Moving companies may find themselves needing to obtain a business loan at some point in time. Whether it be a business acquisition loan, financing for a new truck, loans to upgrade equipment, financing to make sure you meet payroll, tax financing and a number of other uses. In this article we will look at the various business funding options for moving companies.

But first, let’s take a look at the professional moving industry as a whole. There is nothing more frustrating, time consuming, and stressful as moving. Just thinking about the process of moving causes my head to ache – and it is not just me, which is why the moving company industry has seen rapid expansion, growth, and innovation. Consumers that move today cannot afford the costly, and tedious, moving companies that have been around for years, which is why so many new players with creative moving ideas and alternatives are entering the moving business sector.

While the housing crisis that affected millions led to decreased sales for many moving companies, the past few years have led to better times for many Americans; however, since the 2008 recession, many American’s are wary about moving, leading to a rapid decline in the amount of people moving. Despite the lack of people moving and the high expenses of moving companies, many moving businesses have thrived these past few years.

According to the American Moving and Storage Association, the moving company industry consists of over 7,000 moving companies with over 13,900 locations. These moving companies generate over $14 billion, employ over 122,000 people, and have an annual payroll of about $3.6 billion. The moving company sector is experiencing a period of rapid growth, but in a new way than ever seen before. Thanks to tech giants like Uber, many businesses are seeing technology systems, practices, and mobile apps take over the moving company sector, resulting in a massive shift that may be unattainable for some older moving companies.

Moving Company Industry Trends

The moving company sector has seen ups and downs, particularly some really low periods after the housing market crashed. Since the rebounding of the moving company sector, many moving companies have seen increased sales and profitability – but now these popular moving companies are facing a changing industry that may be almost impossible to compete with. Technology is changing the way, and the types of services, the moving company industry is run. Moving companies that are not agile and slow to adopt these unavoidable technological practices will find it difficult to stay afloat in this shifting moving company sector.

- Uber-izing the Moving Company Industry: As we have seen in other industries across the country, Uber has revolutionized the way business is done for many companies. What stemmed from the idea of “Uber Movers” quickly turned into a game changing, technology based business idea. Consumers today want digitalized, on demand services that they can access via their computers or phones instantaneously. Simply put, on demand moving companies are the biggest trend in the moving company sector today. Within the past year alone, plenty of moving apps for a variety of moving services have popped up in the moving company sector, creating increased and complex competition, particularly for moving businesses that have been slow to adopt these technological practices. Focusing on integrating top of the line, instant services for consumers is essential in remaining ahead in this competitive and constantly evolving industry.

- Niche Services: As most moving company business owners are aware of, people do not move often, making the moving company sector incredibly difficult, and limited, to navigate. This is why so many popular moving apps and businesses have been able to succeed in such a short period of time – by offering niche services. Listed below are two of the most popular sectors entering into the moving company world; but for any major player in the moving company sector, offering any type of innovative niche service that allows a moving company to enter a new market and increase customers can help in this highly competitive industry.

- Micro-Mover: One of the largest moving business markets today is micro-mover services, particularly through quick and easy to use apps. Think about it – in the past, how many moving businesses or truck businesses helped with moving a piece of furniture for a consumer from a thrift shop, or Craigslist, to their home? Typically, consumers rely on finding a guy with a truck who would be willing to help out. This has led to one of the most innovative moving company sectors yet, allowing customers to click a button and have top of the line moving services smaller moves.

- College Students: Honestly, how moving businesses did not think about this niche service sooner is astonishing. Parents today are not retiring young and are working non-stop to afford their kid’s college tuition – which is not cheap today. Parents do not have the time to help their children move, especially when they decide to move multiple times throughout their college careers. This is where innovative, creative moving companies come into play. By offering affordable, easy to use, and quick services to an untapped market through new technologies, these moving businesses are reaching a whole new demographic and seeing endless success.

Moving Company Financing Uses

While moving businesses are seeing increased profitability, positive sales, and innovative creativity, every business experiences a time where extra capital can help. Through moving company finance options, there are plenty of needs that can be met.

- Moving Company Truck Financing: Without trucks to move clients’ belongings from one location to the next, they must have a functioning truck and moving equipment. A day without your moving truck, is a day where the business will make no revenue. When it comes time to replace an older truck (or broken-down truck) with a newer vehicle, there are options to both get capital in the form of a loan or equipment lease.

- Moving Company Funding for Marketing, Advertising, and Social Media: Your moving company can only get new business if consumers hear about your services. Marketing and advertising is important to get your business name out to the public to potential customers. With marketing comes a marketing budget, and if you don’t have reserve funds set aside for marketing, an option may be to seek a loan to help pay for advertising costs.

- Moving Company Equipment Financing: There is plenty of equipment involved in moving, and sometimes these expensive pieces of equipment become broken or outdated. Through moving business equipment financing, many moving company owners can purchase new equipment without having to pay the full, upfront costs immediately.

