Georgia Business Funding

Just about every company seeks some sort of debt financing at some point for working capital, acquisitions, purchasing inventory, refinancing business debt, refinancing a commercial mortgage and many other reasons. As for Georgia businesses, they are no different as hundreds or not thousands of Georgia businesses seek financing each and every week. In this article we will look at the state of Georgia, its small businesses and the financing options available to them.

The State of Small Business in Georgia:

Georgia has seen many ups and downs in the past few years, but the small business scene in the state of Georgia is blossoming. By the end of 2015, there were 982,112 small businesses in Georgia, or 97.7 percent, with 1.5 million of those Georgia small businesses being employers, or 44 percent. These strong small business rates have contributed to an improving economic climate, which Georgia has not seen for many years, and a lowering unemployment rate. By the end of 2015, the unemployment rate was down to 5.5 percent, which is still slightly above the 5 percent national average. Overall, doing business in Georgia is leaving many business owners optimistic about the next few years.

The Benefits of Running a Business in Georgia:

The business owners in the state of Georgia are currently feeling optimistic, but this optimism is relatively new. Georgia has been one of the slowest states to recover from the 2008 economic recession that devastated business owners everywhere. There has been sluggish economic growth in the state of Georgia for the past few years, however, business owners are remaining optimistic due to the business friendly environment that the state of Georgia has created. Some of the main benefits of running a business in the state of Georgia include:

- Manageable Taxes and Regulations: Georgia has always been known to have a favorable tax and regulation climate for business owners, both small and large business owners. Georgia has implemented a 6 percent personal income tax, with a similar corporate tax rate for C Corps. The state of Georgia also has a 4 percent state’s sales tax, not including the local sales tax, all of which varies depending on what county the business owner operates in. Unfortunately, Georgia’s tax regulations do have some down sides. Many business owners claim that if a business is operating in more than one county, the tax situation can become pretty complex. Business owners are required to file sales tax information on a monthly basis – but sales tax varies from county to county, making it frustrating at times for business owners who have to file sales tax information for multiple counties. All in all though, Georgia business owners agree that while it is not ideal to deal with the sales tax burdens, the overall tax climate is fair, reasonable, and manageable for all Georgia business owners.

- Locals Love to Support Their Small Businesses: Many larger, metropolitan cities throughout the United States are experiencing strong, supportive communities who want to support their local small businesses – and Georgia is no different, particularly in the major city hub of Atlanta. Also, locals claim it is just good old fashioned southern hospitality and the mentality that the South has about supporting their communities. Customers have remained loyal to their communities in Georgia, and those same residents have become accustomed to doing all that they can to support their new entrepreneurs. This strong community support has created a large network for long-time business owners and startup entrepreneurs alike, contributing to a major resource network for many business owners in the state of Georgia.

- Access to Atlanta: Atlanta is home to over 5.5 million people, helping the city to become a major, bustling hub for businesses everywhere. This large city has created a large, diverse market for entrepreneurs who are willing to take a chance on a creative, innovative idea. Business owners throughout the state of Georgia agree that the major metropolitan area has been a major contributor to businesses thriving throughout the state of Georgia. Atlanta has also become home to a bustling and constantly growing technology hub that has played a vital role in the growing technology industry – some Atlanta locals have even claimed it has attracted to many young and innovative talents that it is starting to have a Silicon Valley feel to it.

The Challenges of Running a Business in Georgia

While the state of Georgia has created a very friendly environment for business owners in every industry, there are still many difficulties that his growing hub is facing. Access to capital and a slow economic recovery have made it difficult to start a new business, even if there is local support in Georgia. Some of the biggest challenges being faced by Georgia business owners include:

- Significant Decline in Per Capita Personal Income and Tough Labor Market: Georgia has one of the lowest per capita personal income rates than most of the United States, which is surprising because so many businesses are finally starting to recover from the recession. The lack of discretionary dollars has made the business environment incredibly competitive in order to fight for customer loyalty – and their limited disposable income. This vicious cycle has been fueled by the tough labor market in the state. Many locals claim that Georgia is the best state to work, but they fail to mention that the business-friendly environment is centered around business owners and big businesses – not the average working person living in Georgia. The low wage that employees make has helped fuel the lower than average per capita personal income, which has also continued to the unemployment gap. This still remains a huge issue for Georgia residents.

- Access to Capital: While access to capital has become difficult for many business owners throughout the United States, Georgia small business owners and startup entrepreneurs have had a particularly difficult time accessing financing needs and resources. Many business owners in the state of Georgia claim that without collateral and quite a few years of steady business, most business owners have no shot at obtaining funding. However, Georgia has seen a gradual increase in Small Business Administration, or SBA, loans for small business owners, which many business owners in Georgia are claiming is the best way to obtain loans today.

- Slow Economic Recovery: Luckily, the past few years have been modest economic growth for the state of Georgia, but for many years after the 2008 recession, the business owners throughout Georgia struggled. Basically, Georgia has dealt with some of the longest recovery periods from the recession than many other states in the United States. Many Georgia business owners believe the market is still recovering too slow – and it is. Georgia saw an incredibly slow economic growth rate of .9 percent for many years, resulting in many Georgia business owners struggling.

