Cement Company Lending

The cement business world has seen rapid changes in the past few years. While the overall cement business industry is valued at over $450 billion, this does not necessarily mean that every cement business is doing well today. Most cement business owners decided that mergers and acquisitions were the way to go for the past few decades, hoping to see a drastic increase in profits – unfortunately, the results were rather lackluster for most cement business owners. This is especially true thanks to the 2008 recession which left many businesses across the United States struggling to stay afloat. Luckily, most cement businesses have rebounded, resulting in positive sales in the past year.

Most of the positive sales are largely due to three major trends affecting cement businesses: rapidly growing innovative technologies, the demands for more sustainable cement business practices, and the steady housing market today. Innovative technologies has revolutionized most business today, but for cement companies, these technologies have led to decreased labor costs, more efficient business practices, and sustainable business practices. Many of the new technologies have led to the transition from wet manufacturing to dry manufacturing processes, which also works toward alleviating the sustainability demands from consumers. The other major trend, the housing market, has led to an increased demand in cement services. This is yet again another industry that is highly dependent on the construction and housing industries, and for the past few years, increased profits have paralleled with those markets.

Cement Company Financing Needs

There are many important trends and constantly fluctuating economic factors that greatly impact many cement companies across the United States; however, many of these vital processes, such as improved technology systems, can be incredibly expensive upfront costs. This is why many cement companies and cement contractors turn to cement business financing options to help alleviate some of the expensive costs in order to grow their cement business. Through cement company loans, many cement companies can use these loans for a variety of technologies, systems, and working capital costs. Some of the most popular cement company finance uses include:

- Financing for Cement Company Technologies: Technology is revolutionizing every single industry in the United States today, and this will only continue to play a prominent role in every cement business. Many cement businesses are struggling with constantly evolving federal and state regulatory issues, as well as focusing on implementing more cost effective and efficient day to day operational technologies. One of the biggest technologies disrupting all cement businesses, as mentioned above, is the transition from wet cement manufacturing to dry manufacturing processes. This has allowed many cement businesses to save capital in the long run, however making the transition into these vital technologies may require cement company financing options. With cement business loans for essential technology systems, many cement business owners also chose to use these funds for top of the line, cloud based systems to improve a multitude of essential daily functions. The cloud based systems available to cement businesses can help improve operations, cut costs, and manage tedious daily tasks more efficiently, leaving little room for errors.

- Cement Company Loans for Marketing, Advertising, and Social Media: Marketing and advertising are unavoidable in the cement business, however many cement business owners struggle with adopting and efficiently integrating one of the most important marketing and advertising tools available today – social media. Through social media, cement business owners can advertise to all types of markets faster and more efficiently than any other mode of communication and marketing. Unfortunately, being able to utilize social media and content marketing without training and experience can be incredibly difficult. This is why so many cement businesses turn to cement company financing. Through cement business loans, many cement business owners can hire a marketing specialist in house or an outside marketing firm in order to compete with the rest of the cement industry.

- Cement Company Equipment Loan: It is obvious to any cement company owner that equipment is an essential component to daily operations, but the most obvious aspect of equipment for cement business owners is the incredibly expensive costs of maintaining or replacing these vital pieces of equipment. Cement company equipment financing provides cement company business owners with the ability to cover the expensive upfront costs associated with many types of cement equipment. This allows cement business owners to replace any piece of equipment quickly and efficiently without having to cut other vital cement business costs.

- Cement Company Expansion and Renovation Funding: With the cement business industry constantly involved in mergers and acquisitions, this is not a new concept. Many cement business owners would love to expand business operations into new markets and territories, however making these expansions can be incredibly difficult and expensive. With the help of cement company funding, there are a variety of options that will allow cement company business owners to achieve these business possibilities.

- Cement Company Financing for Payroll and Hiring New Employees: With the evolution of technology comes less dependence and need for employees, especially in the rapidly evolving cement business world. Cement companies are quickly realizing that more advanced technologies are allowing the cement business owners to cut costs in the employment budget – however, there are still plenty of vital positions that cannot be replaced by technologies. With these specific positions, there are often plenty of degree and experience requirements, leading to high payroll costs for the cement company employers. In any business, there are slow business cycles, leading to employers looking to cut costs in a variety of creative ways, but withholding payroll is never a good option. This is why remembering about cement company finance options for payroll, and hiring new employees, can be essential to any cement business.

- Funding for Sustainability Practices in Cement Companies: Many cement businesses are allocating funds to making sure that better, more sustainable systems and practices are incorporated into daily cement business practices. Sustainability and eco-friendly products are being a huge demand for consumers everywhere, and the cement business industry is not immune to this demand. Whether a cement business owner is looking to try new, more sustainable equipment, incorporate new cement making technologies, and so forth, there are financing options to help.

