Office Building & Office Park Financing

The past few years have been a rocky road for many businesses, particularly when it comes to finding, purchasing, renting, and/or owning office building space. Over the past few months, we have been covering business climates in various states throughout the United States, and so far, there has been an overwhelming consensus from these states that office building space is a top priority amongst business owners. While some states are bustling with office building space availability coupled with low rent and financing prices, other states are struggling with incredibly high financing rates and limited availability – this is particularly true for business owners in heavily populated areas such as Chicago and New York City.

Overall though, the United States has seen massive improvements in office building rates and availability, especially as the startup and entrepreneurial cultures start to grow. At an incredibly fast rate, especially after the 2008 Great Recession, business startups are popping up everywhere. This has led to a major increase in demand for office building space. On the other side however, the Internet of Things, and the overall technology world, have completely shifted the way major businesses are operating. In addition, the way the Millennial generation has fought for more flexible work schedules with less restrictions on coming into an actual office building for work has contributed to more business owners becoming innovative in terms of office building spaces in the United States. These dueling conflicts have created a complicated position for business owners, but in order to fully understand what is happening with the office building space sector, we must first look at the construction industry.

Office Buildings and the Construction Industry

The few years after the 2008 Great Recession left the construction industry struggling, however, after 2012, the demand for office building space grew. As the skilled workforce participants grew, and business owners had more access to a variety of employees, the demand for office building space continued to sky rocket year after year. In addition, consumer spending continued to increase as people everywhere continued to recover from the Great Recession, which ultimately helped fuel the growing startup and entrepreneurial culture that has taken root in the United States, particularly in the booming technology fields.

As demand for office buildings continued to increase, as well as in other construction sectors, the construction industry started to flourish again, which helped to create a stable construction industry. In the past two years alone, office building space has seen some of the highest demands ever – and vacancy rates have lowered to some of the best rates in over a decade. This has also been fueled by many high profile businesses rebounding from major hits after the 2008 recession where these big businesses experienced business office space difficulties. In addition, the NAIOP Office Space Demand Forecast Research has shown its predictions for the 2017 office building demand growing. The office building sector is growing at faster rates than any other construction sector in the United States with year over year growth rates. Overall, the rebounding construction industry has played as a key factor in judging the rebounding and flourishing office building sector climate.

Why Would a Business Owner Need Financing for Office Buildings?

Surprisingly, there are quite a few different reasons why a business owner would be interested in the climate of the office building and office park sector. Here are some of the most common reasons a business owner would need an office building mortgage or financing for an office park complex:

- Developing Office Buildings for Commercial Use (Owner, Occupant, and/or Investor): Some business owners want to invest in various office buildings for commercial use. In other words, business owners can utilize office buildings and office park funding to renovate, expand, or remodel an office building or commercial real estate in order to rent it out to another business owner, or to simply utilize it for their own business office space needs. With the help of office building financing, any business owner can own office space and become an owner and an investor.

- Expanding a Work Space: Many business owners, particularly small business owners or startup business owners, are excited when business profits start rolling in and it is time to expand business operations. One of the first steps of expanding a small business includes hiring new employees, which in turn means expanding a work space. Typically, many small business owners or startup business owners start working out of their homes, but once business starts to pick up and it is decided that hiring new employees would be beneficial to help expand business profits, then finding commercial office building space is the next step. Unfortunately, office buildings are incredibly expensive upfront, and many business owners do not have that type of money just lying around to purchase or refinance commercial property! This is when office building financing comes into play. Through office building funding, many business owners can experience expanding their business!

Best Sources of Financing for Office Buildings:

