Outdoor Recreation Stores are an Economic Driver

Take it from an outdoor enthusiast and outdoor gear junkie – outdoor recreation stores and the gear these stores carry is not cheap. The outdoor recreation store industry is highly profitable, competitive, and consistently growing year after year. Every few years, the Outdoor Industry Association puts together economic studies on the state of the outdoor recreation sectors. The most recent study shows that over 140 million Americans today make outdoor recreation a priority in their lives, even during the Great Recession. Actually, since 2006, the outdoor recreation and equipment store industry has continuously grown each year, and is expected to continue to grow as more and more people make outdoor activities a priority in their lives.

Outdoor enthusiasts everywhere have grown to love their gear shops, leading to an outdoor recreation and equipment store sector that generates more than $646 billion each year, leading to over 6.1 million jobs for Americans. Surprisingly though, without this highly profitable outdoor recreation store sector, many other important industry economies would be greatly affected. The outdoor recreation store sector is so vital the American economy because it directly creates and fuels other major sectors. In 2012 alone, the outdoor recreation store industry impacted these sectors:

- Information – 3 percent

- Professional, Scientific, and Technical Services – 4 percent

- Transportation and Warehousing – 4 percent

- Real Estate, Rental and Leasing – 5 percent

- Finance and Insurance – 6 percent

- Other Industries – 21 percent

- Wholesale Trade – 7 percent

- Arts, Entertainment, and Recreation – 8 percent

- Retail Trade – 10 percent

- Accommodation and Food Services – 12 percent

- Manufacturing – 20 percent

On top of these sectors, there are also a variety of other industries that are heavily affected by outdoor gear stores. For example, the billion-dollar outdoor recreational equipment sector leads to more dollars being spent in travel industries and all of the other miscellaneous expenses involved in traveling. Other expenses that are directly correlated to the outdoor recreational equipment stores sector include: lodging, campground fees, lift tickets, ski or snowboard lessons, fly fishing guides, mountain guides, gym fees, and so forth. Suffice to say, the outdoor recreation and equipment store industry is booming, all while creating jobs and growing the economy in a number of ways.

Outdoor Recreation Equipment Store Trends

- Engaging the Youth: This is one of the biggest issues the outdoor recreation equipment store sector is facing today. Many outdoor gear stores have focused on consumers that like to do the most hardcore outdoor activities – summiting the highest peaks, ice climbing, mountaineering, and so forth. While there is an outdoor revolution occurring with many younger generations trying hard to connect with nature and disconnect from the chaotic technologically driven lifestyle that they are all accustomed to, most of them have no desire to summit the country’s largest peaks. Outdoor recreational equipment stores, such as well-known REI, are finally starting to realize that solely focusing on one type of customer is unrealistic, especially in a time where many American’s are willing to try the car camping experience or simply want to start hiking more. Also, many younger generations simply cannot afford the pricey lifestyle of having top of the line gear (unless of course, you are the adventurous outdoorsy person looking to send the next big peak). Focusing on the largest customer base, Millennials, is essential to staying successful in this rapidly growing sector.

- Outdoor Gear Doubling as Daily Life Necessities: Think about it for a minute – can you remember when yoga and workout pants became a fashion trend? What was once reserved for the yoga mat and running quickly became a favorable fashion trend among women everywhere; not just Millennial women either! More and more American’s are valuing items that can do it all, and the same goes for outdoor gear and clothing. Consumers everywhere are demanding highly functional products to use and wear in all aspects of their lives. More major outdoor recreational equipment stores are starting to offer more items in line with consumer demands.

- Focusing on Technologies: Outdoor recreational equipment stores have been working hard to implement much needed technological advancements. For example, many outdoor retailers are trying hard to connect with younger generations through social media. Just look at REI’s Black Friday initiative #optoutside. Since the start of their boycotting Black Friday two years ago, endless amounts of people have joined the cause through their skillful use of social media marketing. Other major outdoor retail stores are focusing on mobile technologies. Most outdoor recreational equipment stores have already switched from paper order forms to complete online and mobile ordering systems, and the demand for more mobile and app based technologies in the outdoor recreational equipment store sector is growing.

Outdoor Recreational Equipment Store Financing Needs

There are so many new and exciting trends happening in this diverse and competitive industry, which is why it is important to remember the multitude of outdoor recreational equipment store financing options. Some of the most common uses for outdoor store loans include:

- Outdoor Store Financing for Technologies: As mentioned above, focusing on the variety of technologies available to outdoor stores is essential in this highly competitive sector, but unfortunately, many of these technologies can be expensive up front. This is why there are plenty of outdoor store finance choices to purchase these essential systems.

- Outdoor Gear Store Loan for Inventory: Inventory is unavoidable in any retail environment, but as any retail store owner knows, managing inventory can be difficult and frustrating. With the help of outdoor store inventory loans, outdoor equipment store owners can purchase and implement effective inventory management systems to help with daily inventory needs. Outdoor recreational equipment store inventory loan options can also be used to purchase bulk inventory during peak seasons.

