Types of Commercial Mortgages

Purchasing or refinancing commercial real estate requires a large investment of funds that may require a business or commercial real estate investor to seek debt financing in order to handle their property needs. When seeking a loan for commercial real estate, it’s essential for a borrower to do some research on the commercial real estate lending products, as well as the type of commercial real estate lenders there are. In this article, we will take an in-depth look at all of the commercial real estate loan and mortgage options, as well as look at the types of lenders that offer these loan products.

Owner-Occupied Vs Investment / Income Producing

When it comes to uses of commercial real estate, its either owner-occupied CRE, or its an investment property. With owner-occupied property, the real estate is used by a small business for its own operations purposes. That doesn’t mean that owner-occupied (or owner-user) business real estate can’t be income producing from income it gets from tenants. In fact, an owner-occupied piece of commercial real estate can meet such classification if just 51% of the property is used for business uses.

With investment and income producing commercial real estate, the majority of the commercial property is used to lease to tenants as the driver of cash-flow. Another type of investment property is a fix-and-flip, where the goal is to purchase the real estate, fix-it-up, and sell it for a profit.

Types of Commercial Real Estate Loans

- Purchase: This use is used to buy or purchase commercial real estate for a business to use for its operations, or for investment and speculative purposes. Generally, a purchase of a commercial property involves putting in place a mortgage from a conventional lender, but a purchase can also be accomplished with bridge loans or hard money financing.

- Refinancing: Mortgage refinancing is used to buy-out one commercial mortgage lender’s loan to a business or investor, and replacing it with a term loan that has a lower rate than the original mortgage of financing facility, has a longer term and/or amortization than the original loan, or to tap into the property’s equity to obtain cash for business and/or investment purposes.

- Bridge Loan: This type of commercial loan is a short-term lending facility used to either acquire commercial real estate, or used by businesses and investors as temporary financing until a longer-term facility is in place. Most bridge commercial loans are less than two years in terms and have higher rates than more conventional commercial mortgages.

- Cash-Out: This type of financing or refinancing involves either taking-out a previous mortgage, and cashing-out whatever equity the property has, or it involves extracting cash from the equity of a property that is without a mortgage to refinance.

- Hard-Money: Short term commercial real estate loan provided by private and institutional lenders in which financing is provided and secured solely based on the commercial real estate collateral.

- Construction: This type of commercial loan is used by businesses for their own business operation uses, and by investors to construct buildings, developments and communities for speculative purposes.

- Fix-and-Flip: This type of commercial loan is usually used by investors in single family, multifamily and large-scale commercial real estate development. With fix-and-flips, the sole purpose is to develop the commercial real estate and to then sell the property.

