Understanding Waste in the United States

The average American produces about 4.4 pounds of trash every single day, and with over 324 million people in the United States alone – well, that is quite a bit of waste and trash. The Environmental Protection Agency (EPA) estimates in their annual reports that the average American generated over 250 million tons of garbage in 2013 alone. On the bright side, the Environmental Protection Agency also showed that in 2013, recycling and composting from Americans did prevent 87.2 million tons of waste and junk materials from being disposed; this means that approximately 186 million metric tons of carbon dioxide was not released into the air, which is equivalent to taking over 39 million cars off the road for one year.

That is great progress for America, but there is still a long way to go, especially as the American population continues to increase. The EPA also shows that the largest segment of waste in the United States is organic materials such as paper and paperboard, yard trimmings, and food – all of which can be composted or recycled. This is an ongoing major environmental issue that is drastically increasing greenhouse emissions (thus trapping more heat and impacting global warming), however over consumption and increased waste has led to one of the most recession proof and bustling industries in the country today – the junk and waste removal industry.

Junk and Waste Removal Industry

Simply put, the size of the waste and junk removal industry is highly dependent on the amount of waste produced in each area. Since Americans are producing so much waste, as mentioned above, it is obvious that the waste and junk removal industry is massive. Actually, it is a multibillion-dollar industry in the United States. But what does the junk and waste removal industry really do?

- Waste Collection: Waste collection is usually what people think of when they think about the junk and waste removal industry. Waste collection accounts for 55 percent of the industry’s total revenue.

- Waste Treatment and Disposal: At 20 percent of industry revenue, waste treatment and disposal are the second biggest component to a junk and waste removal business. Through waste treatment and disposal, junk and waste businesses find ways to get rid of all the waste collected, which is most often done through composting, incineration, landfill, and recycling.

- Remediation: Remediation accounts of 15 percent of the annual revenue for the waste and junk removal industry. Remediation involves cleaning hazardous and toxic waste and safely removing and disposing it. This hazardous waste typically includes oil spills, contaminates on the ground, asbestos and lead paint removal, restoration of strip-mined areas, and so much more.

In this $75 billion industry, waste collection represents the largest segment of the junk and waste removal industry; transporting and processing waste and recyclables accounts for the smallest portion of junk and waste removal industry revenues; and waste disposal (including landfilling and waste-to-energy) accounts for around 28 percent of industry revenues – and the industry is only continuously growing.

Junk and Waste Removal Industry Trends

As mentioned above, the junk and waste removal industry is booming, and it is only going to continue to grow as the American population continues to grow. Even though most waste and junk removal businesses are faring well in the United States, there is still plenty of competition, especially against the large incumbent businesses that dominate most of the industry. In order to stay ahead of the competition in this highly diverse industry, there are a variety of trends to be paying attention to over the next year.

- “Consumer Society” Mentality: Many consumers today are trying to be more conscientious about environmental issues and waste, however, as mentioned above, there is still too much waste in the world. America is often considered a consumeristic society that always wants more, but then gets rid of those items when they need to make room for more new items. The junk and waste removal industry is constantly growing, and is definitely here to stay, thanks to American consumerism. This has led to a niche area that junk and waste removal businesses can focus on (i.e. large, wealthy home areas). Another key area that American consumerism has effected is the self-storage industry. The United States alone accounts for almost 90 percent of the global self-storage market, with over 50,000 locations nationwide. This means that when it is time to get rid of storage items, junk and removal waste businesses are able to capitalize on it.

- Housing Market and Moving Americans: Over the last few years, the United States has finally started to see a rebounding housing market. This has led to more and more Americans moving or buying new homes; this is a trend that will continue to grow, especially since the average American moves up to twelve times in their lifetime. As many people have personally experienced, when it is time to move, plenty of old junk items get thrown away in the process. So naturally, as the housing market continues to improve, more Americans will continue to move around (or buy homes), and then there is more opportunity for junk and waste removal services.

- Recession Proof Industry: While recessions affect every single industry, with the 2008 Great Recession having some of the worst repercussions of any other recession, the junk and waste removal industry can still profit. With the overwhelmingly large population of the United States today, there is no way that all junk and waste removal services will be considered a “disposable income” service for consumers. This has led to many junk and waste removal businesses remaining successful, even during difficult financial times.

- Landfill Diversion Services: A unique service that more and more junk and waste removal businesses are starting to offer is landfill diversion services through reprocessing and/or repurposing. American consumers are trying to be as environmentally friendly as possible today, and when choosing a junk and waste removal business, knowing that a particular company will do everything in their power to reuse or recycle products can be the deciding factor. While not every junk and waste removal business will offer this, it can definitely increase revenues for many junk and waste removal companies.

