Business Loan Advice

The process of obtaining a business loan can be tricky if not downright confusing. The goal of the business loan is provide your company with the financing it needs to handle its operations. Getting the wrong loan could put you in a position where you eventually struggle to repay the debt. So the goal of the business lending process should be to find the right business loan for your company’s needs. With well over 5,000 lenders offering over 12,000 business loan products, the process of getting a loan isn’t easy. In this article we will focus on tips to help a borrower navigate the business lending process.

- Prepare before you need: The process of getting a business loan can be very easy or extremely difficult depending upon the type of financing the company is looking for, the type of lender they apply with, and the uses for the business loan. From application to funding, the time frame can range from 1 day to 3 months depending on the type and size of the credit facility a small business is seeking. Rather than waiting until the last minute to apply, a business owner should understand the coming financing needs, and apply before the need is imminent.

- Know your options: Its important for a small business owner to know all the credit options available so they can make the best choice for their company. Fact is, the rates of small business loans vary greatly, as well as the terms and fees associated with the loan. Knowing all your financing options allows small businesses to make smart decisions that will aid with the company’s obligations and growth.

- Shop for best rates: This should go without saying. But in order to shop for the best rates, terms, amortizations and fees, a small business owner needs to do their research and homework so that they are fully-informed on all the options available. Remember: for every extra dollar spent on rates and fees, is a dollar that could have been spent on other business uses, or even profits directly to the business owner.

- Make sure you have a legitimate use: what a business owner should not want to do is to borrow money just for the sake of borrowing money. While a lender or broker may try to sell you on why you need fast money, such capital comes with a cost. And the repayment schedule may hamper business cash-flow leading to a need for additional debt financing.

- Apply for enough money: There are always unforeseen expenses that arise in normal day-to-day business operations. The last thing you want to do as a small business owner is borrow money that isn’t sufficient to meet your needs. If you don’t get enough money the first time, you may find yourself seeking additional business loans that will be much more expensive than the first.

- Look outside region: Almost all the time, the preferred way of going about obtaining financing is to walk into the small business’s local bank and apply for a conventional bank loan. Unfortunately, such small banks have a very low approval rate (between 20-40%). Looking for a lender outside your immediate community will open up the opportunities and chances of being approved.

- Lenders with focus on industry: There are thousands upon thousands of business and commercial lenders – each with their own niches and criteria. If for some reason you’ve had difficulty finding a lender that will lend to your particular industries, an option would be to look for lenders outside your state or region to find a lender with a focus on your industry.

- Know what lenders are looking for: Every lender has their own specific criteria for funding. Some lenders put a heavy focus on business and credit history. Some small business lenders focus more on future cash flow and projected profitability. But what every lender looks for is the ability to repay the loan. Showing that you have the ability to fully-repay the loan comfortably is the most important think you can do when applying for a small business loan.

- Choose traditional options first: Conventional small business loans have the best rates, terms, amortization and fees than alternative loans. Getting a small business loan from a bank or credit union will save you an enormous amount of interest payments, and since the terms are extended, you’ll be able to service the debt much easier than shorter-term alternative business loans.

- Use alternative after exhausting conventional: After you’ve tried to obtain a bank or SBA loan, but still find yourself locked-out of conventional bank-rate financing, using an alternative loan is probably the next best option for a small business. While there are many names for loans that are the mid point between a bank loan and a high-interest advance (like mid prime loan, institutional loan or Fintech loan) the rates and terms all pretty much look the same, with rates between 8-25% and terms ranging from 2-5 years.

- Cash advance last: Because of the high rates associated with merchant cash advances, this type of small business financing should be considered only after all other funding options have been exhausted. While a merchant cash advance has its appeal in that they require very few documents, much lower credit scores than traditional financing, and can fund in a fraction of the time of a conventional lender, the price paid for a cash advance is prohibitive at times.

- Consider a SBA-enhanced loan: Loans that are guaranteed by the Small Business Administration have some of the best rates and structures available for growing small companies. The purpose of the SBA lending program is to encourage traditional lenders to provide financing to small businesses that wouldn’t be able to get a bank loan without the SBA guaranteeing a portion of the loan.

