Business Cash Advance Tips

So, you’re looking online for a merchant cash advance to get funding because you have a need that requires immediate financing. Or maybe you have bad credit and haven’t been able to get approved for a loan through more conventional means. Whatever your reason for seeking out a business cash advance, its important to make sure you don’t settle for the highest-rate advances with very short terms. In this article we will provide ten tips to help small business owners get the best merchant cash advance for their situation.

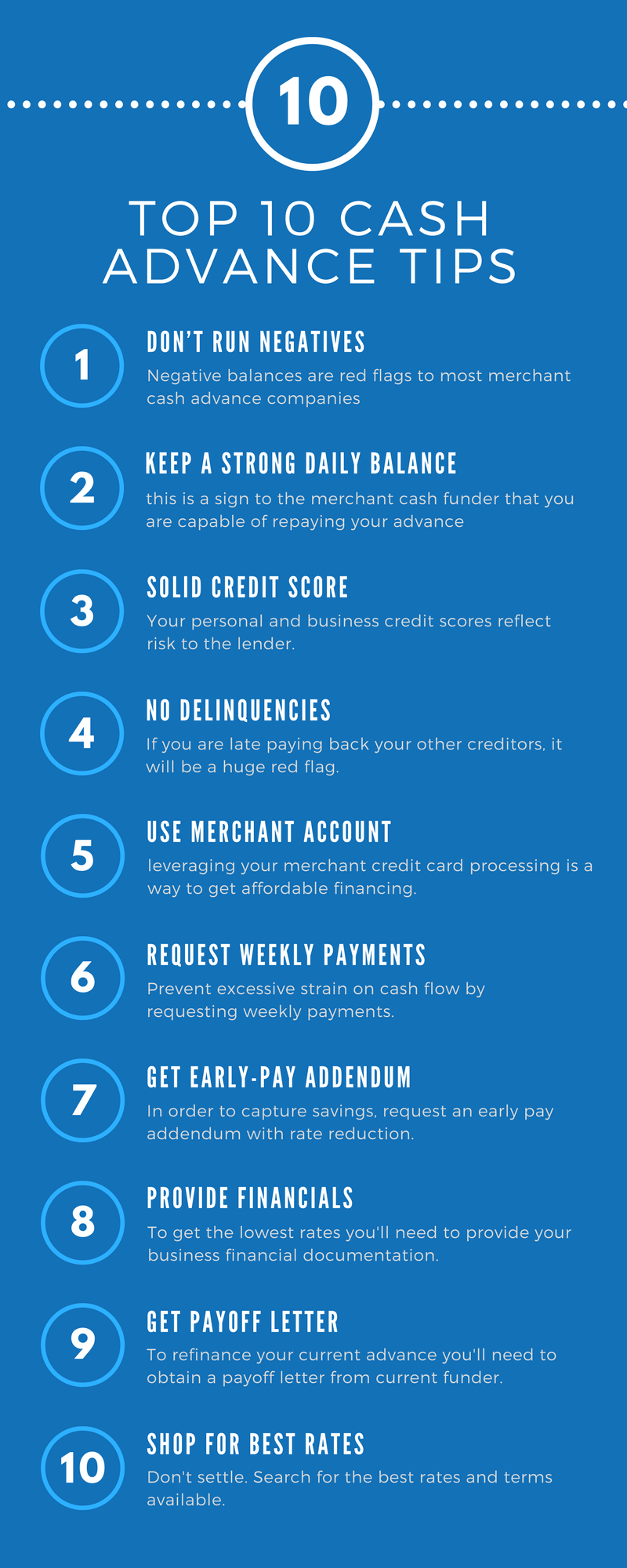

Top 10 Tips

- 1) Don’t Run Negatives: When a merchant cash advance or business cash advance company looks at your business bank accounts to calculate and underwrite an advance, they’ll look at the company’s previous and current transaction history. If a cash advance funder sees that a small business has substantial insufficient funds or bounced checks, it may cause them to deny funding. After all, the funding company will usually require payments to the company be made each business day. And if the borrower company has a track record that shows they have problems meeting their daily financial obligations, it’s a red flag. Therefore, its important that you prevent negative balances.

