Online Business Funding

Where are increasingly small businesses looking to obtain financing options to help fund their companies? They’re looking to the Internet. Business owners are savvy and are constantly seeking better products for the companies. The same is true when it comes to researching the financing options. Business owners understand that when it comes to getting financing, every dollar spent in the interest is a dollar that can’t be reinvested into the company or put into the owners on wallet as profit. With all the options available through a Google search of small business owners are able to access multiple online financing options in a matter of minutes. But with this increased pool of lenders that a business can access is important to educate ourselves down all the financing options that are available. In this article, we will look at all the online business lending options.

What is an Online Loan?

An online business loan relates to any business financing product in which the owner applies for a business loan online, and all of the funding steps are completed either digitally or over-the-phone without having to enter an actual commercial financing office or bank. Online business lenders can handle the entire funding process online and do some secondary actions like telephone conversations from beginning to end without any face to face interactions.

Why Would a Company Use Online Business Loans?

- Speed: as we know everything that we do online has made our life more convenient. When it comes to online business lending the same is true for the consumer (in this case, the small business). Most online lenders can qualify your company within the matter of minutes — if not seconds – and rather than wait around for weeks on end for a bank to make a decision, an online lender can make an instantaneous decision and complete the funding process within a matter of days. Whereas the bank lender may require a human underwriter to analyze financial data in order to make a decision, an online lender inputs the financial data into the computer and the algorithm will determine rates and terms almost immediately.

- Ease: The speed of process isn’t the only part that makes it easy. Previously, a business owner would have to visit many different lenders to obtain competition and multiple offers. But when it comes to online business lending, these companies able to access multiple without leaving their computer chair. Marketplace lending platforms help small businesses to compare options to help them find the best possible rates and terms for their financial situation.

- Higher Approvals: marketplace lending platforms may offer more than a hundred (or even 1000) different business lending options. These lenders understand that there are other business lenders who are competing to fulfill the businesses loan request, therefore, these lenders generally offer more competitive rates and terms then you would see if you were applying to a single lender. Additionally, most marketplace lenders have lower approval requirements that a conventional bank or SBA lender. Whereas conventional lenders approve less than 50% of loan applications, a marketplace finTech lender may have approval rates as high as 75%.

- More Options: when a small business owner used to apply for a loan at the bank, they were accessing a limited number of financial products – mainly term loans and lines of credit. While some other additional lenders may offer equipment leasing, they are limited in the types of products they provide, and the flexibility in such products. Now, when it comes to online business lending, there is in enormous flexibility with the thousands of products that are available online, whether it be factoring, AR financing, bridge financing, ACH loans, and merchant cash advances.

Uses of Online Business Loan Uses:

- Inventory: Online business lending is perfect for a company seeking inventory financing because the process of obtaining financing is extremely quick. Small companies that are seeking inventory need to access financing immediately to take advantage of the opportunity, and online inventory lenders are able to provide financing for retailers within a matter of days — if not this very same business day — as when the business owner applies for the loan or advance.

- Expansion: it’s just not easy to get an expansion loan from a bank or conventional lender because there’s generally a lot of unknowns. While a small business may do and enormous amount of planning and due diligence before expanding, there are always issues that arise that will test any business plan. Conventional lenders generally won’t touch an expansion loan unless the business owner provides substantial collateral and/or personal assets to secure the business loan. Thankfully, online business lenders may be more willing to provide financing to help with expansion because they’re willing to take more risk. But understand, with higher risk also comes higher rates and terms than you would see with bank lenders.

- Working Capital: online working capital loans are probably the most common of all of all online business lending option. Working capital is the difference between having enough capital to run smoothly, and business operations that are under severe financial stress and unable to meet their current financial obligations. Working capital lenders can provide small businesses with immediate and short term working capital solutions that can fund immediately with limited documentation required.

- Emergency Uses: as any business owner would know, problems arise at any given time which can affect business operations. Often, these problems cost money to fix — money that the business may not have available now. Thanks to online business lending options, these businesses can obtain emergency funding, even with the worst of credit.

- Real Estate: most small business owners never considered obtaining a mortgage or refinancing their current commercial real estate loan online. But with the rise of online commercial real estate lenders, the number of small business owners seeking such financing has exploded in recent years. Online commercial real estate lenders offer mortgages, bridge loans, hard money loans and asset based loans that can be completed in less than a month. Additionally, there are also online SBA real estate options that can be funded in less than 45 days.