- Although you may be looking for a loan, consider leasing, too: Rather than purchase a piece of equipment and risk being stuck making payments on machinery that could end up being outdated before the payments are up, and option could be to simply lease business equipment and machinery to avoid the upfront capital costs needed to acquire the equipment.

- Be current on your commercial real estate mortgage: Mortgage information is needed for most business loans, especially when looking to refinance and/or consolidate their mortgage debt. But this information isn’t only required for commercial real estate loans, but for nearly all loans. A lender will want to make sure that the borrower is current on their existing mortgage before providing financing. Being behind on one’s mortgage will almost certainly be declined for funding.

- Prepare for a down payment: While most alternative lenders (fintech, factoring, merchant and business cash advance) don’t require a down payment to obtain financing, nearly all conventional lenders will require some sort of downpayment to ensure that the borrower has some skin in the game, and to make sure that they don’t start off their loan underwater. Usual down payments for conventional loans (especially when dealing with commercial real estate) are somewhere between 10-25% depending upon collateral, credit and ability to service the debt.

- Show business profitability: One of the factors used to determine financing by conventional and some alternative lenders, is profitability. Lenders will look at trailing profits, and then project what profits may be in the future. From there they will then calculate how much debt your company will be able to service comfortably, and then use that to help calculate the funding amount along with rates and terms.

- Show your company’s growth: While a lender will look at how your business has performed in previous years to decide if to approve your loan, and then underwrite the facility, they are still funding based on future revenues. Showing a positive trend in both growth and net revenues is a big plug in both getting approved, and getting the best rates and terms for your small business.

- Positive balance in bank accounts: To get funded for a merchant cash advance, the cash advance funding company will sign-in to the small business’s bank account to verify that the information provided during underwriting was accurate. What they will also look for is whether the business currently has a positive balance. If your bank accounts are negative, the funding company may very well deny funding you.

- Make sure you don’t have tax liens: One way to ensure that your company loses access to the great rates and terms offered by traditional lenders is to have income tax liens. Tax liens are almost always an automatic disqualifier to conventional financing, and absolutely disqualifies your company for SBA financing because the Small Business Administration requires all companies seeking a SBA loan to be in good standing with the government.

- If tax liens, make sure in payment plan: While having tax liens will prevent many small businesses from getting approved for a traditional or SBA financing, it doesn’t prevent your company from getting all financing. Cash advance lenders will provide many companies with tax liens with access to funding – especially if the tax liens are also in a payment plan.

- On time with current lender: If you have an existing small business loan or line of credit, you’re going to want to make sure that you’re current with your lender/creditor. Fact is, no lender is willing to provide a subordinated loan to a company that is already in bad standing with their current lender.

- License up to date: If your small business is required to have specialized licensing for your industry, you’re going to need to make sure that you have such licenses, and to make sure they are also up-to-date. Failing to provide a proper licensing is almost always a disqualifier for most small business lenders.

- Have good online reviews: While small business lenders will look at a number of different factors to evaluate your business during the approval process, some alternative lenders will also look at the online reviews of your business to get a feel for business health. If your clients and customers seem happy, it’s a sign of a healthy business. If your company is obtaining terrible reviews, it’s not only a reflection of the company, but also makes customers less likely to seek your services.

- Do not settle: Sometimes business owners find the entire financing process intimidating and daunting. Because of that, many small business owners tend to settle for the first loan offer that meets their financing needs, without shopping for the best rates and terms. And often times these business owners find themselves regretting the rash decisions because they find that the higher rates and short terms puts enormous stress on cash flow and reduces profitability.

- Avoid business loan brokers when you can: If you feel that you can comfortably navigate the business lending process without the help of a middle-man, then do it. While a business loan broker can help you obtain the financing you need, they may also increase the cost of the loan because many lenders will price the cost of their broker commission directly into the loan. By avoiding using a broker, you may reduce the total cost of financing.

- Work with qualified brokers: Before sending your personal and business information to a stranger, make sure the broker is both reputable and has a history of success. The best way to research this is to simply google the name of the business loan brokerage and make sure they have a sufficient online footprint. From there you should ask your broker what rates and terms do they plan to seek and what types of lenders will they be submitting your file to. You should also ask them for examples of providing successful funding to previous clients with similar funding needs.

