Business Loans For Florida Companies

All companies can use financing at some point during the business growth cycle, and Florida small businesses are no different. Whether the need be lending for purchasing a business, loans for refinancing and consolidation of business debt, working and operating capital lending, financing to purchase inventory, payroll funding for your employees, cash-flow loans, expanding your company, or whatever the use, having access to the best business loan options are important. In this article we will take an in-depth look at the economic environment surrounding Florida businesses, as well as look at all the funding options that a Florida small business could seek.

Since December 2010, Florida has seen rapid economic recovery and growth that is credited towards small businesses throughout the state. In addition, Florida small businesses have helped lower the nation’s unemployment rate.

According to the United States Bureau of Labor Statistics, as of February 2017, there are 10,058 civilian labor force workers in Florida, with 9,557.3 of those workers employed. When looking at the small business profile for Florida by the United States Small Business Administration, the statistics show that there are now 2.3 million small business in Florida, which equates to 98.9 percent of all Florida businesses – these same Floridian small businesses employ over 3.1 million workers, which is equivalent to 43.2 percent. By the end of 2015, Florida small businesses created 93,541 net new jobs, with a 36.2 percent increase in minority ownership, all of which greatly contributed Florida’s increased annual growth rate of 2.0 percent. This annual growth rate is faster than the overall United States growth rate of 1.9 percent. In addition, small businesses in Florida helped lower Florida’s unemployment rate from 5.8 percent in 2014 to 5.1 percent in 2015.

The State of Small Businesses in Florida

Overall, businesses in Florida are thriving, all while working to improve Florida’s economy. Surprisingly, Florida has continuously gained jobs faster than the nation as a whole, leading to growth rates over 3 percent. These growth rates have allowed Florida to recover to pre-recession employment levels faster than other states. The blossoming Floridian economy has allowed Florida to rank well on many business aspects, such as:

- Number 1 Most Innovative State

- Number 1 Best Climate in the Southeast for Business

- Number 2 Best Place to Do Business

- Number 2 Highest Business Birth Rate

- Number 4 Largest Economy in the United States; 19th Largest Economy in the World

- Number 5 Best Small Business Policy Climate

- Number 5 Best State for Future Job Growth

Some of the major statistics and contributing factors to Florida’s businesses are outlined in the State of Small Business Report 2015 for Florida. Below is an outline of key facts from the report:

- Demographic Profile: Florida is currently averaging around 800 new residents every single day. This means that the population in Florida is becoming larger and more diverse than ever before, leading to rapidly shifting demographic business profiles. While white males still run the most businesses in Florida, women and minorities are making huge strides to become entrepreneurs and to impact their local Florida economies. The Small Business Administration has shown the percentages for the various demographics for small businesses in Florida, which consists of:

- African American owned – 38.4 percent

- Asian owned – 24.7 percent

- Hawaiian and Pacific Islander owned – 73.9 percent

- Hispanic owned – 34.2 percent

- Native American and/or Alaskan owned – 21.8 percent

- Minority owned – 36.2 percent

- Nonminority owned – -8.7 percent

- Job Impact and Employment: There are 2.3 million small Florida businesses, with over 400,000 employees, which means 1 out of every 3 working Floridians is employed by a small business with less than 50 employees. This has led to lasting positive effects that has efficiently lowered the unemployment rate throughout the state, while making Florida one of the nation’s leading states for job creation since the 2008 Great Recession. As the amount of small businesses in Florida continues to increase, so does the strength of many job sectors throughout the state. Job industries, such as construction (+7.9 percent), that took major hits during the Great Recession are now expected to see major growth from 2015 into 2018. Other industries in Florida that are expected to see continuous growth thanks to Florida’s small businesses include professional and business services (+4.1 percent); trade, transportation, and utilities (+3.4 percent); education and health services (+2.2 percent); and hospitality and leisure (+1.9 percent).

- International Trade and Travel Industries: Two of the most important economic drivers for the state of Florida are International Trade and travel related industries. Florida is one of the top vacation spots in the country, with people from all over the world visiting as well, which is why so many businesses are entering the travel industries market. The other major economic driver, international trade, has become a vital component to Florida’s economy. The future economic growth of Florida depends on increased international trade. In 2013 alone, 61,489 companies exported goods from Florida, with 95.3 percent of those businesses being small and medium sized businesses.

- Challenges for Florida’s Small Businesses: According to the annual small business report, Florida’s economic conditions are continuously improving – but that does not mean that Florida businesses are not facing serious challenges. Per the September 2015 Florida Chamber Small Business Index Survey, 59 percent of the respondents expect the economy to improve by 2017; 49 percent of respondents reported higher sales; and 77 percent of respondents indicated that their small Florida business was doing better than six months before taking the survey. Overall, Florida small business owners have high optimism and expectations, but most of the respondents are particularly concerned about five key areas: access to capital (23 percent), economic uncertainty (18 percent), growth management process (14 percent), government regulations (12 percent), and workforce quality (12 percent). These key areas are vital for small business owners to be paying attention to in the upcoming months.

Florida Business Financing Needs & Uses

As mentioned above, Florida small businesses are booming and constantly growing, but every single business, regardless of the industry, experiences business fluctuations. Sometimes business is better than expected, and unfortunately, sometimes it is worse than expected. Regardless of the reason, there are a variety of Florida business financing options that can help a business owner stay afloat during difficult and unexpected times.