- Outdoor and Camping Store Loans for Payroll and Hiring New Employees: For any retail store, great employees and stellar customer service is vital. Unfortunately, many businesses experience slow periods and limited working capital, which is when employers turn to outdoor and camping store loans for payroll and hiring new employees. With financing help, outdoor store business owners can make sure that all of these important costs are covered.

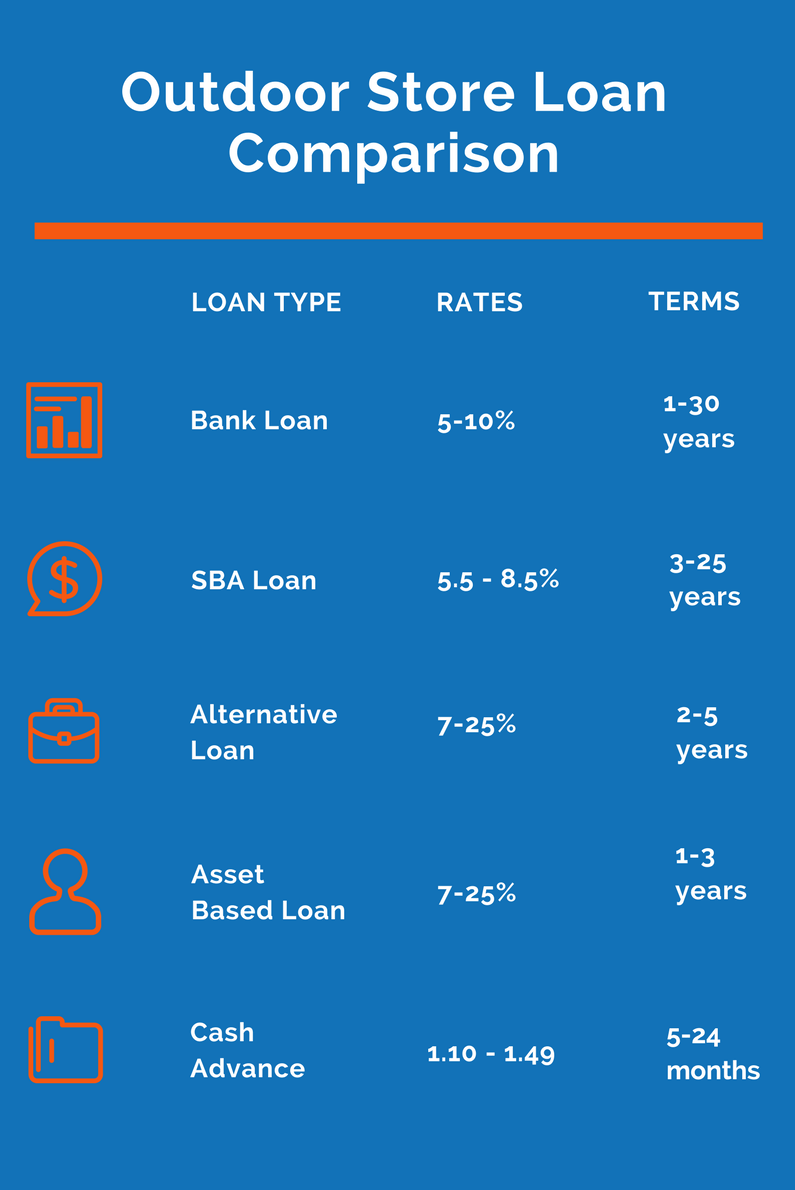

Outdoor Recreation Bank Financing

Bank business loans (term loans and lines of credit) offer any small business, especially outdoor recreation stores, with top quality business capital that can be used for just about any business need (including loans for purchasing real estate, commercial refinancing loans, capital for regular business operations, loans for equipment, inventory financing). While the process of getting a bank small business loan may require quite a bit of personal and business documentation, the end result are rates that start in the mid single digits, and terms that can go as long as 30 years.

Outdoor recreation bank loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

SBA Outdoor Recreation Loans

SBA lending options (both term loans and lines of credit) are another top-notch form of financing for small outdoor recreation stores. This type of traditional financing utilizes the SBA loan guarantee program to encourage conventional business lenders to offer financing to outdoor recreation stores that were unable to get financing without the SBA’s backing. Uses for a SBA outdoor recreation loan include purchasing businesses, refinancing higher-interest business debt, general working capital, purchasing or equipment and machinery and just about any other business financing use.

Outdoor recreation SBA loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Loans For Outdoor Recreation Stores

Getting a conventional business loan requires a lot of hard work, and sometimes bank-rate financing can still escape small business owners. An alternative option to obtain healthy and affordable small business financing is to seek a mid prime alternative fintech loan. These types of business loans are an excellent option for recreation stores that have decent credit but may have taken a loss in one of the past two years. Another quality that is appealing about alternative business financing is how quickly these loans can fund (usually about a week).

Fintech loan documents needed:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Outdoor Recreation Store Cash Advance

A cash advance isn’t a small business loan at all. Instead, its actually the sale of the outdoor recreation store’s future receivables (either bank account or merchant credit card account) to a business funding company in exchange for immediate cash financing. While this type of funding comes at a cost (can be very high interest) it does allow a small business to access funding quickly to cover immediate financing requirements.

Outdoor store cash advance documents:

- Application

- Bank statements

- Credit card statements