- Avoid upfront fees from brokers: While some small business loan brokers will ask for an upfront fee to help obtain you’re a business loan, absolutely avoid paying them. Good brokers are paid for success, meaning they will only get a commission if the borrower is funded. Bad brokers will require upfront fees, and then disappear – leaving the small business owner out-of-cash, but also left stranded to fend for themselves. If the business loan broker is any good at their job, they will only agree to be paid when you get funded.

- Get your taxes done: While many small businesses will file for a tax extension, putting off filing your taxes may hurt your chances of obtaining financing. Every single conventional business lender, and many alternative business lenders will require your most recent taxes (if not 3 years) of both business and personal taxes. Not providing them will almost certainly lead to your application being declined.

- Have financials audited: While audited financials aren’t required by alternative lenders, some conventional lenders may require them. If not, audited financials how more weight than unaudited financials, and will help with the approval and underwriting process. Fact is, financials that are audited are much more credible than Quickbooks printouts.

- Understand what a prepayment penalty is and plan accordingly: Lenders make their money off of upfront fees, and the interest paid back during the course of the loan. The interest that makes the loan profitable to the lender, come directly from you. One way to reduce your cost of borrowing money is to pay off the loan early and reduce your interest payments. Many lenders aren’t willing to walk away empty-handed, so they charge a penalty for paying-off your loan early. Knowing this, you should search for lenders with minimal or no prepayment penalties, and do your best to pay off the loan as quickly as possible.

- Learn about what your late charges will be: while no company ever plans on missing a business loan payment, certain situations may arise that cause a small business to miss a payment. Its important to understand what the penalties would be before entering into a financing agreement with the lender.

- Make sure payments are spread out: The last thing you want to do is borrow money, only to find yourself in a worse cash-flow position. Do your best to ensure payments are spread-out as far as possible. There’s a big difference between making one monthly payment, and having to make daily payments (which, if you miss, you will get charged additional fees). Now, granted, every business owner wants to have the best repayment schedule available, but to make sure that happens requires researching lenders for the best repayment structure available.

Business Lending Definitions and Terms

- What is an interest rate: an interest rate is the percentage of the cost of borrowing loan principal that is charged by the lender to the borrower. This rate is either expressed as a fixed interest rate, or variable interest rate.

- What is an APR?: an APR or Annualized Percentage Rate is the total cost of borrowing the loan amount. This includes not only the interest rate, but all other fees associated with borrowing, including closing fees, broker fees, origination fees, and all other fees.

- What is a factor rate?: Since cash advances aren’t loans, the cost of the funding is expressed differently. A factor rate represents a formula used by merchant cash advance funding companies and other alternative business financing company to express the rate of “borrowing”. A factor rate does not represent the total cost of the funding, as it doesn’t include any banking or origination fees, let alone penalties associated with missing payments.

- Personal credit: While the importance of personal credit varies depending upon the type of small business lender, virtually every lender will use personal credit history to evaluate a business loan application. SBA and conventional lenders tend to require minimum personal credit scores between 650-700, mid prime lenders usually requires scores over 640 and cash advance lenders can approve loans when the applicant has scores as low as 500.

- Business credit: All business lenders will also evaluate a small business’s own credit to evaluate a small business loan. A company’s credit score is not only used to determine whether to approve the loan in the first place, but also to price the rate and decide the term of the loan.

- Business collateral: Depending on the type of loan a small business is seeking, they may be required to provide business collateral to get approved for the loan. Such collateral may include personal real estate, equipment and machinery, inventory or a company’s account receivable. Having sufficient collateral to cover the cost of the loan is generally required for more traditional loans, whereas with cash advances no collateral is required (although a general lien may be placed on the company’s assets).

- Personal collateral: Some small business lenders will require that the applicant provide their own personal property and assets as collateral for their company’s loans. Since most loans are personally guaranteed by the small business owner, all of their assets are at stake should the business fail to repay the loan.

- Net worth: Having sufficient net worth is generally a requirement for traditional and SBA financing. The lenders will require the business owner provide a personal financial statement during the application process, and require that their personal assets are worth roughly the same amount of the loan itself.

- Difference between term and amortization: While there may be confusion between the two, the differences between a term and amortization are quite simple. A term, is the period of the loan when the small business will be paying interest. The amortization is the time when the small business will pay off the entire loan. When the term of a loan reaches its end, that means the small business will then need to renew their term or renegotiate a new term.

