Roofing Business Lending

Since the 2008 recession, plenty of business owners have been struggling to stay afloat, especially in industries that are directly dependent on the housing and construction markets. While many roofing businesses saw decreased profits for a few years following that recession, the past two years have marked significant change throughout the roofing business industry. Since roofing businesses are dependent on the state of residential and nonresidential markets, and the overall housing and construction market has seen continuous growth in the past few years, many roofing business owners have seen huge profit increases – especially because the unemployment rate is the lowest it has been in years, leading to more consumers having more disposable income.

Not only is the low unemployment rate greatly affecting the roofing business market, but the nationwide housing production has increased 11.3 percent by the end of December 2016, leaving many roofing company owners with positive feelings towards profits and business growth in 2017. The largest surge in the housing production demand has mainly come from a high demand of multifamily homes in the past year. According to the National Association of Home Builders, the demand for single family homes dropped 4 percent, however industry analysts believe this is only a temporary drop.

Roofing Contractor Trends

The roofing business world, year after year, has done well thanks to the improving United States economy, leaving many roofing manufacturers feeling optimistic about growth and future sales. Unfortunately, the roofing business industry is grappling with two major trends that have affected almost every other construction related business: a lack of qualified workers and frustrating regulations that are altering the way incumbent roofing businesses have operated for years.

- Finding Quality Workers and Attracting Younger Talent: Finding quality workers and subcontractors has become a major issue for every single roofing business today. The scarcity of qualified (and willing) workers for many construction related businesses has led to panic for many roofing companies, especially because there is plenty of room for business growth – and unfortunately, there are not enough qualified workers to make this growth possible. One of the major ways successful roofing companies are looking to combat this issue is by focusing on the younger workforce while offering competitive benefit and stock packages. Millennials are dominating the workforce today, however they have plenty of demands when looking for a job, the largest one being retirement and/or health insurance packages. Many roofing businesses are finding success in attracting a younger workforce talent through offering a variety of incentives.

- Classification of a Subcontractor: In 2016, roofing businesses struggled to deal with the changing classification of what a subcontractor is under federal standards. Through this decision, three decades of legal precedents were changed, resulting in many roofing businesses grappling with the negative effects of these changes.

- Regulations: In the roofing business industry, state and federal regulations are constantly changing, leading to many challenges for roofing businesses everywhere. Roofing business owners still find that these regulatory issues are the number one problem for roofing companies. In particular, many roofing business owners find frustrations with regulatory burdens that involve altering SPF materials or installation practices because it leads to unexpected business disruption that leads to issues for businesses and consumers alike. For roofing business owners, focusing on the constantly changing regulations can be key in staying competitive.

Roofing Business Financing Uses

Even though roofing businesses have seen increased profits, there are still plenty of uncertain situations arising in the next year. With a new president in the White House, many businesses are unsure of what the new presidency will hold, leading to many roofing business owners optimistic, yet hesitant, about making any large business moves. In order to stay competitive against large roofing business however, many roofing business owners consider the variety of roofing business loan options available.

- Financing for Roofing Business Technologies: There are a variety of roofing technologies that are disrupting roofing businesses today, including the constantly evolving single-ply roofing systems, roofing oriented enterprise systems, GPS apps, and energy saving roofing systems. While some of these technology systems and practices are somewhat new, they are definitely an area that has been continuously discussed and expanded in the past few years. Innovative technology systems have become vital to remaining competitive for roofing businesses and contractors everywhere, however many of these systems can be incredibly expensive upfront. With the help of contractor business financing options for technology, many roofing business owners have the ability to incorporate cost saving technologies that greatly benefit business needs.

- Roofing Business Loans for Marketing, Advertising, and Social Media: Marketing and advertising has always been a main business component for roofing companies everywhere, by the adoption of marketing and advertising through social media has been relatively slow. Through social media, roofing companies everywhere have the ability to reach larger markets and showcase specific content marketing strategies that can benefit business profits. Through roofing business marketing loans, many roofing business owners can hire in house social media marketers or look into third party marketing firms. Either way, investing in marketing for a roofing business is vital to remaining competitive.

- Roofing Business Inventory Loan: Inventory is important in the roofing business, especially when trying to obtain quality items at discounted costs. This has led to many roofing business owners investing in inventory management systems to help with the complicated aspects of efficiently handling inventory. Roofing company inventory loan options can help.

- Roofing Business Funding for Payroll and Hiring New Employees: As mentioned above, employees are a hot commodity in the roofing business world, so making sure to cover payroll costs are essential to keeping quality workers. Unfortunately, all businesses experience slow periods or other unexpected costs, which is why payroll financing for roofing businesses can be essential in covering these necessary costs.

- Roofing Company Equipment Financing: Equipment is a main component to any roofing company, and having the best, top of the line equipment can differentiate one roofing business from another. Having access to quality equipment, or being able to replace a much needed piece of equipment quickly, is vital to any roofing business; this is why so many business owners consider roofing company equipment financing choices. This allows business owners to purchase needed equipment without having to pay the full, upfront cost right away.

