Loans For Engineering Companies

The engineering industry has struggled for the past few years, mainly due to the 2008 recession. The demand for construction and engineering services has decreased since the sudden collapse of oil prices in 2015 that led to most energy companies slowing down, postponing, or simply cancelling major projects. In addition, continuing global economic instability has drastically affected the engineering and construction industry. Even before these recent issues, most engineering businesses took a big hit during the 2008 financial crisis which has led to a continuous shortage of skilled workers in this field. The engineering sector is also facing growing competition from firms in low cost nations. While all of this has led to lower profitability from 2008 all the way into 2015, the engineering sector is seeing positive growth with new trends emerging that are leading to many construction and engineering companies finding their niches. Through the emerging ‘niche’ engineering companies, as opposed to engineering companies offering a little of everything, many companies in this market are remaining optimistic. There is also plenty of optimism going into 2017 because with the rebounding economy comes more engineering job opportunities.

The biggest issue engineering businesses face today is the overwhelming shortage of skilled laborers. Every single aspect of the engineering and construction world has a specific skill set that is difficult to acquire, either through schooling or experience. This decline in skilled laborers originated during the recession when a majority of the employees left the industrial engineering sector, but never returned after the recession. According to Tom Menk, an assurance partner with BDO’s national real estate and construction practice, the engineering and construction sector failed to appeal to more younger and technologically savvy employee candidates, such as Millennials. Most engineering companies also failed to attract this younger workforce when the United States finally started to recover from the Great Recession, leading to major gaps in the workforce that are difficult to fill today. With the constantly increasing rates of baby boomers retiring, the need for a younger workforce has become unavoidable in the engineering world.

While this is a difficulty faced by many engineering and construction companies, we are seeing an influx of younger people going into specialty trades like this because of the ever growing rates of college. These specific trades are a hot commodity for engineering and consulting businesses, leading to better pay for these employees. Engineering business financing options can always help cover necessary and vital costs like payroll during slow times. More often than not, engineering work is directly correlated, or combined, with construction work, however a few of the other different common engineering fields consist of:

- Engineering is one of the most highly skilled construction careers in the industry. It is the science and technology branch that focuses on the design, building, and use of engines, machines, and structures. Typically, an engineer has specific degrees and certifications, making the amount of available engineers limited.

- Agricultural engineers; automotive engineers; biomedical engineers; chemical engineers; computer engineers; electrical engineers; environmental engineers; software engineers; and so much more!

While the engineering business sector has faced some difficult times in the last few years, statistics are showing that engineering companies are starting to see better times. Engineering is a major contributor to the United States economy, leading to over 650,000 employers, over 6 million employees, and nearly $1 trillion worth of structures each year. These engineering companies also indirectly create endless amounts of jobs in other industries. While engineers are vital in creating many different things, there are other companies that then supply the needed materials and/or workers. These numbers are only going to continue to grow, leading to high demand engineering jobs in the future. The trends and demands listed below rely heavily on changing practices and technology in the engineering field. All of these necessities and changes are vital to growing the engineering industry, however they can be expensive up-front costs. With the help of different financing options, engineering companies can easily make this transition into the diverse trends people are demanding today.

Engineering Business Financing Uses

- Engineering Business Financing for Technology: The engineering business world has been slow to adopt new technologies and younger employees in the past; however, this is changing. New, more efficient technology has emerged, and many engineering companies are making this transition due to the necessity of these tools. Building Information Modeling, or BIM, is a technology that has been around for a while, but has always been reserved for the larger firms. Now, all engineering companies can have access to this advanced technology, especially with the help of engineering business financing options. The best, top of the line firms are using 3D printing to produce all sorts of items, as well as using drones to inspect sites. These are much more efficient than the old school way of doing things, however these can be expensive costs. This is another great use for engineering business loans.

- Engineering Business Loans for Payroll and Hiring New Employees: As mentioned above, the demand for qualified, certified, and educated employees is high right now, leading to engineering businesses everywhere having to pay higher wages to their employees. These costs can be difficult to maintain when business gets slow, so being aware of engineering business financing and loan options are always important.

- Engineering Company Funding for Transitioning into Green Practices: With the growing demand for green living growing, the demand for green buildings in both commercial and residential sectors is skyrocketing. Many engineering companies are prioritizing getting LEED certifications for all of their workers. In addition to this, some engineering companies even cover school costs and fees for their employees. Certifications and degrees are not cheap, so finding alternative resources for engineering company funding is something to always consider.

- Engineering Business Loans for Other Fees: Miscellaneous fees, especially insurance, are vital in the engineering sectors. OSHA increased its fines in 2016 for the first time since 1990. There has been a drastic increase in the past few years of jobsite accidents, leading to higher rates and fees for coverage.

- Engineering Company Financing for Creating Niche Business Areas: Most importantly, engineering companies are starting to become more focused on one area of expertise. Many engineering businesses have seen business growth through differentiating themselves from the rest of the industry. A few ways this is being done is through better technology, new geographies, business expansion, augmented service portfolios, and fresh talent – all of these can be expensive ventures, but are the most important aspect for success in this incredibly large industry. This is another great use for engineering business funding.

