Long Term Operating Capital

Every company needs to have the proper amount of working capital just to make sure their business runs smoothly. Without the right amount of working capital, your company will find it hard to maintain smooth operations – let alone be able to take advantage of opportunities that come up in day-to-day business. Even worse, if you misjudge your working capital situation, you may find yourself unable to pay bills, vendors, employees, rent or mortgage. But more than taking care of day-to-day expenses, a company may want to plan their working capital in advance, as well as obtain additional working capital to help their business grow. Ideally, a company would look to obtain a longer-term working capital option so that they can service the debt with ease. In this article, we will explore long-term working capital options available to growing small businesses.

What is Long Term Working Capital?

Working capital, itself, is the difference between a small business’s current assets minus their current liabilities. Ideally, a company would like to see their current assets far outnumber the company’s current liabilities, as that would exhibit a company in a healthy financial situation. The closer current assets and current liabilities are to reaching a parity, the harder the business will find it to keep their current bills paid. Any dip in current revenue could put the business in a position where they are unable to meet their current obligations – even if for just a few days.

Advantages of Long Term Working Capital?

The main advantage of a long-term working capital loan is the ease of repayment. By spreading out the debt repayment to the longest terms possible, the business will find itself making the smallest payments possible. This doesn’t mean that you will pay less – because that may not be the case at all. But by spreading out the payments over the largest number of payments possible, with the longest-terms possible, the business will be paying a minimal amount each month as compared to what they’d pay to a short-term working capital lender.

Disadvantages of Long Term Working Capital?

A disadvantage of a long-term working capital business loan is the fact that you may end up paying a larger total amount over the long-term as compared to what a business would pay a short-term working capital lender. The reason they may pay more is because by extending the terms, you’re also extending the amount of time a lender can charge interest on a loan. Aside from that, its hard to think of any negatives associated with long-term working capital financing.

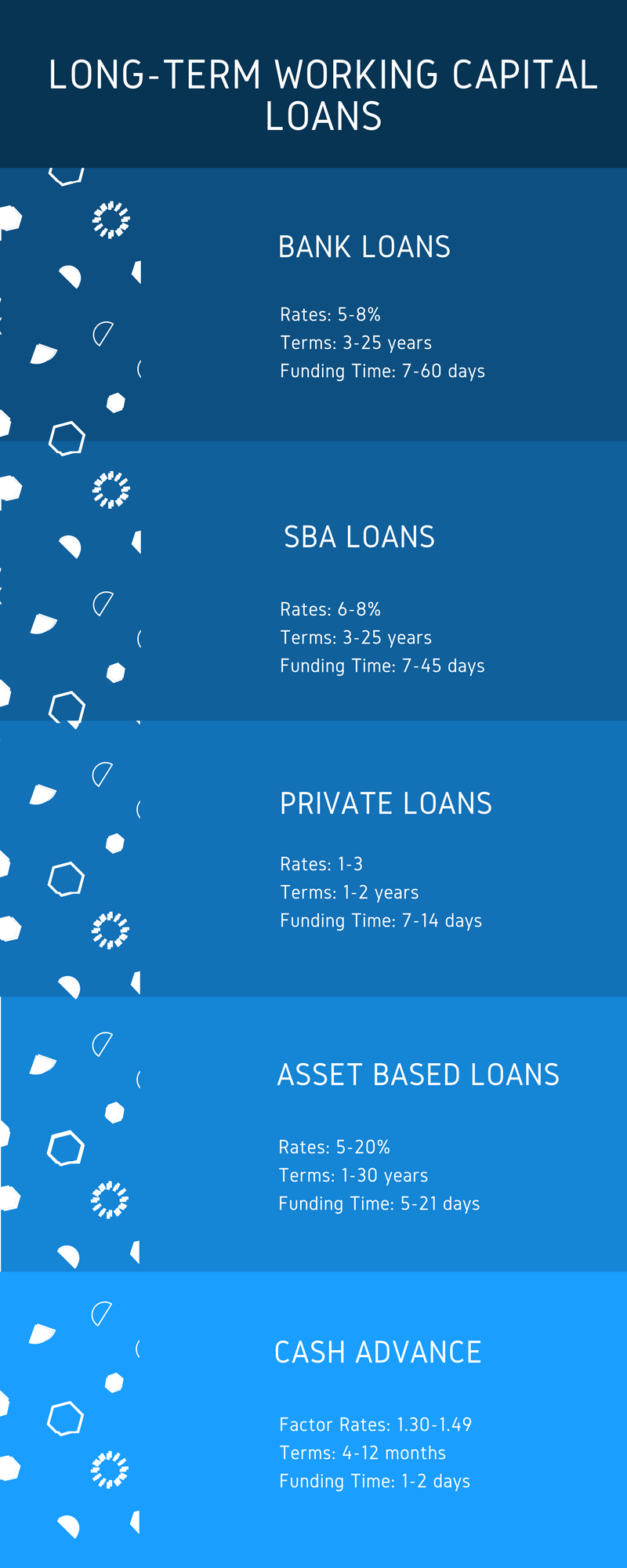

Types of Long Term Working Capital Loans:

