The evolution of the food takeout and delivery sector has rapidly changed since its formation in the late 19th century. What was once reserved for foreign countries and transit hubs, like train stations or intersections on busy highways, quickly turned into an American staple in the early 1950s. After World War II, the restaurant and food world started to quickly expand. More and more American middle class families purchased more cars, moved to the suburbs, and discovered the well-known love of televisions. With more American’s spending more time at home with their families and televisions, the restaurant world took a major hit. People no longer wanted to leave the comfort of their suburban, television driven home lifestyle to go out to eat – hence the creation of what is now known today as the food takeout and delivery industry.

Today, food takeout and delivery services have become a staple in the American lifestyle, with over 46 percent of adults – and 61 percent of millennials – claiming that the availability of takeout and delivery services is a main factor in choosing a restaurant. Plenty of alternative, third party delivery services have entered into the market, such as GrubHub, to facilitate food takeout and delivery services so restaurant owners do not have to handle these expensive services in house. Either way, the message is clear – offering food delivery and takeout options is essential for any restaurant today.

According to the National Restaurant Association, the following suggestions are important for creating a successful food delivery and takeout business option:

- Facilitate Easy Ordering

- Put Thought into the Menu

- Set Up a Takeout Area

- Monitor Accuracy

- Use Sturdy, Quality Packaging

- Assign the Right Personnel

- Grow Through Branding, Marketing, and Sales

Each of these steps may look different for each restaurant business, however these still remain necessary steps to ensure quality food takeout and delivery business models.

Food Takeout and Delivery Business Trends

Year after year, the food takeout and delivery business model has seen continuous growth and increased competition. Studies have shown time and time again that food delivery and takeout services are a staple for all Americans in urban and rural areas – nearly 60 percent of consumers in all areas have ordered food takeout in the past six months. Unfortunately, too many food business owners are still not offering these important services, resulting in many consumers settling for the most popular food takeout and delivery item – pizza. Consumers are demanding more options, but many obstacles must be overcome in order to make this demand a reality.

- Technologies to Increase Food Delivery and Take Out Options: The major obstacle being faced by all business owners that want to expand their food takeout and delivery services is the inability to transport most food outside of pizza and sandwiches. This has led to technology companies focusing on creating top of line, insulated packaging alternatives in order to transport foods and drinks that would have never been considered deliverable before. Exploring and investing in these new options can help any business owner expand into new territory that could increase business profits.

Online and Mobile Ordering: Another big issue being faced by the food takeout and delivery business sector is the demand by consumers for easier, on the go ordering options. Online ordering has become more prevalent in recent years, especially for major pizza companies, but mobile ordering for many food takeout and delivery options is still few and far between. Consumers are tethered to their cell phones today, and with any industry in the United States today, on demand products and services sell.

Food Takeout and Delivery Business Financing Uses

- Food Takeout and Delivery Business Financing for Technologies: There are endless amounts of food delivery and takeout technologies that are geared towards shifting the market for this staple food industry. Every month, there are endless amounts of food startups being created looking to disrupt the food takeout and delivery business sector with new, creative, and advanced technologies (as listed above). In order to remain competitive, especially in this rapidly growing food industry, taking advantage of food takeout and delivery business finance choices for new technologies is important. There are plenty of loans for food and takeout delivery businesses to help purchase essential technologies to boost profitability.

- Food Takeout and Delivery Business Funding for Marketing, Advertising, and Social Media: As mentioned above, the food takeout and delivery business sector exploding when televisions became a staple in most American’s homes. This led to many new food takeout and delivery companies learning to advertise and market their food takeout and delivery services via television ads. While plenty of American’s have televisions today, they have learned to avoid commercials and ads. Today, the best way to market and advertise for food delivery and takeout services is through social media, content marketing, and mobile apps. With the rapidly evolving technology world, the need to market in new and unique ways has become more important than ever before, especially when trying to appeal to a younger market. Through the use of food takeout and delivery loan options for marketing, advertising, and social media, many food delivery and takeout business owners are able to afford this vital marketing tool.

- Food Takeout and Delivery Business Inventory Loans: Inventory is needed in any food sector, and for the food takeout and delivery business sector, having ample amounts of takeout and delivery packaging items are vital – especially if these top of the line packaging options allow for the delivery of other food options (outside of pizza!). Unfortunately, too many food takeout and delivery business owners struggle with inventory management, leaving a business owner with either too much of a certain item or not enough of an important item, resulting in loss of profits (and even upset customers). There are a variety of food takeout and restaurant delivery business inventory loan options to explore other options, such as inventory management technology systems.

- Food Takeout and Delivery Business Loan for Payroll and Hiring New Employees: Obviously, food delivery and takeout businesses rely heavily on quality customer service. Without great customer service, even if the food is delicious, most consumers will not order from that restaurant again. If a food takeout and delivery business owner is struggling with working capital, sometimes business owners contemplate holding off on payroll costs – but this should never be an option. By not covering payroll, many employees become disengaged and unmotivated to give great customer service, which can be detrimental to any business. When times are slow, consider food takeout and delivery business loans for payroll and hiring new employees.

