Merchant Cash Advance Split Funding &

Lockbox

Over the past decade or so, as credit has dried-up for small and medium-sized businesses, an alternative form of business financing has become used more frequently that relies less on a business’s credit, and more on their cash-flow. This type of business financing, called a merchant cash advance, isn’t’ a business loan at all, but instead is the selling of your company’s future receivables to get paid for future work early. The most common form of merchant cash advance involves the ACH repayment method, but an underutilized MCA financing repayment method involves using an MCA split or MCA lockbox. In this article, we will look at the differences between each repayment method, along with the strengths and weaknesses of both.

What is Purchase of Future Receivables?

Purchase of future receivables involves a funding company providing business financing by purchasing future revenue you’ll get through credit card and bank deposits. When the funder purchases your future receivables, they are doing it at a discount, therefore, you’ll only be receiving a percentage of the total receivables being bought. For instance, a funding company may agree to purchase $20,000 of your future merchant credit card deposits or bank deposit cash-flow, and forward you $18,000 of the money. Since repayment takes place over the course of 4-18 months, you are essentially getting paid early for work that will take place up to a year and a half from now.

How Does a MCA Purchase of Receivables Repayment Work?

Typically, a MCA repayment is structured to have a percentage of a company’s daily revenue sent directly to the funding company. Some MCA and future receivable financing companies may accept weekly or even monthly repayments, but that is extremely rare. While the most popular form of repayment comes through having a set payment taken directly from the business’s bank accounts using Automated Clearing House, another way for a funder to collect repayment of a MCA is to collect repayment by splitting each day’s merchant credit card transactions with the merchant. This is either done as a MCA split funding repayment, or as a MCA lockbox repayment.

How Does a MCA Cash Advance Work?

To apply for business cash advance financing (either ACH or MCA), you will need to supply a funding company with a signed and dated credit application, along with your company most recent business bank statements (if you have multiple bank accounts, you will have to provide your main operating account, and may have to provide other bank statements if you transfer lots of money between accounts). Additionally, if you company processes merchant credit card transactions, the funder will request your most recent statements associated with the processing accounts. After the underwriter has run your credit and examined your company’s cash-flow through your bank accounts and through your merchant accounts, they will either offer an initial approval or decline outright. If they offer you a soft approval, they will provide you with specific details along with a list of documents that would be needed before funding. If you decide the offer is the one you want to go with, the funder will send you contracts laying out the terms of the financing for you to review and sign (a contact may also a confession of judgment). After the contracts have been signed and returned to the funder, the funding company will then verify the document information, as well as verify your bank accounts are legitimate. Once that process has been completed, the funding company will then call the borrower, and go over the terms over the phone. If the merchant agrees to the terms, the funding company will then wire the money to the merchant’s account, and the merchant will begin repayment the next business day.

Types of MCA Advances:

- ACH: Most common type of merchant cash advance repayment using Automated Clearing House.

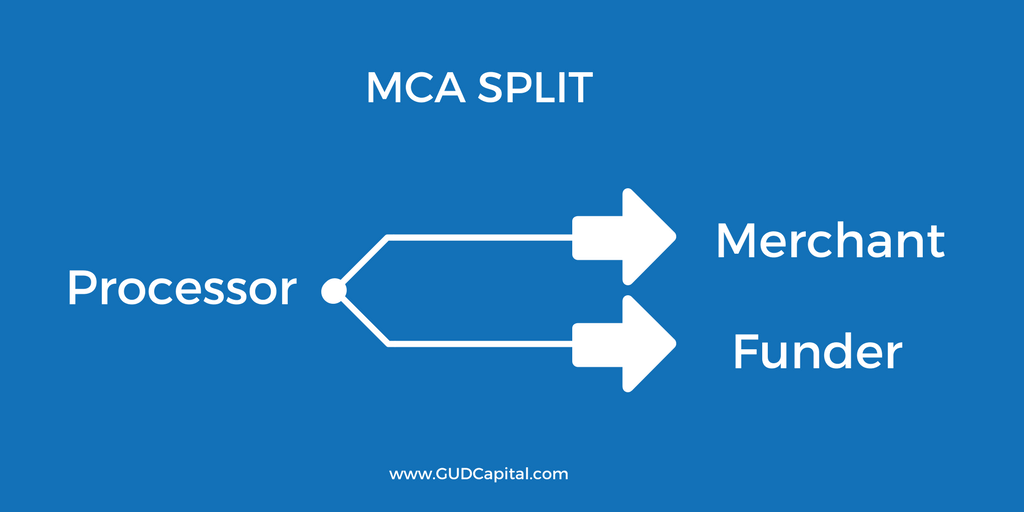

- MCA Split: Splitting your daily merchant credit card deposits with a funder using your existing merchant processors.

