Loans For International Trade

Have you ever had Costa Rican coffee? Or South American bananas? Or simply bought a piece of clothing that was produced in China? If you have, as I am sure all of you have in one form or another, you are experiencing international trade. In the simplest form, international trade is the exchange of goods and services between countries based on supply and demand that helps the overall world economy. Unfortunately, international trade is subject to price fluctuations when political or economic changes occur in other countries that the United States trades with. Similarly, if the United States has major political and economic shifts, this could impact international trade agreements and prices for both the United States and other countries. However, in a perfect world, international business trade allows the United States to experience expanding markets for goods and services, greater competition with more competitive, and often better, prices, and ultimately allows consumers to have access to cheaper products.

International Trade Data, Statistics, and Trends

Every year, the World Trade Organization, the organization that establishes and regulates global trade rules between nations, puts together a comprehensive statistical review of world trade. The most recent data was produced in 2016 and outlines the most current statistical data and trends for 2015 international trade. Some of the major highlights from this vital international trade document include:

- In 2015, the value of merchandise trade and trade in commercial services was nearly twice as high as in 2005, but declined after some small growth in 2012, 2013, and 2014.

- Decline in world commodity prices greatly impacted the value of global merchandise trade in 2015, leading to a 45 percent drop in world energy prices.

- The ratio of merchandise trade to gross domestic product (GDP) fell sharply in 2009 after the Great Recession, bounced back in 2010 and 2011, but then continued to decline from 2012 to 2015.

- Merchandise trade between developing economies increased from 41 percent of 52 percent of their global trade in the last ten years.

- From 2015 to 2016, the volume of world trade grew 2.7 percent, which is in line with the world gross domestic product growth of 2.4 percent.

- Even though there was growth in trade volume in 2015, the dollar value of world merchandise exports declined 14 percent.

- As mentioned above, there are many variables that can increase or decrease international trade. In 2015, international trade was weak, mainly due to: economic slowdown in China, a severe recession in Brazil, and the continuously falling prices of oil and other commodities.

- Even though there was weaker international trade due to many different factors, this was partly made up from economic growth and rising import demand in developed countries.

- Unfortunately, 2015 was the fourth consecutive year of trade volume growth below 3 percent, and the fourth consecutive year of international trade growing at nearly the same rate as gross domestic product.

- The share of manufactured goods in total merchandise exports was just over 70 percent in 2015, up from 67 percent in 2014.

- All major exporters of agricultural products experienced a decline in exports in 2015 by 0.2 percent.

- For major fuels and mining products exporters, there was a drastic fall in exports in 2015, mainly due to increasing geographical diversification in the exporting of fuels and mining products.

- In 2015, world exports of iron and steel were heavily affected by falling prices of steel and iron ores, as well as a decline in demand.

- The transport sector experienced big hits in 2015, with container shipping rates falling sharply and global air freight volumes slowing in certain countries.

Overall, the past few years have been difficult for many international trade businesses, but the vital role that international trade plays in the world economy is undeniable. Not only does international trade fuel the world economy, it also helps developing countries achieve economic growth while helping to alleviate severe poverty. Due to the necessary role that international trade plays in many businesses, more and more United States business industries are focusing on effectively implementing and engaging in international trade.

Understanding Small Business Administration International Trade Loans

For most businesses, engaging in international trade can seem daunting and expensive – but competition from cheaper imports is adversely affecting many small businesses in the United States. Thus, focusing on implementing international trade into a small business can be incredibly beneficial. But how do you go about obtaining export financing to make this business venture possible?

The Small Business Administration offers an International Trade Loan (ITL) program that helps small businesses in the United States participate in international trade. Through the International Trade Loan program, the export financing offers a loan of up to $5 million for fixed assets and working capital for businesses that are starting, continuing, or expanding international exporting business ventures. The International Trade Loan program is very beneficial for small businesses that are being impacted by current import competition, allowing small business owners to make necessary business changes and investments to better compete.

Some of theimportant guidelines for the International Trade Loan program include:

- Guarantee Coverage: The Small Business Administration can guaranty up to 90 percent of the loan, which is a maximum of $4.5 million.

- Loan Term and Rates: International Trade Loan program loan terms are usually limited to ten years, with typically charging between 2.25 and 2.75 percent above the prime rate.

- Eligibility: Small business owners must meet the same requirements as the SBA’s 7(a) Loan Program. Business owners must also establish proof that the International Trade Loan program will help the small business expand, develop an export market, or show that import competition is adversely affecting the small business.

- Use of Proceeds: Working capital is an allowable use for the International Trade Loan program. In terms of facilities and equipment portion of the International Trade Loan, proceeds can be used to acquire, construct, renovate, modernize, improve, or expand facilities or equipment. Proceeds from the International Trade Loan program may also be used for the refinancing of debt.

