Funding For Virginia Businesses

Virginia is home to some of the most beautiful scenery, along with the added benefit of living in a close proximity to the nation’s capital – Washington D.C. All in all, business owners enjoy owning and operating their local businesses in the state of Virginia, especially as the small business support continues to grow throughout Virginian communities.

The Small Business Administration has shown that 97.7 percent of Virginia businesses are small businesses, which equates to 681,517. By the end of 2015, these small businesses employed 1.5 million people, which equates to 46.9 percent of the state of Virginia’s employable population. With that, the overall economy of the state of Virginia grew at an annual rate of 1.2 percent, which is slightly lower than the national average, yet higher than previous years. In addition, minority ownership of small businesses in the state of Virginia increased 33.8 percent, which has led to a robust, diverse economy that has attracted many more people to the state.

The Benefits of Running a Business in Virginia:

Virginia has seen many fluctuations within their local economy for many years, and many Virginians still believe that the state of Virginia’s economy has not yet recovered to pre-recession levels. While this has alarmed many potential Virginian entrepreneurs, there are still many positive reasons to open up shop in the beautiful state of Virginia. Here are some of the most common benefits for owning and operating a business in the state of Virginia:

- Growing Optimism About Virginia’s Economy: According to an annual Economic Expectations Survey that evaluates the top issues facing Virginia’s business owners, a variety of CPA’s have shown that even though the overall economy has not completely rebounded, Virginian business owners are feeling surprisingly optimistic. Many of these business owners in the state of Virginia are well aware of the rapidly fluctuating economy, but these business owners have seen consistent business gains in the past few years, which has allowed many of these businesses to flourish. There is still a lot of uncertainty about the future, but over 64 percent of Virginians feel like the business climate in the state of Virginia is in good standing, with over 15 percent believing it is in excellent standing compared to neighboring states.

- Creating a Diverse Business Community: Virginia has been working hard to create a robust, yet highly diverse, local business economy. Minority business ownership in the state of Virginia grew 33.6 percent from 2007 to 2012 – and the numbers have only continued to rise. By the end of 2015, businesses in Virginia saw a 33.8 percent increase in minority ownership, with a majority of the growth being seen in Hispanic owned businesses and African American owned businesses. This growth has led to an even more bustling economy, which has allowed many business owners in the state of Virginia to thrive.

- Close to Bustling Washington D.C.: Not only is Virginia close enough to Washington D.C. to help businesses remain profitable and reach more diverse markets, but the state of Virginia is also known for having incredibly low property rates; this is especially prevalent in Northern Virginia right now. Northern Virginia was hit hard during the Pentagon’s Base Realignment and Closure plan which left the northern part of the state with a void. Major tech companies in particular have taken advantage of these low rates with easy access to major business centers, creating more opportunities for smaller companies to consider this route.

The Challenges of Running a Business in Virginia:

Great things are happening in the state of Virginia for many business owners, but unfortunately, every state has their challenges for owning and operating a business. For most business owners in Virginia, the pros seem to outweigh the cons, especially if their business is in a niche location – but this has not been the case for all business owners in the state of Virginia. Here are some of the most common challenges associated with owning and running a business in the state of Virginia:

- Health Care Costs: When evaluating the annual Economic Expectations Survey mentioned above, the number one concern among Virginian business owners was the costs and overwhelming uncertainty of the future of health care for their employees. In 2016, two-thirds of the CPAs that were involved in the survey agreed that the Affordable Care Act (ACA) was hurting the local Virginia economy – but most of them also agreed that they needed adequate reform instead of repeal. Even though most business owners in the state of Virginia agree that financial aspects of the Affordable Care Act are overwhelming costs for their businesses, they believe it is still vital to provide such an important incentive to their employees.

- Millennials Leaving Rural Virginia Towns: Many states have been plagued by Millennials leaving their small home towns to larger metropolitan areas for school, work, or just an overall lifestyle change. Regardless of the reason, rural towns in the state of Virginia have been greatly affected by this rapid transition that is creating economic uncertainty for many business owners. However, certain small towns in Virginia are taking huge strides in working with Millennials to help create new systems, policies, and infrastructures that will attract more youth, which will ultimately help support the local business economy in these small Virginian towns.

- Complex Tax Burdens: The state of Virginia is well-known for having the most complex, confusing, and downright frustrating tax codes in the United States. For starters, looking at various areas of the food industry can be difficult. Restaurants are taxed at around 5 percent, but the tax rate for food purchased to eat at home is 2.5 percent. If a business owner does both, they must know the ins and outs of the various food tax restrictions and requirements. Then, if a farmer wants to sell food at the farmers market, it is even more complex. Overall, business owners struggle with setting up the arduous tax requirements for their type of business. Time and time again, this remains one of the biggest dilemmas and complaints amongst Virginia business owners.