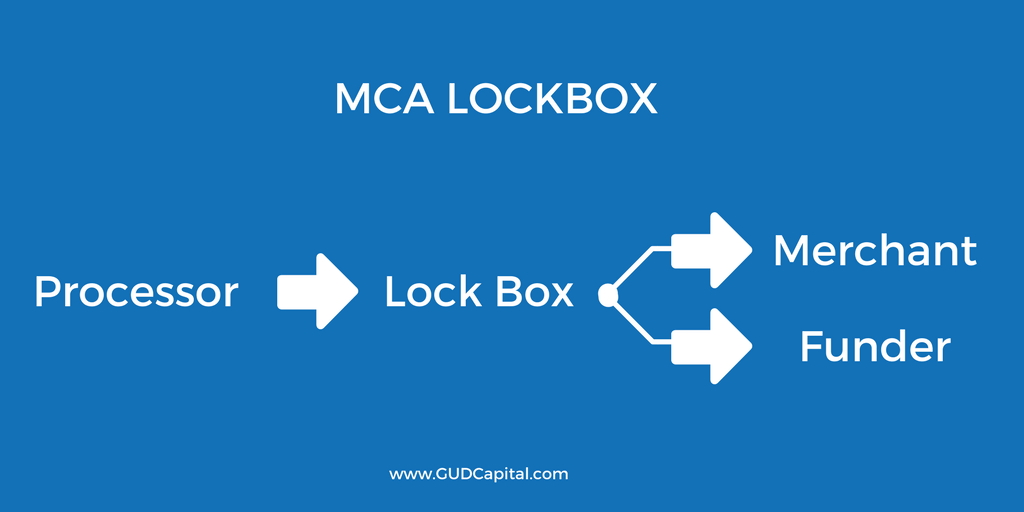

- Lockbox: Splitting your daily merchant credit card deposits using a 3rd bank account in which all deposits are put into.

What is the Difference Between a Merchant Cash Advance Split and Cash Advance Lockbox?

As mentioned, with a MCA split the funder and borrower will split each day’s credit card transactions. Usually, a funding company will take between 5-18% of daily credit card transactions using the merchant’s existing credit card processors. With a split, the funding company will use existing agreements with the credit card processing companies that allows them to collect repayment through their services. But, if a funding company does not have an agreement with your current processor, then the only option to make a merchant cash advance split funding facility work is to have all of the small business’s daily credit card deposits put into a lockbox (bank account controlled by the lender) and then the money is deposited into the merchant’s bank account soon after.

Pros of a MCA Split an Merchant Cash Advance Lockbox:

- Cash-flow friendly: Using your merchant account to obtain and repay funding is much easier on cash-flow than an ACH advance because each day’s repayment to the funder is adjustable. Since the repayment is made by collecting a percentage of sales, the less sales you have, the less the payment to the funder is.

- No Set Daily Payments: Unlike an ACH loan that relies on set payments that need to be made, and automatically deduct from your business’s bank account, a MCA split or MCA lockbox advance isn’t repaid on days when your business is closed, and sales are nonexistent.

- Larger Loan Sizes: By using your credit card sales to obtain financing, you may be able to obtain a larger funding amount than you would by using your business bank statements to get funded. While a business bank statement may show insufficient funds, bounced payments and checks or low daily balances, a MCA split relies almost solely on merchant credit card statements – which alleviates all of the issues.

- Leaves Bank Accounts Untouched: sometimes a business that has an ACH advance can use a MCA split to consolidate their multiple MCAs, or refinance a single MCA, provided that after the previous advances are paid-off the merchant nets 60% of the funds.

Cons of a MCA Split or lockbox:

- Can’t Change Processors: Once you obtain a MCA split, you won’t be able to change processors unless the new processor also has an agreement in-place with the MCA funding company.

- Slower to Fund: Getting an MCA split or lockbox put in place takes longer than getting an ACH advance or other instant business loans. The process of setting up payments through your processors takes more time because you are now including a third person. Now, while it takes a little time to get the program in place with the processor, it only slowdown the process by a day or two.

Conclusion

Using your business’s merchant credit card accounts to obtain funding is an underutilized type of financing. But if you have strong credit card sales that you’d like to leverage, a credit card split or merchant cash advance lockbox funding may be a good choice to get fast working capital. If you are considering obtaining a merchant cash advance and need help understanding your options, please reach-out to our specialist, and they’ll help you navigate the process.