Barber Shop Funding

We all know just how massive the beauty supply industry is today, but unfortunately, this industry has been dominated by female hair salons, female beauty supplies, and female beauty parlors (nail salons, etc). However, now and days, men are attempting to redefine what masculinity means – and this means a higher demand in beauty and hair products for men, as well as women. This rapidly growing demand for access to a variety of men’s hair and skin products has contributed to a rapid growth in the barber salon industry today. For years, barber shops have seemed almost obsolete, with men settling for going to places like Supercuts for their hair care needs – or just simply going to their wife’s salon to overpay for a specialized hair cut that is not much different than what they would get at a Supercuts. Now that we live in a time period where men believe that masculinity is not diminished by the way they take care of their hair and skin, barber shops are booming. In 2014, there were around 656,000 barbers, hairdressers, and cosmetologists, with an expected 10 percent growth rate by 2024. In addition, there were also around 55,000 skincare specialists with a 12 percent expected growth rate, particularly in the barber shop – or businesses that provide these services for men – in 2014. Overall, men are now considered the niche focus for the entire beauty industry; coupled with the green and organic movement, as well as younger generations, these niche areas are helping to revitalize the barber shop industry. Ultimately, the end of 2016 for the barber shop sector was almost unexpected, with the overall men’s grooming and barber shop industry bringing in over $21 billion in revenues. At the rate that the men’s grooming sector is going, expectations for revenues of this under developed business area are expected to reach $26 billion by 2020. No matter the direction a barber shop business is looking to go, whether that is specializing in any particular men’s grooming area of expertise, there is plenty of room for growth in this undeserved, yet incredibly high demanded area.

Barber Shop Sector Trends

While the barber shop and men’s grooming business world is growing at one of the fastest paces ever seen before, there are many different trends that are appearing throughout the industry. Many of these unique men’s grooming business trends can help differentiate barber shop competitors from one another. By focusing on the various barber shop and men’s grooming sector trends, barber shop business owners will help boost business, while appealing to many potential landlords in the process. Right now, landlords in high traffic areas are looking for niche barber shops to draw in a unique, and often difficult to reach, demographic – men. This means that all barber shop and men’s grooming businesses have a unique advantage right now, but as a business owner, they must be able to offer a niche business model that will draw in these highly sought-after consumers. Some of the top industry trends for barber shops and men’s grooming facilities include:

- Social Media Helping to Boost Hair Trends: As everybody can recognize today, social media is the dominating force in business, social, and fashion trends. Almost everything in the world today, particularly in the United States, revolves around social media and marketing trends – and this is no different for both men and women’s hair, facial and skin, and fashion trends. Not only is social media a key driving force behind the growing demand for men’s grooming businesses, but it is also helping to keep business steady. This is due to the constantly shifting hair trends on social media sites, which has allowed barber shops to remain steady and consistently growing. In the end, social media is a key proponent to the revitalization of the barber shop and men’s grooming industry.

- Replication of the Prohibition Era for Men: Prohibition and barber salons have a deep history. Many illegal bars during Prohibition were disguised as barber shops. While the men would still get a haircut and/or beard trim, they would eventually make their way down to the hidden bar downstairs. It was a central meeting place for all the men to get their illegal drinks while socializing with their peers. Today, this is exactly the look and feel that most barber shops are going for. Some barber shop businesses offer beer and/or bourbon for the clients while they are getting their hair cut – some barber shop companies are actually replicating the Prohibition “hidden downstairs bar” theme with a variety of cocktail options for after the haircut. Men everywhere are looking to feel good and clean shaven while enjoying a drink in the process – and barber shops are the niche shops that are catering to this vital demographic.

- The Beard Niche: Is it just me or are beards the new fad? Everywhere you look, even in the heart of a bustling city, men everywhere are going for that rugged mountain man looking beard style. Maybe it is the hipster thing to do, or maybe it is just the Millennial style. Either way, beards are a key money-making niche area for barber shop business owners everywhere. Some barber shop businesses cater exclusively to beard trimming; there are endless beard salons throughout the United States. Barber shop business owners are also trying to incorporate all of these niche areas into their businesses – liquor and/or beer, specialty beard styling, trendy hair styling, a variety of men facial, skin, and hair beauty supplies, and so forth. These trends are revolutionizing the way men get haircuts by creating the ideal experience – which is what every Millennial wants.

- Going Green: Like social media, utilizing green and organic products have become integral to marketing and attracting new customers. Many people today are becoming conscious of the hair and skin products they are using. After years of studies being published showing the harmful effects of various chemicals in our foods, household cleaning products, and beauty products, organic and environmentally friendly products are shifting industry standards. In the end, consumers are willing to pay the higher prices to ensure they are using quality, green products.