Financing Options for Cement and Concrete Companies

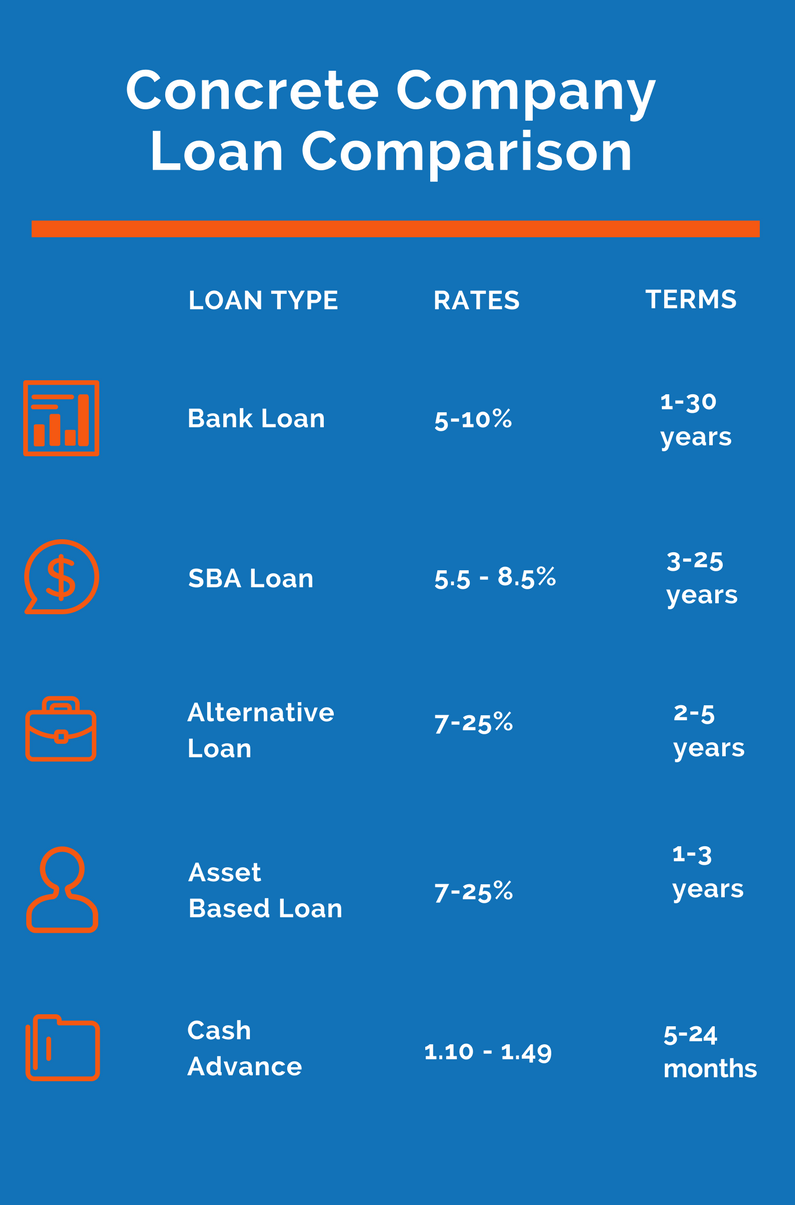

Concrete and Cement Company Bank Loans

Bank loans are the most popular and most desired type of business financing for just about any business, especially concrete and cement businesses. Bank loans are the perfect financing tool for cement companies seeking long-term loans for purchases, refinancing and consolidating business debt, as well as long-term capital for a variety of business uses.

What makes a loan from a bank or credit union so desirable are the low rates and extended terms conventional lenders offer. But with fantastic rates and terms, comes a reduced risk by the lenders, so if you do apply you need good credit and revenues to get approved for a business bank loan.

Cement company bank loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

SBA Concrete Company Loans

SBA lending is another good option for all small businesses including concrete and cement companies. By utilizing the Small Business Administrations loan guarantee, a SBA lender is able to provide high-quality bank-rate financing to concrete companies seeking loans, and if the company fails to repay, the SBA agrees to help the lender cover their losses. Once again, since SBA lenders offer fantastic rates and terms, they expect the applicant to have good credit and good profitability to get approved for an SBA loan.

SBA concrete company loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Concrete Company Business Loans

Two things give alternative business lenders the advantage over conventional lenders like banks and credit unions: Speed and high approval rates. Unlike bank loans, an alternative lender is able to approve a concrete company for financing within the matter of minutes, and complete funding for the loan within a week. And unlike traditional business lenders, alternative lenders approve very high percentage of businesses that apply (roughly 70% as opposed to banks approving 20-40% of loan requests).

Alternative cement company loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Concrete Company Cash Advance

Cash advances are an easy way for a concrete company to get approved and funded without much hassle and paperwork. Cash advance lenders approve up to 90% of all small businesses that apply, and can fund your concrete company within days, if not the very same day (depending on the amount being sought). Cash advances have much higher rates than banks, because they take enormous risk, being they offer financing to borrowers with credit scores as low as 500.

Concrete company cash advance:

- Application

- Bank statements