As with any business, owning a health spa or wellness center not only costs money to purchase, but then requires financing for a variety of business uses. Such financing can be used for purchasing the business or property, refinancing and consolidating business debt, working capital for the spa or wellness center, along with a ton of other uses. Getting financing for your spa or wellness is the easy part; the hard part is making sure that your small business is getting the right type of financing. In this article we will explore all of the financing options and uses of loans for spas and wellness center.

Health and wellness is starting to become an integral part of the American lifestyle today. Actually, people all over are starting to value health, wellness, and holistic healing more so than ever before. What was once reserved for the affluent, or the hippies, is now becoming a staple. The health and wellness spa business is entering new markets at faster rates than the spa industry has ever seen before, and there is no signs of the health and wellness spa business sector slowing down in the near future. With plenty of key market segments for the health and wellness spa business to enter, there is plenty of diversity and competition in this thriving market.

The most recent study put out by the Global Wellness Institute has shown some interesting statistics for the global health and wellness economy in the past few years. The global health and wellness industry grew 10.6 percent from 2013-2015 from $3.36 trillion to $3.72 trillion. The major contributing sectors to the health and wellness industry include:

- Beauty and Anti-Aging: $999 billion

- Healthy Eating, Nutrition, and Weight Loss: $648 billon

- Wellness Tourism: $563 billion

- Fitness and Mind-Body: $542 billion

- Preventative and Personalized Medicine and Public Health: $543 billion

- Complementary and Alternative Medicine: $199 billion

- Wellness Lifestyle Real Estate: $119 billion

- Spa Industry: $99 billion

- Thermal/Mineral Springs: $51 billion

- Workplace Wellness: $43 billion

The global health and wellness spa market grew from $94 billion in 2013 to $98.6 billion in 2015. Spa locations across the world grew from 105,591 to 121,595 in 2015. This means the health and wellness spa sector has added 16,000 spas and over 230,000 workers. With over 900,000 health and wellness establishments around today, and numbers continuing to grow, the health and wellness spa business sector has plenty of trends that are affecting this influential market.

Health and Wellness Spa Business Trends

Year over year, the health and wellness spa business market has seen continuous profitability and growth. The health and wellness spa sector is not expected to slow down any time soon, and there are plenty of new strategic, key markets for many health and wellness spa business owners to enter in. These new markets and trends will allow many health and wellness spas to grow and remain competitive in this highly diverse industry. Some of the key trends for the health and wellness spa business sector for the upcoming year include:

- Antiaging and Medical Treatments: As Baby Boomers continue to age, more and more of them are turning to holistic, alternative antiaging and medical treatment options. Consumers today do not want to be reliant of pharmaceuticals, the medical industry, and record high medical insurance deductibles to feel good. As more consumers turn to health and wellness spa companies for antiaging solutions and holistic medical treatments, the health and wellness spa business sector has a huge opportunity to profit immensely from this venture. Not only can health and wellness spa businesses profit from this new interest in holistic health and wellness healing, but they can also really make a difference in the lives of many.

- Uberization of the Health and Wellness Spa Business: Just like every other industry today, on demand services via mobile phones is becoming commonplace in the health and wellness spa business world. Thanks to tech giants like Uber, consumers have become accustomed to on demand apps and services. Few health and wellness spa companies have chosen to implement these omnichannel service options, but those health and wellness spa companies that have effectively implemented mobile apps and omnichannel options are seeing increased profitability and more consumer interest in their services.

- Health and Wellness Spa Options for Children: Americans today are valuing their health and wellness more than ever before, especially Millennials. As these Millennials get older and start creating their families, the health and wellness spa sector will continue to see growth in health and wellness spa options for children. Whether a health and wellness spa business is offering nutritional training, yoga for children, spa treatments, or meditation classes for kids, the health and wellness spa business sector has a huge opening in a new, strategic key market that parents today will pay for. Taking advantage of this niche service can help to attract more and more people to the health and wellness spa sector.

- Wellness Festivals: Everyone is aware of the rapid increase in music festivals, raves, and other festivals like Burning Man. These festivals have attracted younger demographics and have led to a new trend that is taking over the health and wellness spa business: health and wellness festivals. Whether health and wellness spa businesses are putting on these festivals, or contributing their services to these festivals, many health and wellness spa business owners are seeing a huge demand for more affordable group wellness festival options. This business venture is not every health and wellness spa business, but for those health and wellness spa businesses looking to attract more young people to their businesses, this is definitely a major trend to be paying attention to in 2017.

- Workplace Wellness: Workplace health and wellness spa options have become integral in major companies such as Google, Apple, and Virgin Group Ltd. The idea of workplace wellness became a huge hit around the 70’s, but it was mainly for the elite and affluent workers in large companies. Today, big players like Apple and Google are shifting the norms and requiring workplace health, wellness, and spas, and this health and wellness spa business niche is leading to increased profitability year after year. Forward thinking companies are attempting to create a positive, open, and healthy workplace through workplace health and wellness programs, which many major health and wellness spa businesses are now offering to companies everywhere. Becoming a part of this business service niche can help differentiate health and wellness spa businesses in this highly competitive market.

