Colorado Business Lending

The state of Colorado is one of the top places to conduct business in the United States. Not only are there plenty of favorable benefits for running a business in the state, such as attracting a wide variety of entrepreneurs and consumers, but the local government has continuously worked hard to make sure the state of Colorado remains a viable place for small business to thrive – and this is evident by the state rankings for a variety of business benefits, such as:

- Colorado was ranked #2 as the Most Entrepreneurial State in 2015.

- Colorado was ranked #4 as the State for Startup Activity in 2015.

- Colorado was ranked #5 Best State to Start a Small Business in 2015.

- Colorado was ranked #8 as the Most Innovative State in 2016.

According to the Small Business Administration, there are 572,546 small businesses in the state of Colorado, which equates to 97.6 percent. These small businesses then employ 1 million people, which is 48.8 percent of the state’s workforce. This has contributed to a thriving local economy in Colorado. By the third quarter of 2015, Colorado’s economy grew at an annual rate of 2.4 percent – which is faster than the overall United States growth rate of 1.9 percent. These booming small businesses have created a thriving local economy, and have even created a favorable unemployment rate. By the end of 2015, the unemployment rate was 3.5 percent, which is down 4.2 percent from 2014. This is well below the national unemployment rate of 5 percent.

Benefits of Running a Business in Colorado:

Overall, the state of Colorado has been steady, if not thriving, for years – even during the 2008 Great Recession that devastated many states in the United States. Even though every state has positives and negatives when it comes to owning and operating a business, the state of Colorado is appealing to many because even the challenges of running a business in the state of Colorado are more bearable than many other states in the country. Here are some of the most common benefits associated with owning and operating a business in the state of Colorado:

- The State Appeals to Millennials: Most Millennials today want a different work and play lifestyle than their parents did. Today, the Millennial generation is striving for a good work and play balance, with more emphasis on play and work flexibility to continue to do the things they love to do. What better place to have all around access to some of the most beautiful scenery, outdoor activities, and booming city lifestyle than the state of Colorado? The sheer beauty of the state is enough to convince anybody to move there – and during a time where people, particularly Millennials, are concerned about the environment and the health benefits of being outside all the time. Where the state of Colorado has succeeded is that the business owners in Colorado have caught on to the desires of the next workforce generation. Most business owners in Colorado may not be able to offer above and beyond pay wages, but most of the successful Colorado entrepreneurs have made a point to appeal to this generation by offering many work benefits that allow them to play and work. Ultimately, the local business economy has attracted many Millennials, which contribute to a thriving local economy.

- Population Growth in the State of Colorado: Colorado is known for their rapidly growing technology and cannabis industries, which has ultimately attracted more and more people over the years, resulting in a booming population growth. In turn, this boosts business growth in Colorado. Since the business climate is catered towards helping small business owners throughout the state, Colorado has created a “win-win” situation for business owners everywhere. This has led to the rapidly increasing “serial entrepreneurs” throughout Colorado. The possibilities are endless in this constantly growing and bustling state.

- Communities that Favor Local Businesses and Business Growth: The communities throughout the state of Colorado are dedicated to helping small businesses grow. Similar to California, these communities make sure to support their local businesses; this is also seen in the local Colorado government. With the mutual support of local Colorado communities and government, the ability to start and operate a business in the state is easy, affordable, and maintainable. In addition, Colorado is one of the few states that has seen gradual increases in small business loans year after year – while many business owners Colorado believe it is still difficult to obtain funding, the overall supportive business climate has made it easier than in many other states.

- Taxes and Regulations: Based on every other state of business snapshot we have addressed in the past few months, this is incredibly rare to have taxes and regulations as a benefit to running a business in a state. Even though Colorado still has state income taxes, many Colorado business owners agree that they are manageable, especially when looking at the other low, hassle-free, and manageable regulations and taxes associated with running a business in the state of Colorado.

Challenges of Running a Business in Colorado:

Even though Colorado business owners are special in that there are an overwhelming amount of positive sides to owning and operating a business in the state, there are always downsides to running a business. Some of the most common challenges associated with running a business in Colorado include:

- Rising Costs of Living: Overall, the local Colorado economy is booming, with Colorado business owners everywhere reaping the rewards. However, with a booming, bustling economy leads to an increase in population, which ultimately increases the cost of living. Luckily, many business owners in Colorado say they have not yet felt the effects of these costs of living increases, but it is only a matter of time before business owners experience this on a large scale.

- Cannabis Industry Creates Limited Options for Commercial Space: Ironically, one of the biggest industries that has boosted Colorado’s economy has become one of the biggest struggles for every other business industry in the state. With constantly growing demand for commercial space, and with high profit businesses in the cannabis industry snatching up all the open space, many other Colorado business owners have been struggling to expand their operations. Luckily, many Colorado business owners still admit that it is the price to pay for the otherwise favorable business conditions.

