Financing For Caterers

As many people are aware, the 2008 recession hurt too many businesses, and drastically effected many industries for years to follow – some industries are still struggling to rebound from the Great Recession today. Catering and hospitality businesses are no different, but the Bureau of Labor has shown that even during the recession, the catering, restaurant, and hospitality companies fared well. While there were plenty of cut backs and closures throughout among caterers, they still gained 1.6 million jobs during the recession. This means that almost one out of five nonfarm jobs was created during the recession.

For the catering businesses in particular, there has been shocking recent growth in the past few years, leading to the expectation of reaching over $45 billion in the near future. Catering company revenues continue to increase, and customer bases continue to expand. Part of this expansion and growth is due to the lower unemployment rate in the United States today, leading to more people and families having more disposable income. Another major component to this rapid growth among caterers is largely contributed to catering businesses expanding the amount and types of services offered, as well as catering to very diverse and specific consumer preferences. While the catering industry is continuously growing and doing well, there are still many trends that are important to pay attention to in order to remain successful in this diverse and highly fragmented industry.

Catering Business Trends

- Catering to Special Diets: Vegetarian, vegan, gluten free, nut free, dairy free, corn free, soy free, paleo, raw, organic, sustainable, local – consumers are demanding a variety of catering alternatives than the regular meat and potatoes American meal. Every consumer today has a dietary preference, and catering to so many different types of people can be tedious and difficult, however making sure to offer some type of variant options to please at least most of the crowd should be a priority for any catering business. Also, many successful catering businesses suggest broaching the topic of dietary restrictions early on in the catering process. Discussing with clients all of the do’s and don’ts at the beginning can save a lot of time and effort later on. There are a variety of catering business loans to help make this transition and to experiment with different ingredients and recipes.

- Visually Pleasing Meals: When catering an event, it is important to remember that the first thing people notice about the food is how it looks. Bright colors have become the new norm among caterers, especially when it comes to “one bite” dishes, which has also become a highly requested type of catering. People do not want to eat something that is visually unattractive or simply looks gross. Considering catering business financing to help expand the business or to purchase better ingredients can help.

- Catering Workforce: Catering businesses struggle most with finding adequate, qualified, and experienced employees, and when they do find them, it can be difficult to keep those employees on for extended periods of time. The International Caterers Association outlines various tips and tricks to help catering businesses engage with their employees betters, all while fostering a work environment that generates growth and leadership skills. These are important aspects to have in a catering business, especially when employees will be the face of the business when at an event.

Reasons a Natural Health Food Store Would Need a Loan

- Technology: Natural health food stores can excel in this competitive industry by implementing the latest technologies to improve customer satisfaction. Some of the major ways natural health food stores are remaining competitive with technology is offering mobile phone loyalty programs (or apps) that update consumers with the latest deals and savings. Other technological systems that are improving natural health food stores are new point of sale systems that streamline processes for faster customer check outs. There are also back of the house cloud based systems that are helping natural health food store business owners to better manage inventory, increase sales, and to take care of tedious, time consuming work.

- Social Media and Marketing: Marketing and advertising are not handled the same way anymore; say goodbye to newspaper ads and paper flyers. Everything is now digital. Consumers want to be able to look up any piece of information about the natural health food store they are shopping from, all while having access to third party consumer reviews. Through the use of effective social media marketing and content marketing, natural health food store owners have the ability to compete with incumbent health food store giants like Whole Foods, especially when ensuring consumers that they can offer products to fit their sustainability friendly needs.

- Mobile Websites and Ecommerce: Understanding how to effectively and creatively capture the attention of consumers today, especially Millennials, is no easy feat. This is why many natural health food store owners decide to hire outside of the company for these complicated, but vital, business needs. There are a variety of financing options to help make this possible.

- Expansion and Renovations: Business expansions and renovations can be incredibly expensive, and they often end up costing more than anticipated. For natural health food stores in particular, there are certain renovations that could help to boost consumer awareness and profitability. For example, my local co-op in Boise, Idaho decided to install solar energy systems to help promote more sustainable energy practices in the community! There are a variety of loan options to help natural health food stores achieve their goals while promoting better sustainability practices.

- Inventory: Inventory is one of the most essential components to any retail business, but with a food store, managing inventory can be difficult. Often times, food store retailers stock up on popular items and then the food expires; or food retailers do not stock up on enough of a certain product which can lead to disgruntled customers. There are a variety of inventory management systems on the market today that take the usual hassles out of managing and ordering inventory. Through advanced analytics, these technological systems make it easy and convenient to manage inventory for a natural health food store. There are also plenty of funding options to consider when purchasing this expensive equipment.

- Hiring New Employees and Payroll: Employees are the lifeblood for any type of retail establishment. If a natural health food store is doing well, business owners often consider hiring more employees to expand operations; this can often be more tedious and expensive than many people realize, which is why there are financing choices to consider before embarking on hiring new employees. Covering payroll costs of current employees is also an important aspect of running a natural health food store. Unfortunately, when money gets tight, too many business owners consider delaying payroll, but this should never even be an option. By delaying or holding payroll, many employees become frustrated and often quit or become disengaged, which can hurt the business much more than cutting another cost. Remembering that there are loan options to help cover payroll costs is essential.

