Idaho Business Funding

Idaho has become a bustling, robust state, particularly in southwestern Idaho where the capital, Boise, is. Yes, you read it right – Idaho, not Iowa, as many people from other states refer to it as. It seems like a hoax that such an unknown area would be ahead of the rest of the United States, but the data has shown just how popular the state of Idaho has become to run a business in.

According to the Small Business Administration’s Small Business Profile, by the end of 2014, there were 149,476 small businesses, 34,769 small businesses with employees, 114,707 small businesses without employees, and 278,100 workers employed by small businesses in the state of Idaho. This rapidly growing small business culture in the state of Idaho has led to Idaho’s economy growing at a faster rate than the overall United States did in 2013 (and this has only continued to happen in the following years). This means that Idaho’s real gross state product increased by 4.1 percent, where the United States’ only increased by 2.2 percent.

Not only has the economy in Idaho rebounded faster than many other states in the United States after the Great Recession, but the unemployment rate has continuously lowered year after year. This is mainly due to the growing entrepreneurial culture and small business culture that Idaho has helped to cultivate – leading to small businesses in Idaho employing 96.7 percent of all employees in the state.

The Benefits of Running a Business in Idaho:

Idaho has seen a rapidly growing customer base in the past few years, which has led to major expansions in and around the capital, Boise. Through these fast growing customer bases, more and more jobs are being created, which in turn has allowed rapid economic growth throughout the state of Idaho. The growing and robust economy in the state of Idaho has paved the way for entrepreneurs, small, medium, and large businesses everywhere. Increased population in Idaho has allowed businesses in the area to thrive, while still enjoying the low costs of living, low unemployment rate, affordable tax rates, unique and niche markets, and a beautiful and exciting outdoor lifestyle that many of the residents crave.

- Low Cost of Living Coupled with Affordable Commercial Real Estate: Idaho has one of the lowest costs of living in the United States today, which has attracted many new residents and small business owners to the state of Idaho. Such low costs of living has transferred over into the commercial real estate market – which is a particular downside to running a business in many other states throughout the United States. This has also helped to create a bustling startup and entrepreneurial culture, particularly in Boise and the rest of Ada County. Ada County has had a vacancy rate of 13.05 percent for many years, but as the startup culture continues to grow and attract more people to the area, this rate has continuously lowered. Overall, low costs of living and affordable commercial real estate has become a rare commodity in the business world in the United States.

- Low Unemployment Rate: As the state of Idaho continues to draw in more new consumers, business owners everywhere have had no issues finding qualified, skilled workers to hire. While this is a positive sign for existing businesses in the state of Idaho, this could potentially cause problems for new business owners who are facing strong competition for qualified employees. Luckily, major universities throughout the state have continued to produce highly skilled and qualified applicants for future positions. These schools are also continuing to attract more and more students, mainly in part to the low costs of living in Idaho.

- Consumers Crave Local, Niche Markets and Access to the Outdoors: If you ask any resident in the state of Idaho why they moved there – or for locals, why they have not left yet! – they will tell you how beautiful, scenic, and easily accessible the outdoors and public lands are in the state. Boise in particular has become a major hub for extreme outdoor enthusiasts, particularly because every possible outdoor activity is within a thirty minute drive from town. This has led to a specific type of culture, similar to Colorado and Oregon, that is looking to support local businesses and niche markets. Idahoans are passionate about supporting other Idahoans, especially if these business owners make an effort to help others and/or the environment in the process. Just walk in downtown Boise, and it is obvious to any business owner how much the locals care about supporting their local businesses!

The Challenges of Running a Business in Idaho:

While the state of Idaho’s economy is continuously growing and has experienced continuous drops in unemployment since the 2008 Great Recession, there are always challenges associated with running a business in any state. For Idaho, the challenges are more manageable than some of the more heavily populated states in the United States, but there are still challenges. Some of the most common challenges associated with starting and running a successful business in the state of Idaho include:

- Limited Access to Funding for Many Startups: Idaho has a smaller population than many other places in the United States, which has led to lower rates of access to funding for all business sizes. While there are still many resources to for Idahoan business owners to raise capital, particularly by dealing with alternative financing companies, this has been a major concern for Idahoan business owners for quite a while – especially for the smaller towns outside of Boise and Ada County. Luckily, local Idaho business owners are expecting to see improvements in the near future when it comes to access to financing options due to the rapidly increasing population and businesses throughout the state of Idaho.

- Hourly Wages for Employees: While the drastically low hourly wages for employees in Idaho has always been a benefit to Idahoan business owners, the state of Idaho has recently been subjected to pressure to raise their minimum wages. As four (out of six) of Idaho’s neighboring states make efforts and pass legislature to drastically increase their minimum wages by 2020, Idaho is being pressured to do the same. While there have been no major legislative moves as of yet, many Idahoan business owners believe it is only a matter of time before the hourly wages they have to pay their employees raise.