Florida SBA Loans

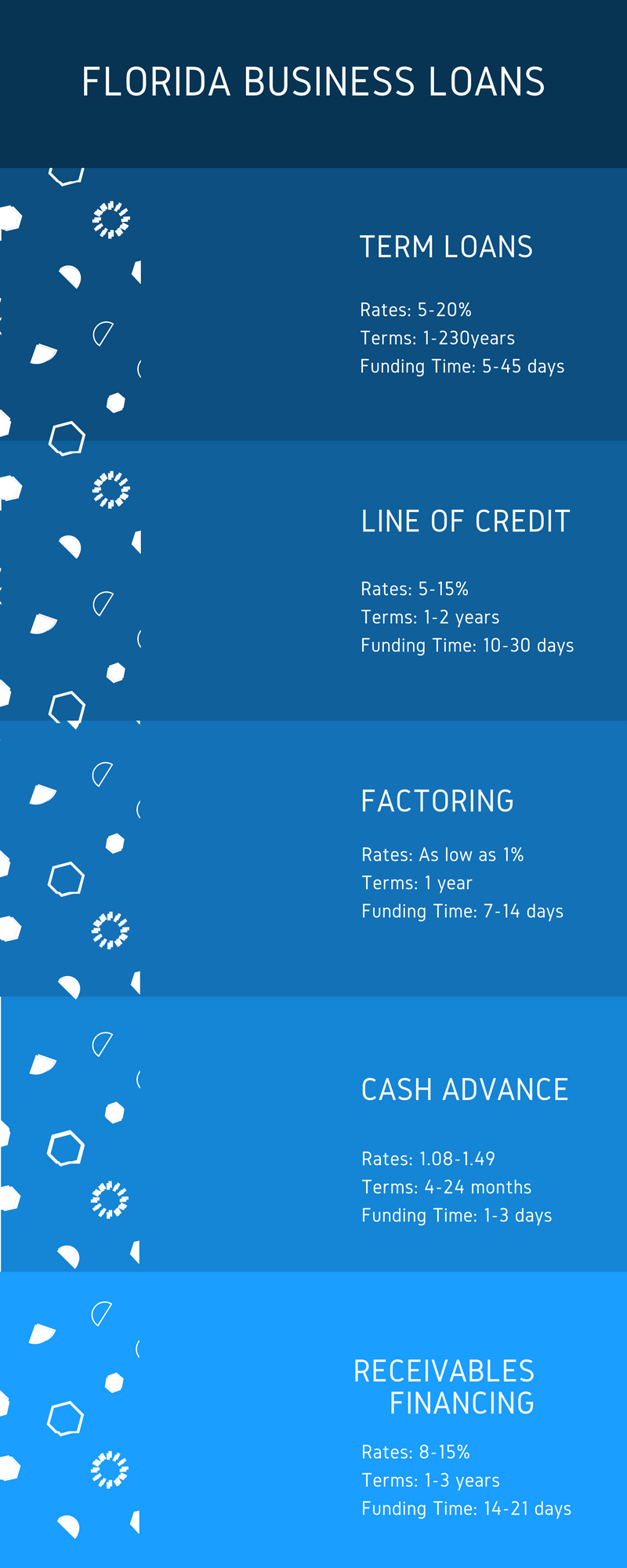

A great way to Florida businesses to obtain affordable, healthy, bank-rate small business financing is to utilize the Small Business Administration’s lending programs. SBA lending offers Florida businesses with rates ranging from 5.5-8%, with terms anywhere from 5-25 years depending upon use. On top of offering affordable term loans, SBA lenders also provide revolving lines of credit.

Florida Bank Loans

Term loans and lines of credit from banks are always the most affordable types of small business funding. The main reason why bank loans are so cheap as compared to more alternative lenders is because conventional business lenders don’t take much risk. Since risk is priced into the lending facility, by not posing substantial risk of failure to repay, it allows the lender to reduce the overall rate they charge the Florida small business.

Florida Asset Based Loans

Asset based loans are a great way for Florida businesses to monetize the assets on the company’s balance sheet. Some of the assets that can be monetized and used as the basis for an asset based loan include commercial buildings, land and other commercial property, along with accounts receivable, inventory and equipment & machinery.

Florida Factoring

Invoice factoring is a form of asset based financing, in that the small business is monetizing their accounts receivables by selling their 30-90 day unpaid invoices. By selling your invoices, it allows Florida small business owners to access much needed working capital to help with cash-flow at an affordable rate.

Florida Equipment Financing

There are many ways to finance new or used business equipment. While some Florida business owners will find it easiest and most affordable to obtain a term loan or other type of lending facility to purchase business equipment, other small business owners may find that the best way to obtain the equipment is to lease rather than buy. By leasing, the Florida company won’t be forced to pay the full-price for the equipment upfront, nor will they stuck with outdated equipment in a couple of years.

Florida Private Lending

Private business loans are simply any type of business loan that is provided by a non-bank lender. That means almost every alternative lender, fintech lender, marketplace lenders, cash advance funders, equipment leasing companies, factoring companies, asset based lenders are also private business lenders. With that having been said, other private lenders are actually loans provided by investors.

Florida Merchant Cash Advances

Cash advances are a way for Florida company to access their future potential revenue. Cash advances are structured much different than normal business loans, because cash advances aren’t loans at all. Instead, cash advances provided to Florida small businesses are actually a business-to-business transaction where the small company sells a portion of their future revenue to a cash advance company in return for fast cash. Cash advances are repaid by either having a portion of their daily credit card sales remitted to the cash advance funding company, or by having a set amount automatically sent to the funder using Automated Clearing House transaction through the business’s bank account. Types of cash advances include long-term merchant cash advances, bad credit cash advances, additional position cash advances, and advances used for consolidation.