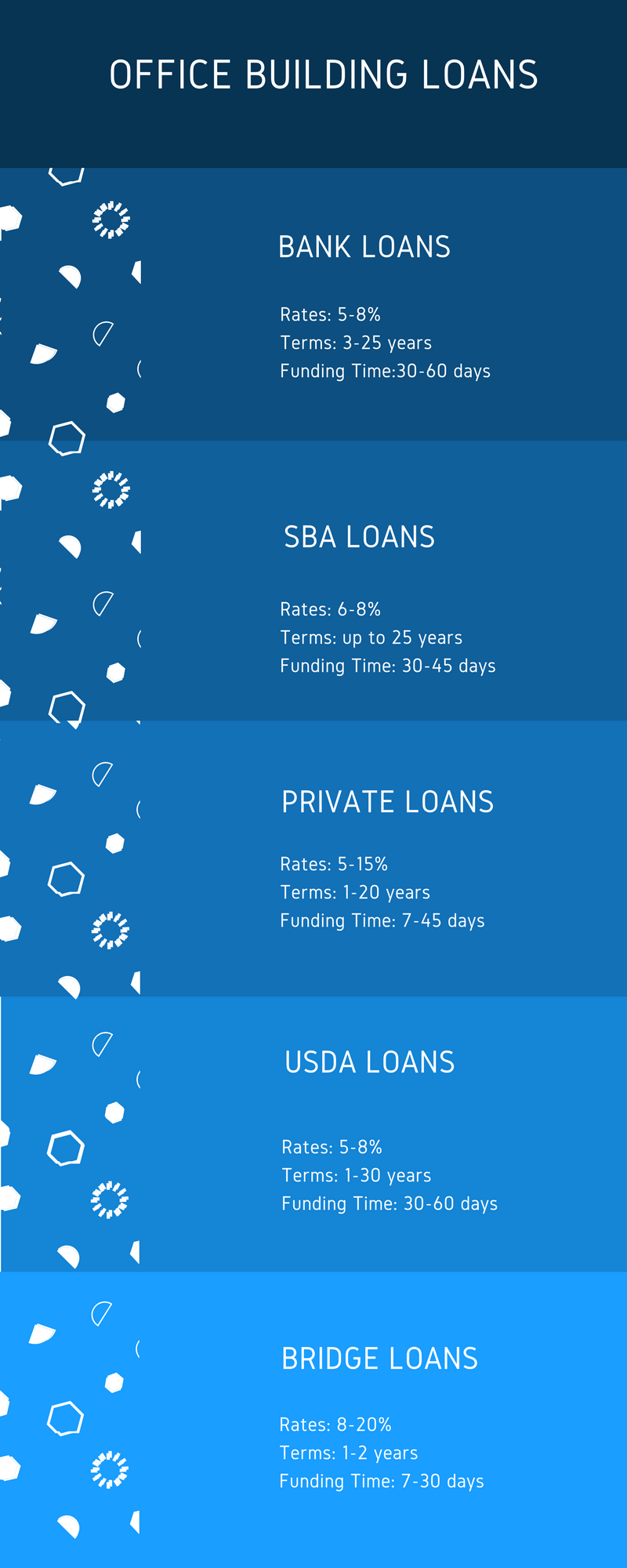

As the office building space sector continues to experience promising forecasts and increased profitability, the demand from business owners will continue to go up. This rapid spike in demands for commercial office building space has led to increased rents – Class A rents are already up 3.5 percent. Renting or owning office building space is inevitable for many business owners, especially when it is time to expand. This is why it is so vital to understand the various financing options for office building spaces in the United States. While there are many various funding choices, the most common office building and office park loan options include:

- Small Business Administration (SBA) Loans: Real property SBA loans typically come in two types – 504 or 7a SBA loans. SBA 504 loans are a 50 percent loan form the bank, coupled with a 50 percent loan from the government. In comparison, an SBA 7a loan is a 90 percent government backed bank loan. Overall, both loans tend to have small down payments, fixed interest rates, and the ability to finance building improvements. While these SBA financing options, just like other types of loans, come with disadvantages, these are still some of the best options for office space financing.

- Traditional Financing: Conventional bank financing is always a great option for any business owner looking to expand operations through office buildings. Traditional financing is simply utilizing a loan from an established bank, however this can be difficult for many small sized businesses because banks view them as too much of a risk. But if you are able to obtain a loan from a conventional lender, you will get the lower rates, longest terms and amortization and least amount of points to close your loan or mortgage.

- Private Business Lenders: Non-bank business lenders are able to offer financing to commercial real estate owners that banks and conventional lenders may not. Private lenders are a great financing option for office building owners seeking financing that doesn’t require lots of paperwork (low doc commercial real estate loans) and loans to property owners who have bad credit.

Types of Office Building Loans:

- Mortgage: an office building mortgage is the use of your commercial real estate as collateral to obtain long-term financing to purchase, refinance, or build-out the commercial property. Nearly all commercial real estate lenders offer some sort of mortgage ranging from 2-30 years in term and amortization.

- Refinance: Getting rid of your existing mortgage and replacing it with a brand-new mortgage. Usually refinancing a commercial mortgage is done to obtain a lower rate, to obtain a longer term (to reduce monthly debt payments), or to tap into some of the office building’s equity to use for improvement or working capital uses.

- Cash-out Refinancing: This type of refinancing is used by commercial property and office buildings that have substantial equity in their real estate. If you have substantial equity, you can buy-out your current mortgage with a new, larger financing amount, and take the balance and cash-it-out to use for other purposes (improvements, build-outs, working capital).

- Bridge Loan: Short term financing used temporarily until permanent office building financing is completed. Generally, a bridge loan for an office building has a term that is less than two years, and has higher rates than most.

| Types | Rates | Terms | Funding |

|---|---|---|---|

| SBA | 5-6.5%% | 1–25 years | 30-60 days |

| Conventional | 5-10% | 1-30 years | 30-60 days |

| Private | 6-15% | 1-10 years | 7-30 days |

| Bridge | 6-15% | 1-2 years | 7-14 days |

Conclusion

As you can see there are a number of financing options available to company’s that own commercial real estate, office buildings and office park complexes. Understanding all the options may seem daunting, but informing yourself of the loan options available could save thousands of dollars. If you are looking for an office building mortgage, or other form of commercial real estate, and need help understanding the financing options, please reach-out to one of our commercial real estate loan experts, and they’ll help you navigate the process.