- Business assets: A traditional or alternative business lender may require some sort of collateral for the loan being provided to the small business. To prepare for this, you should put together a list of all your company’s assets along with the fair market value for each asset, whether they are tangible, intangible or intellectual property.

- Personal assets: As part of the underwriting process involved with conventional and personal assets to ensure you have enough assets to help the lender recoup some of its losses should your small business fail to repay the loan. Lacking sufficient personal assets may preclude you from getting conventional or alternative lending.

- Learn about Confession of Judgment: a COJ is a legal document often used by merchant cash advance funding companies as part of the funding process. A confession of judgment is an admission and final judgment agreed upon by the small business borrower before the loan is provided. While confession of judgments are banned in certain states, the overwhelming majority do allow for them.

- DSCR: is a ratio used by business lenders to help understand the small business’s ability to repay their debt. Debt service coverage ratio (DSCR) is a calculated by dividing net operating income by the annual debt accumulated by the small business. For many conventional and SBA lenders, they will look to see a debt service coverage ratio is 1.1 or better.

- Origination fee: small business lenders don’t just make money servicing the loan one its put in place, it takes man hours and resources during the application, underwriting, funding and wiring processes that costs the lenders money. To help compensate for these resources being used a lender may require an origination fee to cover some of these expenses.

- Prepare for a UCC search: A Uniform Commercial Code lien is something a small business lender will file against a small business when they provide financing to them, so as to give notice to the public that the lender has first rights to the business’s assets should they fail to repay their financing. By informing the public, they are letting other lenders know that should they also provide the business with a loan, they will have to wait until the first lender is repaid before they could seek-out business assets in case of default.

- Know difference between gross revenue and net revenue: Many times, we tend to get caught up with the total revenues a company brings in when judging a company. While it’s important to take into account total revenue, what many lenders will focus on most is net revenue. Gross revenues are the total income a company brings-in, whereas net revenues represent the amount of money left over after all business expenses are paid. While a company may bring-in substantial gross revenues, that doesn’t include the costs of doing business. If their costs are larger than the revenue they bring in, the company isn’t profitable. Having profitability shows a lender how much free cash you’d have left over to repay a loan should they.

- Understand covenants: as part of the lending process, particularly when it comes to lines-of-credit, factoring and accounts receivable financing, the lender may put restrictions on how the financing is used. The point of the covenants is to clearly lay-out what activities the financing can be used for, and clearly explain what purposes the financing cannot be used for.

- Due Diligence: involves a lender researching and analyzing a borrower’s credit, revenue, cash-flow and other obligations when deciding on whether to provide financing, as well as pricing the financing.

- EBITDA: short for earnings before interest, taxes, depreciation, and amortization is an indicator some lenders (almost always conventional or asset based middle-market lenders) use to help determines a company to service its business debt.

