Credit Card Business Loans

When a retail business needs to get a business loan, the amount of the funding is relatively small as compared to most types of business financing. While the average SBA or conventional business loan size is in the hundreds of thousands of Dollars – if not millions of dollars — the average loan provided to small retail-type businesses are generally in the tens of thousands. Due to the fact that retailers and merchants generally seek smaller amounts of financing, and considering conventional bank lenders require loan amounts of $350,000 or more, the options available for funding are few. For loans under $350,000 (and especially under $100,000) the options available are generally only inflexible merchant cash advances that are repaid using a set daily repayment. Such repayments can strain a merchant’s cash-flow because the amount remitted each business day is a set amount that must be paid regardless of how much revenue the business did that day. Even if the merchant retailer had few sales on any given business day, they must repay that set amount no matter what. Rather than being stuck making inflexible payments, a way for small business retailers to obtain cash advances with more flexible payment terms is to use your merchant credit card processing transactions to obtain and repay a business loan. In this article we will take a closer look at merchant cash advances using credit card sales.

Advantages of Credit Card Business Loans

- Easy Funding: Unlike with more conventional business loans, getting approved and funded for a credit card business loan is relatively easy, with the merchant only needing to provide a credit application, business bank statements, and merchant processing statements. One those are submitted to the cash advance lender, and after the lender provides an offer, the merchant can be funded in as little as 24 hours.

- Bad Credit Accepted: Traditional lenders, and even many alternative and fintech business lenders require credit scores of, at least, 650-700 to get approved for a small business loan. Credit card business lenders can provide financing to businesses with credit scores well below 500. Why? Because the loan is repaid by splitting your credit card processing transactions. By structuring repayments this way it reduces the lender’s risk. With less risk a lender is more likely to provide financing to merchants with bad credit.

- Limited Time in Business is OK: Almost all traditional business lenders require a company to be in business for at least 3 years. Many alternative lenders will require that a company be in business for at least a year. Even many ACH cash advance lenders will require the small business or merchant to be in business for 6-12 months in order to meet their minimum requirements. Credit card split lenders, on the other hand, can offer funding to company’s that have only been in business for as little as 3 months (provided they have sufficient credit card revenue to warrant the loan).

- High Approval: Conventional business lenders generally have approval rates that are below 50%. Only 40% of small business loan owners that apply for a loan from a small bank get approved. That number drops to as low as 20% when borrowers seek financing from a large bank. Alternative lenders have much higher approval rates, with up to 70% of merchants getting approved. A MCA split lender will provide the highest approval rates of all, with many approving up to 95% of all loans.

- No Other Collateral Required: Most small business lenders will require collateral that is more than the amount of funding the small business is seeking. A company seeking $250,000 in financing would normally have to provide collateral that is up to 200% of the loan amount being sought. With a credit card cash advance split funding, the borrower doesn’t need to provide any collateral to get approved for a loan. While a general lien in placed on the business for providing financing, no collateral is required to get funded.

How Do You Use Credit Cards to Get a Loan?

Credit card business lenders will require an applicant to provide between 3-6 months of merchant credit card processing statements to show the amount of credit cards they process each day, as well as which credit card companies were used in the sales. The merchant cash advance lender will then usually project the amount of credit card sales the merchant will do in the coming months, and then offer to buy a portion of those future credit card sales transactions at a discount. If the merchant agrees to the funding, the funder will then wire a lump sum to the merchant’s bank accounts, and then collect repayment by splitting each day’s merchant credit card sales until the cash advance is fully-repaid. Since the repayment happens by withholding a percentage of each day’s sales, and considering the fact that no one can predict the exact amount of sales that the business will have during any given day, its impossible to calculate exactly how long it will take to payback the cash advance. Therefore, with a credit card split advance, there isn’t an exact term associated with the repayment.

What Type of Businesses Can Use Credit Card Business Loans?

