There are many reasons a deli, food market, mini mart or bodega may need financing. As with any small business, you have expenses including rent, utilities, payroll, inventory, equipment, advertising and other expenses which must be paid for in order for your deli to operate well. If you don’t have much capital reserves, you’ll need to find some sort of business financing to take care of your needs. In this article we will look at the various types of business loans available to delis and food markets and fast serving restaurant establishments.

The United States is seeing more and more people on a daily basis that are consumed with endless amounts of work and personal obligations, leading to an incredibly fast paced lifestyle. This fast paced lifestyle leaves no room to cook wholesome, healthy meals for the average American today. With this increase in people on the go, Americans are looking to food companies and retailers, particularly the deli foods market, to provide easy, convenient, affordable, healthy, and fast food options. Through this ever growing demand, the chilled and deli foods market reached $799.4 billion in 2014 and is expected to reach $988.7 billion by 2021, growing at a CAGR of 3.0%.

Americans today are not expecting to slow down any time soon, and this is evident with the lack of people retiring in recent years. People are working longer than ever before at a faster pace than ever seen. The deli foods market sector is seeing rapid growth in a lot of different areas. Typically, the deli foods market world was focused on sandwiches, savory pies, meats, and so forth, but with the majority of Americans focusing on health, the demand for other alternatives is rising. In 2014 alone, prepackaged sandwiches generated revenue over $322 billion, and will continue to generate a large portion of revenue for the deli food market industry, the deli foods store sector is seeing increased demand for more prepackaged, healthy salads and other vegan and vegetarian friendly options. While many positive things are happening for the deli foods market sector, there are many trends that are changing the way business is done.

Deli Foods Market Industry Trends

Like any business, the deli foods market has seen cyclical periods of growth, however there is increased struggles ahead for the deli foods market sector in 2017. Consumers are shifting their spending patterns and are valuing their health more than ever before, leading to many major trends that are shifting the way business is done in the deli foods market world. Many deli foods markets have struggled to stay afloat and competitive in light of new technologies that have made shopping in stores unnecessary today, such as major food delivery services. Even Amazon is launching a fresh foods service! In a day and age where technology systems, practices, and platforms are revolutionizing business industries across the United States, the deli foods market sector must start paying attention to major deli foods market industry trends. Some of the major deli foods market sector trends include:

- On Demand and Busy Lifestyles: Let’s face it – Americans are overloading their daily schedules and are now constantly on the go, which has fueled the demand for easy, convenient, and quick food options. This is where the deli foods market is creating a large business niche, especially because the deli foods market sector provides healthier alternatives (sandwiches, etc) to quick fast food options. Today, people are demanding healthier food options at every location. Just look at airports – now consumers everywhere have the option between typical unhealthy fast food options and prepackage, or fresh, sandwiches and savory appetizer options; this revolution is most notable in large airports!

- Natural Meats: As seen in every single other industry in the United States today, consumers are demanding natural products, whether they are environmentally friendly, hormone free, antibiotic free, free range, organic, grass fed, or a combination of all of those. Consumers are being more proactive about their health than ever before, starting with the food they put into their bodies. In addition to personal health, consumers are also worried about the environment, and with more and more studies showing the detrimental effects of meat production on the environment, people are becoming worried. This has led to an increased desire of having all natural meats from Americans across the country.

- Creative and Innovative Food Options to Compete with Major Discount Retailers: In attempts to appeal to the majority of consumers who have turned away from expensive deli meat products towards major discount retailers, many specialty deli food stores and markets are working towards creating new and exciting food options. Through innovative creativity that has been fueling many food industries, such as catering businesses, many deli food market retailers are feeling optimistic about this new venture. Consumers today want fun and exciting experiences when spending money, reinforcing the importance of creative food choices.

Deli Foods Market Financing Uses

As mentioned above, many businesses go through periods of expansion, growth, and profitability, but every business also experiences slow periods that can hinder working capital needs. When budgets get tight, there are still important bills and expenses that need to be paid. Through deli foods market financing options, there are plenty of choices that can help alleviate working capital expenses. Some of the most common uses for deli foods market financing include:

- Deli Foods Market Financing for Technologies: Whether it is top of the line refrigeration systems, quality kiosks for consumer convince, new point of sale systems, or technology platforms for day to day operations, there are endless amounts of technologies that are changing business operations for deli food markets everywhere. Through deli foods market financing for technologies, many of these vital systems can be purchased to increase productivity and profitability.

- Paying rent: Like any retail store, you’ll need to pay rent or your mortgage each and every month. But during slow periods you can have a drop in revenue that can put you behind on your bills, and threaten your ability to pay rent. When those times occur, obtaining a short term business loan may be a good option.

- Deli Foods Market Loan for Marketing &Advertising: As with any business, if customers don’t know about your deli, they won’t visit. Therefore, getting your name out there requires some marketing – which is rarely cheap. The cost of acquiring customers can be pricey, and when financing is need, a deli should look to obtaining some sort of debt financing to be used as an investment for marketing and advertising purposes.

- Deli Foods Market Inventory Loan: In any food industry, having access to adequate inventory is essential for efficient daily operations. With deli foods market inventory loans for perishable food goods, delis can obtain needed funding to have all important inventory on hand at all times, especially before peak seasons.

- Deli Foods Market Payroll and Hiring New Employees Loan: Through deli foods market payroll and hiring new employees loan options, many deli foods market owners can make sure that these important costs are covered, even during slow periods.