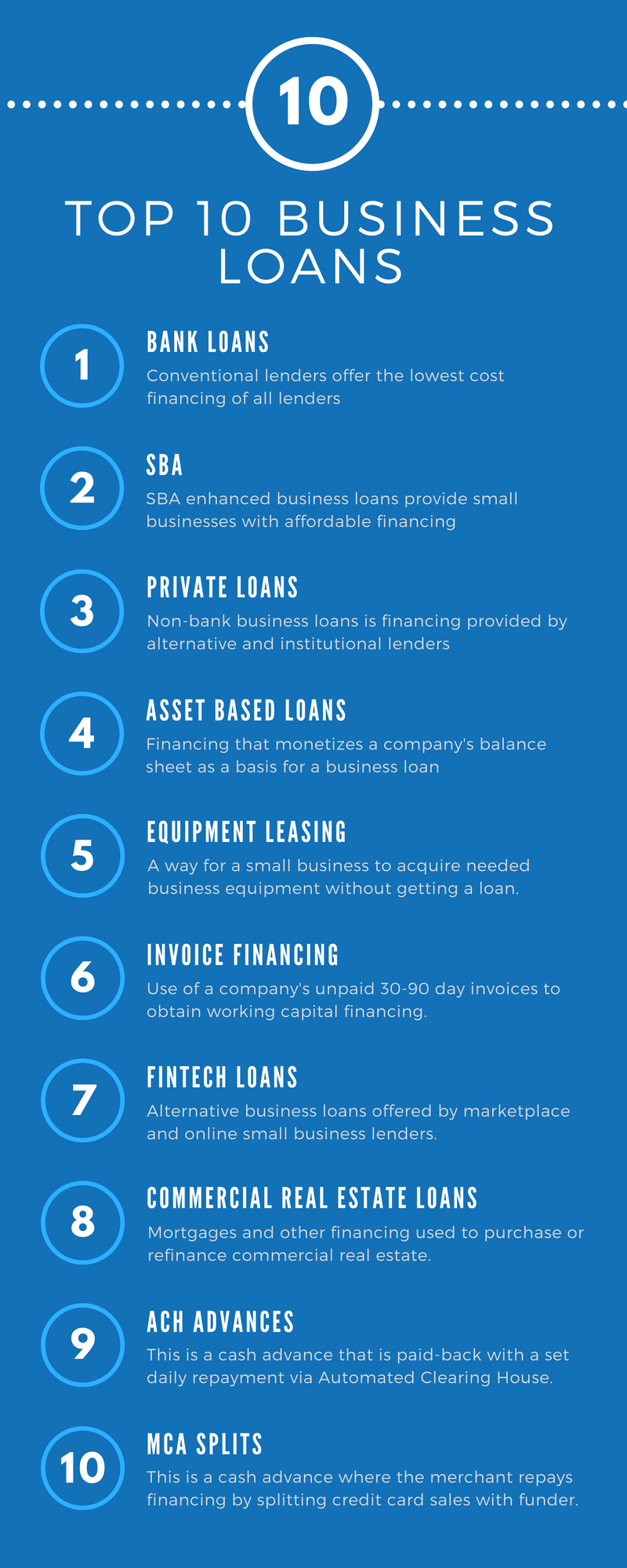

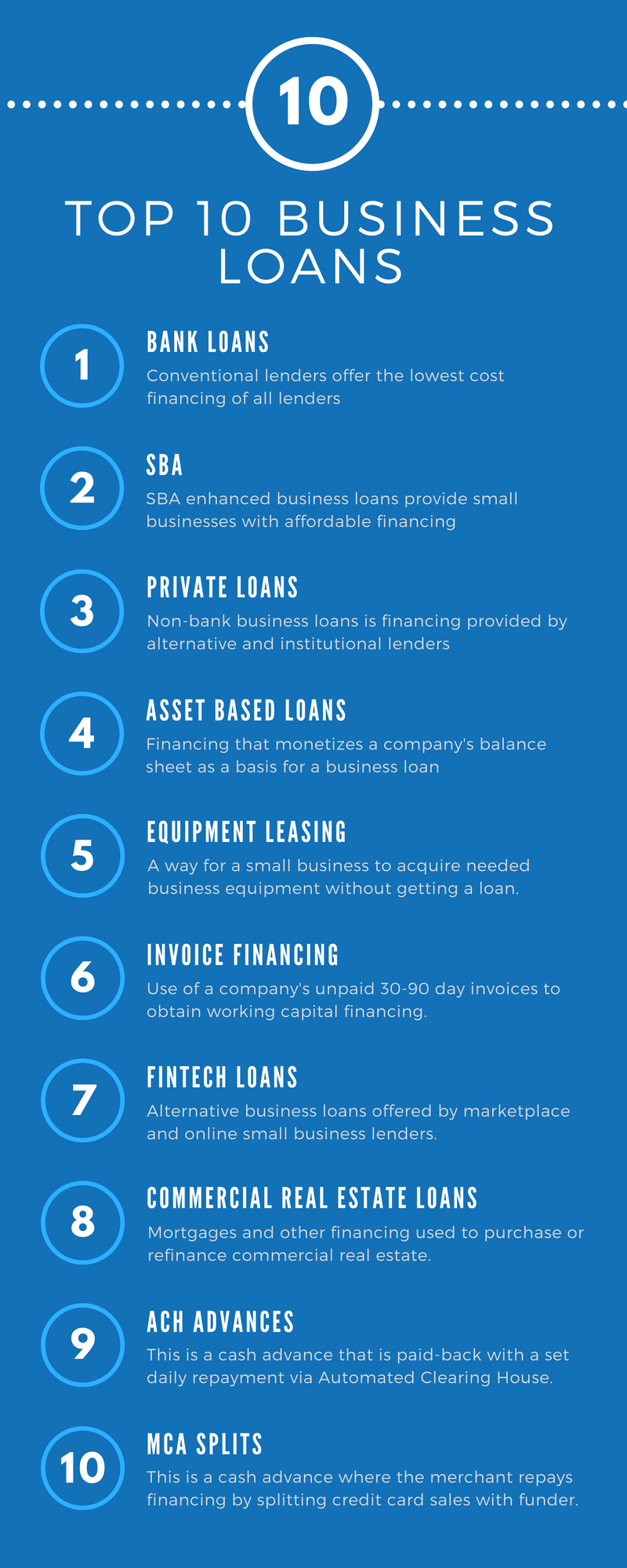

Types of Small Business Loans

- Conventional: Banks and conventional lenders can provide rates that are lower than all other commercial lenders, as well as provide terms that are longer than alternative lenders provide. Additionally, bank fees are much lower than some of the higher-rate alternative lenders.

- SBA: Financing provided by conventional lenders that take advantage of the SBA enhancement program – meant to encourage conventional lenders to provide affordable financing to small businesses that wouldn’t have received it without the enhancement.

- Alternative: Non-bank loans offered by online lenders, marketplace lenders, and fintech business lenders. Alternative loans generally have affordable rates, even if the rates aren’t quite bank-rate.

- AR financing: A form of asset based financing in which you leverage your small business’s accounts receivable for collateral to obtain a short-term loans or business line-of-credit to use for working capital purposes. The outstanding receivables are used as collateral.

- Factoring: This type of business financing in like AR financing in that invoices are uses a basis to obtain financing. The difference is that with factoring, the invoices are not used as collateral, but instead sold directly to the factoring company in exchange for business financing.

- Private Business Loans: private lenders are generally loans offered by a group of investors for fast growing small businesses, and businesses with substantial assets. Other private lenders focus solely on commercial real estate loans such as mortgages, bridge loans and hard money loans.

- Commercial Real Estate Loans: Financing that is used to purchase or refinance commercial or investment real estate. The commercial real estate collateralizes most commercial real estate loans itself.

- Asset Based Loans: A way for a company to obtain working capital for its operations uses by monetizing the assets on the businesses’ balance sheets. Most common forms of asset based lending relies on real estate, accounts receivable, equipment and/or inventory as collateral for the ABL.