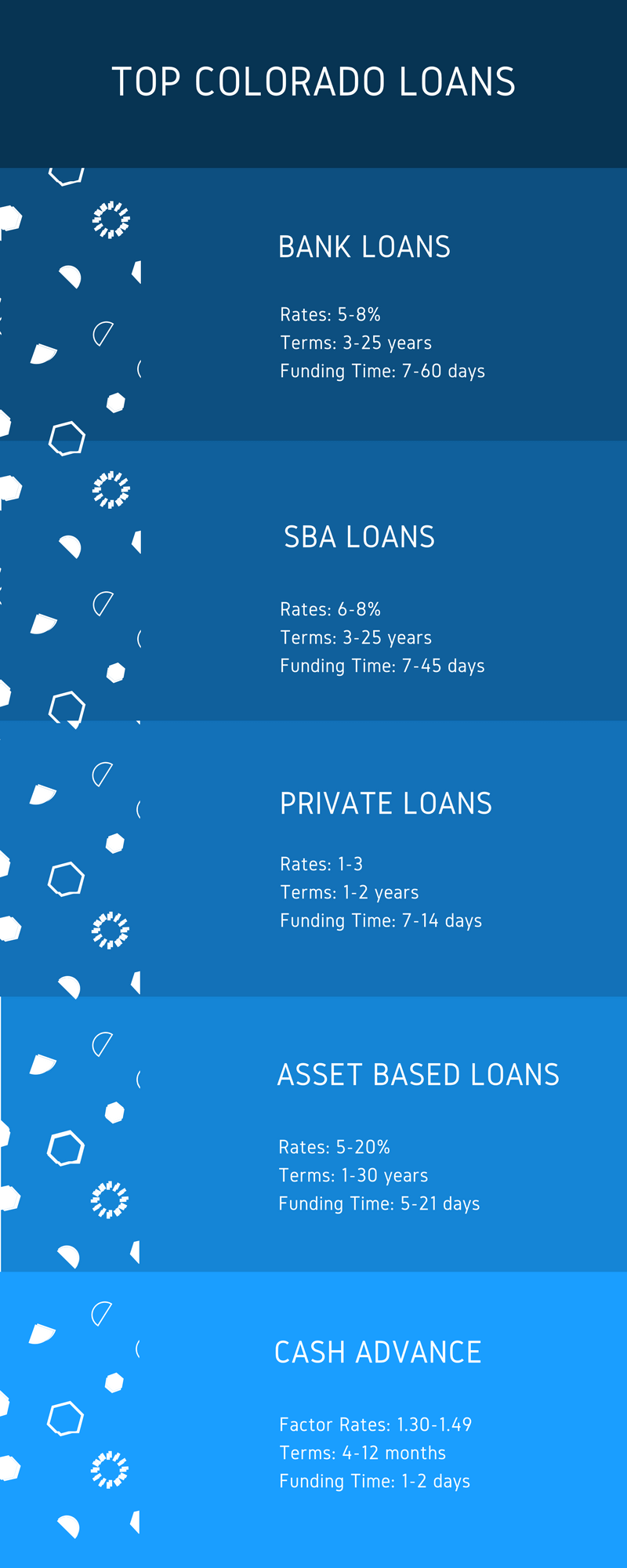

Types of Colorado Business Lenders

- Colorado Bank Lenders: If a Colorado business is looking for a business loan with the best rates, and also the longest terms available, a bank business loan is clearly the best option. Bank loans have rates that start in the mid-single digits, and terms than can last up to 30 years. Banks offer Colorado businesses term loans that can be used for just about any business use (including purchase of real estate, commercial real estate mortgages and loans, acquisitions of other companies, working capital, equipment purchases, and just about any other use you can think of).

- Colorado SBA Loans: If your Colorado small business has good credit, and has been profitable in the past two years, but still find yourself unable to secure a bank business loan, a good option may be to seek SBA financing. With a SBA lending a Colorado small business can obtain bank rate financing through the use of the Small Business Administration’s loan guarantee. This SBA enhancement reduces the risk of SBA lenders by covering a large portion of their losses should the small business default on their loan. By offering this enhancement the Small Business Administration hopes to increase the number of loans provided to U.S. and Colorado small businesses.

- Colorado Private Lenders: non-bank private loans are a good source of financing for small businesses that need an alternative to conventional lenders. Non-bank lenders provide financing for a number of uses (working capital, acquisitions, equipment financing, factoring, and cash advance refinancing and consolidation) but the main use is for commercial real estate loans and commercial property financing.

- Merchant Cash Advance: If you are a Colorado business with bad credit, or need to get a business loan quickly without the hassles of a bank or more conventional form of financing, a good option for fast funding is a merchant cash advance. Cash advances are not a loan, but a way for merchants to get funded upfront for business revenue they’ll make over the next 4-18 months.

- Asset Based Loans: If you are a Colorado business that’s looking for financing and has assets on its balance sheet that it would like to monetize, a good options may be to get an asset based loan or line-of-credit. With an ABL a Colorado small business can use commercial (or personal) real estate as collateral, as well as use their company’s account receivable, inventory, equipment and machinery to obtain financing.