Sale of Future Receivables

Its not a secret that having access to sufficient business capital is crucial to making sure that a business can stay afloat and thrive. But when it comes to small companies and corporations, getting access to sufficient cash-flow to cover all of your company’s expenses and obligations isn’t easy at all. While many if not most businesses that seek financing will generally look to a national bank, small bank, community bank or credit union for financing, the chances of getting approved for a business loan is less than a 50% chance at best. In fact, when it comes to large national banks, the approval rate for a loan is somewhere around 20%. Additionally, if you can get approved for a bank loan, the process will take weeks or months, and will require you to provide lots of business and personal financial documentation before you’ll be funded. With that having been said, just because conventional financing may not be right for you, there are alternative options to obtain financing – one of which involves the “purchase of future receivables.” In this article, we will take a look at the sale of future revenues, and its advantages and disadvantages.

What is a Purchase of Future Receivables?

The sale of future receivables is a way for a company to sell future business income to a 3rd party and obtain immediate cash. Since this is the sale of future earnings, it’s a business-to-business transaction – not a loan. Since the sale of future receivables isn’t a loan, its not regulated by most local, state or federal laws. Lets remember that the purchase of future receivables is a type of high-risk business funding, and the risk will be priced into the financing offer. Therefore, the rates associated with the purchase of future receivables are often higher, if not much higher, than conventional business financing. Additionally, while rates associated with a traditional loan are calculated using an APR, a cash advances rates are calculated using a formula called a “factor rate”.

What is a Factor Rate?

A factor rate represents a multiplier representing the total amount the merchant or small business will have to pay back. For example, if a merchant receives $10,000 in funding from a company that purchases future receivables, and its paid-back at a 1.15 factor rates, the merchant will pay back $10,000 X 1.15 = $11,500. Usually, a company that purchases receivables will offer factor rates between 1.10-1.50. Since this is a sale of future receivables, there isn’t any sort of savings for early repayment that you’d get with an APR loan product. That doesn’t mean that you can’t capture savings from paying early. Since this is a business-to-business transaction, the merchant could come to an agreement before or after funding to reduce the total payback amount with an early payoff of the funds. Most factor rates offered by company’s that purchase future receivables are in the 1.10-1.50 range.

How Does a Sale of Future Receivables Work?

When a funding company purchases future receivables from a small business or merchant, they’ll analyze their recent cash-flow, and provide between 10-20% of annual revenue as funding to the borrower. Two analyze cash-flow, most funding company will look at the past six months of transactions through the businesses bank accounts, or will analyze their most recent merchant credit card processing statements. After analyzing cash-flow, the funding company may then ask for additional documents before offering contracts to the borrower. Such documents may be tax returns, profit and losses, debt schedules, AR schedule among other documents. Once the merchant has completed signing the contracts, the funder will then verify the company’s bank accounts and/or merchant accounts to make sure the date provided previously was accurate. Once that process is completed, the funding company will then wire funds directly in the small business’s bank account. From beginning-to-end the process usually takes between 1-3 days, but can be funded the same day if the applicant meets certain conditions.

Pros:

- Fast Financing: As mentioned previously, getting financing by selling your future business receivables is very quick. While a bank takes weeks or months to complete due diligence before coming to a final decision, let alone funding, a cash advance takes a matter of days to complete. Even more, the approval process with a merchant cash advance future receivables sale is almost instantaneous. Therefore, you don’t have to wait around for days and weeks wondering if you’ll be approved. You’ll know whether you’re approved the very same day as you submit your application.

- Easy to Get Approved: Getting approved for sale of future receivables or merchant cash advance is extremely easy to get approved for. While a bank will require a credit score of at least 650-700, a cash advance funding company will generally look past a credit score and fund merchants with credit scores as low as 500 if they are able to show good cash-flow and revenue. Therefore, a merchant cash advance is the ultimate form of bad credit business financing.

- Limited Documentation Needed: While a bank will require personal and business tax returns, income statements, balance sheets, debt schedules, AR and AP aging schedules, personal financial statements, resume, etc, most cash advances under $100,000 only require a simple application and a few months of business bank statements to get approved and funded.

- Access to Additional Funds: Whereas once a bank provides a loan to a small business, you won’t be able to get more funds from the bank for years to come unless you refinance your current loan, a cash advance company will provide more funds within 2-6 months of funding the first cash advance.

Cons

- Expensive: As mentioned previously, the usual factor rate associated with the sale of future receivables is usually within the 1.10-1.50 range, meaning you may effectively payback up to 150% of the amount of money you were funded. That doesn’t mean that the APR is 50%, because the average cash advance is paid-back in less than a year. Therefore, if you have a factor rate of 1.50 paid-back over 6 months, you are effectively paying a 100% APR – and that’s not including any fees associated.

- Cash Strain: Most cash advances require set daily payments be made automatically from the small business’s bank account each business day. Since these payments will be authorized by the merchant to be remitted each day, the small business always has to keep a sufficient amount of cash in their accounts to service the daily debt. Meeting this obligation along with all the other obligations and bills a company has may put a real strain on the business.