Health Spa and Wellness Center Bank Loans

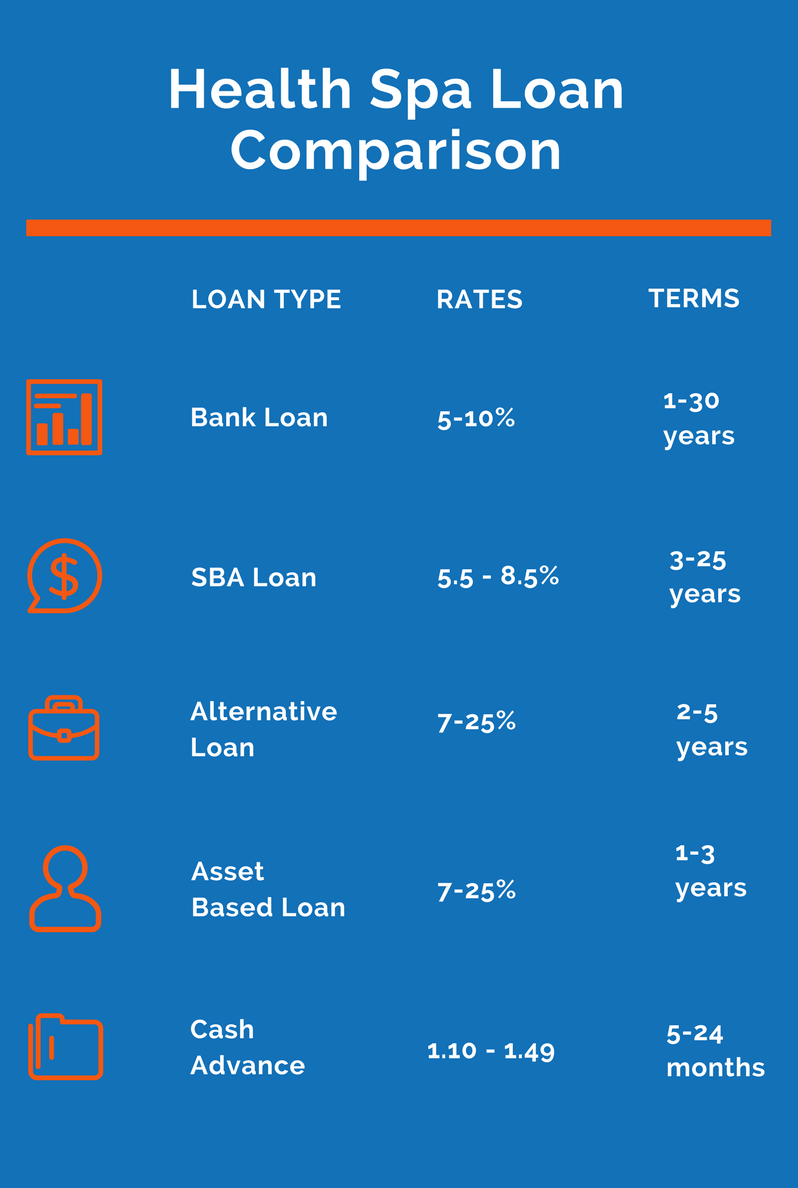

Health spas seek out traditional bank business financing first because of the health lending options they provide. Banks are able to offer health spas the lowest rates and terms on conventional bank term business loans and also lines of credit. The reason banks are able to offer spas such low rates on their business loans is because banks take much less risk than any other business lenders. The less risk the business lender takes, the lower the rates the borrower will have. Bank loans for spas are used for business real estate loans, funding to refinance business debt, commercial debt consolidation, working capital, equipment leasing and many other types of of business financing.

Documents a wellness center of health spa will need for a bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Health Spa and Wellness Center SBA Loans

SBA financing is the perfect type of loan for spas and wellness centers that have good credit and solid business revenue, but have exhausted their attempts at getting a business loan from a bank or credit union. SBA spa loans aren’t loans that are actually originated by the Small Business Administration, but they are instead business loans provided by a conventional lender, but the SBA agrees to cover a large percentage of the SBA lender’s losses if the spa doesn’t repay their SBA loan. Small Business Administration loans come in both term loans and lines of credit, and are used for acquiring businesses and their assets, purchasing or refinancing commercial real estate, general operating capital uses, and purchasing and/or leasing business equipment.

Documents a spa or wellness center will need for SBA financing:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Spa and Wellness Center Loans

Alternative small business loans are relatively new to the business funding space, but they’ve filled a need for small companies that have solid income, but have been unable to get a loan from a bank or SBA lender. To fill that gap, alternative business lenders offer products that are both affordable and lower in fees than high-interest cash advance lenders offer. Alternative loans are generally under $500,000, and used mostly for working capital uses (advertising, inventory, equipment, payroll, expansion, bills, rent, mortgage, paying taxes, etc.). Unlike the long drawn-out funding process you’ll go through with a bank or SBA loan, alternative business lenders have really simplified the business application process, and can offer pre-approvals in just minutes, and can fund your business within a week.

Alternative loan documents for spa and wellness centers:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Spa and Wellness Center Cash Advance

Cash advances are by far the most expensive form of small business financing for spas and wellness centers. With that having been said, cash advances are also the fastest way for a spa or wellness center to get funded. Cash advances aren’t loans, so there isn’t a long, drawn-out application process. In fact, all that is needed are an application, bank statements and merchant account statements. After those documents are supplied to a cash advance lender, they will make an offer, and the funding process can be completed in days, if not the very same day. Since a cash advance isn’t a loan, its structured much differently that most small business lending products. The lender will purchase a portion of the spas future receivables (either bank account deposits, or merchant credit card transactions) and the small business will repay the lender each business day directly from their bank account or credit card processing account, until the lender is repaid.

Documents for spa & wellness center cash advance:

- Application

- Bank statements

- Merchant statements