Arizona Business Funding

Arizona business owners have been feeling incredibly optimistic and excited about the current and future business climate of the state. Over the years, the state of Arizona has experienced a stable and growing economic climate with lowering unemployment rates – all of which are largely due to the positive state of the small business sector in Arizona.

According to the Small Business Administration Small Business Profile, there were 511,828 small businesses in Arizona with 98,257 of those small businesses having employees (making 413,571 small businesses in Arizona non-employers) in 2013-2014. In total, there were over 955,194 workers employed by small businesses in the state of Arizona for those last recorded years. These businesses contributed to an economic growth rate of 1.1 percent, which was slower than the United States national average of 2.2 percent. However, there was a rapid decline in unemployment rates throughout the state; in 2013 alone, the unemployment average in the state of Arizona dropped from 7.8 percent to 6.8 percent. This has contributed to a favorable business climate for all business owners in the state of Arizona.

Benefits of Running a Business in Arizona:

As mentioned above, the state of Arizona has seen continuous year after year improvement since the 2008 recession that has left many business owners still struggling to rebound from. Luckily, Arizona residents and business owners have been lucky enough to enjoy a stable business climate, as well as manageable tax rates, a stable economy, and a highly skilled labor force. The Greater Arizona area is also recognized as a state that offers minimal regulatory approaches, no corporate franchise taxes, top economic programs to support businesses, and a huge supporter of the pro-business climate. Some of the top benefits to running a business in the state of Arizona include:

- Low and Manageable Tax Rates: Most business owners make business decisions, especially where to start and open up a business, by the tax rates and climate in each state. Arizona is known for low and easily manageable tax rates and conditions, which is why the state of Arizona has continued to see growth in many business sectors. The sales tax in the state of Arizona is at 5.6 percent, with the corporate income tax at 6.968 percent. Coupled with a personal income tax ranging from 2.59 to 4.54 percent, many business owners in Arizona would agree that the Arizona tax rates are relatively manageable and agreeable – although the overall tax conditions will still vary from county to county in Arizona, so many business owners do plenty of research before picking the ideal spot to create an Arizona business.

- Growing and Stable Economy: The state of Arizona has some of the best signs of a steadily growing and consistently stable economy. From 2010 to 2014, a major recovery period for most states throughout the United States, Arizona saw consistent economic growth, with only one year of economic growth being below the 2 percent mark. This has allowed a level of security and comfortability for many of the state of Arizona’s residents and business owners, as well as other businesses in surrounding states. This is coupled with stable and low real estate costs that have contributed to an influx in new businesses relocating to the state of Arizona. A seven year study by Spectrum Location Solutions found that Arizona is the third-best market for California businesses that are leaving the state – and so far, over $68 billion in capital has been diverted across more than 1,5000 states, with Arizona being a large beneficiary of those divestments.

- Lowering Unemployment Rates and Growing Labor Market: Year after year, the state of Arizona has continued to experience a lowering unemployment rate, which is currently around 5 percent; while this is relatively higher than some states right now, it has remained stable and consistent, and the 5 percent rate is still lower than the national average unemployment rate. However, those states that are experiencing lower unemployment rates are struggling to find qualified, skilled employees, making the labor market highly competitive. With the steady 5 percent unemployment rate, Arizona business owners still have plenty of options when it comes to hiring skilled, educated employees with a variety of talents and skill sets.

Challenges of Running a Business in Arizona:

Like every other state, Arizona business owners have seen plenty of business fluctuations. While the business climate for small, medium, and large sized businesses is positive in the state of Arizona right now, there are always difficulties for business owners in the states they operate their businesses in. Some of the top challenges associated with owning and operating a business in the state of Arizona include:

- Less Disposable Income for Arizona Residents: While the cost of living in Arizona is reasonable, per capita income is much lower than the national average. This means that all of the businesses that rely heavily on Arizona residents and their disposable incomes are struggling – which is many of the small businesses in Arizona. This major issue coupled with the limited access to capital that small Arizona business owners are dealing with has left many small business owners struggling. This has also fueled the minimum wage hike that has become a major controversy in the Arizona business world. By 2020, the state of Arizona will be required to meet the $12.00/hour minimum wage requirements, which many business owners are struggling with. However, this minimum wage hike will also be essential in raising the per capita income of the state’s residents.

- Access to Capital: Many states across the country today are struggling with access to capital, even as the financing climate continues to improve since the Great Recession. In Arizona in particular, access to startup capital is even more difficult. Entrepreneurs in the state of Arizona are struggling to differentiate themselves from other entrepreneurs with similar ideas, particularly because obtaining the limited startup funds in the state of Arizona is incredibly difficult. All in all though, businesses in Arizona are faring better than other states in terms of access to financing.