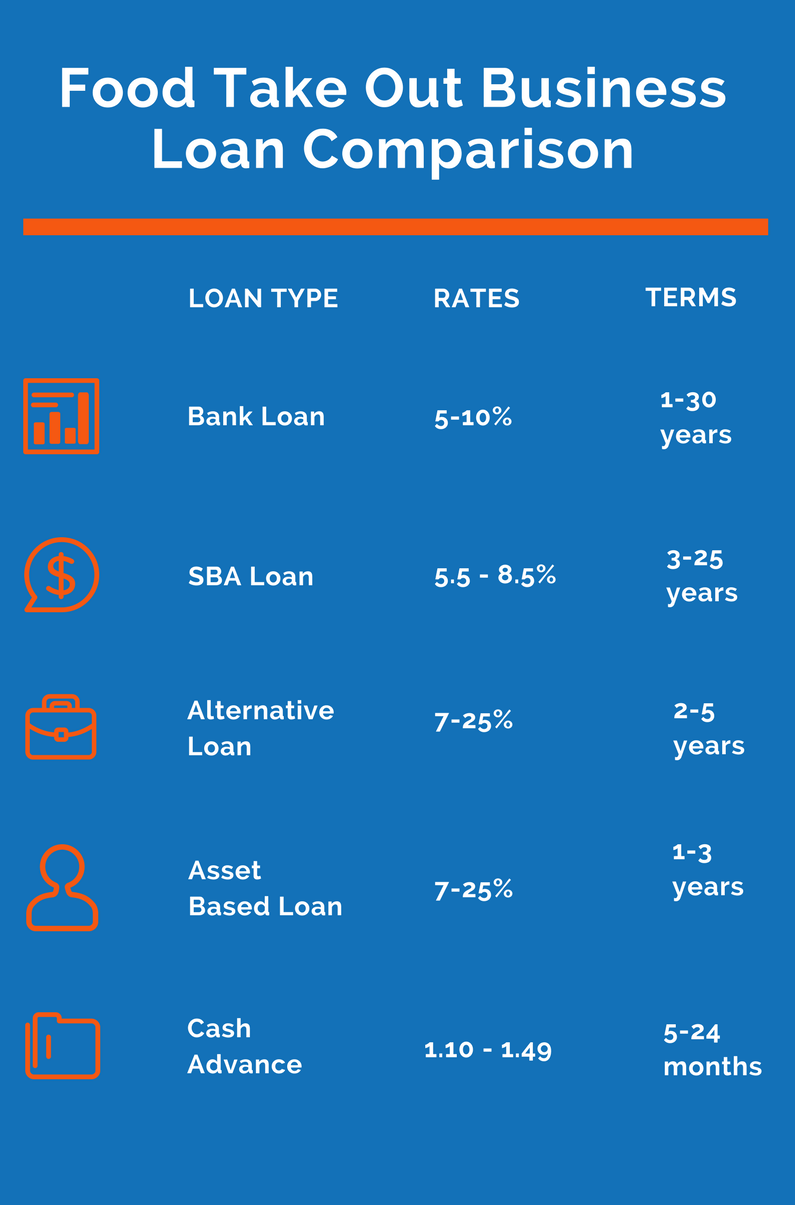

Take Out Restuarant Bank Loans

Bank business loans for take out restaurants can be used for many uses, including restaurant working capital, making payroll, buying and upgrading your cooking facilities and it’s equipment, purchasing or refinancing commercial real estate, refinancing and consolidating your restaurant’s debt among others. Bank business loans are very affordable for restaurants, with rates starting in the mid single digits, and very low fees. To get a bank restaurant loan your establishment will need to show good revenues along with quality business credit.

Take out restaurant bank loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Take Out Restaurant SBA Loans

SBA loans are the perfect type of financing for take out restaurants looking for affordable lending options, but have been denied by their banks in the past. SBA restaurant lending is affordable because the loans are provided by banks, but the Small Business Administration agrees to cover most of the loan in case the take out restaurant fails to repay their loan.

Take out restaurant SBA financing documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Take Out Restaurant Loans

Not every take out restaurant is going to have the greatest financials or perfect credit. Alternative take out restaurant financing is the next best option, with rates ranging from the high single digits, to mid 20s. Take out restaurant alternative lending is usually used for working and operating capital for the food establishment.

Alternative take out restaurant loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Take Out Restaurant Cash Advance

Restaurants see lots of transactions using both debit cards, and credit cards. One way to obtain financing is to use one (or both) of those to sell a portion of your future revenue to get immediate cash financing. Take out restaurant merchant cash advances are the sale of future merchant account receivables to a funding company, and then the funder takes a percentage of each days merchant processing account deposits until the loan is repaid. A restaurant business cash advance works much

Documents for a take out restaurant cash advance:

- Application

- Bank statements

- Credit card statements