Any business that processes credit cards using a merchant account can get approved for a business loan using credit card sales. If you process more than $8,000 per month in Visa, American Express, Mastercard or Discover credit cards can get approved for funding. Generally, merchants and brick-and-mortar and online retailers are the best fit for a credit card business loan because they process a large amount of credit card transactions each day.

Why do Funders Prefer Credit Card Business Loans?

Many credit card business lenders prefer offering MCA split funding because of the reduced risk involved. Where with a traditional business loan, the lender is relying on the borrower to send them a monthly check to get paid back, an MCA lender get paid back a little each day through splits with the merchants credit card processing accounts. When funding is provided, the merchant will agree with their current processor to send a certain percentage each day to the funder. Therefore, since the lender isn’t reliant on the merchant’s responsibly sending them a check, the process is automated and taken out of the merchant’s hands.

Use of Credit Card Split Loans?

- Working Capital

- Pay Bills

- Emergency expenses

- Make Payroll

- Replace Equipment

- Make Repairs

- Advertising & Marketing

- Inventory

Types of Credit Card Business Loans?

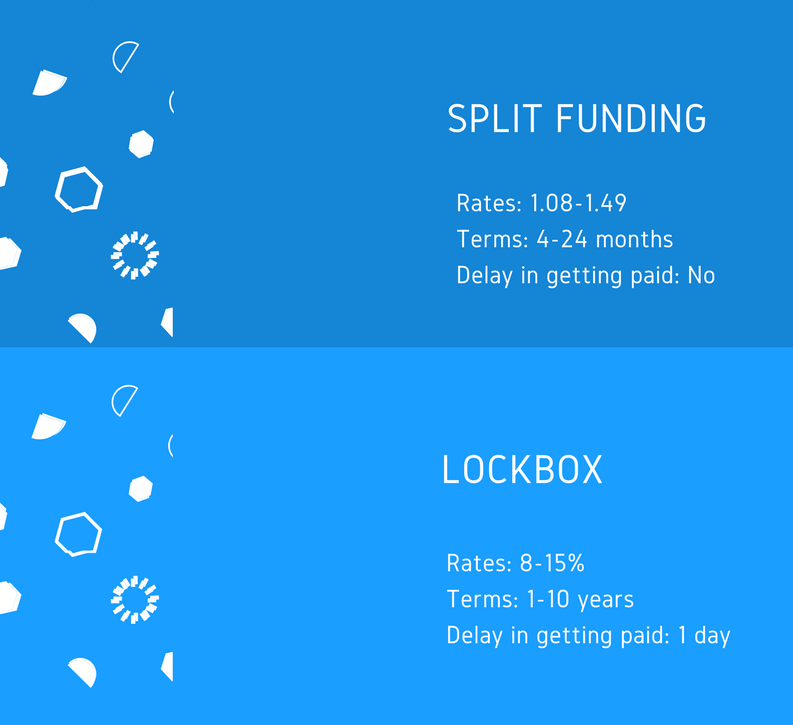

- Split: A credit card split is the most common type of credit card business loan. With a split the merchant will keep their current processing account, and the processor will simply send the remittance to the funding company each day.

- Lockbox: If a funding company doesn’t have an agreement worked-out with the merchant’s current credit card processor, a way to get an agreement in place is to setup repayment using a lockbox. Using this repayment plan the credit card transactions are deposited into an account controlled by the credit card business lender, and then after the lender collects their portion, the rest is forwarded to the business’s accounts (which usually causes a 1 day delay in funds reaching the business’s bank accounts).

Conclusion

MCA credit card business loans aren’t a cheap form of business financing. Fact is, the rates are much higher than loans provided by banks – some with rates that effectively work out to be nearly 70% on an annualized basis. But if you’re a merchant in need of fast business funding and don’t have access to bank lending, it may be the difference between being able to take advantage of a business opportunity, or missing out. If you’re considering getting a credit card business loan, please reach-out to our financing experts, and we will walk you through the process.