Low Doc Business Funding

While every business would like access to affordable business capital, not all businesses meet the requirement to get financing from a conventional commercial lender. Most lenders are going to require a full-array of business and financial documents of the business, and maybe require personal and financial documents of all the company’s owners. But, unfortunately, for a variety of reasons a company may not be able to provide the documentation that a large bank, small bank, community bank or credit union will require to underwrite and fund a loan. In this article, we will take a look at the options for you to fund your business without having to provide lots of documentation.

Why Do Businesses Want Low Doc Loans?

There are a variety of reasons a business may want to obtain a business loan with limited or no documentation. The main reason many businesses seek low-doc loans is because the documents they have won’t support what a lender looks for when they underwrite loans. If you have limited or no profitability, the chances of obtaining a conventional bank loan is slim at best. So, obtaining a low-doc business loan or low-doc working capital funding may be the only option available.

Why Do Lenders Generally Require Lots of Documents?

Lenders are not only lending their own many, but oftentimes they are lending out their own investors money. By lending investor money, it is the responsibility of the institution to reduce the risk associated with the debt facility, to make sure that investor money is in a position to get the best return possible. To help reduce the lender’s and investor’s risk, they will look at past performance of the company to get an idea of what the company’s revenues will look like in the future. If the company doesn’t exhibit the proper cash-flow to support a new loan, the lenders simply won’t provide it.

Low Doc Business Loan Options:

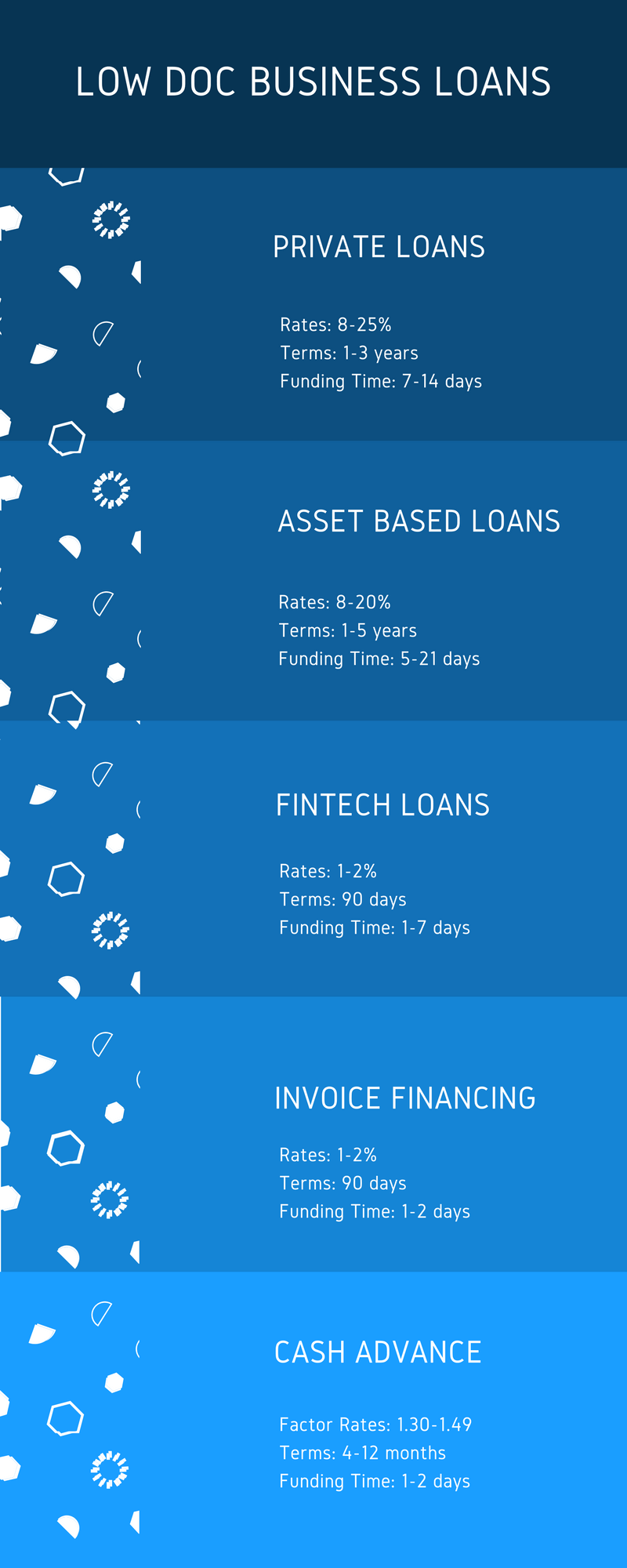

- Low Doc Private Loans: non-bank private business loans are a great way for small businesses seeking quality rates and decent terms to get a financed without having to provide a significant amount of business and financial documentation. Private business lenders are able to offer creative underwriting and financing products with flexibility that more conventional lenders don’t offer. Documents needed for a Private Business Loan.

