Optical Store Loans

The optical store industry is in a unique position today. Most retail businesses are struggling to cater to younger demographics, but optical stores are struggling to cater to all demographics. It has become increasingly more difficult to offer a variety of in-store optical lens options due to high inventory costs and a rapidly growing dependence on online shopping. Unfortunately, many older generations that are retiring much later in life than previous generations still have a high dependence on in-store purchasing. This has led to optical store owners having to become incredibly creative and customer centric in order to cater to all consumers.

Even though optical stores is facing many challenges today, they have fared very well the past few years. Analysts have shown that since 2011, optical stores has seen increasing revenues, reaching over $11 billion in 2013. With increased profits comes more employment opportunities, leading to the optical store industry growing in employment rates at over 24 percent. Overall, optical store businesses are booming, but there are always needs for optical store financing.

Optical Store Trends

- Competing Against Big Chains: Unfortunately, large incumbent businesses like Walmart and Costco have a huge advantage when it comes to almost any product; and this is no different in the optical store industry. For any optical store owner that has adequate financing however, competing against big chains is still a realistic opportunity. For example, most optical store owners believe that they cannot compete with the low prices offered by big chains, but most of the time, those stellar discounted deals are advertised to simply draw in customers. By the time customers get in the door, they quickly realize that all the other products are not. Sometimes optical stores need funding to obtain great discounts from their wholesalers, which is why there are plenty of optical store financing options to help.

- Consumer Centric with Younger Generations: Many optical stores have to make many expensive transitions, leading to a heavier reliance on optical store loans. These different financing options can lead to optical store owners having more funding to cater to their largest customer base – Millennials. This generation is shaping the way for what the latest fashion trends are all the way to the best optical lenses to buy. Millennials want easy, convenient, and tech savvy businesses to cater to their needs. Focusing on this demographic can be expensive, but it is the most important aspect of running an optical store business today.

- Online and Mobile Services: When it comes to any retail environment, having online and mobile websites and apps is essential today, especially when trying to compete with the big chain optical stores. Through optical store financing, many optical store business owners are able to create easy to navigate and order shopping experiences for consumers everywhere. Optical store financing also allows optical store owners to integrate other technological services that are becoming more and more valuable in the business world.

Optical Store Financing Uses

- Technology Financing: Technology is revolutionizing every single industry in the United States today, and the optical store industry is no different. When it comes to optical store financing, there are a variety of uses for that capital that can help optical store owners implement vital technological systems and practices. Some of the optical store loan options can help with purchasing and implementing top of the line point of sale systems. With these point of sale systems, consumers are treated to a quick and quality experience, as well as optical store businesses having the ability to ring up multiple customers efficiently via tablets. Other technology essentials include mobile websites and apps; back of the house management systems; and so much more. There are plenty of optical store loans to help with this vital transition.

- Marketing, Advertising, and Social Media Funding: Every optical store business owner knows that advertising and marketing are essential components of running a business; however, many businesses in all sorts of industries have been slow to adopt social media marketing and content marketing. These forms of advertising have become unavoidable today, especially because consumers rely on social media for, well, everything! Consumers today also like to be able to find out any piece of information via their phone in an instant, along with third party customer reviews. This is a major reason for considering optical store financing, especially if an optical store owner does not have the ability to manage the business social media accounts; this is when optical store financing allows business owners to hire a marketing agency.

- Expansion and Renovation Loans: It is always exciting when an optical store owner is considering expansion or renovations (or if an eye doctor is thinking about expanding his or her practice to offer optical store services); however, more often than not, there are overwhelming expenses that continuously add up. This is why many business owners turn to optical store finance choices to make sure that there are no issues along the way.

- Hiring New Employees and Payroll Financing: No matter the industry, payroll is an unavoidable expense. Even when money is tight, cutting payroll should never even be a consideration. By paying optical store employees on time, business owners are creating a healthy work environment that fosters growth. By not paying employees, many optical store employees will either quit or become disengaged. When payroll costs become a burden, there are a variety of optical store loan options that can help. If an optical store owner is considering financing to hire new employees because business is doing well (or the first employee!), there are also optical store funding choices for that as well.

- Inventory Funding: For most retail businesses, inventory is vital, and the optical store industry is no different. Sometimes business owners order too much of a certain product, or not enough of a popular item; this can lead to wasted, or missed, capital. This is why many optical stores are turning to inventory management systems in order to prevent errors that can really hurt a business’s financials. There are also plenty of optical store financing options to make this a viable option.

- Working Capital: Having sufficient operating capital to keep your cash-flow positive is important for any optical store and small businesses in general.

