Utah Business Funding

With over 4,000 commercial and business lenders available, each offering a number or financing products, its not easy for small business owners in Utah to compare each and every option to make sure their company is getting the best funding options available. In this article we will look at the various funding options available to small and mid-sized companies in Utah.

But first….

For the past eight years, the state of Utah has been ranked as one of the top ten states to conduct business in; Utah is not only the top state for businesses, but has also been ranked year after year as one of the happiest places to live! Utah has created an amazing business climate, allowing the state of Utah to be one of the fastest recovering states from the 2008 recession.

According to the Small Business Profile for Utah by the Small Business Administration (SBA), Utah is home to 259,786 small businesses, which is 96.7 percent of all businesses in the state. Of these businesses, 520,366, or 47.2 percent, create jobs for local Utahans. This has led to an annual economic growth rate of 4.6 percent in 2014 and 2.9 percent in 2015 – which is much faster than the overall growth rate of 1.9 percent for the United States.

So how is the state of Utah surpassing so many other states with their business climate? Let’s explore some of the benefits and challenges of owning and operating a business in the state of Utah.

Benefits of Running a Business in Utah:

The state of business in Utah is booming, and Utah business owners across the state are reaping the rewards. While every business in the state varies fluctuations, many Utah business owners would agree that the benefits outweigh the challenges for owning and operating a business in the state of Utah. Some of the top benefits of running a business in the state of Utah include:

- One of the Lowest Tax Rates in the Country: The state of Utah is known to have some of the lowest tax rates for business owners throughout the United States – which can be seen in the strength of the economy in the state of Utah. Since 2006 alone, the state of Utah has seen an economic expansion rate of 2.3 percent, which is much higher than the nations average of 0.5 percent. This is largely in part due to tax regulations that the state of Utah’s government has created. Utah business owners have a flat corporate tax rate of 5 percent – in comparison to other tax rates in other states, Utah ranks as sixth best for corporate tax rates. Overall, the favorable tax regulations and climate have created economic stability and optimism for Utah business owners.

- Large Bilingual Workforce: The state of Utah is known for having a large LDS population (The Church of Jesus Christ of Latter-day Saints), otherwise known as Mormons. Young LDS members are often expected to participate in missions for a few years, often in other countries. This has led to a majority of Utah’s population becoming bilingual or multilingual, which in turn has become a major benefit for business owners in the state of Utah. Business owners in the state of Utah have access to a variety of language skill sets, leading to more than 130 languages being spoken in daily commerce throughout the state of Utah – the Beehive state even has more Mandarin immersion classes than every other state in the United States. Ultimately, this large concentration of multilingual employees and business owners has benefited the state of Utah in terms of the global economy. This has benefited the state of Utah in creating international business connections with major companies such as eBay, Goldman Sachs, Oracle, and Proctor & Gamble – the state of Utah has since doubled their international trade.

- Innovative, Tech Savvy Entrepreneurs: The state of Utah is experiencing exponential growth in the technology and sustainable resources sectors (predominately the solar industry), leading to the state being dubbed Silicon Slopes – both for the budding technology sector and the massive mountains throughout the state. Major technology entrepreneurs have started out in the state of Utah, mainly for the favorable tax regulations, and have found unprecedented support from the state of Utah’s community, local government, and the rest of the United States. As more and more successful technology and sustainable resource sectors gained access to outside funding and venture capitalist support, other investors have taken notice. This has led to more investors from surrounding states supporting Utah-based technology startups and established Utah businesses.

- Strong Community Support: The state of Utah is often ranked as one of the top places to live, both for quality of life and for business climates. Similar to Utah’s surrounding states, such as Idaho and Colorado, the amazing outdoor access has attracted many young people to the area, leading to the state of Utah being ranked as one of the most youthful states in the United States – with an average age of 29 years. Thus, Millennials have become a major force in the local economy. Utah is home to five national parks, seven national monuments, two national recreation areas, six national forests, 14 world famous ski resorts, and many state parks – all of which have attracted entrepreneurs, families, and Millennials. These same people are the kind of people that want to support their local environments and local economies, which in turn has created incredibly strong community support for Utah businesses. This has allowed small businesses in the state of Utah to thrive.

Challenges of Running a Business in Utah:

After reviewing the benefits of running a business in the state of Utah, it seems hard to believe that there are any disadvantages to owning and operating a business in the Beehive state. Like any other state though, there are always challenges associated with running a business, and unfortunately, the state of Utah is not exempt from the nature of business. Some of the most common challenges associated with owning and operating a business in the state of Utah include:

- Limited Access to Qualified, Talented Employees: Utah has some of the top colleges in the country, particularly in the technology sectors – which is paralleled by the state’s growing technology industry. Unfortunately, this has created a double edge sword for the state of Utah. As more Utah-based technology companies continue to grow and thrive in the state, coupled with the already low unemployment rate in Utah, business owners are struggling to find enough qualified employees for their businesses. Competition has become fierce amongst Utah business owners today.

- Per Capita Personal Income: While Utah is lucky in that it has a booming economy that allows many Utah business owners to reap the rewards, the state of Utah is struggling with incredibly low state wages. This has created an odd situation for many employees in the Beehive state. With some of the lowest per capita personal income rates in the United States, some business owners are worried that limited disposable income from many locals Utahans will hurt businesses in the long run.