Types of Commercial Real Estate Lenders

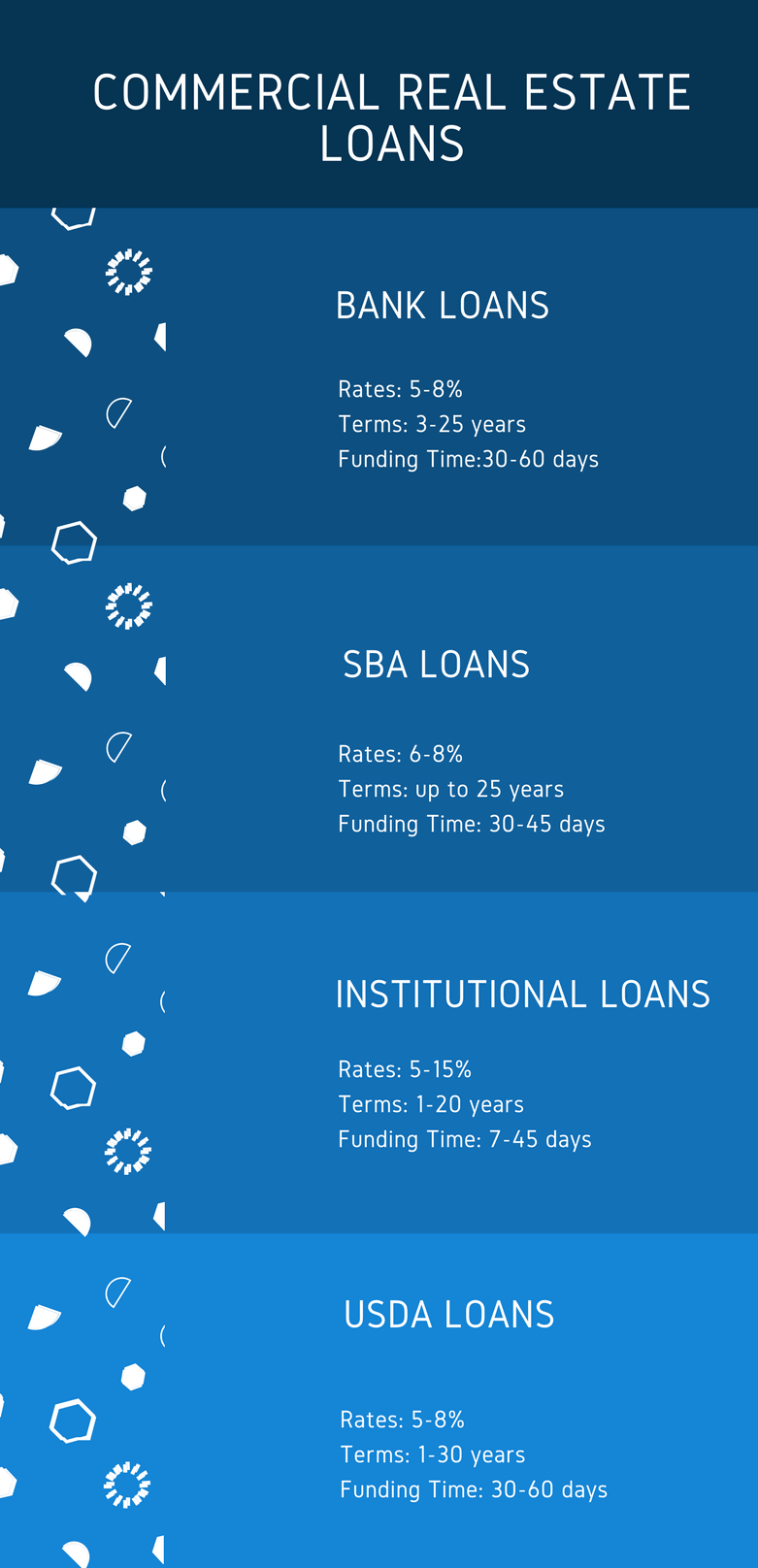

- SBA: The Small Business Administration offers commercial real estate lending programs to small businesses seeking to acquire, refinance and development owner-user commercial real estate. The SBA’s lending programs are not available to commercial real estate investors and speculators, as the SBA commercial real estate loan must be used on property in which a for-profit small business (that meets the SBA guidelines) uses, at least, 51% of the property for business uses. SBA 7(a) loans are used to purchase and refinance commercial real estate debt. SBA 504 loans are used to develop, build-out and construct buildings for a company’s own uses.

- Bank: conventional lenders such as large national banks, smaller banks, credit unions and community banks offer commercial real estate loans for a variety of uses. Although some will provide loans for investment uses, the great majority provide only owner-user commercial mortgage financing. Borrowers that qualify for a traditional mortgage from a bank will get the best rates along with the longest terms and amortizations of all commercial lenders. But getting a bank loan for commercial real estate isn’t easy, so the borrower will have to show excellent credit along with great cash-flow and revenue.

- Private / Institutional Lenders: these types of non-bank lenders are often provided by a single investor, or pool of investors that concentrate their investment into commercial real estate. Private and institutional commercial real estate lenders offer long-term and short-term mortgages, along with bridge loans and hard money loans. Institutional lenders will provide financing for both commercial real estate that is used by a company for its own purposes, but also for income producing and/or investment real estate.

- USDA: this type of commercial real estate loan is solely-focused on helping under-served businesses in rural communities get the financing they need to help their small business thrive. The program is administered though the USDA’s Rural Business and Coop Program and it purpose is to help businesses in areas populated with 50,000 or less. Borrowers looking to obtain financing from the USDA’s business loan program will need to have good credit, because the loans are originated by conventional lenders, and the USDA guarantees a portion of the loan, reducing the lender’s risk.

Summary

There are quite a variety of loans available to purchase, refinance, rehabilitate, construct and invest in commercial real estate. Understanding your options, and then working to get the right loan for your small business is crucial to making sure that your business obtains the best possible commercial real estate loan and mortgage. Making the wrong choice could strangle your business with expensive payments that can hurt your company’s bottom line and prevent maximum growth. If you help understanding all the commercial real estate loan options, please feel free to reach-out to us, and one of our loan advisers will help you navigate the process.