Financing Options for Optical Stores

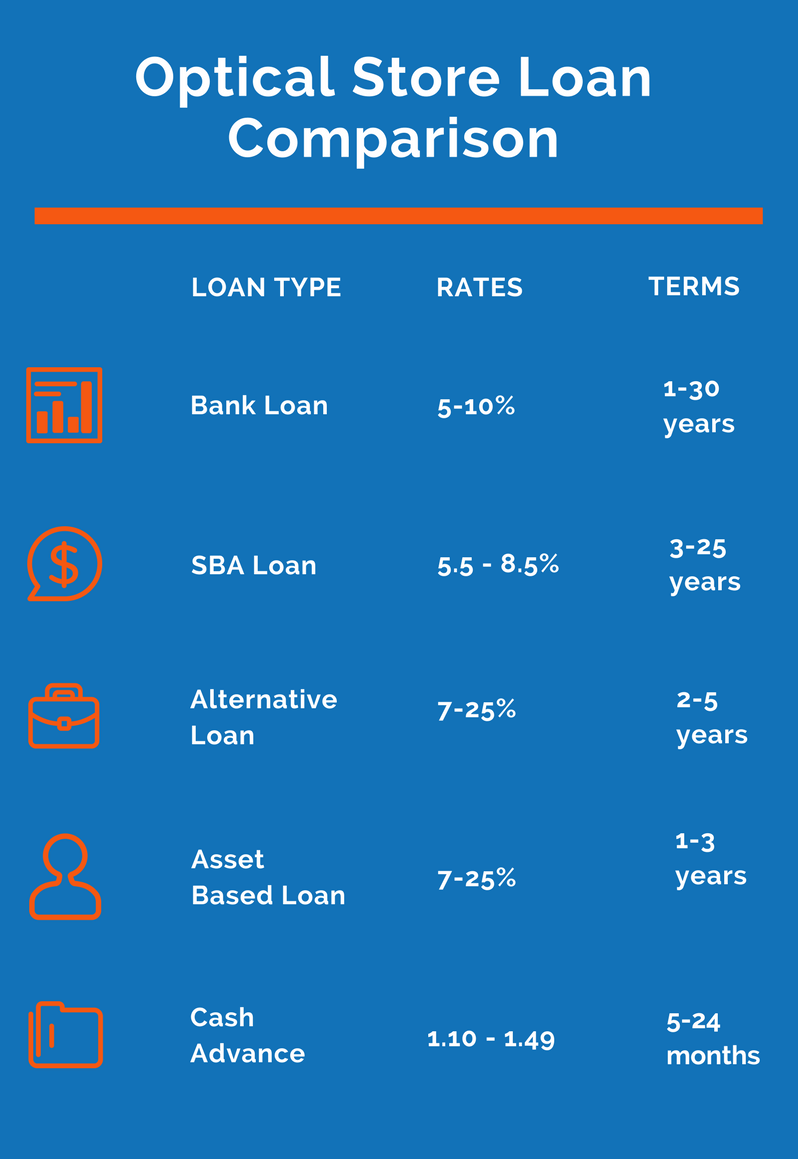

Optical and Eyeglass Store Bank Loans

For many small optical stores, having access to very low-rate financing is important when buying your business, purchasing real estate, refinancing and consolidating business debt, and having sufficient working capital. When looking for the lowest rate loans, getting financing from a bank or community lender is the best option for an optical store.

Documents an eyeglass or optical store will need for a bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Optical Store SBA Loans

SBA lending for optical stores are the next best option for eyeglass stores that want bank-rate loans, but were unable to get approved. SBA loans are great for acquiring an optical store, refinancing optical store debt, obtaining working capital for your eyeglass store, among a number of other uses.

Documents needed for an optical store to get a SBA loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Optical and Eyeglass Store Lending

When an optical has tried to get a bank loan, but found themselves unsuccessful in obtaining one, another option would be to trying the alternative lending route. Alternative loans can fund much faster than SBA and conventional lending, and requires much less paperwork and documentation than traditional lenders require.

Documents needed for an eyeglass store to get an alternative loan:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Optical Store Cash Advance

Eyeglass stores process lots of credit card and debit card transactions each day. If your eyeglass store was unable to get approved for both traditional and alternative lending, another option can be to sell a portion of your optical store’s future business transactions in return for an immediate lump sum of cash. Cash advances are the sale of the optical store’s future receivables, and the loan is repaid by having small amount taken directly from the business bank account or credit card processing transactions.

Documents needed for an eyeglass store cash advance:

- Application

- Bank statements

- Credit card statements (if process credit cards)