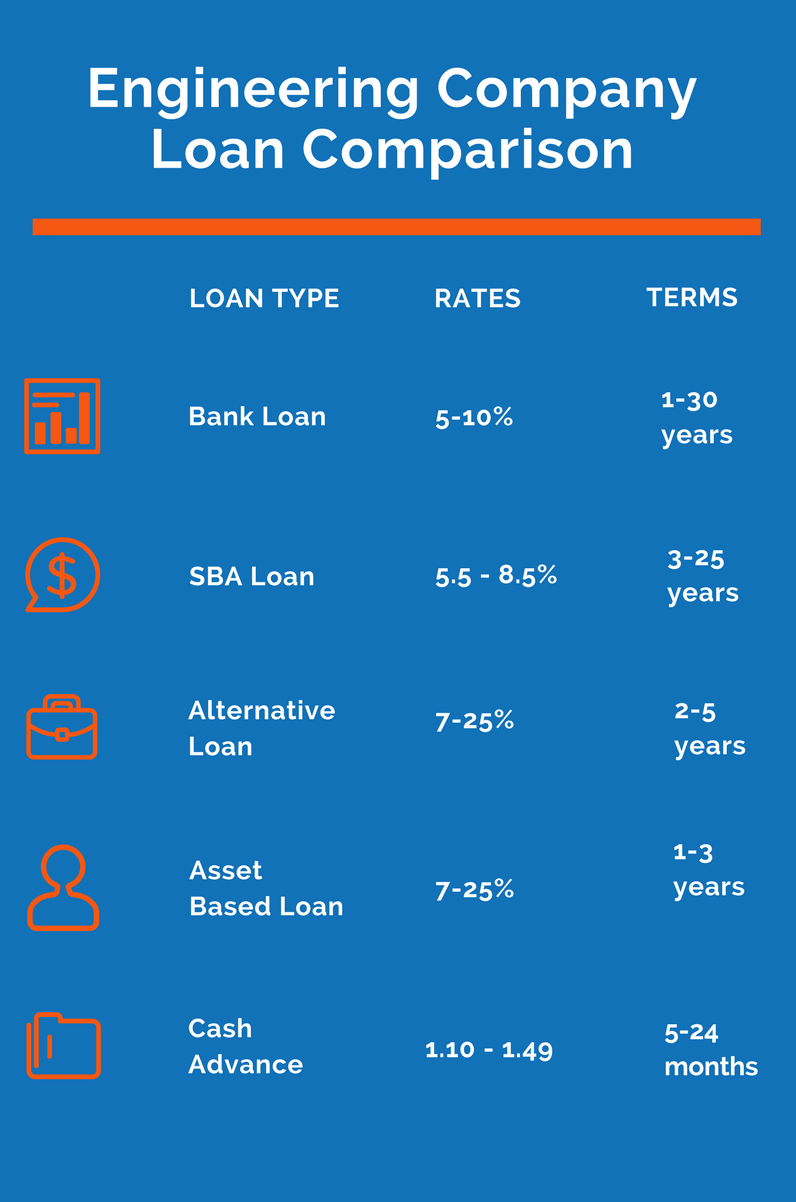

Engineering Company Bank Loans

Bank lending for engineering companies is a great way for to get very affordable business loans. Bank engineering business loans can be used for nearly any use, including purchasing real estate for your engineering company, to refinancing and consolidation of engineering company debt and general working capital purposes. Rates for a bank business loan start in the mid single digits, and bank business financing have terms that can range from the short term (1-3 years) but can last up to 30 years depending upon use. While bank business loans offer great rates to engineers, they require much more business documentation, credit and collateral than any other form of business financing.

Engineering company documents needed for a bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Engineering Company SBA Loan

Engineering companies use SBA financing when they are seeking true bank-rate business financing, but are unable to get their engineering company approved for a bank loan. By utitilizing the Small Business Administration’s SBA loan guarantee program, an engineering company may be able to obtain bank-rate financing because the SBA is willing to guarantee a large portion of the loan. By issuing the SBA guarantee, the traditional lenders are more willing to provide financing to engineering companies they normally wouldn’t. With that having been said, getting a SBA engineering loan requires substantial business and personal documentation and business profitability.

SBA loan documentation:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Engineering Business Loans

With the nature of the sector, many conventional business lenders won’t provide financing to many construction and engineering companies. Bank lenders find that there is too much unpredictability, thus: could cause engineering companies to default on bank loans. When a small business find themselves locked-out of bank-rate financing, the next best financing option would be to get an alternative engineering loan. Alternative loans (sometimes called fintech loans) are a way for a small company to get financed within a week or two, and requires much less documentation than a conventional business lender requires.

Alternative engineering loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Engineering Company Cash Advances

When all else fails, an engineering company can skip the entire loan process and access future revenue immediately. Through the use of cash advances, an engineering company or any small business can sell a portion of their future business receivables in exchange for immediate cash financing. The engineering company will provide minimal documentation, and can get an instant approval. After approval, the small business can expect to have money deposited directly into their account within 1-3 days, and sometimes even the same day. After the money is deposited, the engineering business will then repay the cash advance lender in incremental payments that are automatically deducted from the small business bank account each dia via ACH until the cash advance is fully-repaid.

Engineering cash advance documentation:

- Application

- Bank statements

- Credit card statements