Makeup Store Funding

The United States is plagued by perfectly posed Instagram selfies and the latest fashion trends to ensure that the selfies are “model status worthy”. Our social media and fashion driven society has led to beauty companies becoming a multi-billion-dollar industry today. Cosmetic, face cream, and perfume businesses combined generate over 75 percent of industry sales alone. Market research shows that cosmetic stores will reach over $51.8 billion by 2020, while employing more people than most industries in the United States. The cosmetic industry is booming today, and is only expected to see increased profits over the next few years, which is why consumer trends for beauty stores have become so vital. In addition to paying attention to rapidly changing consumer preferences, there has also been a drastic increase in demand for more omnichannel experiences, offering more diverse and multicultural product lines, and sustainable and eco-friendly products. Unfortunately, many of these transitions can be incredibly expensive, which is why there are plenty of cosmetic store financing choices.

Cosmetic Store Industry Trends

- Catering to Multiple Types of Consumers: When thinking of the cosmetic store industry, it is easy to assume that cosmetic stores cater to young women, especially since young women have been the bulk of consumers for years – but things are changing. More and more cosmetic stores are launching products specifically geared towards men, older women, and older men. Everyone wants to feel good, which is why all sorts of people are turning to the cosmetic industry for specialized products. For cosmetic store owners who want to compete against major cosmetic store players, consider catering to a niche area such as men. This is a relatively new market to enter, which is why those that are a part of it are seeing huge profits.

- Going Green: Sustainability and environmentally friendly products are a key issue on consumer’s minds today – especially when it comes to items that they will be putting on their skin. Going green consists of many expensive components: sustainable packing, using less waste and water to produce cosmetic products, organic ingredients, and so much more, all while providing a competitive price that consumers are willing to pay. While converting old systems and practices over to more environmentally friendly practices will be expensive, there are a variety of cosmetic store loans to help.

- Taking Cues from Sephora: Sephora has become one of the largest cosmetic retailers in the United States today, but the incumbent cosmetic store did not gain its success from repeating old cosmetic store ways. Sephora transformed the beauty industry across the country, leading to many cosmetic store owners mirroring their successes. The biggest benefit that many consumers see with Sephora is the diversity in product offerings, the above and beyond customer service experience, and the knowledgeable and informative staff that answers any and all questions without unbiased brand preference opinions. Even major drug stores like CVS are starting to take cues from Sephora for the new cosmetic store industry business model.

Cosmetic Store Financing Uses

- Cosmetic Store Technology Financing: Major cosmetic stores, such as Sephora, have revolutionized the cosmetic industry, leading to many smaller cosmetic stores turning to funding options in order to remain a viable competitor. Cosmetic store financing for technology can be used to purchase top of the line point of sale systems to increase, and speed up, the overall customer experience. There are also plenty of cloud based systems that help with daily managerial operations for the cosmetic store industry. Another major cosmetic store loan use for technology would be to create omnichannel experiences; using cosmetic store funding to create an online website, a mobile website, or “click and order” mobile apps. There are endless amounts of technology based systems that can improve cosmetic store business practices and systems, leading to an increase in profits.

- Cosmetic Store Financing for Marketing, Advertising, and Social Media: Many industries have been slow to adopt modern technological marketing and advertising practices; when it comes to the cosmetic stores, this is not true. The cosmetic, and overall beauty, stores were some of the first industries to fully utilize social media and content marketing in order to reach key demographics (such as Millennials and Generation Z). However, there is always room for optimized marketing strategies, which is why cosmetic store loans can help bring in outside marketing companies to draw in more customers and increase revenues.

- Cosmetic Store Inventory Loans: Inventory is an incredibly important component to any retail business; however some cosmetic store businesses have difficulties in ordering enough of the right product, or too much of the wrong product. This is why many technologies based startups have worked to create top of the line inventory management systems – but these systems can be incredibly expensive upfront costs. This is why so many cosmetic store business owners turn to a variety of alternative inventory financing sources to cover the upfront costs of these vital systems.

- Cosmetic Store Funding for Hiring New Employees and Payroll: For retail businesses, having qualified, quality, and talented employees is essential, especially in the cosmetic store industry. Employees in the cosmetic industry must be knowledgeable in the products they sell, as well as knowing how to cater to a variety of different consumer preferences. In order to keep employees happy and willing to work hard, covering payroll is vital. No employee wants to work hard to not get paid, which is why there are plenty of cosmetic store loans to help cover payroll costs. Also, if a cosmetic store loan is needed to help finance the search for new employees, there are plenty of options to make that happen.

- Cosmetic Store Loans for Expansion and Renovations: For any business, considering expansion or renovations can be exciting, but they can also be daunting. Covering such expensive, upfront costs can be incredibly overwhelming, which is why so many business owners turn to cosmetic store loans to ensure that expansion and renovation costs can be covered. Also, sometimes expansions or renovations may seem doable without taking out a loan, but unexpected costs can arise. There are plenty of cosmetic store loan choices to help.