- Collateral Requirements: Collateral located in the United States is accepted; first lien on property or equipment financing by the International Trade Loan program is required. Additional collateral may be required.

International Trade Bank Lending

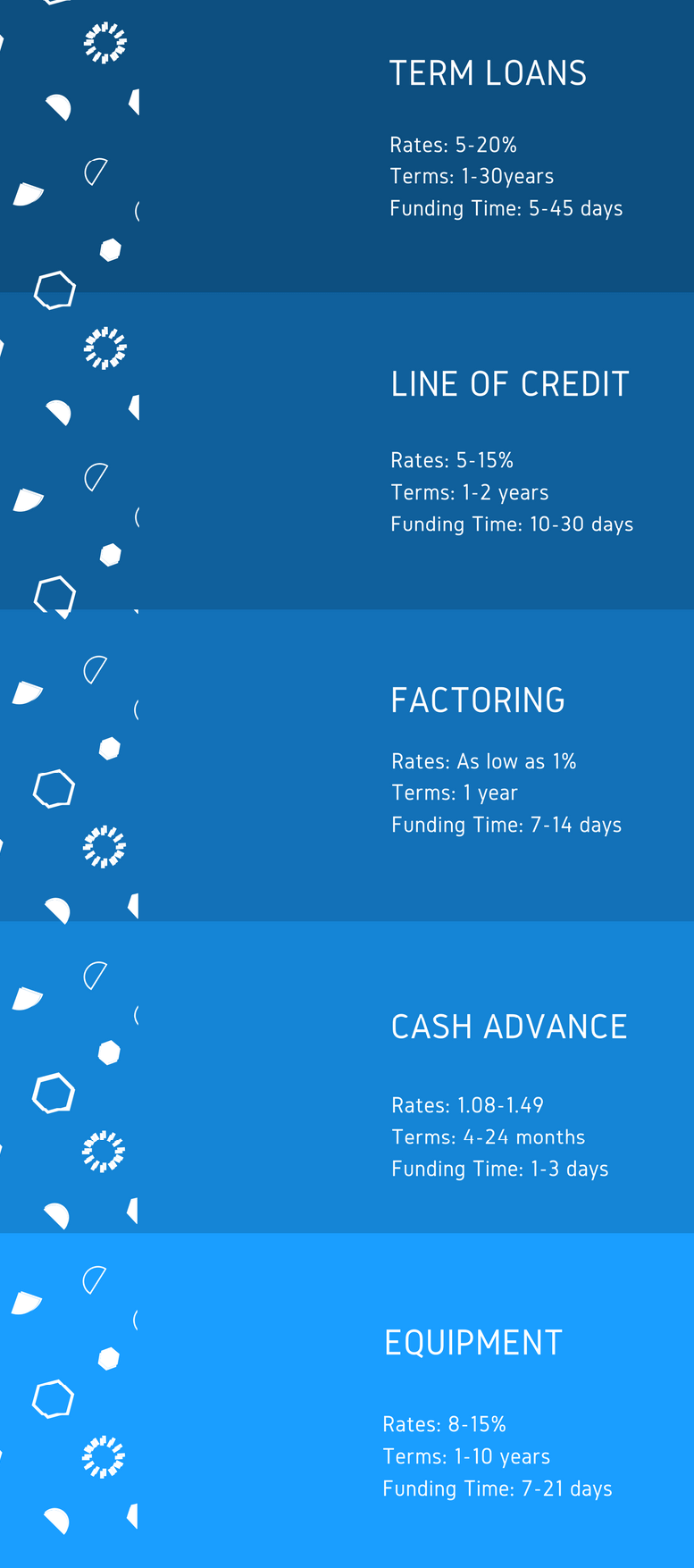

International conventional lending for trade offers American small businesses with the most affordable types of financing facilities for short term business uses. Rates and terms always vary, but if your small company is looking for international trade loans from a conventional lender, you’re seeking financing with rates that start in the mid single digits, and terms that can go up to 10 years for working capital and inventory financing uses.

Alternative International Trade Loans

While not usually the first choice of financing when your small business qualifies for more conventional forms of financing, alternative loans still offer growing companies with affordable capital that is much easier to access than you’d expect from a traditional business lender. Rates start in the upper single digits and terms can range from 1-5 years. This type of financing is perfect for growing companies seeking financing for international trade that need quick financing, and also requires minimal business documentation.

Trade Loan Cash Advance (Future Receivables)

If you’re a small business engaging in international trade and need to obtain financing almost immediately, a good way to access quick financing is to get a cash advance against your company’s future revenue. While not technically a loan, a small business cash advance is a form of financing that involves selling a portion of your company’s future receivables (funding company analyzes cash flow), and the funding company provides you a cash payment for the receivables at a discount. Unlike conventional business loans, a cash advance can be approved immediately and funding can take place as soon as the same day.