Types of Georgia Business Loans

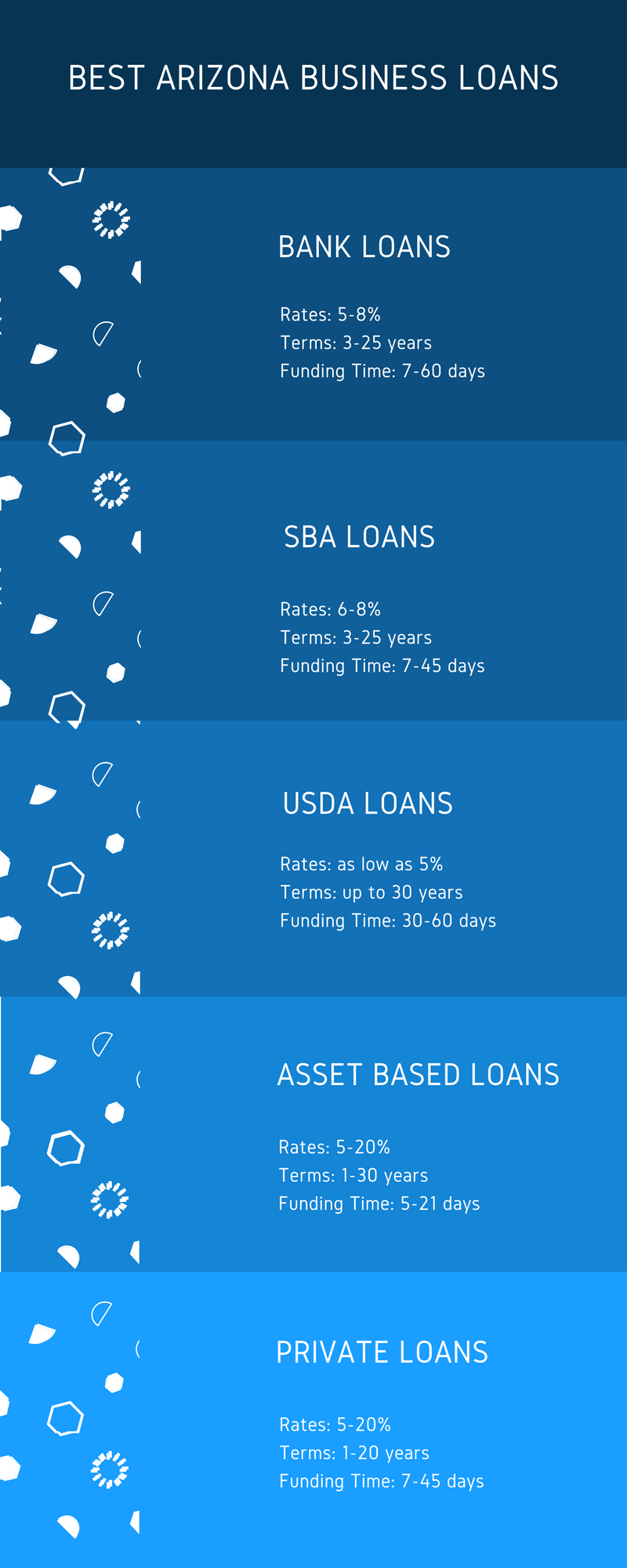

- Conventional loans: traditional bank business financing is usually the first choice of any business – including Georgia small businesses. The reason that traditional banks, credit unions and community lenders are usually the first choice of any business looking for debt financing is the fact that these lenders offer the lowest rates and best terms of all commercial lenders.

- SBA Loans: another form of conventional financing that is used in conjunction with a SBA enhancement used to entice traditional business lenders to provide financing to quality businesses that may not have had any traditional financing options without it. A SBA enhancement guarantees the government will cover a great majority of a SBA lender’s losses should the borrower default. By reducing this risk to the SBA lender, the bank is more likely to provide financing to a small business.

- USDA Loans: another form of conventional business financing that is very similar to a SBA loan in that the government is willing to cover much of the USDA lenders losses should the borrower default. The main difference between a USDA loan and a SBA loan for Georgia businesses is that to qualify for USDA lending your business must be in a community with 50,000 inhabitants or less.

- Private Loans: this relates to all non-bank business lenders – usually marketplace lenders, fintech lenders and alternative lending platforms. Private lenders offer quality financing options for small businesses in Georgia because they have flexibility that many conventional lenders don’t offer.

- Equipment Financing: relates to all ways businesses finance their business equipment and machinery. While there are many different loan options to purchase business equipment the most common way a Georgia small business obtains equipment and machinery is to lease the equipment. Equipment leasing works by having a lender purchase the equipment for a small business from a vendor, and then the equipment is leased to the small business for a period of time.

- Factoring: Factoring involves the purchase of a company’s accounts receivable or unpaid invoices. Rather than take a loan out by using the accounts receivables as collateral, a factor will purchase the AR outright, and forward most of the AR’s value to you. This is a great way for a Georgia business to access financing that it may not have access to with conventional financing.

- Merchant Cash Advances: this type of financing isn’t a loan at all, but the purchase of a company’s future receivables by a funding company. Instead of waiting for weeks, months or even years to get paid for future work, you can sell your future receivables at a discount, and get access to immediate financing within a day or two. After you’ve been funded, the financing company will then collect repayment by remitting a certain percentage of a merchant’s credit card processing transactions, or by taking a set amount each day from the merchant’s bank accounts via Automated Clearing House.

Conclusion

As you can see there are quite a few financing and funding options for Georgia small businesses. The key to getting the right business loan is to know all of your options, and get many offers from various lenders so you can compare. If you need help learning about all the financing options, and need help securing business financing, please reach-out to one of our funding specialists, and they’ll help you navigate the process.