- SBA Working Capital: this type of working capital is great for growing businesses that have found it hard to get approved for a long from a conventional lender. SBA working capital loans are provided by conventional lenders (such as large banks, small banks, credit unions, community banks as well as non-profit lenders) and have rates that start around 6% and can go up to around 8% depending upon SBA program being used, and the lender involved. The government does not provide SBA loans itself, instead the bank or SBA lender will loan the small business money, and if the small business fails to repay their long-term working capital loan the SBA will cover most of the lender’s losses. By issuing this SBA guarantee, the hope is that the lender will provide financing to small businesses that wouldn’t get approved for bank-rate financing without it. By reducing the lender’s risk substantially, small businesses that utilize the SBA business loan programs are able to access some of the best financing options available.

- Bank Working Capital: banks offer some of the longest term working capital loans available to businesses. Not only to conventional banks and traditional lenders offer long terms, but they also offer rates that can be as low as 5%. But banks can only offer such low rates by reducing their risk substantially. Therefore, to get approved for a long-term working capital loan from a bank, your business will need to show established profitability for years running, strong balance sheets, good credit and a strong history of repaying lenders. The process won’t be quick, either, as a long-term working capital loan from a bank can take weeks if not months to complete. Bank lenders offer term loans, lines of credit, and possibly equipment financing.

- Private Lending Working Capital: this type of non-bank commercial lending uses money pooled by private investors and is generally underwritten by a private investment bank. Private money loans are a great tool for some businesses seeking long-term working capital but aren’t quite able to get bank financing, or don’t have the time to go through the approval process required by a bank or conventional lender. While private business lenders don’t have terms that are as long as a bank, their terms can extend up to 3 years, and have flexible repayment opportunities. Another great aspect of long-term working capital loans from a private lender is that there is usually not a prepayment penalty if the borrower repays the loan in full after 6 months. Additionally, private money lenders can provide more funds to the small business as needed, to make sure the small business’s long-term capital needs are taken care of.

- Asset Based Working Capital: this type of long-term working capital involves monetizing assets on your company’s balance sheet to obtain financing. While many types of asset based financing involves short-term financing facilities (such as invoice financing, bridge loans, merchant cash advances, AR financing) some asset based loans can provide terms up to 5 years if the right asset is used as collateral for financing. When companies think of asset based business lending, they tend to think of using your company’s invoices as collateral for financing (AR financing) or outright selling of your company’s unpaid invoices (factoring). But by using your company’s commercial real estate or business machinery as collateral, some asset based lenders can offer extended terms.

- Fintech Working Capital: loans provided through online fintech marketplaces are a great way for a growing small business to obtain affordable financing that has decent term lengths. Marketplace fintech loans are generally only used for working capital purposes, and have rates that start in the high single digits, with terms that can range from 2-5 years depending on loan amount and business type. The beauty of a fintech alternative business loan is the ease with the application and funding process. A borrower looking for a mid-prime fintech loan can apply online and get an initial preapproval instantaneously. After the initial approval, the lender will require the borrower send additional documents and the underwriter can have a final approval in place within days. After that, funding happens relatively quickly, with the entire process taking less than a week from beginning-to-end.

- Merchant Cash Advance Working Capital: while merchant cash advances are generally considered the shortest-term of all financing options, there are some cash advance lenders that can provide terms that range up to two years (sometimes even longer). Merchant cash advances tend to be used by companies and business owners that have ban credit, but to get a merchant cash advance with a long-term, the company is going to have to have good credit, as well as a excellent business cash-flow. Long-term merchant cash advances aren’t loans at all, but they are instead the sale of a small business’s future revenue in exchange for the business accessing the future revenue immediately. So in essence, if you are approved for a merchant cash advance with a 24 month payback, you are essentially getting access to funding 24 months in advance of payment.

Conclusion

As you can see there are quite a number of long-term working capital lenders that provide loans to growing small businesses. Each of these lenders provide financing products that look much different than the other lenders. Some of the lenders may have a number of in-house working capital products themselves. Realizing that there are so many options available can be overwhelming and confusing. If you need help navigating the long-term working capital loan process, please feel free to reach-out to one of our financing specialist, and they will help you get funded with ease.