Financing Options for Roofing Contractors

Roofing Company Bank Financing

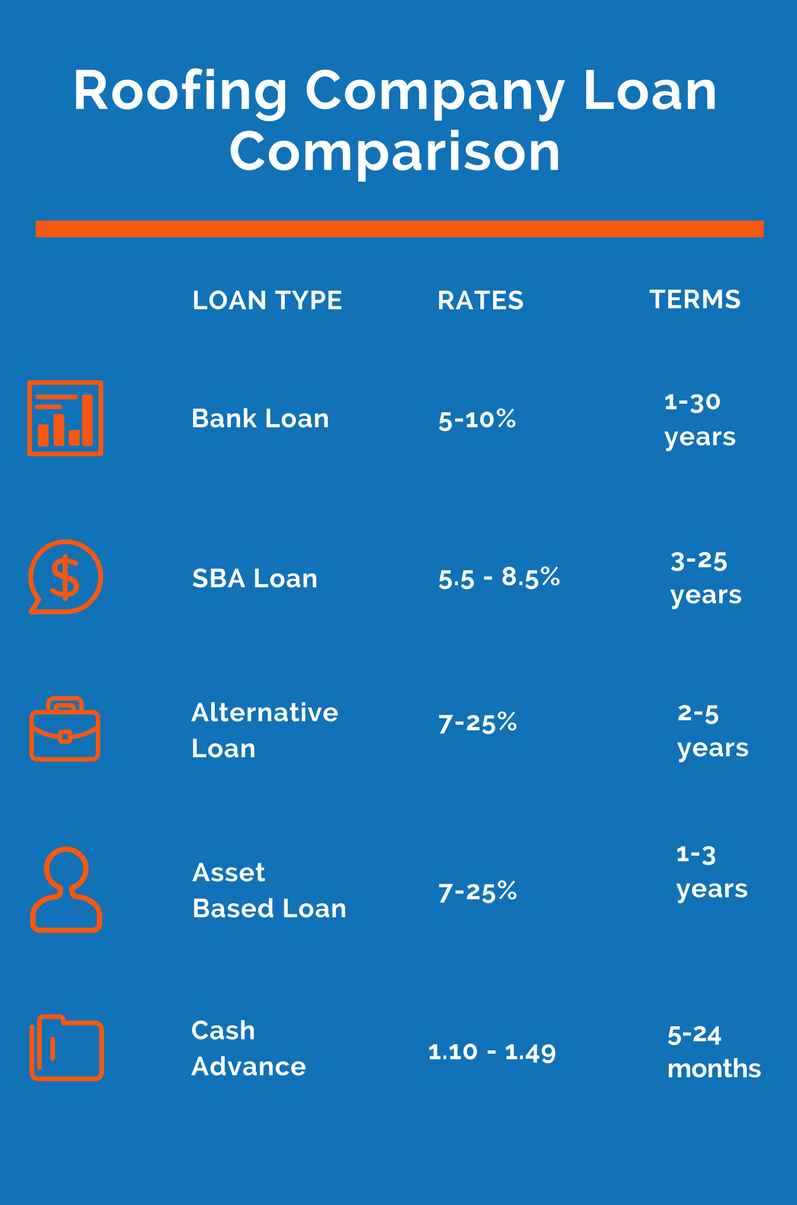

Roofing company’s may have needs relating to getting a loan for inventory, or making payroll for your roofers. Rather than wasting lots of money on high interest small business loans and cash advances, the healthiest option would be to get a bank business loan or line of credit. While bank lenders have a process which can be daunting, getting a business loan through a bank provides roofing contractors with the best rates and the longest terms of all small business loan options.

Roofing contractor bank loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

SBA Loans For Roofers

SBA lending for roofing companies and contractors are the next best options for small businesses that would like bank-rate financing, but need a little extra help getting approved from a conventional small business lender. By willing to cover a large portion of the loan should the roofer default on their loan, the SBA helps encourage business lenders to provide financing to borderline applicants.

Roofing contractor SBA loan documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Roofing Company Loans

While all roofing companies (and pretty much any small business) would prefer getting a bank-rate small business loan through a conventional lender (small and large banks, credit unions, community banks) getting approved can be difficult because they only approve between 20-45% of their loans. The next best option may be to get an alternative loan for your roofing company. While alternative business lenders don’t offer rates as low as traditional lenders, they do offer affordable financing that can be delivered within the matter of days, not months like banks.

Alternative roofing company loan documents:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Roofing Company Cash Advances

When all else fails, and a roofing company finds themselves needing immediate cash financing, a good option may be to sell some of their future revenue in exchange for immediate money. Cash advances aren’t really business loans, but they are instead the sale of the roofing company’s future receivables to a funding company, and the funder supplies the roofing company with a percentage of those projected receivables.

Roofing company cash advance documents:

- Application

- Bank statements

- Credit card statements