Illinois Business Funding

Simply put, the state of Illinois has had many ups and downs for many years. While Illinois is home to one of the largest bustling cities in the United States, the rest of the state is home to rural, agricultural farms that have seen better days. Consistently rising tax rates and unfavorable local government have made running a business in the state of Illinois a hassle, but Illinois small business entrepreneurs continue to persevere and make the local Illinois economy grow – even if the rate of entrepreneurship in Illinois has been below the national average for years.

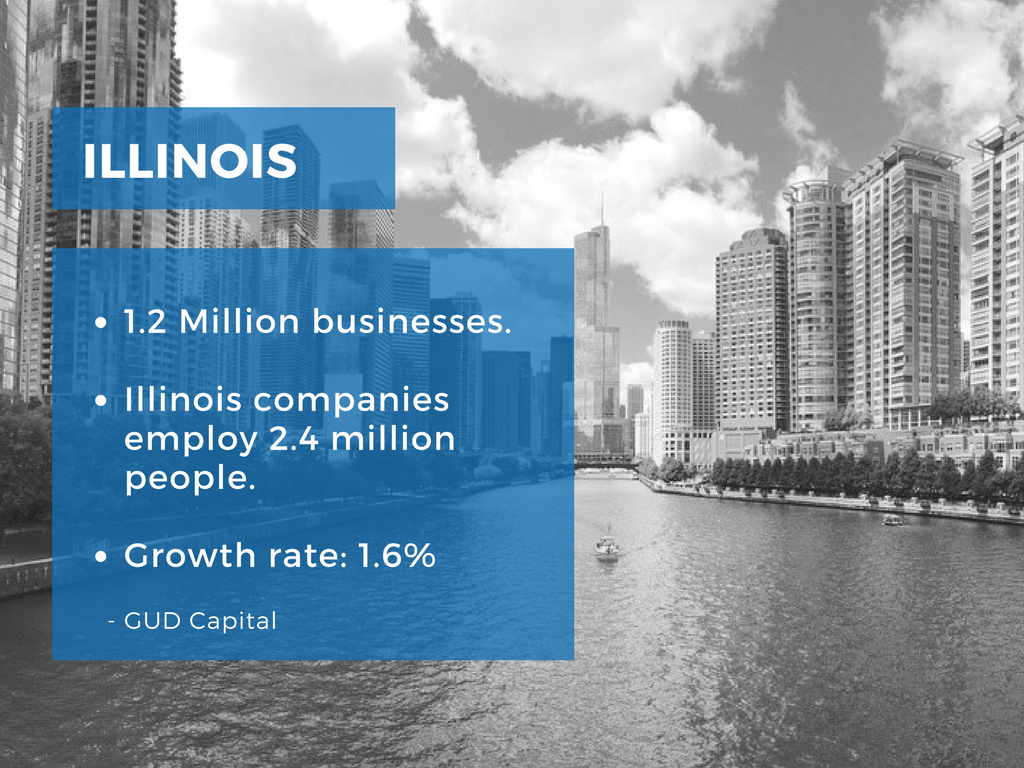

According to the annual Small Business Profile of Illinois that the Small Business Administration produces regularly, there are 1.2 million small businesses in the state of Illinois, which equates to 98.2 percent. These 1.2 small businesses employ 2.4 million people, which is 46.4 percent of the state’s population. In the past year, there has been 19,000 net new jobs created with a 39.8 percent increase in minority business ownership.

Even though business owners throughout the state of Illinois have been struggling with many challenges, these entrepreneurs have contributed to an annual growth rate of 1.6 percent in the state’s economy. While this was below the national growth rate average of 1.9 percent, it was still higher than Illinois’ 2013 annual growth rate of 0.8 percent. Overall, running a business in Illinois is difficult, but there are many positive sides of operating in Illinois.

The Benefits of Running a Business in Illinois

While the state of Illinois has struggled with high unemployment rates and unreliable state financial issues, there are still many benefits to owning and operating a business in the state of Illinois. Some of the most popular reasons that business owners consider running a business in Illinois include:

- Illinois is Working Hard to Create More Opportunities for Minority Owned Businesses: Not only have the rates of small business ownership increased in the past few years, particularly after the 2008 Great Recession, throughout Illinois, but the Illinois state government, along with the Small Business Administration, have worked hard to create a friendly environment for minority owned businesses. Year after year, rates of minority owned businesses throughout Illinois have increased. On top of that, the state of Illinois has worked towards better supporting this businesses, with an emphasis on helping veteran owned businesses. The emphasis that Illinois has made on supporting these various types of business owners has encouraged more people to become entrepreneurs throughout the state.