- 2) Keep a Strong Daily Balance: While its important to prevent negative balances to get approved for funding, to get the best rates and terms on your merchant cash advance, you’ll want to keep your average daily balances as high as possible. When a funding company sees that an applicant has sufficient balances on a consistent basis to meet their new financial obligation, they’re much more likely to not only provide financing, but provide it at a lower rate and longer term then they would to an applicant with lower daily balances.

- 3) Solid Credit Score: Your credit score reflects your past payment history to creditors. Being that the merchant cash advance company you’re seeking funding for will be your new creditor (should they fund your advance) they’ll look at your credit score to gauge how much risk you’ll present. If they see lots of delinquencies, insufficient credit history, bankruptcies or past defaults to other merchant cash advance companies, then you may pose too much of a risk to for own internal risk models. Therefore, its important to keep your credit score as high as possible. While most business cash advance funding companies will provide financing to the highest-risk borrowers, getting the best rates and terms requires having credit scores over 650.

- 4) No Delinquencies: If a funding company sees that you’ve had past delinquencies, it’s a big red flag to the underwriters processing your advance. Again, at the end of the day, the funding company has but one goal: getting paid back after providing financing. But if the funder sees you have issues paying your other creditors, they very well may decline to provide financing. Therefore, to make sure you get the best business cash advance, you should make sure you’re on-time with all your payments to creditors.

- 5) Use Merchant Account: Most merchant cash advances are structured in a way in which the funding company collects repayment using Automated Clearing House to deduct a set amount from the merchant’s bank accounts each business day. While ACH advances are the most common type of funding, another form of merchant cash advance repayment is done using the merchant’s credit card processing. A MCA split is a business cash advance in which the funding company is repaid by splitting the merchant’s credit card sales. Rather than remit a set amount each business day from the bank account, the funding company will take a percentage (usually between 5-20%) of the company’s daily credit card sales until the advance is fully-repaid.

- 6) Request Weekly Payments: With most ACH advances, and every MCA split funding advance, the payments are made daily, but there are other payment schedules offered by merchant cash advance funding companies. While not common, there are some advance companies that will allow for weekly payment options. Rather than make pulls directly from the bank account Monday through Friday, these cash advance funders can setup the pull to happen once a week. Having weekly payments rather than daily allows the merchant to not have the daily cash-flow strains that many merchant cash advances create.

- 7) Get Early-Pay Addendum: While a merchant cash advance isn’t a loan, but instead the sale of future receivables, that doesn’t mean that you can’t obtain savings by paying off the cash advance early. Many funding companies (if not all) will offer some sort of discount if the small business is able to pay off the advance early. Ranges of savings for early-payoff can be anywhere from 5-25% depending upon company and how much the balance of the cash advance is.

- 8) Provide Financials: While most cash advance companies only require an application and a few months bank statements to get an initial approval, to get the lowest rates, longest terms, and largest funding amount, the funding company may ask to view the company’s financial documents. Such documents include business tax returns, income statements, balance sheets, accounts receivable, accounts payable, debt schedule and contracts.

- 9) Get Payoff Letter from Previous Advance: If you currently have a high-rate merchant cash advance and are looking for way to refinance or consolidate the advance(s) into a lower-rate financing, you’ll need to obtain a payoff letter from the current funding company. The new advance funder will need to see the exact balance of the current advance before they’re willing to buy-it-out. Therefore, if you are in the process of seeking a new advance to refinance your old one, its essential to reach-out to your current funder, and get a payoff letter documenting the date funded, amount funded, and total owed as of today.

- 10) Shop for Best Rates: There are dozens and dozens of cash advance funding companies available to small businesses seeking immediate funding. But not all cash advance funders are the same, as they all vary in rates they charge, terms they provide and fees. Getting the right cash advance for your small business may save your company 20-30% as compared to taking any old advance. Therefore, it’s important to shop around for the best rate (as you’d shop around for anything else). But with so many options it can be hard to figure-out what advance would offer the best rates. Fact is, if too many advance companies run your credit, it could cause an adverse effect. So if you need help navigating the funding process, and would like professional assistance, please reach-out to one of our funding specialists, and we’ll help you get the best merchant cash advance available.