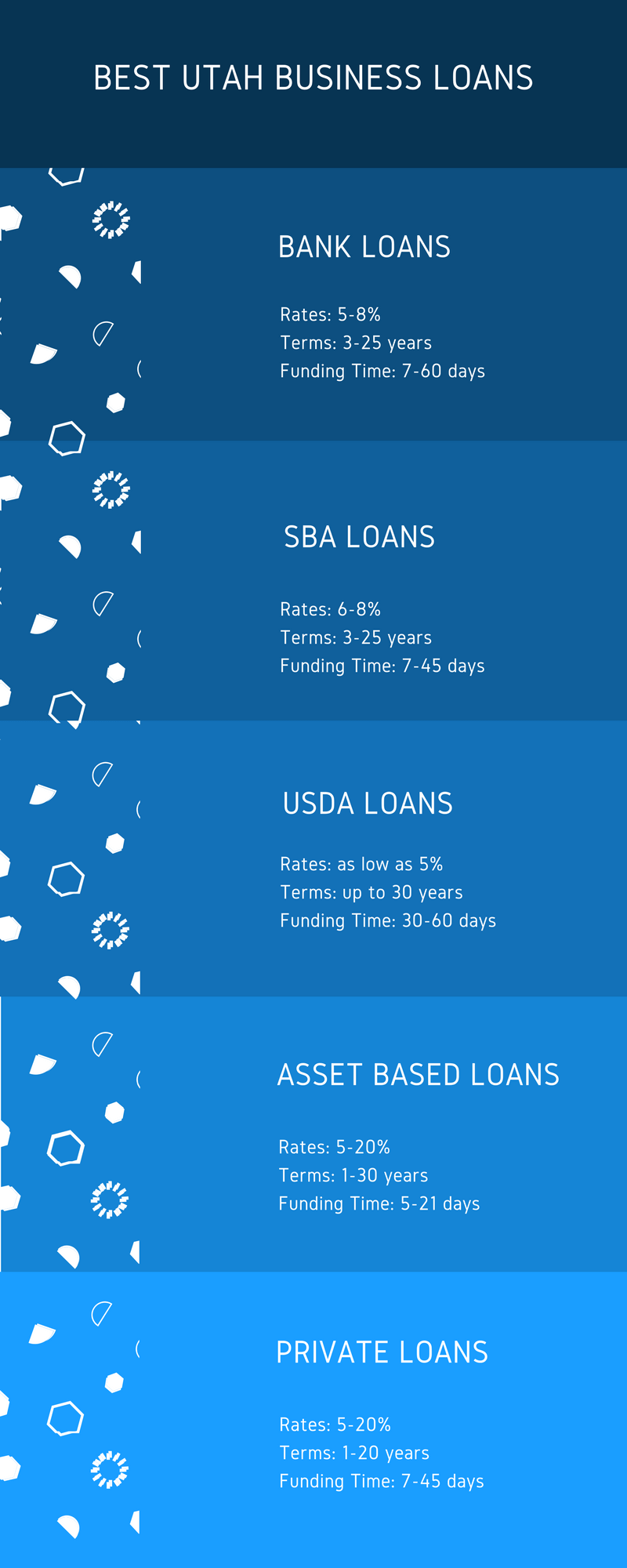

Types of Utah Business Loans:

- Conventional Utah Bank Loans: Utah banks, credit unions and community lenders offer Utah small businesses access to the best, most affordable capital of all commercial lending options. Utah large and small banks offer term loans, lines of credit and equipment financing with rates that can be as low as 8%, and terms up to 10 years for working capital, and up to 30 years to purchase or refinance commercial real estate.

- Utah SBA Loans: Another form of traditional business financing with a twist, in that SBA loans are conventional lending facilities offered by conventional lenders, but the loan is guaranteed by the Small Business Administration to ensure the Utah SBA lender isn’t stuck with the full loss should the borrower default on their loan.

- Private Utah Loans: This type of non-bank lending is primarily used to purchase or refinance a commercial real estate loan, commercial balloon mortgage refinancing or bridge loan. Other uses of private commercial loans include cashing-out some of the property’s equity, or to build-out or improve existing facilities.

- Alternative Utah Loans: This type of financing relates to any and all business loans provided by non-bank lenders. There are a number of alternative business lenders, most of which focus on providing Utah businesses with working capital. Some of the alternative lenders include fintech lenders, marketplace lenders, and midprime alternative lenders.

- Merchant Cash Advances: This type of Utah business financing involves the sale of the company’s future receivables to a 3rd party funding company, in exchange for getting paid early for services that will take place over the course of the next 4-18 months.

- Equipment Leasing: This type of financing works by having a lender purchase business equipment or machinery for a Utah small business, and then they lease it to the business for a period of time. This helps many Utah companies get equipment without having to pay the full-cost upfront.

Conclusion

Like we stated above, there are plenty of financing options available to small businesses in Utah. While some banks may have tightened their lending requirements over the past year, that doesn’t mean your options are limited. If you need help understanding all the financing options as well as help obtaining the right business loan, please feel free to reach-out to one of our funding specialists, and we will help you navigate the process.