Refinance a Commercial Balloon Mortgage

There are many financing options available to small businesses and investors to finance commercial properties. While every lender requires some sort of down payment to purchase or refinance a commercial property or commercial real estate, not every CRE owner or potential borrower can afford a large down payment for the real estate. One tool used by lenders, business owners and investors to help reduce the initial out-of-pocket expenses to get the real estate mortgage is to get what is called a commercial “balloon loan” as a mortgage. A commercial balloon note is very useful, and they are very common in commercial real estate financing because they allow the borrower to pay lower down payments and monthly mortgage payments, which helps with both the acquisition of the property, and also with the debt service. But the drawback is that you end up with one massive payment due on the final payment. In this article, we’ll take a look at commercial balloon mortgages, and the options to refinance a commercial property that has a balloon note.

What is a Commercial Balloon Payment?

Unlike a fully-amortized mortgage, a balloon payment has a shorter-term than amortization period. That means when the term is up, the borrower will be left with a balance due to the lender – which is due as a last payment called a “balloon payment”.

How Does a Balloon Payment Work?

Balloon mortgages generally range in terms up to seven years, but have amortizations up to 30 years. What this means is that the lender will have you payback the mortgage over the course of up to 7 years, using amounts that would be associated with paying back the loan over the course of 30 years. By calculating your commercial real estate loan payments in this manner, it helps reduce the amount that the borrower/owner of the commercial real estate pays in monthly payments. Since not many business owners or real estate investors have the cash needed to make the final “balloon payment” most borrowers will either refinance their balloon mortgage before the balloon payment is due, or would have sold the commercial real estate.

Risks of a Commercial Balloon Mortgage?

The biggest risk associated with a commercial real estate balloon mortgage is they may not be able to refinance their mortgage before the final balloon payment is due. If they are unable to refinance their commercial real estate, they’ll be left with a potentially massive payment, and no way to meet this financial obligation. When that happens, the only options tend to either be the short sale of the commercial property, or foreclosure. Therefore, you must understand these risks beforehand, and plan-out how you will refinance your property well in advance of the final balloon payment.

Advantages of a Commercial Balloon Mortgage?

The biggest advantage of obtaining a balloon mortgage is first and foremost the access to capital to purchase the commercial real estate. Without a balloon mortgage structure, many of these borrowers wouldn’t have had enough of a down payment, or the ability to service their monthly debt payments associated with the loan. In fact, nearly 90% of small businesses that own their commercial real estate and have mortgage, usually are using some sort of balloon mortgage financing.