- Moving Business Loans for Hiring New Employees and Payroll: Having access to quality workers is essential in a moving business, however when business owners do not pay their employees, then it becomes difficult to maintain a quality workforce. Through moving business loans for payroll and hiring new employees, moving business owners can have access to extra working capital to cover these vital costs.

Moving Truck Traditional Financing

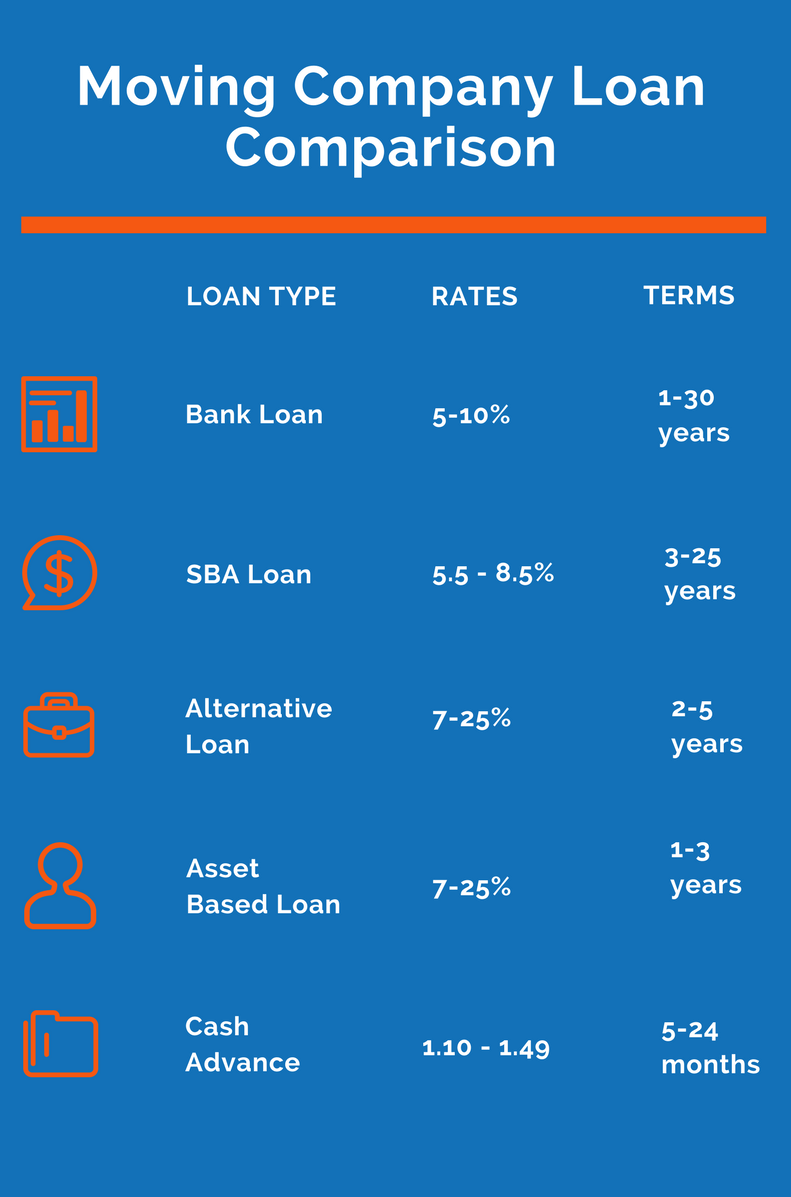

Traditional financing is usually every small business owner’s first choice when it comes to getting a loan. Why? Because bank loans are the cheapest financing option available, bar none. Bank loans have rates that will start in the single digits, and the funds can be put to just about any use, including purchasing trucks, equipment loans and working capital. Getting a bank business loan for your trucking company won’t be easy, so you need to have good credit and have your business financials in order.

Moving company bank loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Moving Company Alternative Loans

Alternative moving company financing is probably the most common type of business loan used by professional movers. The need for financing is usually immediate when it comes to professional movers, and the ideal of waiting weeks and months to get a small business loan isn’t a consideration. Getting an immediate business loan to replace and/or fix a moving truck is incredibly important when the need arises. Alternative moving company business loans are a way for movers to secure financing within a week or less, with affordable rates and decent terms.

Moving company alternative loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Moving Company Cash Advance

While cash advances are generally nobody’s first option, it is often the only choice of financing for moving company’s needing quick business loans. Moving company cash advances aren’t loans – ACH cash advances are actually the sale of the moving company’s future receivables in exchange for immediate money. The moving company will sell some of its future bank deposits, and then repay the lender by agreeing to have a set amount of money pulled from their business bank account each business day via automated clearing house until the funding is repaid.

Moving company cash advance documents:

- Application

- Bank statements