- Access to the Chicago Market and Strong Connectivity with National Transportation Hubs: The city of Chicago has almost 3 million people living there, making this one of the strongest, busiest, and most diverse markets in the Midwest. This city alone has allowed the business owners to thrive in the Chicago region, which helps make up for some of the other challenges associated with running a small, medium, or large business in the state of Illinois. In addition, the large, diverse Chicago business market, the city of Chicago is known has one of the major national transportation hubs in the United States. With access to a bustling railway system and major international airports, Illinois business owners have access to both local and distant markets that allow their businesses to thrive. Being centrally located in this bustling city allows many Illinois business owners to quickly ship or receive products, making Chicago an ideal business location for many business owners.

- Skilled Workforce: Similar the state of Indiana, Illinois is filled with prominent colleges and universities, which ultimately increases the amount of strong, skilled workforce participants. These colleges and universities have prepped many Illinois students for specified work skills that make them hot commodities throughout the state. Also, the state of Illinois has worked hard to create a variety of business support and development organizations which continues to benefit the skilled labor force throughout the state of Illinois.

The Challenges of Running a Business in Illinois

Every state in the United States has plenty of positives and negatives about owning and operating a business, but unfortunately, Illinois tends to have some of the highest rates of struggles for business owners everywhere. In particular, the state of Illinois struggles with unusually high taxes coupled with the lack of a state budget due to years of financial mismanagement by the state. Below are some of the most common challenges associated with operating a business in the state of Illinois:

- Uncertainty for Business Owners Due to Lack of State Budget Mismanagement: For far too long, the state of Illinois has been battling with the state legislatures in the state’s capital, Illinois. There has been no agreement thus far on long-term budgetary legislature, which poses many risks for business owners throughout the entire state of Illinois. Going months without any real, long term deals remains at the forefront of every Illinois business owner’s mind today.

- Incredibly High Taxes: Across the country, Illinois is known for having some of the highest business and residential tax rates around, which ultimately makes starting and running a business incredibly difficult. The top marginal corporate income tax rate is at 7.75 percent, including the personal property replacement tax. In addition, the state sales tax rate is at 6.25 percent, but can reach 9.75 percent. This has led to overwhelming, and often times unexpected, costs for small and large Illinois business owners alike. These high tax rates have continuous infuriated Illinois business owners and residents, especially with continuous talk amongst the state government about permanent tax rate hikes in the near future.

- Rural Parts of Illinois Still Struggling with Slow Economic Growth: Everyone is well aware of the booming, bustling Windy City, Chicago, which supplies most of the economic growth for the state of Illinois. Unfortunately, outside of Chicago, there has been painfully slow economic growth for the rest of the state. Most of Illinois is rural farm land that has seen a drastic decrease in production. This has led to the majority of the state of Illinois’ businesses closing or greatly downsizing, which has contributed to the overall slow economic growth since the 2008 recession.

Types of Illinois Business Loans:

- SBA Loans: this type of conventional business financing is provided by Illinois banks, credit unions, community banks to provide financing to growing small businesses using a special enhancement provided by the government. A SBA-enhanced business loan is a run-of-the-mill loan where the government agrees to cover a large portion of the lender’s losses should the Illinois SBA borrower fail to repay their loan. By providing this enhancement the government is encouraging lenders to provide financing to small businesses that they normally wouldn’t.

- Bank Loans: conventional bank loans offer Illinois small businesses with the best rates and terms available. Bank loans are often used by Illinois businesses to acquire other businesses, purchase commercial real estate, refinance a business mortgage, help with expansion financing of the business, and offer the small business working capital. Banks offer multiple types of financing facilities but the most common are term loans and business lines of credit.

- Private Loans: Non-bank business loans are provided by non-traditional lenders that look to provide creditworthy small businesses with financing that they may not be able to obtain through a bank or credit union. An advantage of a private business loan for Illinois businesses is the fact that applicants aren’t required to have the same credit score a bank would require, nor will the funding process take as long as bank financing.

- Asset Based Loans: ABL lending is a type of business financing that monetizes a business’s assets to use as collateral to obtain funding. Assets often used for collateral with ABL financing are accounts receivable, commercial or personal real estate, equipment & machinery and inventory.

- Alternative Loans: nontraditional business financing is the mid-ground between a low-interest bank loan or SBA financing, and a high-interest merchant cash advance. Alternative lending funds in a fraction of the time of a bank loan, with approvals taking just minutes, and funding can be completed in as soon as a week.

- Merchant Cash Advances: this type of business financing involves a funding company purchasing future receivables of a small business in return for immediate cash. A funding company will analyze a company’s cash flow, and then advance up to 15% of the company’s gross annual sales. Since this is a purchase of future receivables, a cash advance isn’t considered a loan, but instead a business-to-business transaction.