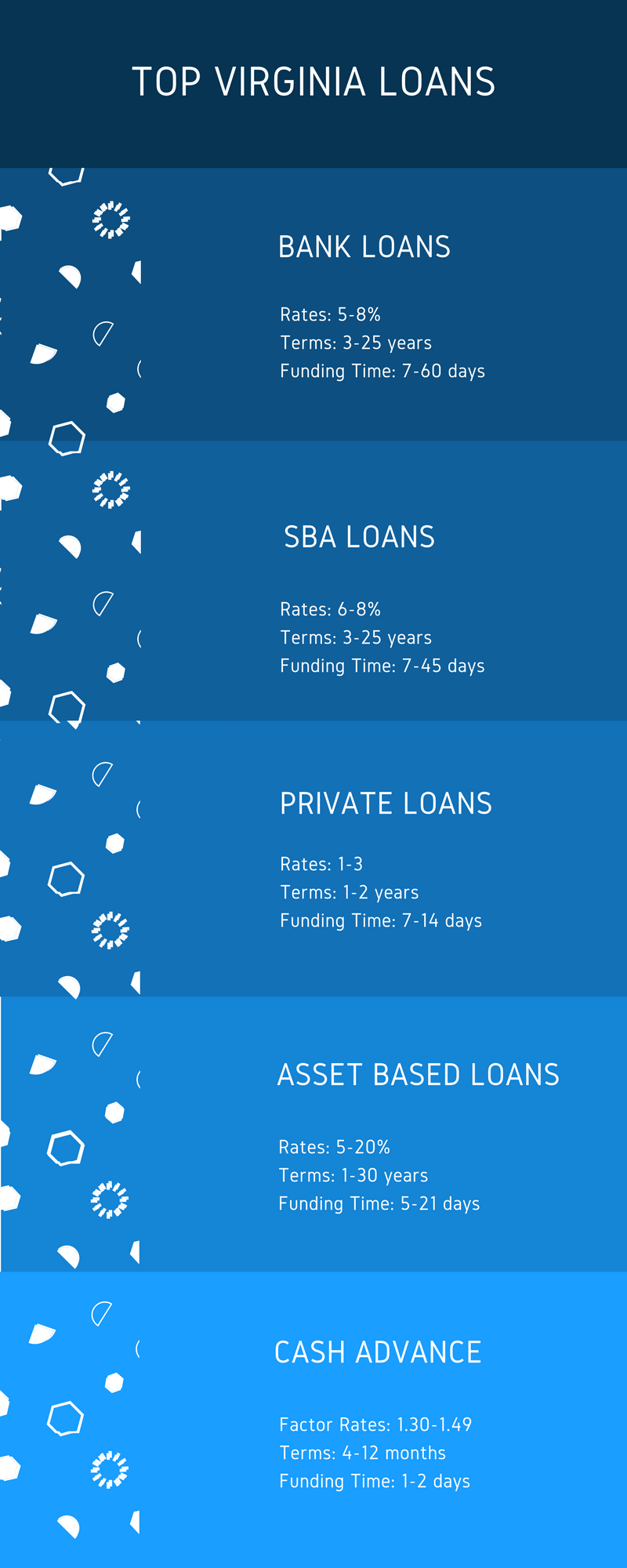

Types of Virginia Business Loans:

- Bank Loans: Conventional business lending from a bank or credit union offers Virginia businesses with the best quality of financing due to banks offering very low rates and very favorable terms. Bank lenders provide financing that can be used for a wide variety of uses, especially long-term financing for purchasing and refinancing of commercial real estate. Other uses of bank financing for Virginia businesses include general working capital uses, construction and buildouts of facilities, and many other uses.

- SBA Loans: SBA lending for Virginia businesses is a good financing tool for companies seeking true bank-rate financing, but haven’t had any luck obtaining financing through a bank or credit union. SBA lenders use the Small Business Administration’s lending programs because it offers enhancements that reduce the Virginia SBA lender’s risk by agreeing to cover a great majority of their losses should the borrower fail to repay. By offering this SBA enhancement, the lenders are more inclined to provide a borderline business with financing.

- Private Loans: Non-bank lending options are loans and financing provided by private investors to Virginia small businesses who are experiencing strong growth or have commercial real estate they’re willing to use as collateral. Private business loans are also used to consolidate merchant cash advances for companies that are profitable and meet other criteria.

- Asset Based Loans: ABL lending is a type of financing that monetizes a company’s balance sheet. If a Virginia company has strong AR, equity in commercial real estate, has inventory that it can pledge, or has valuable equipment & machinery, they may be able to use these assets to obtain an ABL facility.

- Equipment Leasing: When a Virginia business needs to obtain equipment or machinery, but don’t want to obtain a loan or pay the full-cost of the equipment upfront, they can choose to lease the business equipment. The way equipment leasing works is: a financing company will purchase the equipment for the Virginia business, and then lease the equipment to the small business for a period of time, with an option for the company to purchase the equipment as the end of the lease.

- Merchant Cash Advances: This type of financing isn’t a loan, but the purchase of a Virginia business’s future receivables. A Virginia business will sell a portion of its future bank account deposits or merchant credit card sales to get a lump sum in cash, and then payback the financing over the course of the next 4-24 months through either ACH payment from the Virginia company’s bank account, or by splitting the company’s credit card sales. What is nice about a cash advance is that bad credit generally doesn’t prevent a Virginia company from getting financed.