- USDA Loans: A type of business loan administered by the US government meant to encourage financing to small businesses in rural communities with less than 50,000 inhabitants.

- Bridge Loans: a form of short-term financing used temporarily until a more permanent financing solution is completed. Bridge loans are used for both commercial real estate financing, as well as for working capital purposes.

- ACH Cash Advance: This involves selling your company’s future business revenue in return for upfront financing. With an ACH loan the repayment to the lender is made by having a set amount taken from the company’s business bank accounts each day until the advance is repaid.

- MCA Split Advance: Similar to an ACH advance, an MCA split is also the sale of the company’s future receivables. The receivables used in an MCA advance are credit card sales, and repayment is made by splitting each day’s credit card sales with the funder until repaid.

Documents Needed For Funding

- Business tax returns: Depending on the type of business loan you’re seeking, the lender may very well request your business tax returns, not only for the financial information provided, but also so they can look at and verify the business’s structure.

- K1 statements: These statements are used by corporations and partnerships to report each shareholder’s portion of deductions, credits, income and losses. A lender may use this statement to verify how much each owner’s equity is, to make sure a sufficient percentage of the ownership is agreeing to the loan.

- Income statements: these statements, often referred to as a profit and loss (P&L) are a financial report that shows revenue and expenses for business operations during a year or portion of a year. After revenues and expenses are calculated, you’d like to see a net profit that can show your small business’s ability to repay the new business debt (loan).

- Balance sheets: These statements are a summary listing of all the company’s asset, liabilities, and the company’s shareholder equity. Lenders will often analyze a company’s balance sheet to see if they have sufficient collateral to support the loan. The purpose of the collateral is to make sure the lenders have some way of recovering losses should the small business default on their loan.