Loan Options for Waste Removal Companies

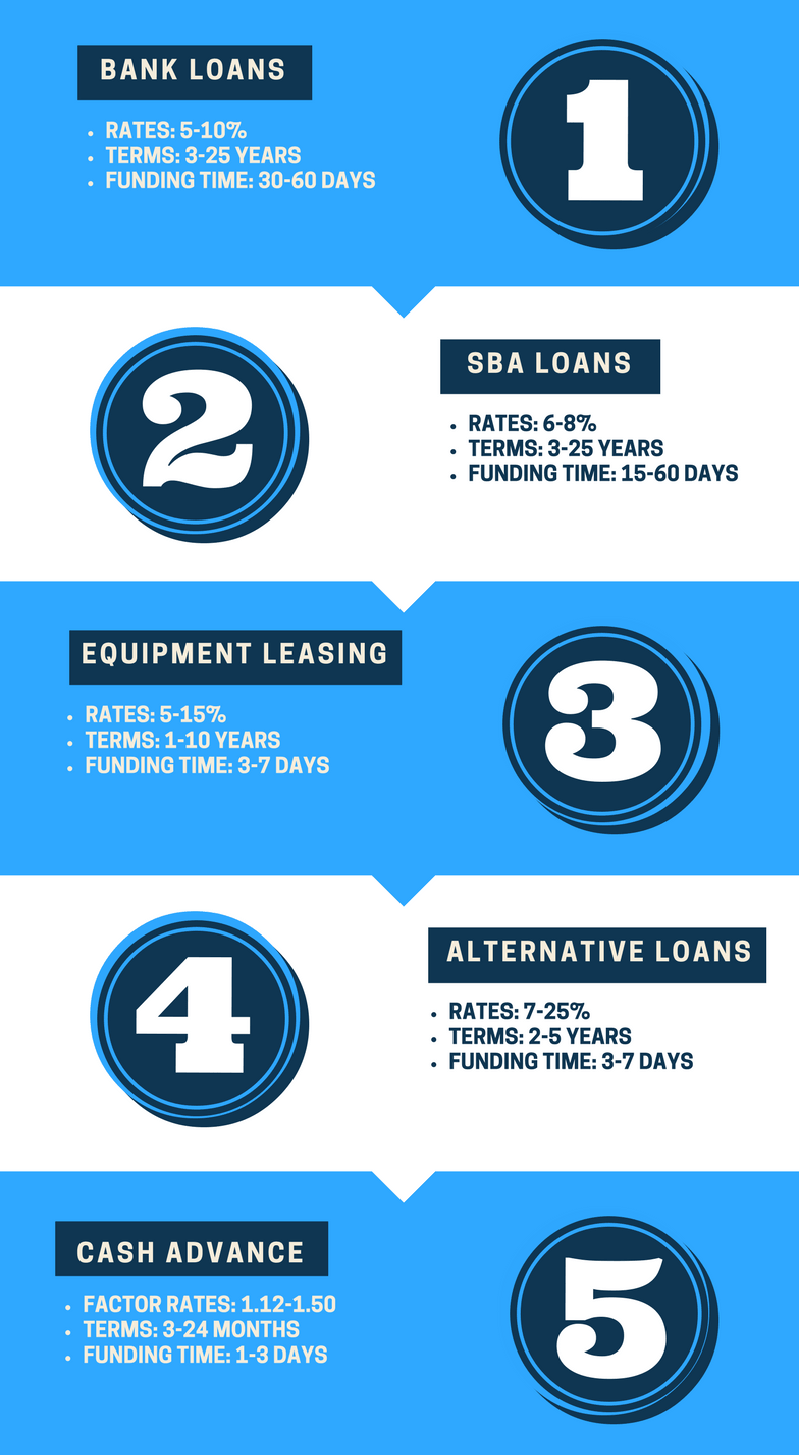

Waste Removal Company Bank Loans

Getting traditional business loans from a bank is never easy. But with good credit, solid business revenues and collateral, a waste removal company will get the best business loan available as far as rates and terms. Bank business loans may take a long time to complete the funding process, but the end result is well worth it. Whether the uses are for purchasing real estate, refinancing real estate or business debt, working capital, purchasing equipment, etc. a bank loan is the best option available.

Documents waste removal and junk pick up companies need for a bank loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

Waste Removal Company SBA Loans

SBA waste removal loans are very similar in both rates and terms as you would any other business loan a company would get from a bank. The main reason for that is because SBA lenders are traditional lenders that utilize the Small Business Administration’s loan guarantee program. This programs allows waste removal companies to get bank-rate loans for companies with borderline bank-rate credit and profitability. Uses of a waste removal SBA loan include: purchase or acquisition, startup costs, working capital, refinancing debt, etc.

What a waste removal company will need to get a SBA loan:

- Tax returns

- Financial statements

- Debt schedules

- Personal financial statement

- Personal tax returns

Alternative Waste Removal Company Loans

Alternative fintech business loans are the mid path between bank and SBA lending, and the higher-rate sale of future receivables and ACH financing. Alternative loans require much less business and personal financial documentation than conventional business lending options, and fund within a fraction of the time as traditional business lenders.

Documents needed for waste removal alternative business lending:

- Tax returns

- P&L

- Debt Schedule

- Application

- Bank statements

Waste Removal Company Cash Advances

While technically not a loan but, instead, the sale of the waste removal companies future receivables, a cash advance is a way for a company to obtain immediate financing with minimal paperwork. As opposed to waiting weeks or months with traditional and alternative lenders, a cash advance can be approved within minutes and fund within 24 hours in most cases.

Documents needed for a waste removal company cash advance:

- Application

- Bank statements

- Credit card statements