Types of Idaho Business Loans:

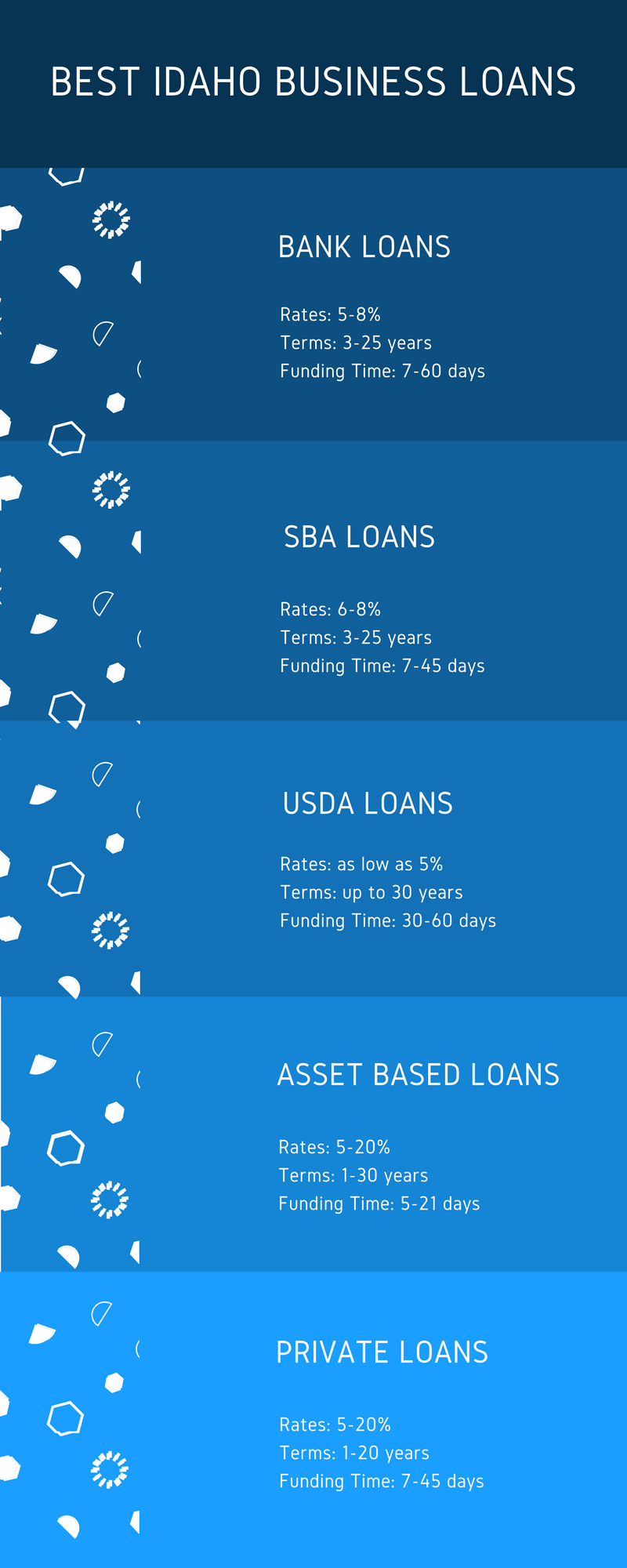

- Bank Loans: This type of financing is the most common type of conventional financing provided to Idaho small businesses. Bank loans are used to purchase businesses, mortgages for commercial real estate, refinancing Idaho business debt and general working capital purposes.

- SBA Loans: A form of conventional financing in which the lender obtains a guarantee from the federal government that the SBA will cover much of the Idaho SBA lender’s losses if the Idaho business defaults on their loan. By reducing the risk to the Idaho SBA lender, they are more likely to provide financing.

- USDA Loans: Another type of federally backed loan program that provides financing to small businesses in underserved rural areas. Just like with the SBA lending programs, the USDA loan program provides risk reduction to the Idaho lender through the use of the government guarantee program.

- Private Loans: Non-bank business loans provided to Idaho businesses that have strong net profits and or commercial real estate. Private business loans for Idaho companies are used for a variety of uses including working capital, hard money loans, bridge loans etc, but the most common use is to consolidate merchant cash advances.

- Commercial Real Estate Loans: Loans that use commercial real estate as collateral for financing. Most common types of commercial real estate loans are mortgages (both purchases and refinancing).

- Asset Based Loans: Financing that is collateralized through either business or personal assets. The most common assets used for collateralizing an asset based loan for Idaho businesses are accounts receivables, but other acceptable assets include real estate, equipment & machinery and inventory.

- Equipment Leasing: Rather than purchasing equipment outright or obtaining a loan to purchase the equipment another option is to have a 3rd party buy the equipment for you, and then lease it to you for a period of time.

- Factoring: This type of financing involves selling your unpaid invoices to a lender at a discount in order to obtain immediate financing.

- Merchant Cash Advance: Similar to factoring, a merchant cash advance is the sale of your company’s future receivables at a discount to the funder. Cash advances are usually done using ACH, a MCA credit card processing split, or a lockbox.