Shoe Store Loans

Like any other retail environment, the shoe and footwear store industry is heavily reliant on consumer spending and rapidly changing consumer preferences. With the evolution of technology and the high dependence on social media in the United States today, footwear and shoe store companies have been grappling with utilizing these tools to the best of their advantage. Luckily, many smaller shoe and footwear stores have started to follow suit with incumbent shoe and footwear companies such as Nike. By actively engaging consumers through brand awareness and plenty of social media use, many shoe and footwear businesses are seeing profitability in this highly diverse and competitive industry.

Over the past few years, footwear and shoe businesses have been bustling, mainly in part to increased disposable income amongst consumers. The global footwear industry annual revenue is over $52 billion, with over $29 billion being directly from United States footwear and shoe spending. In the United States alone, there are now over 28 thousand shoe and footwear store fronts – and this does not include the rapidly expanding online shoe and footwear market that has put many shoe and footwear store fronts in jeopardy.

Unfortunately, what is truly hurting and scaring the entire shoe and footwear industry is the confusion surrounding the new president and the uncertainty around particular policies. According to the Footwear Distributors and Retailers of America, one of the largest trade organizations focused solely on the footwear and shoe store industry, one major issue: the United States withdrawal for from the Trans-Pacific Partnership trade deal. As many people are aware of, the Trans-Pacific Partnership was a trade deal between twelve other nations that set new terms for trade and business investment. While the personal sentiments across the country vary regarding this partnership, many bigger businesses, especially in the shoe and footwear industry, were very upset. The Footwear Distributors and Retailers of America talked with some of the largest shoe and footwear store players in the industry, all of whom feel that the withdrawal from the TPP has already drastically effected business sales. Apparently, the TTP deal allowed the shoe and footwear industry to easily reach key markets – namely Vietnam and Japan – that would have allowed many shoe and footwear businesses, and consumers, to save more than half a billion dollars a year.

Overall, the shoe and footwear industry is faring well, and businesses feel confident that they will continue to do even in light of the TPP withdrawal. However, there are also many other essential ways that the shoe and footwear businesses need to consider in order to remain competitive. Listed below are some of the key shoe and footwear store financing needs.

Shoe and Footwear Store Financing Needs

- Shoe and Footwear Store Financing for Technology: One of the most important technological ventures for the shoe and footwear store industry is the investment in omnichannel operations. Through omnichannels, shoe and footwear store owners will be able to compete with the large, big business shoe and footwear stores that are dominating most of the industry today. Through shoe and footwear store financing, there are a variety of choices to help shoe and footwear store business owners invest in effective omnichannel experiences. By offering online shopping alternatives for shoes and footwear, both internet and mobile websites, many shoe and footwear business owners will have a key advantage over other competitors. There is also a technological need to enhance the typical brick and mortar shopping experience, particularly through efficient and top of the line point of sale systems, as well as customer centric data analytic tools. All of these vital technological practices are unavoidable for competitive shoe and footwear businesses, but sometimes these essential systems can be expensive, which is why many retail businesses consider shoe and footwear business loans.

- Shoe and Footwear Store Loans for Marketing, Advertising, and Social Media: Every retail business owner knows that marketing and advertising are essential in the competitive marketplace today, however many industries have been slow to adopt the most important marketing and advertising tool available today – social media and data analytics. Through social media, many shoe and footwear businesses are able to reach large demographics, market customized offers to key customers, and allow consumers to give personal reviews and feedback. This is such a vital technological marketing practice, but sometimes, managing and effectively utilizing social media for business purposes can be difficult and time consuming. Remembering that there are a variety of shoe and footwear store financing choices for marketing is important.

- Shoe and Footwear Store Expansion and Renovation Funding: It is always exciting for a successful shoe and footwear business owner to consider expanding business operations or renovating current locations to improve customer satisfaction. Even though business owners plan for the worst case scenario, unexpected opportunities always arise, which is why it is always important to remember that there is shoe and footwear store expansion financing options to help make this important dream a reality.

- Shoe and Footwear Store Financing for Payroll and Hiring New Employees: For any retail business, employees are the lifeblood of the business – and this is no different for retail shoe and footwear stores. Employees are often trained to become knowledgeable in the shoe and footwear store industry, as well as being taught vital customer service skills. Unfortunately, when times get tough, business owners contemplate putting off payroll to cover other business priorities, but this is always the wrong decision. By avoiding payroll, employees become disengaged and do not bother working hard. Why would they if they are not getting paid? This is why there are plenty of shoe and footwear store loan options to help cover payroll. If a business owner is wanting to bring in more employees to help boost business profits, there are also shoe and footwear store financing choices for hiring those new employees.

- Shoe and Footwear Store Inventory Loans: Inventory is essential for any type of retail business, both online and in brick and mortar storefronts. Unfortunately, inventory also comes with its own frustrations and setbacks. Managing inventory can be incredibly difficult, especially if a certain product is ordered and does not sell, or if there is not enough of a particularly popular item. Thanks to the evolution of technology however, there are so many different types of inventory management systems to help with this complicated, but necessary, matter. Also, shoe and footwear store inventory loans can be used to purchase bulk items that will help increase profits.