- Prepare a schedule of liabilities: a debt schedule lists all existing debt a small business may have, along with the name of the creditor, the original amount loaned, the date the loan was funded, the current balance of the business loan, interest rate of the loan, along with the debt payment schedule.

- Make sure AR schedules are in order: Accounts payable aging reports and schedules report how much a company is expecting to receive from its clients over the course of the next few months. AR schedules generally lump invoices into three groups: under 30 day invoices, 30-60 days and 60-90 days.

- Have a business plan: Not all lenders require a business plan (particularly alternative lenders) but many traditional lenders require a business plan so they can evaluate whether the funds are going to be put to proper use, and to make sure the plan in sound. Fact is, the lenders want to get repaid, and the best way to ensure they’ll be repaid is if the business succeeds. Providing a business plan that clearly lays-out your company’s path to success is helpful during the loan application process.

- Prepare realistic projections: Depending on the type of small business loan you are seeking a traditional or alternative lender may ask for projections of future revenue in the future months or years. While we all like to be optimistic in how well our businesses will do in the future, make sure to be realistic with your projections so as to not scare the lender off. If the lender believes your projections aren’t credible, he may feel that you aren’t credible, either.

- Prepare a resume: While not all lenders require a personal resume of the business owner, some conventional lenders (particularly SBA lending institutions) will require a resume showing that you have sufficient experience in the field that your business is operating.

- Articles of incorporation: In order to get a small business loan, you need to show that your small business has all required licenses and incorporation documents.

- Bank statements: Bank statements are used by both traditional and alternative lenders during the underwriting process. But, while bank statements are needed for a small part of the underwriting process, and alternative business lender will be much more reliant on bank statements. Some alternative lenders are even solely reliant on bank statements to analyze a small business’s cash-flow.

- Business Credit Report: much like a personal credit report, a business credit report is a summation of the company’s past history of meeting its financial responsibilities. Common credit reporting agencies used by lenders are Experian, Dun & Bradstreet and Equifax.

- 1003 Form: is a form used commercial and residential real estate lenders to process real estate applications. Created by Fannie Mae, this form is the standard for the industry.

- Rent Roll: a listing of all the commercial real estate’s current occupants as well as the monthly payments made to the landlord, as well as listing total rent received and total income of the commercial real estate.

- Promissory Notes: a signed legal document stating that a borrower will pay a certain sum of money on a specific date named in the contract, to a specific lenders or creditor.

- IRS 4506: a form used by many conventional lenders that allows them to request access to the past 3 years of federal tax returns of an applicant. It is used to evaluate and verify the income of an individual or business.

- Credit card processing statements: For small businesses seeking financing using their merchant processing account – called merchant cash advances – you’ll need to provide between 3-6 months merchant processing statements. The funding company will evaluate the statements and then decide on how much they can lend you (based on the number and total volume of transactions). Repayment to the lender occurs by having a small percentage of each day’s processing transactions remitted to the funding company.

- Provide lease information: If you don’t own your commercial real estate but, instead, lease the commercial property, you’ll need to provide proof of most recent rental/lease payment. If for some reason you have fallen behind in your company’s rent, it’s a major redflag for the lender. Chances of getting approved for a small business loan when you’re late on your rent will make a lender think the same will happen with your monthly payment to them.

- Be ready to provide landlord info: almost all lenders will want to contact your company’s landlord to both verify the company’s business location is legitimate, but to also make sure the company is current on their lease payments. A company that is unable to verify their business location and/or is behind on their lease payments will have difficulties getting funded.

- Make sure you have an EIN number: this nine digit number is assigned by the Internal Revenue Service and is used for identification purposes. All corporations, partnerships, LLCs, sole proprietors, and non-profits must present an EIN in order to get financed by a lender. Without an EIN you’ll find it impossible to get a business loan.

- Get an appraisal done: If you’re looking to purchase commercial real estate, refinance your commercial real estate, or obtain working capital using your commercial property as collateral, you’ll either need to get an appraisal, or have the lender hire their own appraiser. Usually, if your appraisal has been completed within the past 18 months, the lenders can recertify the appraisal.

- Title insurance: This type of insurance protects the borrower (and by extension the lender) should there be some sort of technical defect in a title to a piece of commercial real estate.