- Application

- Two years tax returns

- 1 year financials (and YTD)

- Debt schedule

- Bank statements

- Low Doc Fintech Loans: this type of financing is generally offered online institutional lenders looking to fill the gap between conventional lenders like banks and SBA lending institutions, and the high-interest, high-risk business funders like merchant cash advance companies. Fintech and marketplace loans don’t have terms as long as bank loans, but do have terms that range from one to five years, and have terms that start near bank-rate, but can go up into the high-teens. Documents needed for a Fintech Loan:

- Application

- 2 years tax returns

- 1 year financials (and YTD)

- Debt schedule

- 6 months bank statements

- Equipment Leasing: Financing your business equipment and machinery by leasing rather than purchasing the equipment outright is a good choice for small businesses looking to keep as much capital in their accounts as possible to obtain the equipment. When a small business seeks a lease, a leasing company will purchase the equipment for the business, and then lease the equipment to the business for a period of time. Usually at the end of the lease, there is are options for the business to refinance the equipment, purchase for as little as one Dollar, or return the equipment to the financing company. What’s great about equipment leasing is that the documents needed to get financed are limited, and sometimes require only an application and purchase order. Documents needed for an Equipment Lease:

- Application

- Purchase order

- Financials if over $100,000

- Low Doc Asset Based Loans: ABL financing relates to any financing that involves using your personal or business assets as collateral for funding. Since there are variety of assets that may be pledged as collateral, each type of loan will be structured differently than other asset based loans. Common types of assets used for an ABL include personal real estate, commercial real estate, business equipment and machinery, company inventory and other assets. Documents needed for Asset Based Lending:

- Application

- Appraisal

- Financials

- Invoice Financing: This is a very easy form of financing for businesses that need cash quick, have businesses that owe you money for services already performed, and don’t want to go through a process that requires the need to provide lots of business or financial documentation. Invoice factoring is the sale of individual unpaid 30-90 day invoices to a 3rd party in exchange for immediate financing that can be completed within a day or two. After the business presents the factoring company with the unpaid invoice, the factoring company will then forward up to 90% of the invoices value, charge a small fee between 1-3%, and then forward the remaining amount to the business once the invoice is fully-paid. Documents needed for an Invoice Factoring:

- Unpaid invoice

- Application

- Low-Doc Commercial Real Estate Mortgages: Almost all conventional business lenders will require substantial documentation before offering a long-term mortgage or other commercial real estate loan. Low-doc commercial property loans are a way for real estate owners and investors to obtain a mortgage without having to provide tax returns, financial statements, and other documents. With low-doc commercial real estate mortgages a company that is facing a balloon payment is able to get financing fast, and without having to prove income. But a low document real estate loan comes with a price, and the rates will definitely be much lower than conventional financing, and the terms generally max-out at 8 years (as providing a long-term financing poses too much of a risk without providing documents.). Documents needed for a low-doc Mortgage:

- Application

- Appraisal

- Use-of-funds

- Insurance

- Low Doc ACH Cash Advances: A merchant cash advance may be an ideal financing option for businesses that have bad credit, need financing very fast, don’t have the profitability that a conventional lender looks for, or don’t have the documents needed to get traditional business lending. A cash advance isn’t a loan at all, but it’s the sale of future business receivables to a 3rd party that allows small businesses to access money they would be receiving over the next months or years. An ACH business loan is a type of merchant cash advance where the repayment to the funder happens through Automated Clearing House transactions that are deducted from the business’s bank account each business day. The payment associated with the ACH payment is always fixed, in that the amount is set, and the same amount is always deducted. Documents needed for an ACH Cash Advance:

- Application

- 6 months bank statements

- Low Doc MCA Split: Merchant cash advance split funding is another type of purchase of future receivables that involves a different type of repayment to the funder than happens with an ACH payment. A MCA split repayment involves having the funding company take a percentage of the small business’s merchant credit card processing transactions. Instead of having a set amount taken from the business’s bank account each day, with a MCA split funding company will take a percentage of each transaction. On days when you have less sales, the total repayment will decrease. Documents needed for an MCA Cash Advance:

- Application:

- Bank statements

- Merchant processing statements

Conclusion

As you can see there are not a shortage of options to finance your company with low or no documents. The key to getting the best low-doc loan for your company or commercial real estate is to know all the options and shop around for the best rates, terms and fees. If you feel like you may need help during this process to learn about all the options, and then shop for the lowest rates, reach-out to one of our funding specialists, and we’ll help you’ll navigate the process.