Working Capital Using Real Estate

Every business could use an injection of capital from time-to-time to help with the costs associated with running a small company. Aside from your regular costs-of-business that you plan and budget for, there are always situations that arise during the course of business that requires the business to spend money to address. Ideally, a business would simply stop by their local bank and obtain bank-rate financing with ease – but that is hardly ever the case. Lenders are much less aggressive in providing financing to small businesses than they have been in the past – especially if the borrower has bad credit or poses a high-risk to the lender. Another option would be to seek out an alternative lender or marketplace business loan. But those types of loans are almost always based solely on cash-flow and recent revenues, so if you haven’t had strong sales as of late, they may not be a good fit. So what other options are there for small businesses that need working capital but find themselves with limited options? If you have commercial real estate, you may be able to use the equity in the property to obtain business financing at affordable rates.

Uses of a Commercial Real Estate Working Capital Loan

- Build-outs: Financing the construction of facilities to help move-in a new tenant, and to make sure the space’s conditions are conducive with what the business needs to operate.

- Tenant Improvements: financing to help upgrade the interior of the building to help accommodate the needs of a new tenant.

- Emergency Needs: financing to handle any and all problems that arise during the course of business operations.

- Fix Equipment: financing to help fix or replace crucial business equipment and/or company machinery.

- Advertising: paying for the cost of advertising your business’s products or services.

- Payroll: financing to make sure all of your small business’s employees are paid on-time and in-full.

- Operating Capital: paying for all costs of keeping the business running smoothly and efficiently.

