Financing a Wedding Shop

The wedding and bridal shop industry is so incredibly diverse, ranging from wedding invitations to bridal gowns to the bride’s mother’s and brides maid’s attire – all of which play a significant role. Even though bridal and wedding businesses have many components, most of the specific shops have seen successful profits and growth in the past few years. Unfortunately, many wedding and bridal stores find themselves in a unique situation right now. While there are plenty of people who are now employed since the 2008 recession, there is much more disposable income, leading to couples splurging on more expensive weddings. The issue however, is that the rates in which people are getting married has significantly declined in the past few years. Luckily, there is some hope: when young couples do eventually decided to get married, they have a bigger wedding budgets. Research has shown that couples who marry later in life tend to have higher wedding budgets and can afford more expensive wedding and bridal products. Even though bridal and wedding shops are doing well, there are plenty of different trends that businesses need to be watching out for.

Wedding and Bridal Shop Business Trends

While there are many different trends going on in the wedding and bridal shop industry, the biggest ones all revolve around technology based platforms, systems, and practices. While many of these technological trends can be expensive to implement at first, with the help of wedding and bridal shop financing, these systems can help to boost profits in the long run.

Technology Based Platforms: The wedding and bridal shop industry has recently seen a huge reliance and transition period to many technological platforms. Some of the most innovative and important technologies being implemented in the wedding and bridal shop industry, especially with the use of wedding and bridal shop loans, include:

- Save the Date Wedding Invitations: Years ago, the only choice people had for save the date wedding invitations were the usual paper card and envelope, with the occasionally creative couple who mixed it up with save the date magnets or some other clever idea. Today, electronic save the date invitations have become commonplace, and many brides and grooms expect wedding and bridal shops to offer these services.

- Mobile Options: Many successful bridal and wedding shops have started to implement mobile apps or websites that allow brides and grooms to easily manage or edit all wedding information. Whether it is adding to do lists, booking hotels, sending out update information to guests, or any other component of planning a wedding that can be done via a cell phone, customers want access to programs like this.

Environmentally Friendly Options: There is plenty of waste and non-eco-friendly products in the wedding and bridal store industry. Just with paper invitations alone, younger couples are demanding alternatives that cater to more sustainable life practices. Living and purchasing products that provide a more sustainable and green lifestyle has become a major expectation among many generations, but in particular with Millennials – who are the biggest demographic that wedding and bridal shop owners cater to. By transitioning into a more technology based

Wedding and Bridal Shop Financing Uses

- Wedding and Bridal Shop Financing for Technology: Technology is revolutionizing the ability of wedding and bridal shops to stay ahead of the competition, with every wedding and bridal shop needing to be implement these new technological systems and practices. Not only will investing in these systems benefit the bridal shop business owner, but it will lead to increased customer satisfaction, which is the main component to any retail environment. There are many different wedding and bridal shop financing options that can help to cover expensive, upfront costs of these technologies, as well as helping to effectively implement them. Whether a wedding and bridal shop loan is used to purchase new point of sale systems, or to launch an easy to use website and mobile application, there are plenty of wedding and bridal store loan choices.

- Wedding and Bridal Shop Expansion and Renovation Loan: Expansion and renovation are always exciting concepts for wedding and bridal shop owners who are seeing positive generated revenues; unfortunately, many business owners can end up in over their heads with expansion and renovation costs. This is why considering wedding and bridal shop expansion and renovation loans can be useful, especially if a wedding and bridal store owner starts to expand or renovate and more unknown costs are thrown into the mix!

- Wedding and Bridal Shop Funding for Marketing, Advertising, and Social Media: Every single industry is finally starting to realize the huge impact that effective content marketing and advertising via social media platforms is having on the business world. Consumers today, especially the younger generations that wedding and bridal shops tend to cater to, are heavily reliant on social media, third party review platforms, and effective marketing campaigns. Marketing, advertising, and social media should no longer be on the backburner of priorities for a wedding and bridal shop, especially when trying to appeal and draw in more Millennials and Gen Y’ers. Unfortunately, too many business owners have no idea how to effectively use social media to market and advertise, which is why many business owners chose to use wedding and bridal shop financing to hire a marketing firm to help boost business profits.

- Wedding and Bridal Shop Financing for Payroll and Hiring New Employees: When a wedding and bridal shop business is doing well, many business owners consider hiring new employees. This can be an exciting venture, however searching, interviewing, and hiring new employees can be a tedious and expensive process, which is why there are plenty of wedding and bridal store loan options to help. Also, if a wedding and bridal shop is not doing so well, sometimes business owners consider cutting payroll costs to cover other important business expenses – but this will always be the wrong choice. Withholding payroll from valuable employees will lead to a disengaged workforce – or it will lead to employees quitting and finding other jobs that will actually pay them on time. When money gets tight, there are always wedding and bridal store business loans to help cover this necessary cost.