- Personal Guarantee: Most cash advances and sale of future receivable contracts require the business owner to personally guarantee the amount funded. Often, this guarantee is bolstered using a confession of judgment – which many funding company’s will require merchants to sign and notarize before funding. So if your business is unable to repay the cash advance, you may personally be on the hook for the balance.

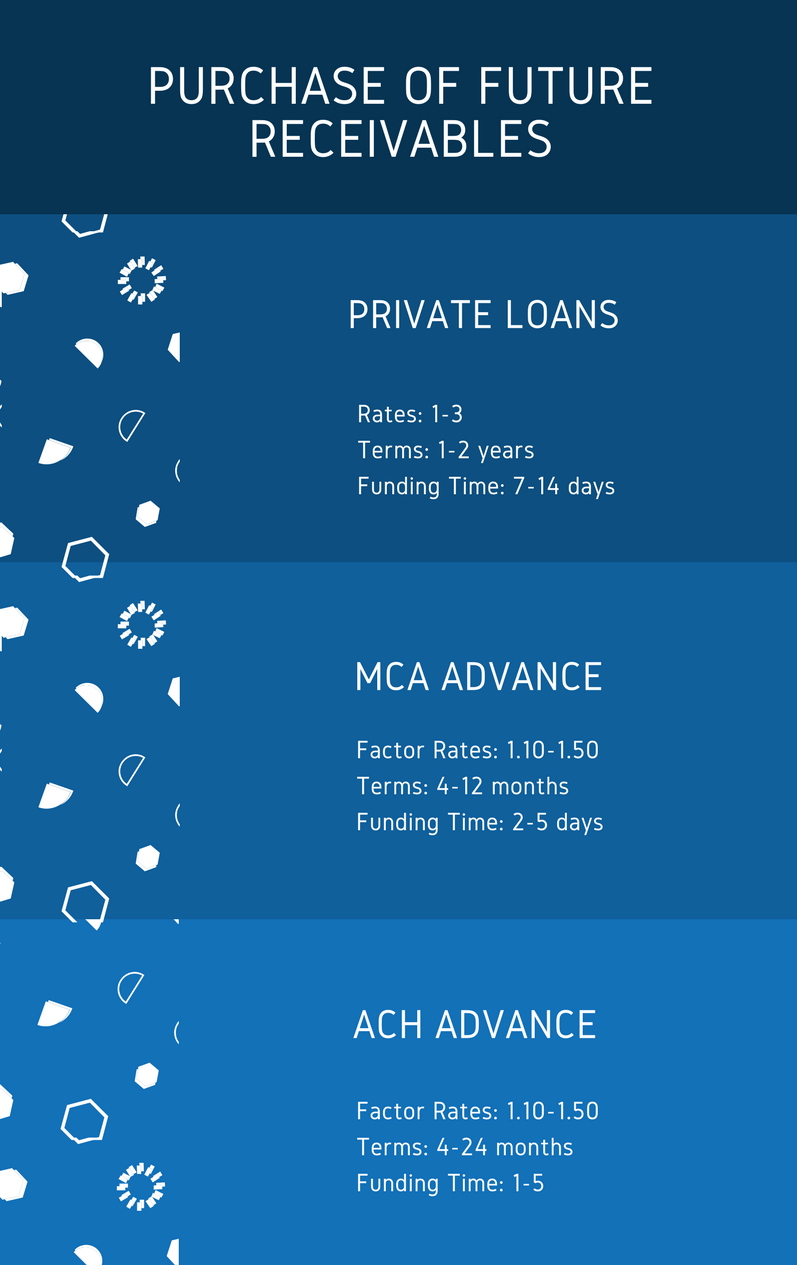

Types of Purchases of Futures Receivables:

- MCA Split: This type of sale of future receivables involves a funding company being repaid by splitting the merchant’s credit card processing deposits with the merchant. Each day, the funding company will take a percentage of the merchant’s credit card sales until the advance is repaid. Since MCA splits involve a percentage of daily sales, on days when the merchant does less credit card volume, the funding company will get lower payments. On days when you are closed and no credit cards are processed, no payment is made to the funder. Therefore, there is not an exact term associated.

- ACH Advance: This type of purchase of future receivables is very similar to a MCA split, in that they involve daily payments to the funding company until the funder is repaid. The main difference is the way the funding company is repaid, as an ACH advance funder is repaid by collecting a set amount from the small business’s bank account until the advance is repaid. Since the amount remitted through the bank account through Automated Clearing House is a set amount, there is an exact term associated with it.

- Private Financing: While not very common, there are a number of private and institutional investors that structure their business financing facilities as purchases of future receivables, and not a conventional APR lending model. But most private and institutional lenders that offer to purchase future receivables, they don’t require a daily payback through a MCA split or Automated Clearing House payment. Instead, the private funding company will accept repayment by monthly check.

Conclusion

While selling your future receivables to obtain business financing isn’t for every company, it is a viable option for small businesses needing immediate cash or businesses that have credit issues. Keep in mind that selling your future receivables isn’t cheap, and if you obtain a cash advance for working capital with the wrong terms, you could do your company serious harm. If you need help understanding how a purchase of future receivables works, and if it could be the right choice for your company, please feel free to reach-out to one of our financing specialists, and we’ll help you navigate the process.