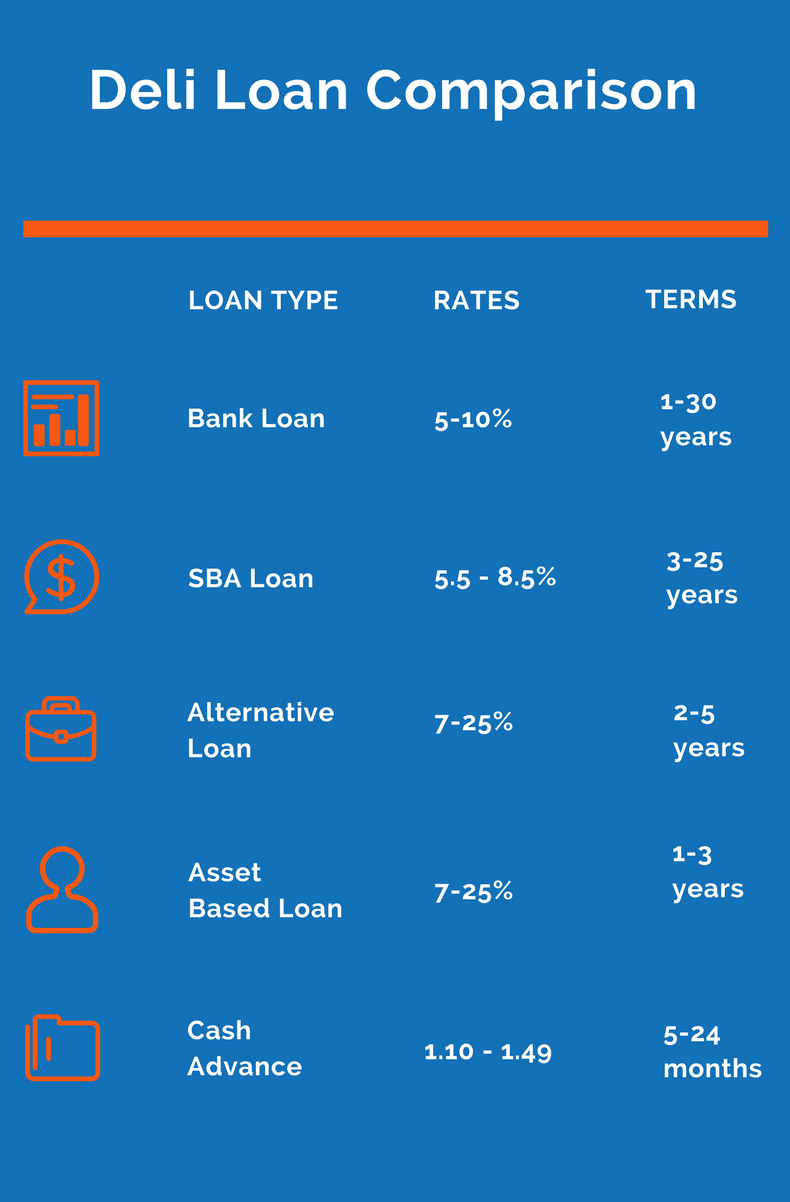

Deli Bank Loans & Traditional Financing

Most delicatessans will seek-out a bank loan (large and small banks, credit unions, community banks) first and foremost because they offer the lowest rates and longest terms of all small business lenders. Conventional bank business loans are used by delis and small businesses to obtain their delis real estate, refinance their current deli mortgage, consolidate business debt, and for working capital purposes. The process of getting a small business bank loan is never easy, so you’ll need to prepare early, have lots of patience, and be diligent. At times the process may be frustrating, but knowing that at the end of the process you will have the best small business loan rates and terms will make the application process worth it.

Documents needed for a deli bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Delicatessen SBA Loans

Delicatessen SBA loans are loans administered by the Small Business Administration to help small businesses access affordable bank-rate financing. While SBA loans aren’t actually provided by the Small Business Adminstration – but tradtional banks instead – the SBA agrees to cover a large portion of the loan balance should the deli default on their loan to the SBA lender. SBA loans are used refinancing and consolidating business debt, working capital, purchasing a deli and a variety of other uses.

Deli SBA documentation:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Deli and Food Market Loans

Most businesses don’t plan on needing to obtain capital until the need arises. When that need does arise, very few can wait around weeks and months for the small business loan process to be completed by a bank or SBA lender. Fortunately there are alternative loan options which use expedited funding processes to provide your small business with affordable financing within a week or less. Alternative loans, also referred to as fintech or institutional lending leverages technology to qualify the borrower and to expedite the due diligence process. End result: a small business can get an initial approval within just minutes and have affordable business financing in place within just a week.

Alternative deli and food market loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Deli Cash Advance

Another way to obtain extremely fast business capital is to leverage your delis merchant credit card processing transactions and/or deli bank account deposits as basis for small business financing. A merchant cash advance isn’t actually a loan to the deli, but a cash advance in exchange for sale of future deli credit card transaction deposits. The deli agrees to sell a portion of its future merchant receivables in exchange for cash, and then repays the business funding company by agreeing to provide a portion of all merchant payments to the funder until the cash advance is repaid. A business cash advance (ACH advance) is slightly different in that the repayment is made by having a set amount taken from the deli’s bank account each day through Automated Clearing House transaction.

Deli cash advance documents:

- Application

- Bank statements

- Merchant statements