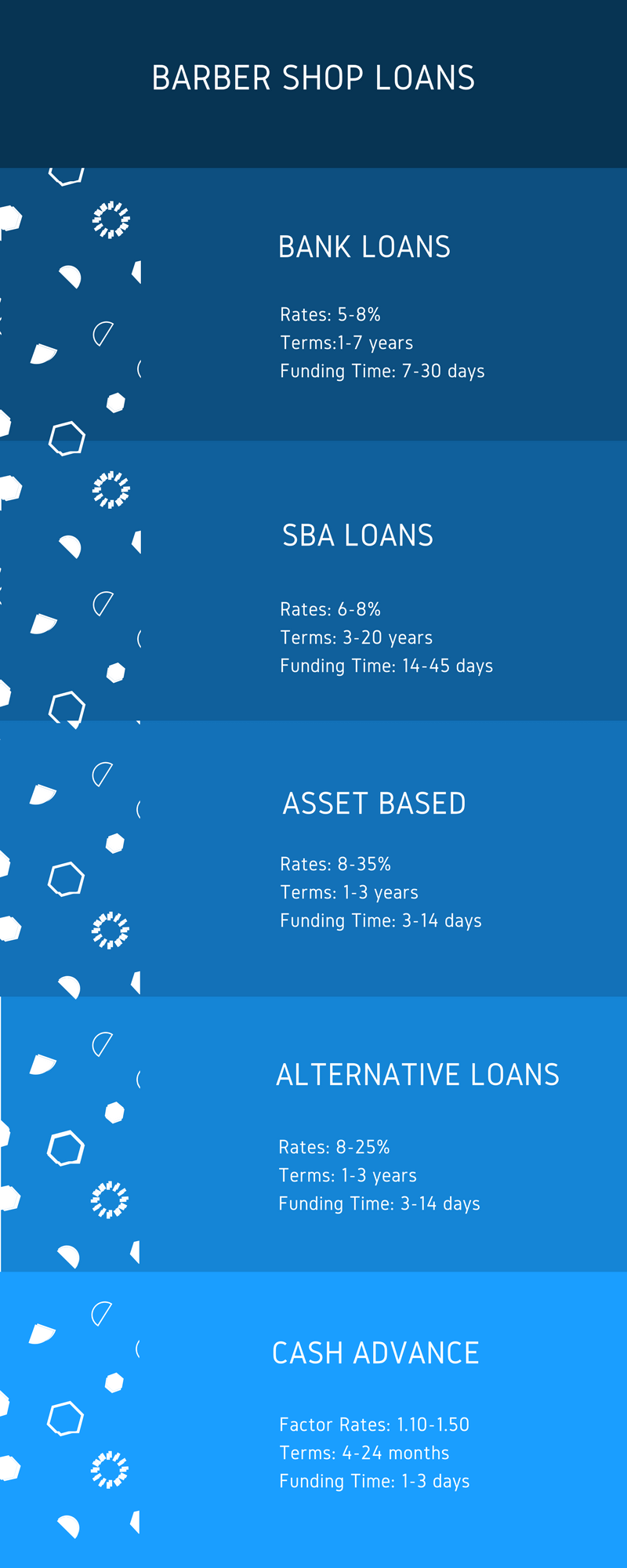

Types of Barber Shop Loans

SBA Loans: Barber shop loans guaranteed by the small business administration are a great option for any small business to obtain capital needed to run their companies – especially for barber shops. SBA barber shop loans aren’t financing in which the government does the lending, but is instead a form of conventional financing provided by large and small banks, along with credit unions and community lenders that is backstopped by the Small Business Administration. This means that if the borrower of the SBA barber shop financing fails to repay the financing, the government will step in and cover most of the lender’s losses.

| Funding Amounts | $50,000-$5,000,000 |

|---|---|

| Collateral | Required |

| Fees | Medium costs |

Conventional Loans: This is just standard barber shop business financing offered by banks and credit unions that are used for general business purposes including purchasing real estate, refinancing real estate, working capital, equipment financing and just about any business use. Conventional business financing is generally structured as either a term loan, or a business line of credit.

| Funding Amounts | $100,000-$10,000,000 |

|---|---|

| Collateral | Required |

| Fees | Low Fees |

Merchant Cash Advances: this type of barber shop funding isn’t a loan at all, but involves selling your barber shop’s future receivables to a funding company (at a discount to the barber shop funder) in exchange for a one-time lump-sum of cash paid upfront to the barber shop. Barber shop merchant cash advances for working capital is great for shops in need of immediate financing to cover expenses because it can be completed within a day or two. The downside is that it’s the most expensive form of business financing available to barber shops.

| Funding Amounts | $5,000-$1,000,000 |

|---|---|

| Collateral | Not Required |

| Fees | Varies |

Equipment Leasing: If you don’t want to borrow money to purchase equipment outright, another option could be to lease your barber shop’s equipment. Barber shop equipment leasing allows barber shops to obtain equipment relatively easily without being stuck with outdated equipment a few years from now. Equipment leasing works by having a lender purchase equipment for a barber shop, and then they lease it to the barbershop for a period. When the term is over, the barber shop is given the opportunity to extend the term, or purchase the equipment outright.

| Funding Amounts | $5,000-$5,000,000 |

|---|---|

| Collateral | Required |

| Fees | Low |

Alternative Loans: Barber shops should always seek out more traditional forms of barber shop financing (such as conventional or SBA lending) because the cost of borrowing is least expensive of any type of commercial financing. But if a shop is unable to get financed using conventional lenders, a good option could be to seek-out alternative lending sources such as asset based lenders, mid prime lenders, fintech lenders, and other non-bank commercial lenders. While the rates and terms aren’t as desirable as traditional lending sources, alternative barber shop loans offer affordable financing with terms that make repayment easy.

| Funding Amounts | $5,000-$10,000,000 |

|---|---|

| Collateral | Not Required |

| Fees | Low |