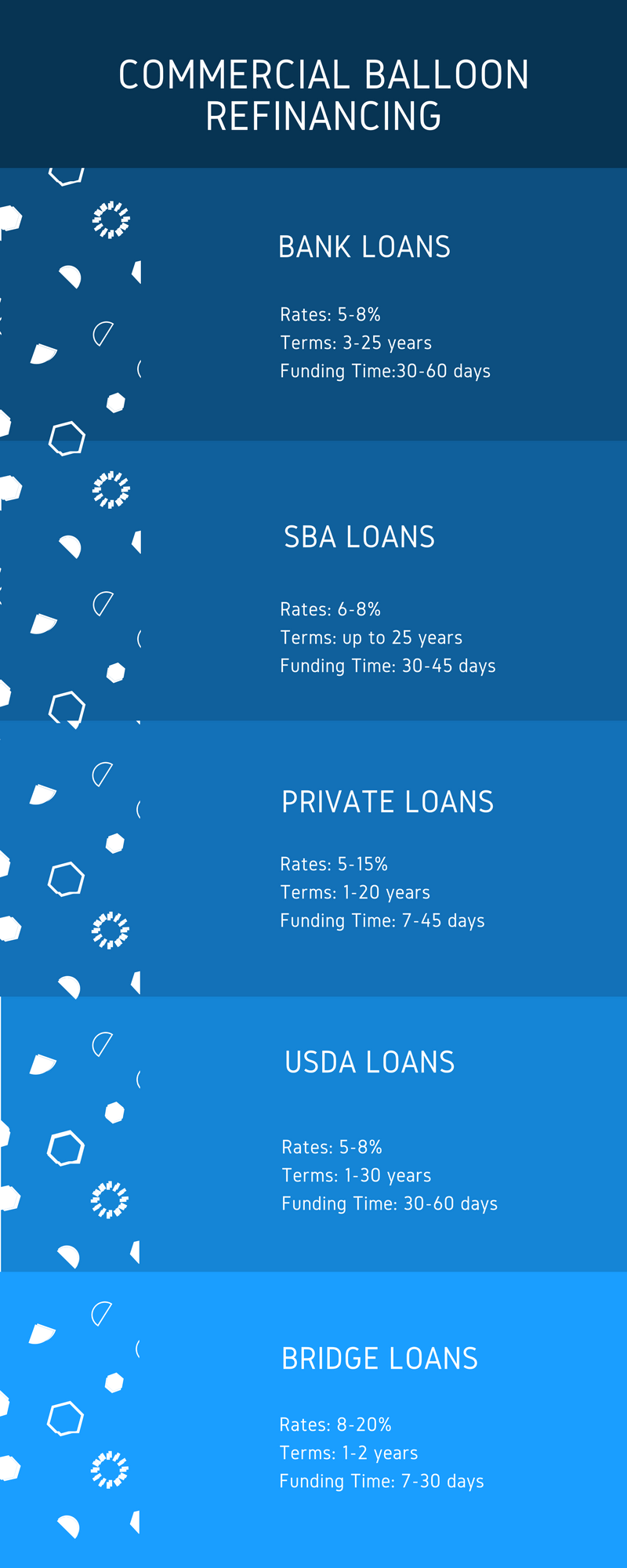

Options to Refinance Commercial Balloon Payments:

- Bank Mortgage: Banks offer both adjustable and fixed rate mortgages to businesses and real estate investors that are looking to refinance their current balloon mortgage. By refinancing with a conventional bank lender, you will obtain among the lowest rates, that can be fully-amortized up to 30 years. But if you are looking to get your commercial real estate financed quickly, this may not be the best option as a bank loan will generally require full documents including a few years business tax returns, personal tax returns, income statements, balance sheets, year-to-date financials, rent rolls and appraisals. From beginning-to-end, getting your commercial real estate balloon note refinanced by a bank may take months therefore, you may want to start the process of refinancing your balloon through a bank well in advance of the final balloon payment.

- SBA Mortgage: SBA offers refinancing options for small businesses facing a balloon payment that are very affordable and can help the small business grow their operations. SBA loans aren’t actually originated by the SBA, but are instead originated by conventional lenders and receive a SBA guarantee that if the borrower defaults, the SBA will cover much of the SBA commercial lender’s losses. SBA 7(s) real estate refinancing loans are fully-amortized up to 25 years, with rates that are generally between 5-6.5%.

- Private Lender: Non-bank private commercial real estate lenders offer a variety of lending options for real estate owners looking to refinance a commercial balloon payment. Private and institutional lenders are able to offer terms ranging up to 7 years and can even refinance your current balloon payment for a new balloon payment.

- USDA Loan Mortgages provided by the USDA lending program is similar to the SBA commercial real estate financing program in that the USDA doesn’t actually provide the loan to the business owner. Instead, the USDA helps backstop loans provided by traditional commercial real estate lenders by encouraging them to lend to under served rural communities with less than 50,000 inhabitants. By providing this loan guarantee, the goal is to encourage the development and job growth in rural areas.

- Bridge Loan: If you are a commercial real estate owner that faces a coming balloon payment, one way to avoid a payment is to obtain temporary financing for your CRE by obtaining a short-term loan used as a placeholder until permanent financing (or sale of the commercial real estate) becomes available.

Conclusion

As you can see there are a number of commercial financing options for business owners and property owners looking to refinance their CRE before the final balloon note is due. Waiting until the last moment to get your commercial balloon note refinanced is never wise, as there is always a risk that the lender you’re working with will chose not to refinance the note for whatever reason. When a balloon mortgage is due and you can’t refinance it into a fixed rate or fully-amortized loan, you need to work fast to find some sort of bridge financing to help prevent a short-sale or foreclosure. If you have a commercial balloon payment that will soon be coming due, and need help finding the right lender to refinance your commercial real estate, please reach out to one of our commercial real estate loan specialists, and we’ll help you navigate the financing process.