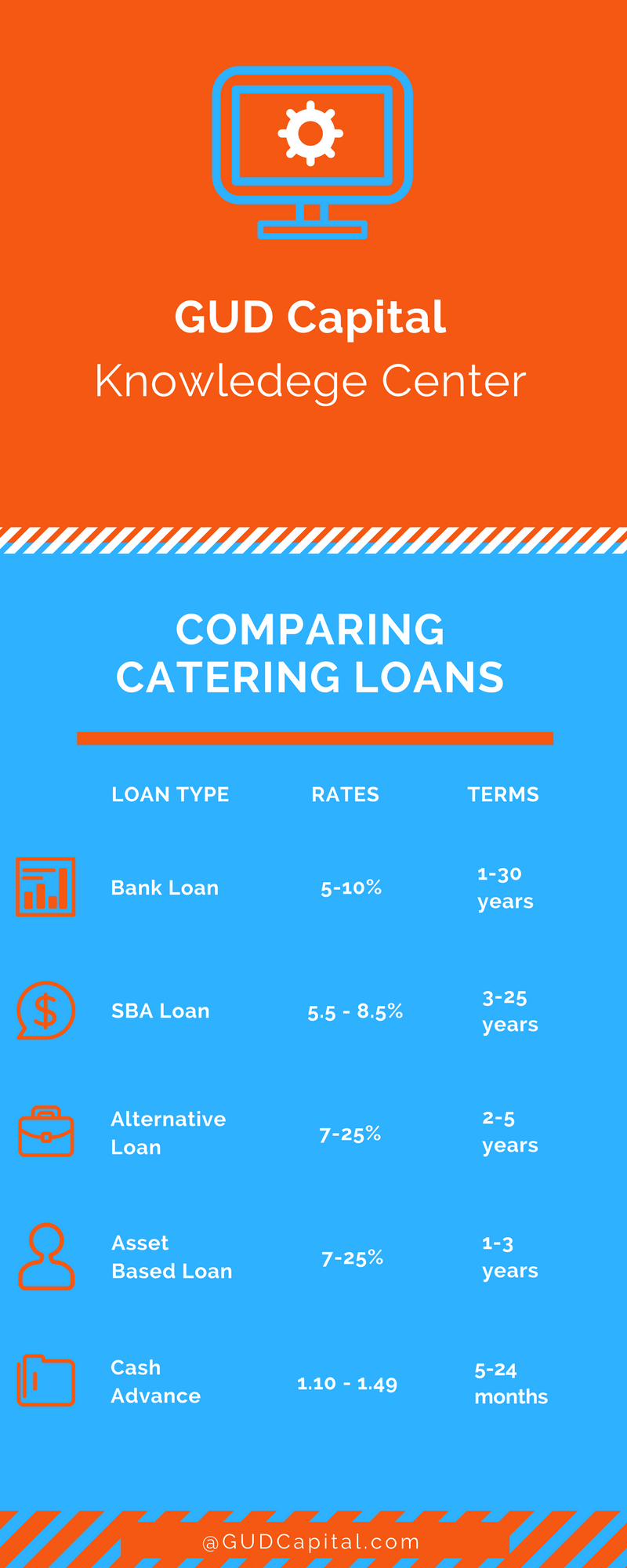

Catering Company Bank Loans

Catering company bank lending is clearly the preferred choice for any caterer. If you are able to get approved for a bank loan, you can expect to get the best rates available to caterers, and also the most desirable terms. Uses of a bank loan include purchasing your business, expansion of your catering company, working capital to take care of expenses, and a variety of other uses.

Documents needed by catering company to get a bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Catering Company SBA Financing

SBA lending is the perfect financing option for well-established caterers that haven’t been able to get bank financing, but have solid financials and business credit. SBA loans can be by a caterer for a variety of uses, including purchases, catering company operating capital, refinancing your catering companies business loans or consolidating your catering company debt, along with many other uses.

Documents a catering company will need for SBA financing:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Catering Company Alternative Lending

Alternative business loans are a great financing choice for catering companies that are in need of quick financing, or who are unable to get approved for SBA lending. Alternative catering loans fund very quickly (usually in one to two weeks) and require a fraction of the paperwork traditional business lenders require. Uses for alternative fintech loans for caterers are mostly used for catering hall working capital purposes, advertising and marketing your catering business, and other short term uses.

Documents needed for catering alternative business lending:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Catering Company Cash Advance

A quick and easy way for catering companies to obtain cash to help with expenses, a catering or restaurant cash advance isn’t a loan but the sale of future catering company receivables. Either by selling future credit card sales or by selling future bank account deposits, the funding process is very swift with funding within 24-72 hours.

Documents needed for a catering company cash advance:

- Application

- Bank statements

- Credit card statements