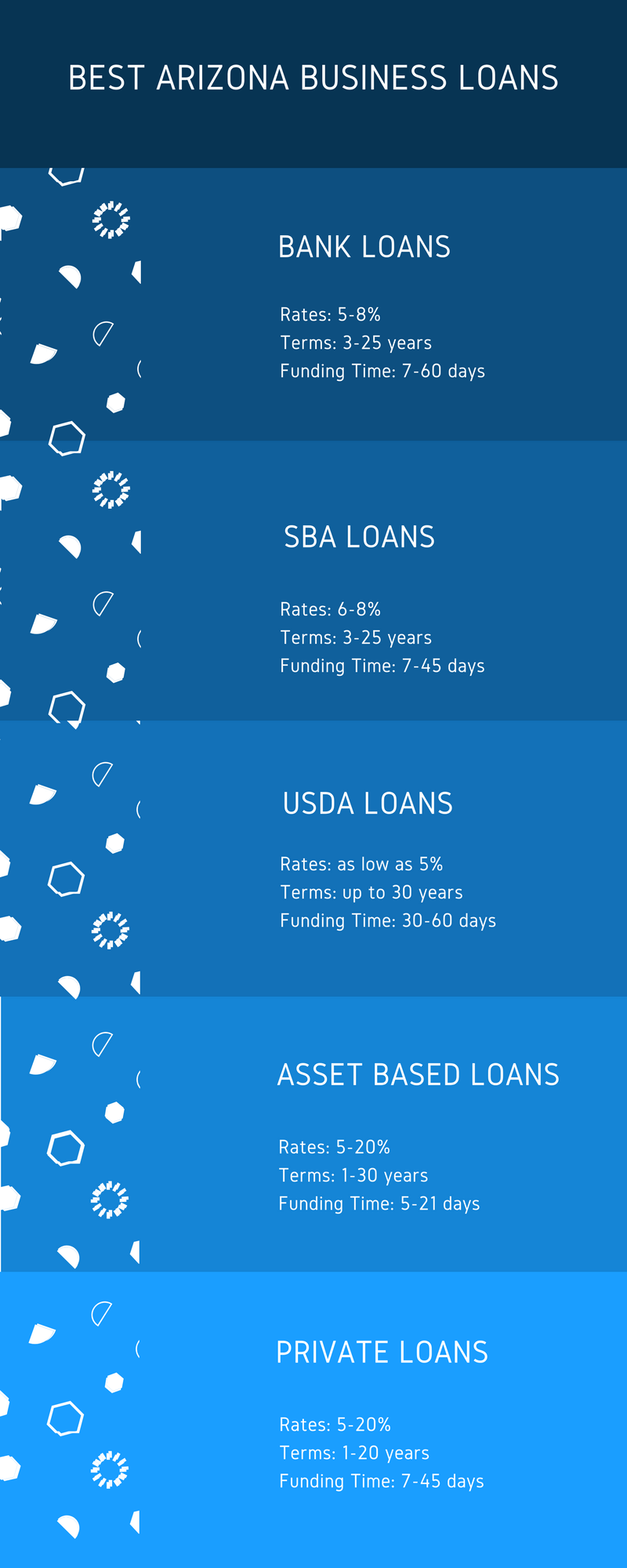

Types of Arizona Business Loans:

- Bank Loans: Conventional business loans and lines of credit from a bank or credit union is usually the best way for Arizona businesses to get the best rates and longest terms. Simply put, bank financing is clearly the top choice for businesses looking for the cheapest cost of financing. Bank loans are used for a variety of uses, including purchasing and refinancing commercial real estate, upgrades, expansion and working capital.

- SBA Loans: This type of business financing involves having a conventional lender provide financing to an Arizona small difference. The only difference between a SBA loan and conventional bank lending facility is that the US government backstops SBA loans. That means if the Arizona small business should default on their SBA loan, the lender won’t be fully-exposed because the Small Business Administration agrees to cover much of the lender’s losses.

- USDA Loans: Loans provided through the USDA are much like SBA loans in that the bulk of financing is covered by the US government. The main difference between a SBA loan and USDA loan is the area in which the small business operates. In order to qualify for an USDA loan the small business much be in a rural community with less than 50,000 inhabitants.

- Asset Based Lending: This type of financing involves using your company’s or personal assets as collateral to obtain business financing. Asset based loans are good options for Arizona small businesses that have good accounts receivables, equity in commercial real estate, or have valuable equipment and machinery.

- Factoring: This is a type of alternative financing/asset based lending that involves selling a portion of your unpaid invoices to a factoring company in order to obtain immediate financing. The factoring company will usually forward between 75-95% of the invoices value, subtract a small fee for themselves, and then forward you the remaining amount once the balance has been paid.

- Private Business Loans: This type of financing is a form of non-bank, institutional and fintech loan provided by online lenders and private investors. Non-bank private loans are a great choice for Arizona businesses that are profitable, but need a financing facility that is more flexible than the loans provided by Arizona banks.

- Equipment Leasing: Rather than pay the full cost of a equipment upfront, another option could be to simply lease the equipment rather than purchase it. By leasing the equipment, Arizona businesses are able to obtain access to crucial business machinery and equipment with having to pay a minimal down payment.

- Merchant Cash Advance: This unique type of working capital financing involves selling a portion of your future receivables to a funding company so you can get paid for work you’ll be doing over the next 3-21 months. Merchant cash advances are a good form of financing for companies that needs loans fast, or for companies and Arizona business owners with bad credit.

Conclusion

There are hundreds if not thousands of small business financing options for Arizona companies. The key to making sure your company flourishes is to obtain the best possible financing at the lowest cost of borrowing. But understanding all these options can take a ton of work and time that you may not have. If you need help understanding and obtaining all the different forms of financing for Arizona companies, please reach-out to one of our financing specialists, and we’ll help you navigate the process.