Subprime Business Funding

The term “subprime” has a lot of negative connotations around it, mainly because it became popularized leading up to, and during the financial crisis that led to the Great recession. But in business finance, “subprime” doesn’t and shouldn’t be looked at in an overly-negative view. Fact is, both businesses and consumers have had their credit take a hit over the past decade for reasons that may have been out of their control. And no business or consumer should find themselves locked-out of quality financing options because of a personal or business credit in years past. In this article we will discuss what subprime business lending is, and the types of subprime lending options available to small businesses.

What is Subprime Credit?

In business finance, subprime credit simply means the borrower poses a higher credit risk than most bank-rate lenders are willing to accept when originating business loans. Usually, a subprime business loan is provided to businesses that have had issues maintaining a repayment schedule to lenders in the past. While there isn’t a set criteria for a business loan to be considered subprime, they usually have business owners with FICO scores under 640, lack collateral, have been in business for only a brief time, or missed payments to lenders. Sometimes it’s a combination of all of those factors.

The reasons for the risk could be a number of reasons including:

- Limited Time in Business: a business that is under two years old may be considered a high-risk only because of the short time they’ve been in operation, not necessarily proving a track record that can be projected into the future.

- Poor credit: If the business or business owner has had a history of late or non-payment to lenders, vendors or suppliers, it will probably negatively affect their credit scores. When lenders see bad credit it is a red flag that the borrower could have issues repaying them.

- Lack of collateral: many bank-rate lenders (large and small banks, credit unions, community lenders) will require some sort of collateral to help reduce their risk and provide an opportunity to recoup some of their losses should the borrower default. With subprime lending, collateral isn’t always needed.

- Too much debt: if a business finds itself over-leveraged and having cash-flow issues, a bank-rate lender will definitely be wary of providing financing out of fear that the borrower may not be able to service the debt. Subprime business lenders are willing to take on more risk, even if it includes subordinating to other lenders.

Types of Subprime Business Loans:

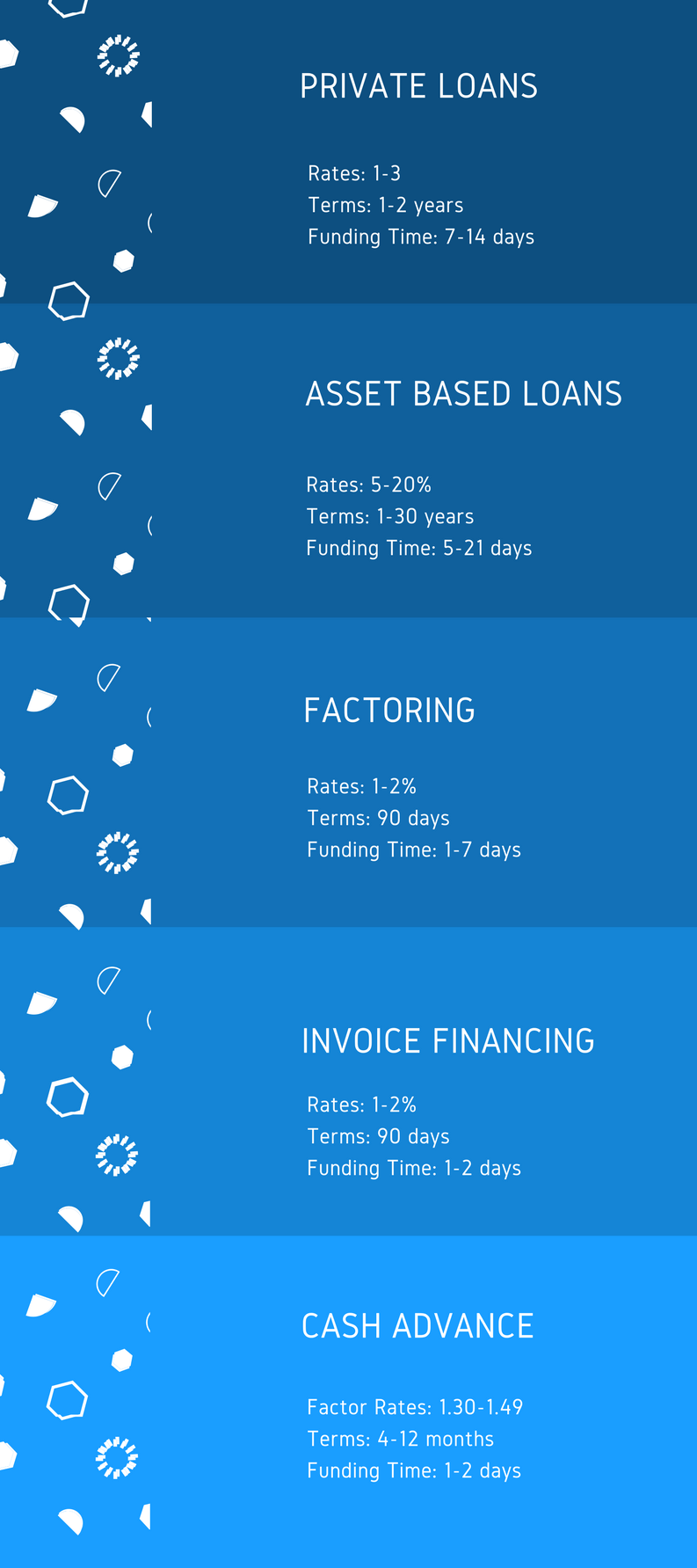

- Private business loans: private loans are simply loans provided by non-bank lenders. While many private business lenders are marketplace, fintech and online lenders, and number of private business lenders are just institutional investors looking to place loans with companies that are experiencing high growth or project high growth in the future. While a bank will require a two to three years of profitability to get approved, a private business lender may not require profitability at all.

- Asset Based Loans: one way of obtaining a subprime loan (especially for business owners with bad credit) an option is to monetize assets on your company’s balance sheet. With asset based subprime lending a borrower can pledge commercial or personal real estate, accounts receivables, unpaid invoices, business inventory and business equipment & machinery as collateral. While the rates are higher than bank loans, and while you are putting your personal or business collateral at risk should you default, asset based lending provides businesses that would normally be unable to get funded, to obtain reasonable financing for their business.

- Factoring: while technically not a loan, factoring is used by many small businesses to obtain working capital for business operations by selling accounts receivable to a third party in exchange for immediate payment. So rather than wait around for 30-90 days to get paid, a business that is labeled as a subprime credit risk can obtain necessary capital without having to get a loan, or establish a long-term financing relationship.

- Invoice financing: similar to factoring in that financing is based on unpaid accounts receivables (unpaid invoices) invoice financing or discounting is the use of the invoice as collateral for funding. Rather than sell the invoice to a factoring company, a factoring company will forward the small business a large percentage of the invoice’s value, collect a fee for itself, and once the invoice is paid, the factoring company will then forward the remaining amount to the borrower.

- Merchant Cash Advance: this type of financing also isn’t a loan, but instead the purchase of future receivables of a funding company. What makes this different than factoring is that factoring involves the purchase of billing for a job completed. With a merchant cash advance, this is a purchase of work that is to be completed over the next 4-24 months. When a subprime business obtains a merchant cash advance, they will receive a lump sum. After funding occurs the borrower will then repay the funding company by having a set amount deducted from their bank account each business day, or by splitting their merchant credit card sales with the funding company.

Subprime Business Loan Alternatives:

- Equipment Leasing: while not considered solely a subprime lending facility, equipment leasing may be used by subprime lenders to obtain crucial business equipment and machinery. Whereas an equipment loan involves obtaining financing so the business can but the equipment outright, equipment leasing for subprime borrowers allows companies to obtain the equipment without having to purchase. A lender will purchase the equipment for the borrower, and then lease the equipment to the subprime borrower for a period of time.

- Midprime Financing: is a great type of affordable financing for borrower just above subprime. Midprime borrowers generally have FICO credit scores between 640-680, and have been profitable in one of the past two years. If you are able to qualify for a midprime loan, you will generally see rates in the mid-teens, and terms ranging from 1-5 years.

Conclusion

While a true bank-rate business loan is always preferred (because the rates and terms are the best available) its not always obtainable. But just because you don’t have the credit or requirements required by a traditional and conventional business lender, it doesn’t mean you lack options – because you do. As you can see there are quite a few options for borrowers deemed to be a subprime credit risk. But obtaining the right type of financing facility takes due diligence on your part as a business owner. If you need help navigating the financing process, please feel free to reach-out to one of our funding advisers, and we will make sure you get the best business loan possible.