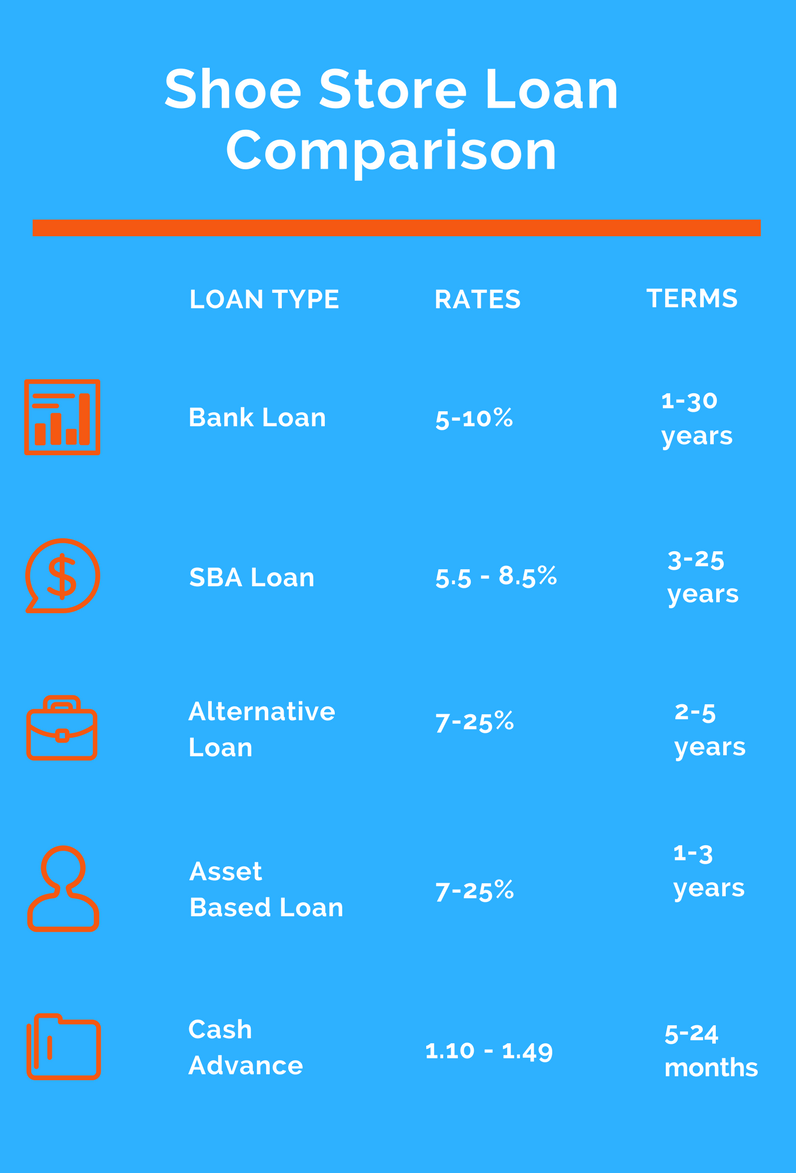

Shoe Store Bank Loans

Bank loans are the ideal financing facility for nearly every shoe & footwear store. Loans offered by traditional banks (large and small banks, credit unions, community lenders) have rates that start in the mid single digits, with terms and amortizations that can be as long as 30 years. Bank-rate financing for footwear stores can be used for nearly any business purpose, including acquisitions, refinancing, consolidation of debt, purchase of commercial real estate, etc..

Documents a shoe store of footwear company needs for a bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Footwear Store SBA Loans

While conventional bank lending offers shoe stores with the best rates available, there are other comparable options, including SBA financing. SBA lending offers shoe stores bank-rate loans to companies with good credit, but who have not been able to get approved for conventional financing. Uses for SBA loans include working & operating capital, refinance of business loans, consolidation of shoe store debt and purchasing real estate.

What documents a shoe store will need to get a SBA loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Loans For Shoe Stores

The first choice of any shoe retailer should be to obtain bank-rate financing, but if you’re unable to get approved, getting the right alternative loan can be an attractive form of financing. While alternative loans offer higher rates than banks, they do offer affordable financing that can be obtained rather easily. Alternative loans can be used for variety of shoe store purposes, but the main use tends to be for working capital.

Documents needed for a shoe store alternative loan:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Shoe Store Cash Advances

Cash advances are a good option for shoe stores that need cash quickly, have bad credit, or lack sufficient financial and business documentation to get a more traditional financing options. Cash advances are the sale of the shoe stores future receivables (either credit card sales or business bank account deposits) in return for immediate cash. Unlike alternative and conventional loans, selling part of your future revenue allows you to obtain financing in as little as 24 hours, sometimes even the same day.

What you’ll need to get a shoe store cash advance:

- Application

- Bank statements

- Credit card statements (if you accept credit cards)