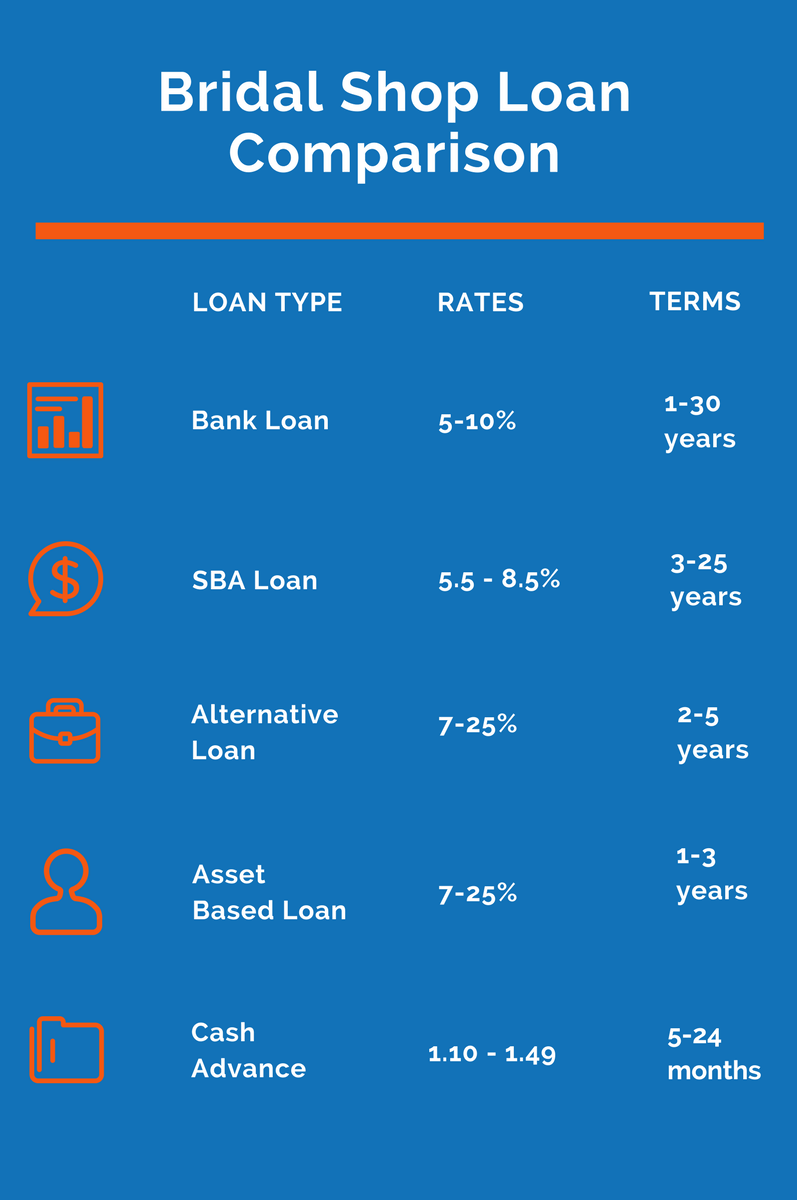

Financing Options for Bridal Businesses

Bridal & Wedding Shop Bank Loans

Bank lending to bridal shops is clearly the most afforable of all the small business lending options. Rates are very low — starting in the mid single digits — and the terms can range from short to long-term. Uses of bank loans are generally for higher funding amounts, and they rarely offer small amounts for working capital – although banks do offer lines of credit to help with the need for operating capital. Bank lending is often used to purchase real estate, purchasing expensive business equipment, refinancing business debt and a variety of other uses

Documents needed by a bridal or wedding shop to get a bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

SBA Bridal and Wedding Shop Loans

Getting a bank loan isn’t easy — especially with banks only approving between 20-40% of all small business loan requests. But, by using the SBA lending program to guarantee your loan, you may be able to get a small business lender to approve your business for financing. SBA loans are simply bank credit facilities provided to small businesses in which the government agrees to cover a portion of the small business lender’s losses should the bridal store fail to repay their loan.

Documents a bridal or wedding shop will need to get a SBA financing:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Bridal Shop Business Lending

If your bridal shop has tried both bank lending and the SBA loan route, but were unable to get approved for both types of financing, the next best business financing option would be to try an alternative loan. Alternative business lenders approve about 70% of all small business loan requests, and the process is much easier to navigate than traditional lending, with funding completed within two weeks of the initial application process.

What a bridal shop will need for an alternative loan:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Bridal Shop Cash Advances

Not every bridal shop will have success with obtaining financing from both traditional and alternative lenders. When all else fails, or if you’re in need of financing immediately, another funding option could be to get a business cash advance. This type of financing isn’t technically a loan, but the sale of the bridal shop’s future receivables (credit card and debit card deposits into the business accounts) in exchange for a lump sum of financing. While cash advances tend to be pricey, sometimes its the only option available.

Documents needed for a bridal shop cash advance:

- Application

- Bank statements