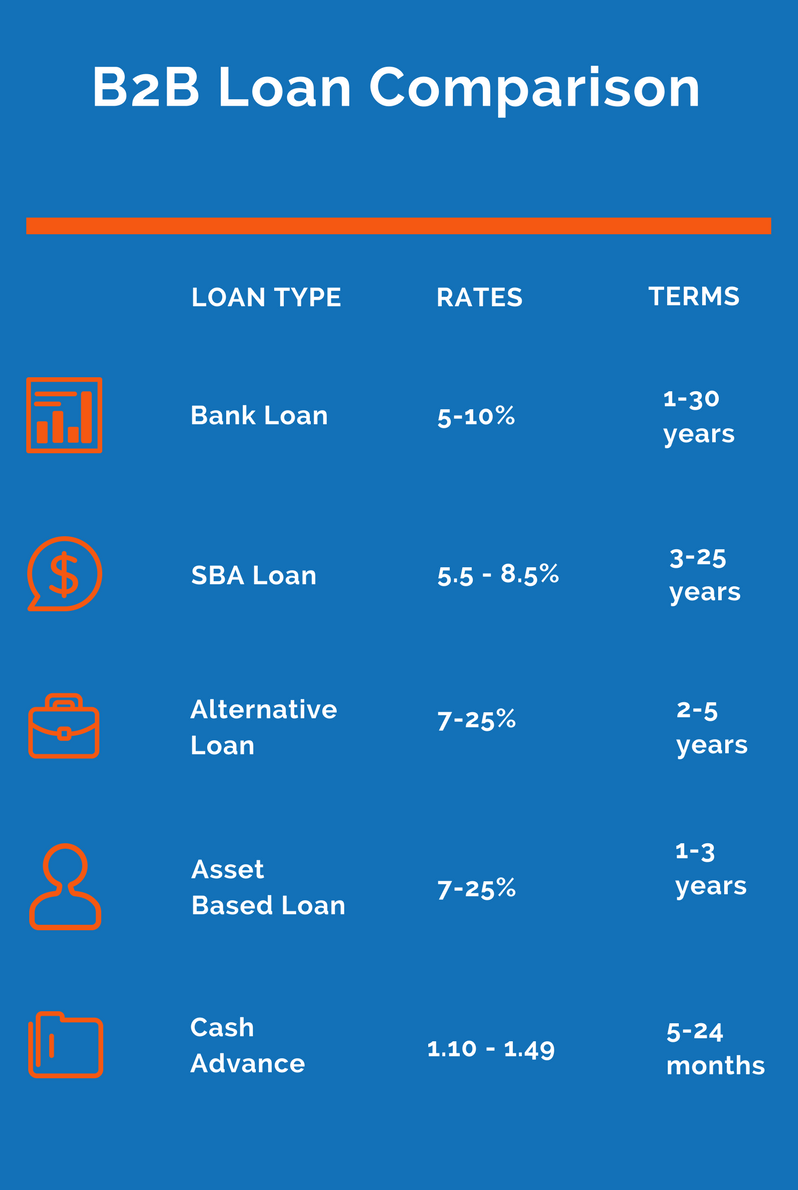

Regardless of the use of funds for the B2B company, the best type of financing available are conventional bank loans and lines of credit. The reason why: bank and conventional lenders don’t take much risk, and only fund the most creditworthy small businesses. Therefore, to get a bank business loan, you’ll need to have excellent credit and revenues. But to get financed through a bank lender, your business will need to provide lots of paperwork, and can expect a funding process that may be slow. But with some patience and a little bit of work, the process of getting a B2B bank loan can provide you with the healthiest business financing available. Uses for a conventional bank B2B loan would be for real estate purchases, refinancing real estate, refinancing business debt, consolidating business debt and working capital.

B2B bank lending documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

B2B SBA Loans

SBA lending for B2B businesses are a great form of small business financing for companies that have tried to get a bank loan, came close to obtaining the financing, but weren’t able to get their business funded in the end. SBA B2B lending is meant to help E-biz companies (and all other small businesses that meet the SBA criteria) by reducing most of the B2B SBA lender’s risk by agreeing to cover most of the lender’s losses if the B2B company fails to repay their loan. Uses for B2B SBA financing include purchasing or acquiring a B2B company, refinancing and consolidating business debt, operating capital costs, inventory financing and a number of other uses.

B2B SBA financing documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative B2B Loans

B2B companies need flexibility, and one of the most flexible forms of small business financing is to obtain an alternative fintech loan. Alternative B2B lending is a good option for a company that needs affordable financing, but needs it much faster than a bank or SBA lender is willing to provide it to the B2B company. Altnernative B2B financing can be obtained in a week or less, with less documentation and credit requirements than a conventional B2B lender. Uses for alternative B2B capital are usually for working capital purposes, including buying inventory, making sure your employees payroll is covered, funding to help with expansion of your company, marketing and advertising and just about any use you can think of.

Alternative B2B funding documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

B2B Cash Advances

B2B cash advances are a way for an E-biz to get immediate funding without having to go through a long approval and underwriting process required by most conventional and alternative business lenders. B2B merchant cash advances are the sale of the a portion of the B2B’s future receivables (in the form of sale of future bank deposits or merchant account transactions) in exchange for immediate funding. The B2B company will then repay the funder by making small payments each day until the funder is repaid. Uses for a B2B cash advance are usually for working capital and emergency uses.

B2B cash advance documents:

- Application

- Bank statements

- Credit card statements