Oregon Business Funding

The state of Oregon has experienced rapid growth in the past few years – partly for the state’s beautiful scenery and outdoor activities, but mainly for the people and the startup culture that has been created throughout the state. Major metropolitan areas such as Portland have helped create a thriving economy for the state of Oregon, even though the small rural business owners are still struggling.

According to the Small Business Administration, there are 346,961 small business in Oregon, or 97.6 percent – meaning almost all the businesses in Oregon are small businesses. This has only helped to attract people from across the country to try their luck at entrepreneurship in the state of Oregon. These small businesses then employ 777,655 of Oregon’s employees, or 55.7 percent.

Overall, Oregon has thrived, even during difficult times. Here are some of the most common benefits and challenges of running a business in the state of Oregon.

The Benefits of Running a Business in Oregon:

The state of Oregon has created a bustling economy with plenty of other attractions that people have fallen in love with, helping to boost the Oregonian population; this in turn has created an entrepreneurial society for all residents. Some of the biggest benefits and reasons that people chose to open up businesses in Oregon include:

- “Keep Portland Weird”: Many of us have seen the show Portlandia, which takes a satirical approach to the now famous city of Portland, Oregon. While many of the scenes in the show are hysterical, many locals will admit that, well, it is not far off from the reality of Portland – hence the infamous bumper sticker that you see all across the country “Keep Portland Weird”. This culture has attracted people from across the United States from all types of lives, which has ultimately allowed a booming startup culture to form throughout Oregon. The residents of Oregon have created their own little society that supports all sorts of wacky yet genius startup ideas, making the Portland region one of the best places to open up shop.

- The Local Movement: In addition to the constantly growing startup culture in the state of Oregon, the local residents have made huge strides in the “shop local” movement. Residents across the state of Oregon have made countless efforts to prevent big box locations from popping up, allowing many small Oregon business owners to thrive. Even though the state of Oregon has some complicated challenges that make running a business difficult, the people of Oregon have made it possible for business owners to succeed anyways.

- Healthy, Stable, and Growing Economy: As more and more people are attracted to the state of Oregon, the state’s economy has experienced rapid increases. By 2014, Oregon’s economy grew faster than the national average, and signs of continuous increases are already showing. One of the major business industry’s that has really helped boost and ultimately stabilize the Oregon economy has been the cannabis industry. This has not only stabilized the Oregon economy, but it has created a whole new market for entrepreneurs.

The Challenges of Running a Business in Oregon:

In major metropolitan areas like Portland, owning and operating a small business has never been better, but the business owners in the rest of the rural areas of the state of Oregon are having different experiences. Many of the challenges of running a business in the state of Oregon still affect small business owners across the state, but these challenges are even more difficult for the rural Oregon business owners. Here are some of the most common challenges associated with owning and operating a business in Oregon:

- Confusing High Taxes: Most new business owners in the state of Oregon are often confused by the high tax rates associated with opening a new business, particularly because most Oregonian residents are familiar with the lack of sales tax the state has. Unfortunately, no sales tax transfers over to other areas of the state – such as business taxes. Not only are the taxes incredibly high for many Oregon business owners, but the taxes are also part of a complex system that leaves many business owners frustrated. For starters, Oregon’s corporate income tax system has a two-bracket structure that has corporations pay 6.6 percent on the first $10 million they make, but after that, the tax rate hikes up to 7.6 percent. Then, the state’s personal income tax rate consists of four tax brackets that have varying tax percentages based on the district the business is in. Overall, these high tax rates have left many Oregon business owners struggling to make ends meet.

- Increased Cost of Living, Rising Real Estate Costs, and Declining Personal Income: The decline in personal incomes throughout the state of Oregon is nothing new for the locals, especially after the loss of federal timber harvests that were vital to Oregon’s economy in the mid-1900s. During this time, Portland’s growing economy helped support the rest of the state of Oregon, but unfortunately, this is not the case today. While Portland is still a major bustling metropolitan area, when it comes to employee’s personal incomes, the city lags behind every other major metropolitan area in the country; this ultimately affects the rest of the state that Portland had been supporting for so long. Even more so, the decline in personal income has not mirrored the rapidly growing population increase that has fueled the increase cost of living – which then rises the cost of real estate throughout the state. Oregonian business owners are struggling to find a good balance of adequately paying their employees to help with the decline in personal income while still covering their rapidly increasing rent rates.

- Complicated Labor Market: As the appeal of living in Oregon has grown, so has the labor force and employment levels. This has been a great situation for Oregon business owners because it has helped widen the pool of qualified applicants. However, Oregon, particularly in Portland, is well-known for their startup culture, resulting in potential employees quickly becoming employed with other companies. This startup culture has created such a high demand for skilled applicants throughout the state of Oregon, but there simply is not enough skilled, qualified employees to go around!