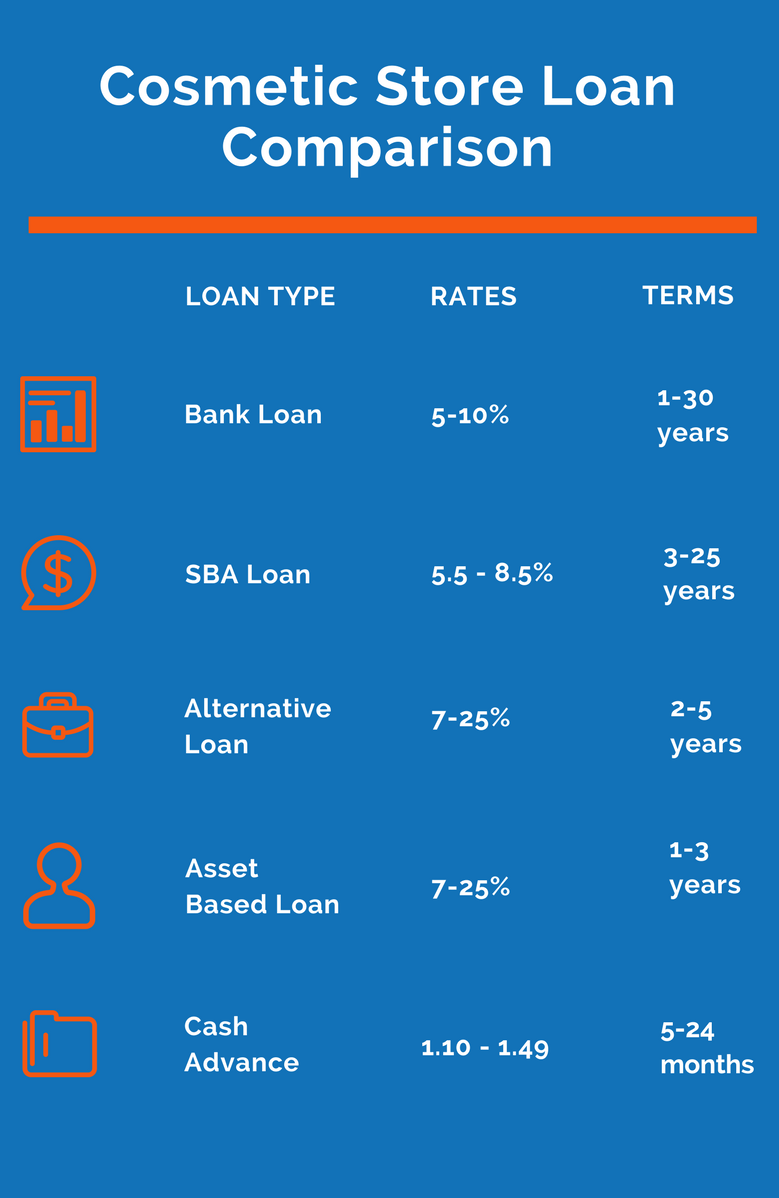

Cosmetic Store Loan Options

Cosmetic Store Bank Loans

If you own a cosmetic store and have good business and personal credit, fantastic sales, revenue and profitability, the best financing option to help with business expenses would be a conventional business loan from a bank, credit union or community lender. These types of small business lenders offer cosmetic store the best rates and longest terms of any commercial financing. Even more, these small business lenders have very low fees, and don’t restrict how the cosmetic or beauty salon can use the funds.

Documents to get a cosmetic and beauty store bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Cosmetic Store SBA Loans

SBA loans are the perfect type of financing for cosmetic stores that have tried to get a bank loan but found the lender unwilling to approve a loan to their small business. SBA loans aren’t actually provided by the Small Business Administration or government, but they are loan provided by large and small banks, along with community lenders and credit unions that is backed by the government. What that means is: if the cosmetic store fails to repay their loan, the Small Business Administration agrees to pay for a large percentage of the losses.

Cosmetic Store SBA Loan Documents:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Cosmetic Store Lending

Getting approved for traditional business lending isn’t easy. In fact, only a small percentage of small businesses are able to get approved for a bank or SBA loan. With alternative business lending, the chances of your cosmetic store getting approved for funding is quite high, with many lenders having up to 70% approval ratings. With higher approval ratings also increased risk to the lender, and as the risk increases, so does the rate of the higher-risk loan. Therefore, an alternative loan is always a higher rate than the lower-rate bank loans.

Alternative cosmetic store documents needed:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Cosmetic Store Cash Advances

As with many retail businesses, a cosmetic store will see lots of purchases for smaller dollar amounts. If a cosmetic or beauty store processes lots of credit card payments, or accepts lots of debit card purchases, they can use those two types of receivables to obtain small business funding with ease. A cash advance is the sale of the cosmetic stores future sales to a 3rd party at a discount. The cosmetic store will accept funding, and then repay directly through remitting a small amount from their bank account or credit card transactions until the funding is repaid.

Documents needed for cosmetic store cash advance:

- Application

- Bank statements

- Credit card statements (if process credit cards)