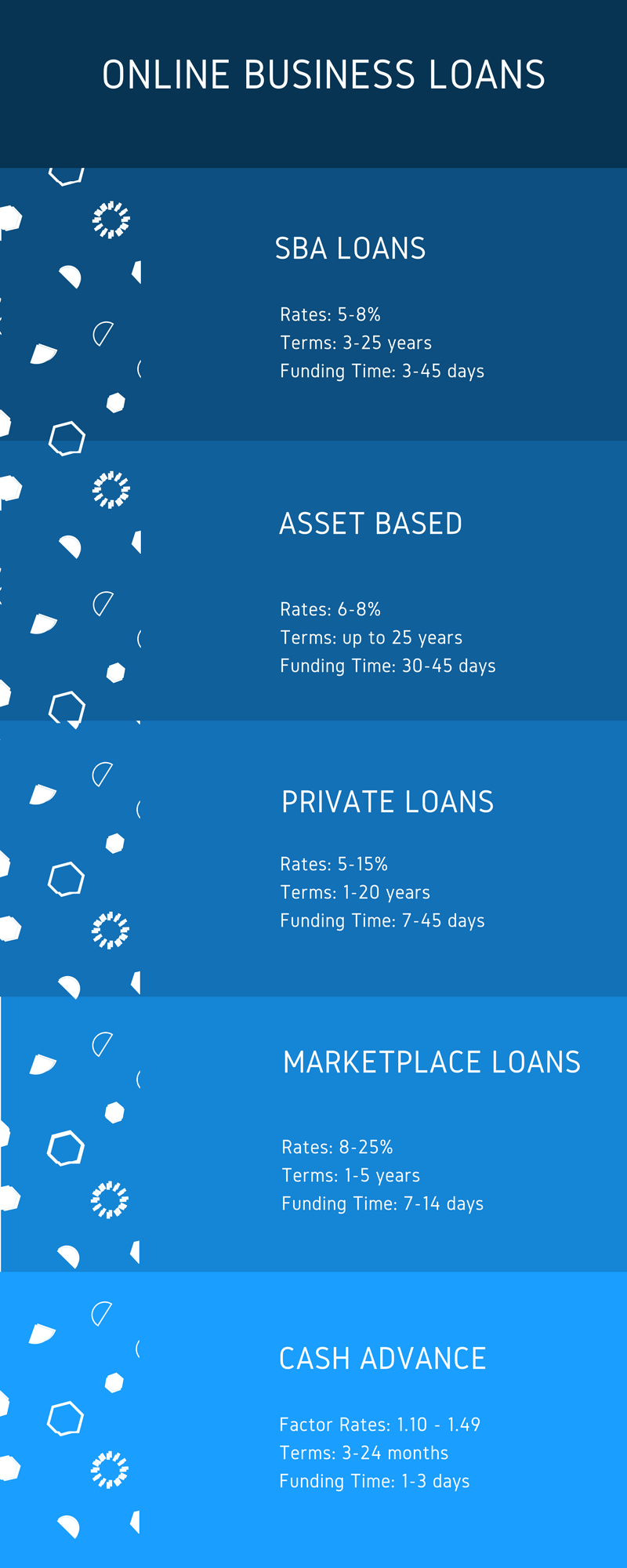

Types of Online Business Loans:

- Online SBA Loans: to understand the beauty of online SBA lending you first have to understand the process involved with the SBA financing; SBA lending is just a traditional type of financing offered by banks and nonprofit lenders. So, understanding that SBA lending is provided by traditional banks, the process can take a long time to complete. But when it comes to online SBA lending, the process is much faster. Where a conventional SBA loan may take up to two months to fund, an online SBA loan may only take three or four weeks to complete.

- Online Marketplace Loans: marketplace lenders are almost exclusively operated online. By operating online these funding companies can reduce their overhead which is been passed on to the borrower as savings. Marketplace lenders generally don’t operate as a single lender, but a platform of multiple lenders that a Power can shop for the right financing for their needs.

- Online Invoice Factoring: getting your invoice factored by an online lender is a way to make sure that you receive financing within a day or two, and the process is as painless as possible. Factoring your invoice involves selling your unpaid 30 to 90 day invoice to a third-party factoring company in exchange for up to 90% of the invoices value immediately.

- Online Equipment Leasing: for companies that don’t want to purchase equipment outright, an option may be to simply lease the equipment. Online equipment leasing companies are able to offer nearly instant approval’s and can deliver the equipment within a matter of days.

- Online Commercial Mortgages: One can obtain a commercial real estate loan through online lenders offering conventional lending programs, SBA lending programs and USDA lending programs with ease. By getting your commercial real estate loan through an online lender, the business owner is able to streamline and speedup the funding process. Also, you’re able to increase your chances of being approved because you’re able to access lenders outside your region. Alternative online commercial lenders offer short term commercial real estate products such as hard money loans, bridge loans and second mortgages.

- Online Private Loans: it seems many small businesses are looking for private lenders because conventional lending options are very difficult to get. Private non-bank lenders can offer flexible financing products in different types of creative forms. But finding a private lender is extremely difficult because they’re usually individual investors who don’t advertise their products widely. One way to access private lenders is to seek them on mine through an online business loan broker.

- Online Merchant Cash Advances: getting a cash advance for your company is always easy to obtain. But getting the best cash advance with the lowest factor rates and longest terms requires some shopping around. There are hundreds of merchant cash advance funding company and each of them have different requirements and different structures of their products. Using an online merchant cash advance broker is a way to navigate the process of selling your future receivables to obtain immediate funds.

Conclusion

As you can see there are a variety of funding options for a growing small business in need of financing. In fact, there are thousands of lenders offering tens of thousands of lending products — all with varying characteristics and requirements. As mentioned previously, finding the right financing products for your business can save you lots of money. That money could have been used for additional business operation uses or even taken as profits by the owners. Making sure you’re getting the right financing requires understanding all of the financing options available. If you need help learning about your financing options and would like help navigating the process, please reach out to one of our financing specialists and we will help you get the best loan for your company.