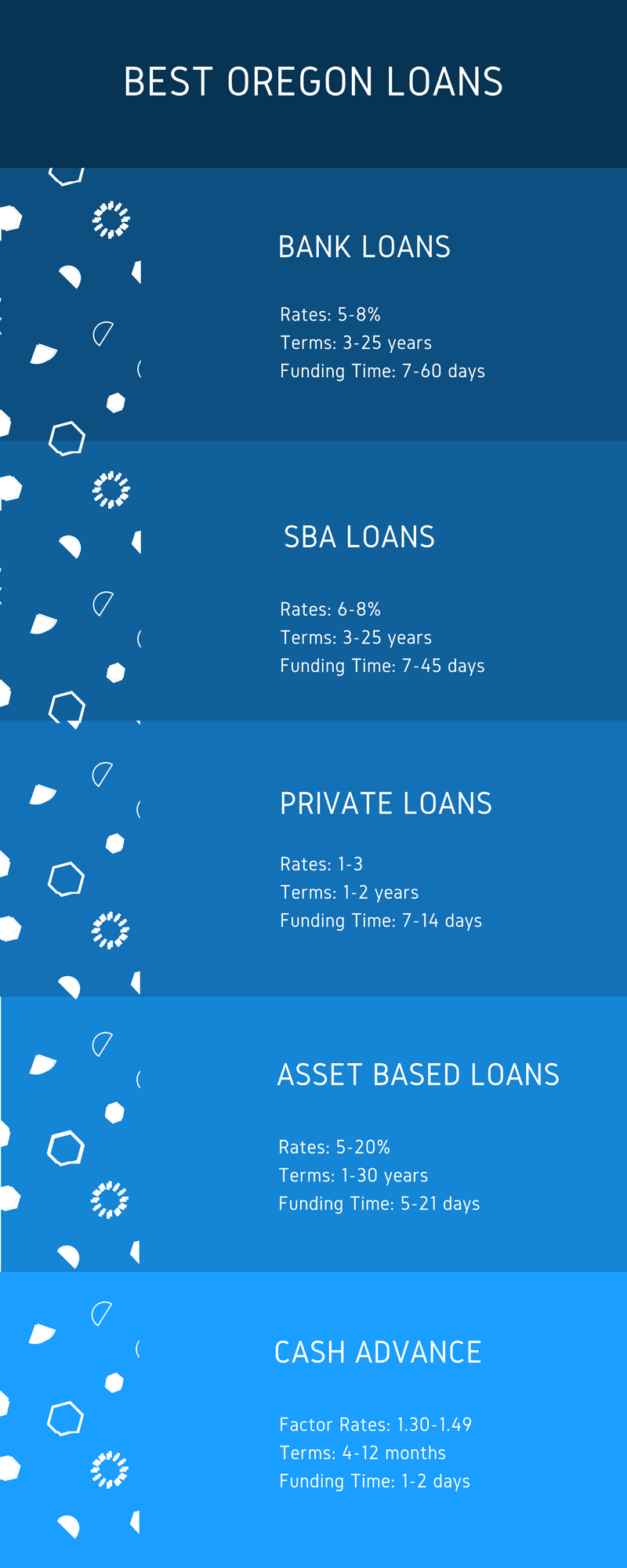

Types of Oregon Business Loans:

- SBA Loans: this type of financing is offered by Oregon banks, credit unions and community lenders to small businesses that meet the SBA guidelines for financing. SBA loans for Oregon businesses aren’t actually provided directly from the Small Business Administration itself, but instead are provided by private and public lenders, and the SBA agrees to cover most of the lender’s losses should the Oregon business fail to repay their SBA loan.

- Bank Loans: conventional banks offer just about the best rates and terms of all Oregon small business lenders. Traditional banks offer rates that start in the mid-single digits, and have terms that can extend out 25-30 years depending on use. Uses of conventional loans from Oregon banks are used for just about all business uses, including business mortgages, refinancing business debt and working capital.

- Private Loans: this type of financing is offered by non-bank, non-SBA lenders. Private business loans offer small business flexible financing not offered by conventional lenders with strict lending requirements and underwriting guidelines. Private business loans are used to purchase and refinance commercial real estate, consolidate merchant cash advances, and provide revenue based financing for profitable companies.

- Alternative Loans: these loans are offered by online lenders, fintech lenders and marketplace lending platforms. Fintech loans leverage technology to provide financing much faster than a bank, without most of the documentation requirements conventional lenders require. While the rates aren’t as low as Oregon banks offer, the rates are still very affordable.

- Asset Based Loans: ABL financing is the leveraging of an Oregon business’s balance sheet to help obtain financing. Asset based loans generally monetize collateral such as accounts receivable, commercial or personal real estate, business inventory or equipment & machinery.

- Invoice Factoring: this involves the sale of the Oregon business’s accounts receivable to obtain immediate financing. The factoring company will purchase the invoices, forward the Oregon business a large portion of the value, charge a fee, and then forward the remaining amount to the business once the invoice is paid.

- Equipment Leasing: this is a way for Oregon business to obtain needed equipment without having to pay the full price of the equipment outright, or without having to take out a loan to obtain the machinery. With equipment leasing, a 3rd party will purchase the equipment from the vendor, and then lease the equipment to the Oregon business for a predetermined term.

- Merchant Cash Advance: this involves the Oregon business selling a portion of their future revenue so they can get paid early for business they will do over the next 4-24 months. A merchant cash advance lender will analyze a business’s cash flow based on bank account deposits or merchant credit card transactions. After determining the funding amount, the lender will provide financing, and collect repayment by either taking a set amount from the merchant’s bank account each business day, or by splitting the business’s merchant credit card transactions.

[wp-review id=”83288″]