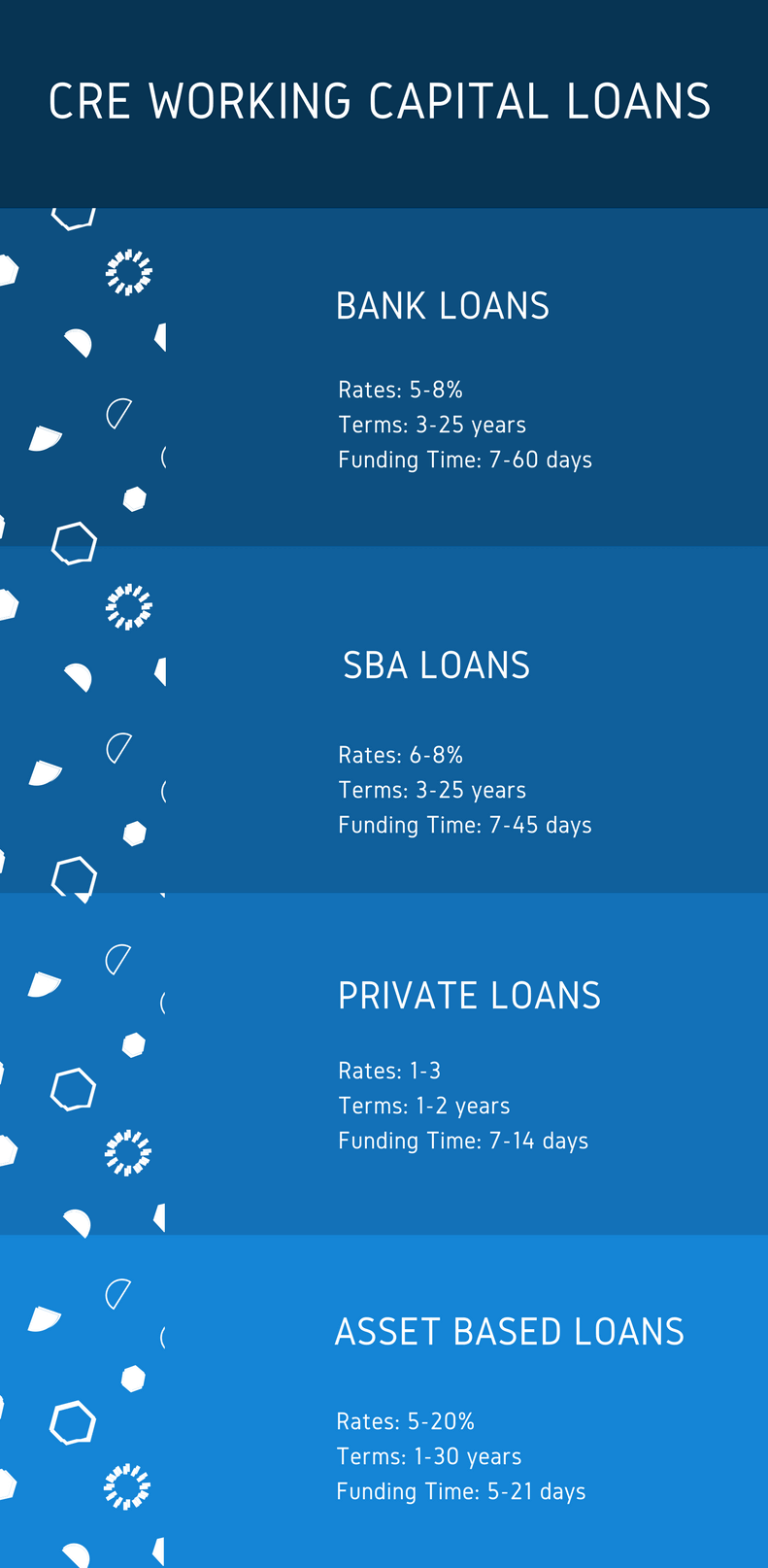

Types of Business Real Estate Working Capital Loans

- 2nd Mortgage Loans: This type of financing is used by small businesses that own commercial or personal real estate in which they already have a 1st mortgage lien, but use the equity in the property to obtain a 2nd loan using the real estate as collateral. This type of commercial financing exposes the second mortgage lender to increased risk, because the 1st mortgage lender will have first rights to business assets should the company fail to repay the lender for their mortgage. Therefore, the lender will seize the commercial or personal property, sell it off at fire sale rate, and then the 2nd mortgage lender will have rights to whatever is left over after the 1st lien lender recoups their losses. This leaves the 2nd mortgage lender with a possibility of being left empty-handed. Therefore, because of this increased risk exposure, the lender will charge much higher rates than the 1st lien lender. Additionally, the terms associated with the 2nd lien mortgage will be much shorter than the first, with terms usually being less than 5 years. Since the terms are shorter than the first lien mortgage, a 2nd mortgage is often used to take care of short term working capital purposes associated with the business. Since this type of financing may dramatically increase the small business’s debt service, a 2nd mortgage should only be used by businesses that feel they can make good use of the funds, which will pay for the cost of borrowing and then some.

- Cash-Out Refinance: For companies that have substantial equity in their commercial real estate or personal property, a good way to get a working capital loan is to tap into the equity in the commercial real estate. If a business owns their real estate, and the value of the property is worth more than the total balance on the business real estate mortgage, what a business can do is refinance their current mortgage for more than their current mortgage, and up to the amount that the real estate has been appraised at. That means the lender will pay off the 1st mortgage in-full, and then provide the small business with additional capital that can be used for operating and working capital purposes, and the funds would be paid-back under a new mortgage. So rather than take-out a separate working capital loan on top of their small business’s existing mortgage – leaving the business with two loans – the business will have one loan paid to one mortgage lender. Since this is a 1st mortgage, the terms will generally be long – as opposed to general working capital loans based solely on cash-flow and revenue, which are almost always short term. And since this is a first mortgage the rates will most-likely be bank-rate, as opposed to other revenue based working capital loans like factoring, AR financing, cash advances and mid prime loans.

- Mortgage Refinancing: while a general refinance of your current business real estate loan or commercial mortgage may not net you additional funds immediately, a refinance of their business loans could help aid in the company’s debt service, freeing up additional cash. By getting a business a lower rate for their mortgage, you will effectively reduce their monthly mortgage payments – that can help free up extra cash to use for working capital purposes. Additionally, when you refinance your business or commercial real estate, the lender will also look to consolidate other debt into the new mortgage – which will also help reduce the business’s daily, weekly and monthly cash-flow and revenue. But you need to be careful with a refinance, being that there may be many fees charged by the lender before funding. If these fees are substantial enough, you may end up negating whatever savings you were trying to obtain.

Lenders That Provide Working Capital Using Real Estate as Collateral

- SBA Lenders: while SBA lenders don’t offer cash-out refinancing or 2nd mortgages, they do offer working capital using the SBA 7(a) program and will require that your commercial and/or personal real estate be used as collateral for financing. If you are able to get a SBA working capital loan, you will get fantastic rates starting at 6% and terms ranging up to 10 years.

- Conventional Bank Lenders: banks and other conventional and traditional commercial lenders are often able to provide cash-out refinancing that can be used for working capital if the business is willing to have their 1st business mortgage bought-out. Traditional lenders offer the lowest rates and longest terms of all business lenders, and can have rates lower than loans provided with a SBA enhancement.

- Private Lenders: these types of lenders are able to offer commercial real estate working capital loans with a wide array of structures. Private business lenders are non-bank lenders; therefore, they aren’t beholden to the same requirements and regulations that banks are. Because of this, non-bank lenders can get fairly creative and take risks a traditional lender wouldn’t take.

- Asset Based Lenders: these lenders generally offer 1st, 2nd and even 3rd mortgages that are generally very short term that can be used for working capital. An asset based real estate loan can be structured as a term loan, line of credit or sales of future receivables. While these types of loans are fairly easy for a business to get if they have the appropriate amount of equity available, they are most often used by companies who have had problems getting a working capital loan because of bad credit.

Conclusion

While obtaining a working capital loan for your business using your commercial real estate may not be ideal for many small businesses, it is a good option for businesses unable to obtain working capital through more traditional means, or are unable to obtain the full-amount of financing they were seeking. If you do seek to explore how to use business real estate to get working capital, you need to research the options well to make sure that you find the right option. If you need help navigating the real estate financing process, please feel free to reach-out to one of our experts, and we will walk you through the process to get the best possible loan available.

[wp-review id=”83275″]