- Have utility bills ready: when a company seeks a merchant or business cash advance, the funding company will ask for minimal documentation. But the borrower will need to provide proof of their business address. One of the documents a funding company may ask for is the small business’s utility bill showing a clear business address.

- Provide list of inventory and its value: Many traditional and alternative lenders will require the small business borrowers to provide a listing of all business assets. One of the assets a company can show is a full listing of all your company’s inventory, along with the inventory’s value. While a lender will never provide the purchase price retail costs as collateral, they can use some of the inventory’s value when looking at assets and collateral.

- Flood certification: If your company sits in an area designated to be a flood zone, lenders may will require the small business to obtain federal flood insurance. The lender wants to be repaid for the loan, and if they know that your company is at risk of flooding, they want to make sure that your insurance will be able to cover the costs of the loan repayment.

- Environmental site assessment: For most traditional lenders and SBA lenders looking to provide financing secured by commercial real estate there will be a requirement to get a type of environmental due diligence. If the commercial real estate was used by a company identified at “environmentally sensitive industry” the lender will required to have an environmental site assessment as part of the due diligence process.

- Provide Certificate of Good Standing: Nearly all lenders, regardless of whether traditional or alternative, will require a Certificate of Good Standing. This certificate is offered by each state and shows that your company has met is requirements to operate as a business, and is compliant. This certificate goes by other names including “Certificate of Authorization” and “Certificate of Existence”.

- Get a business valuation: Not every lender will require your small business to get a valuation before providing financing. In fact, not many will. But if you’re looking to sell your company, of if you’re looking to acquire another company, some conventional business lenders will like to see a proper or realistic business valuation.

- Franchise agreements: if your small business is part of a franchise, a document that many conventional lenders will require before approving and funding your company is a franchise agreement. This agreement between franchisee and franchiser gives your small business consent to use its brand and business model in return for compensation.

- Statement of personal history: formally known as Form 912, a statement of personal history, is a form used exclusively in the SBA lending process to help determine character and credit eligibility. Essentially, the form asks about the small business borrower’s criminal history, and then uses the information to check against Federal Bureau of Investigation indices.

- Decision logic-login: when a company is seeking a merchant cash advance or business cash advance they are required to provide their most recent bank statements, and the cash-flow shown in the statements are used to determine funding. In order to make sure that the bank statements supplied haven’t been fraudulently doctored, a cash advance lender will usually require you to verify the information by accessing your online banking to check to make sure the information provided in the statements were accurate.

- Digital signature: To obtain nearly any type of business loan, a credit check will need to be run on the small business and it’s owners. In order to authorize a credit check, a signed application by the small business will need to be provided to the lender. While most lenders will require a hand signature, many if not all will accept a digital signature provided the IP address and license number are provided.

- Sba 1919 – borrower information form: This form is used to collect identifying information about the SBA 7(a) business loan applicant, loan request, business debt, information about the company owners and other previous financing information about the small business and its principals.

- Executive summary: While not required by most alternative lenders, a small business executive summary is simply an overview of the business, how much they are looking for, and an explanation of the use-of-funds. This is usually required by conventional lenders to help them fully-understand the financing overview to help them decide if they should offer a pre-approval and move into further discussions.

- Proposed bill of sale including terms of sale: legal document agreement that outlines the terms of sale between a buyer and seller used to legally purchase a business. A bill of sale will provide information regarding the terms of the sale and change of ownership.

- Affiliate business info: as part of the SBA lending process, the Small Business Administration requires the company to list any affiliations the company may have. In order to qualify for a Small Business Administration loan, the company must meet the official definition of a “small business”. Therefore, its essential to provide all affiliate interest to make sure your operations are compliant with SBA lending guidelines.

- Supply contracts: During the underwriting process a business lender will try to get an understanding of what your company’s finances will look like in the future (as they are funding based on only your financial track-record, but also your expected revenues in the future). Supplying contracts showing expected earnings may make it easier to obtain financing, if not required by the lender to secure financing.

Summation

- As you can see there is a ton of information to take into account when a small business is seeking financing for their company. Understanding all your options and the processes with getting funding can be confusing for many to understand. If you need help with the application and funding process, please feel free to reach-out to one of your financing specialists, and we’ll help you navigate the funding process to help you get the right business loan.